Federal Reserve Signals Possible Support for Rate Cut

The Federal Reserve is signaling potential support for interest rate cuts, as recent statements from key officials highlight the central bank's readiness to respond to economic uncertainties, particul

The Federal Reserve is signaling potential support for interest rate cuts, as recent statements from key officials highlight the central bank's readiness to respond to economic uncertainties, particularly those driven by trade policies and their impact on employment and inflation.

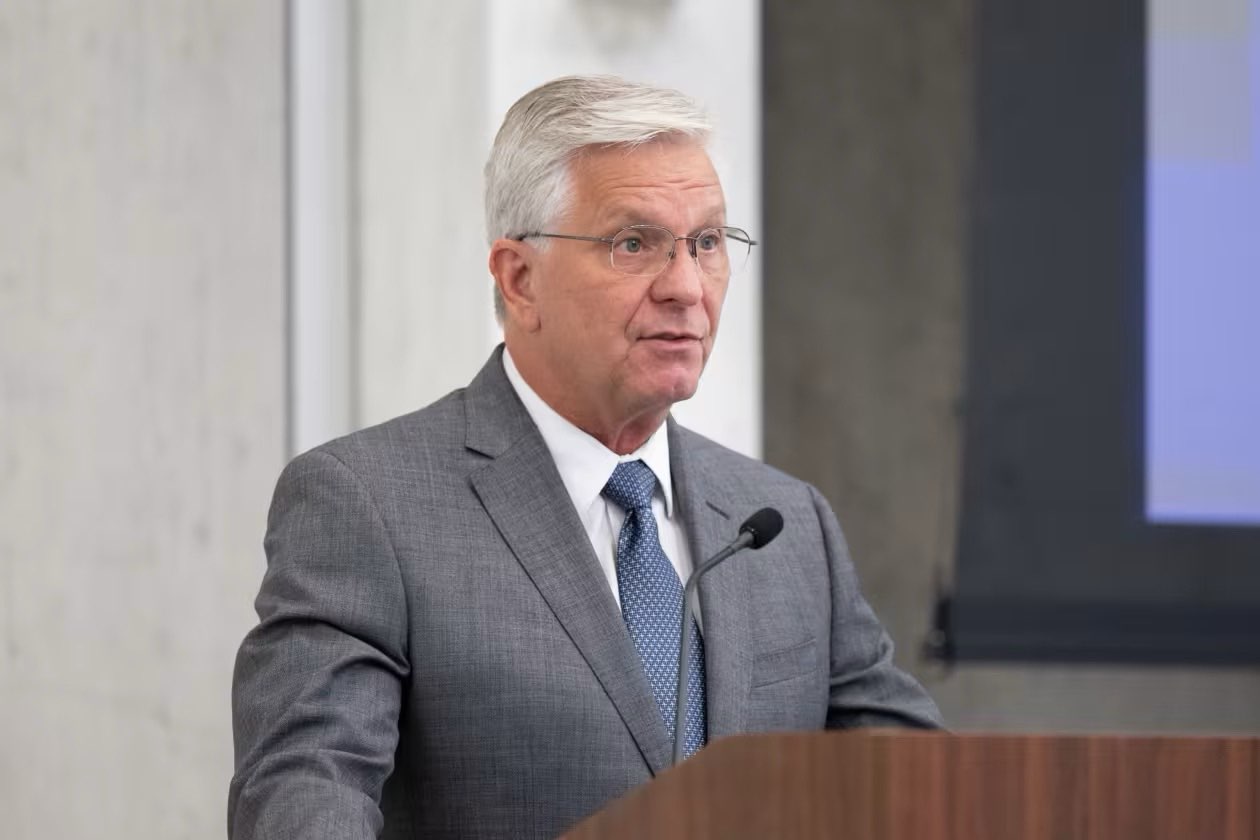

Fed Governor Christopher Waller and cleveland Fed President Beth Hammack have both weighed in on the conditions that could prompt the Fed to adjust rates, offering insights into the timing and rationale behind such a move.

Waller: Rate Cuts If Tariffs Drive Job Losses

Fed Governor Christopher Waller has indicated that he would support interest rate cuts if aggressive tariff policies, potentially reinstated by the Trump administration, lead to significant rises in job losses.

