JPMorgan Says Hedge Funds, Not Foreign Investors, Are Driving Stock Sell-Off

Recent U.S. equity selloff has largely been driven by hedge funds—particularly those focused on equities—significantly reducing their risk exposure, according to jpmorgan. In contrast, there is little

Recent U.S. equity selloff has largely been driven by hedge funds—particularly those focused on equities—significantly reducing their risk exposure, according to jpmorgan. In contrast, there is little evidence of a large-scale selloff by foreign investors, and U.S. retail investors continue to buy stocks.

The bank analyst Nikolaos Panigirtzoglou pointed out that foreign outflows from U.S. equities do not necessarily lead to negative returns or underperformance relative to international markets—especially when domestic investors, particularly retail investors, remain buyers. He emphasized that the market's trajectory now hinges heavily on whether the U.S. enters a recession.

JPMorgan addressed a growing market concern: since mid-February, U.S. equities have underperformed global markets, prompting questions about who's selling and whether foreign investors are exiting. But data cited in the report shows almost no evidence of large-scale selling by foreign investors in either equities or Treasuries.

According to U.S. Treasury data, foreign investors bought about $24 billion in U.S. equities in February—more than reversing January's $13 billion in outflows. They also purchased around $120 billion in Treasuries. Japanese data shows that after a modest $5 billion net selloff in February, Japanese investors bought $13 billion and $14 billion worth of foreign stocks in March and early April, respectively.

We believe that much of the selling in U.S. equities this year has been driven by equity-focused hedge funds, including quant and discretionary long/short funds, JPMorgan stated—disputing the narrative that foreign selling is the main culprit.

The bank estimates these funds have offloaded about $750 billion worth of equities so far in 2024. Another major driver has been trend-following hedge funds, such as ctas, which unwound long positions from mid-February and flipped short in early April—selling an estimated $450 billion.

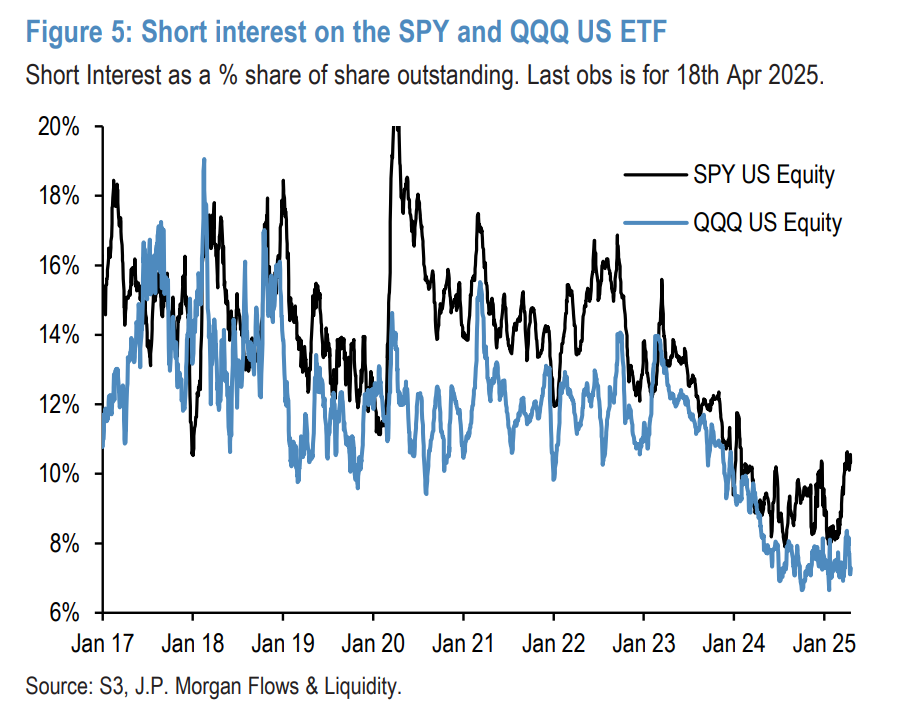

This hedge fund de-risking is also evident in U.S. equity index futures, especially S&P 500 and Nasdaq 100 contracts. Additionally, short interest in S&P 500 ETFs has risen sharply since early 2025, with notable increases in short interest in small-cap index constituents—further highlighting hedge funds' outsized role in the correction.

JPMorgan noted that some hedge fund selling may reflect rotation into European and Chinese equities. However, they believe the bulk of the activity is broad-based de-risking rather than a region-specific shift.