Waller expressed concern that high tariffs could trigger layoffs and a rise in unemployment, stating, "It wouldn't surprise me that you might start seeing more layoffs, a tick up in the unemployment rate going forward if the big tariffs in particular come back on." In such a scenario, Waller expects the Fed to act swiftly with rate cuts to support the labor market, saying, "I would expect more rate cuts, and sooner, once I started seeing some serious deterioration in the labor market."

Waller's remarks come in response to President Donald Trump's recent tariff actions. On April 2, Trump announced steep reciprocal tariffs on several countries but placed those plans on hold for 90 days to allow for negotiations. Despite this, a baseline global tariff of 10% has been implemented, with levies exceeding 100% on China. Waller stressed that while the immediate impact of these tariffs on the economy may not be significant before July, unemployment could rise quickly if high tariffs are reimposed.

Regarding inflation, Waller believes that any price increases due to tariffs would be temporary. He stated, "I'm willing to look through whatever tariff price effects there are," indicating that he would not overreact to short-term inflationary pressures. This view contrasts with that of Fed Chair Jerome Powell, who has cautioned that tariffs could lead to more persistent inflation, potentially complicating the Fed's dual mandate of fostering maximum employment and stable prices.

Waller's stance suggests a greater focus on the employment side of the mandate, prioritizing labor market stability over temporary inflation spikes.

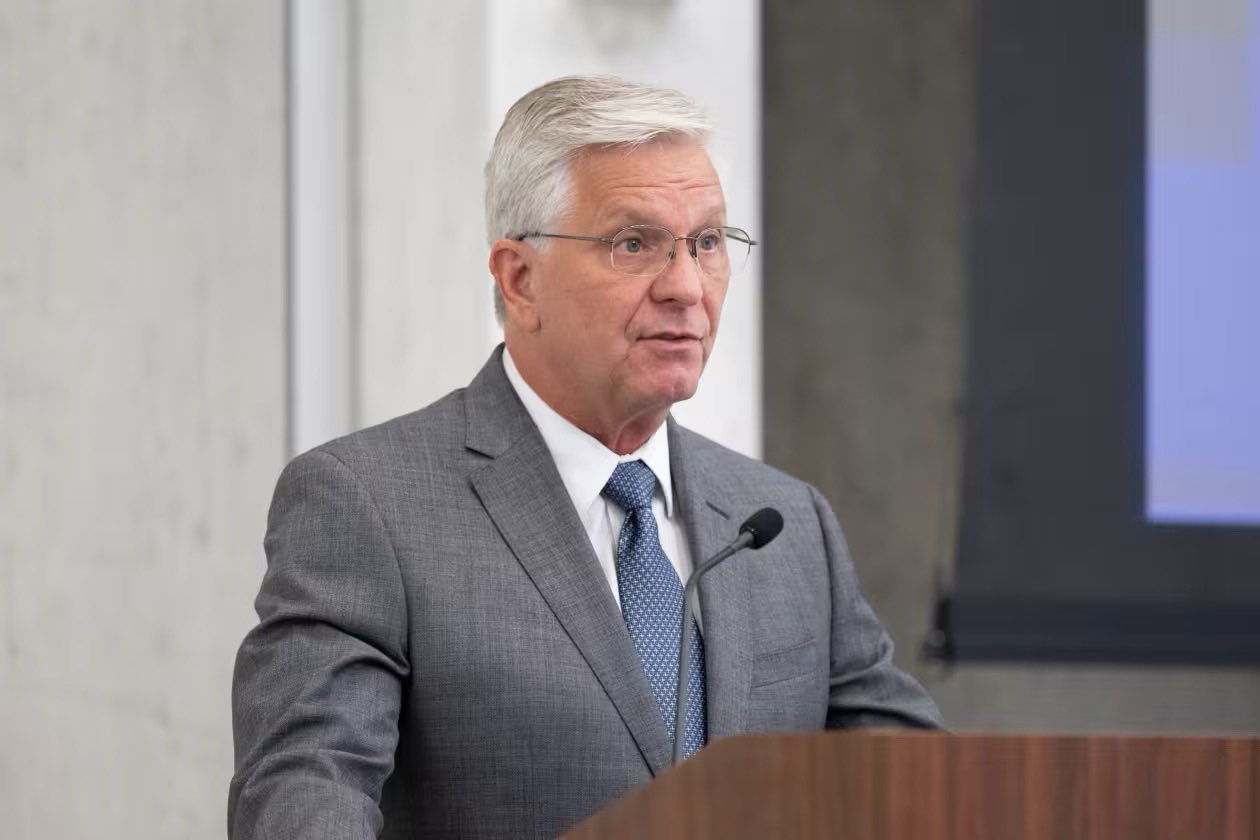

Hammack: June Rate Move in Play If Data Is Clear

Complementing Waller's perspective, Cleveland Fed President Beth Hammack has provided insights into the timing of potential rate adjustments.

While ruling out a rate cut at the Fed's May 6-7 meeting, Hammack indicated that June could be a possibility if economic data provides clear guidance. She emphasized the need for "clear and convincing data" before making any moves, stating, "If we have clear and convincing data by June, then I think you'll see the committee move if we know which way is the right way to move at that point in time."

Hammack's comments briefly pushed the probability of a June rate cut to about 65% in interest-rate swaps markets before the move partially retraced down to 58.2%. She reiterated that the Fed is not operating with a predetermined "base case" for the economy and stressed the importance of patience in decision-making. Hammack noted that while it is unlikely officials will have sufficient information to act by May, subsequent meetings could see action once there is more clarity on the path for growth and inflation.

Both Waller and Hammack underscore the Fed's cautious approach amid economic uncertainties, particularly those stemming from Trump's trade, immigration, and regulatory policies.

Hammack highlighted the high levels of uncertainty regarding how these policies will be implemented and how other countries and companies will respond. She remarked, "This is a good moment for us to take our time and make sure we're moving in the right direction," while also noting that the Fed has demonstrated its ability to act quickly when necessary.

Bond Yields and Rate Cut Predictions

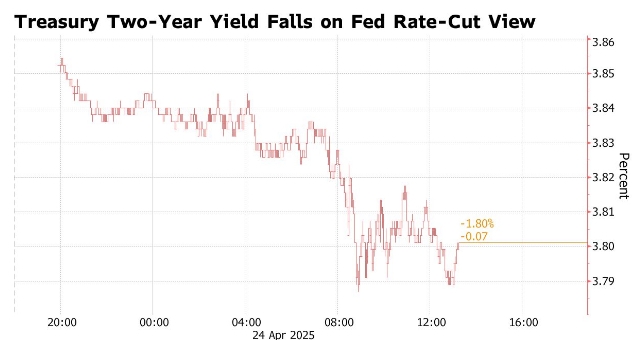

Treasuries rallied on Thursday following comments from Hammack, with short to intermediate-maturity bonds leading the surge.

Yields on two-year notes dropped by as much as 8 basis points to below 3.79%, while five-year yields fell nearly 10 basis points to under 3.93%, reflecting their sensitivity to anticipated Fed policy shifts.

This marked another day of gains in the $29 trillion Treasury market, which has experienced volatility throughout April 2025 due to Trump's evolving trade policies and uncertainty over the Fed's next moves.

The Fed's most recent action came in December 2024, when it completed three rate cuts totaling 100 basis points, setting the target range for the US overnight lending rate at 4.25%-5%.

At the start of 2025, many Wall Street economists anticipated further cuts beginning in June, though some foresaw no additional reductions within the year. Wagers on at least two cuts by year-end grew amid signs of weak personal spending and moderating inflation, yet traders remain cautious, hesitant to fully price in a cut before July. Complicating the outlook, the Trump administration's tariff plans threaten to reignite inflation, dampening bets on earlier rate cuts despite slowing economic growth.

Conclusion

The Federal Reserve is carefully weighing the potential need for interest rate cuts in response to evolving economic conditions, particularly those influenced by trade policies.

Governor Waller has emphasized the importance of supporting the labor market if tariffs lead to job losses, while President Hammack has highlighted the necessity of clear data before taking action. As the Fed navigates these complexities, its decisions will be closely watched by markets and policymakers alike, with the possibility of a rate cut as early as June if economic indicators provide a clear signal.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.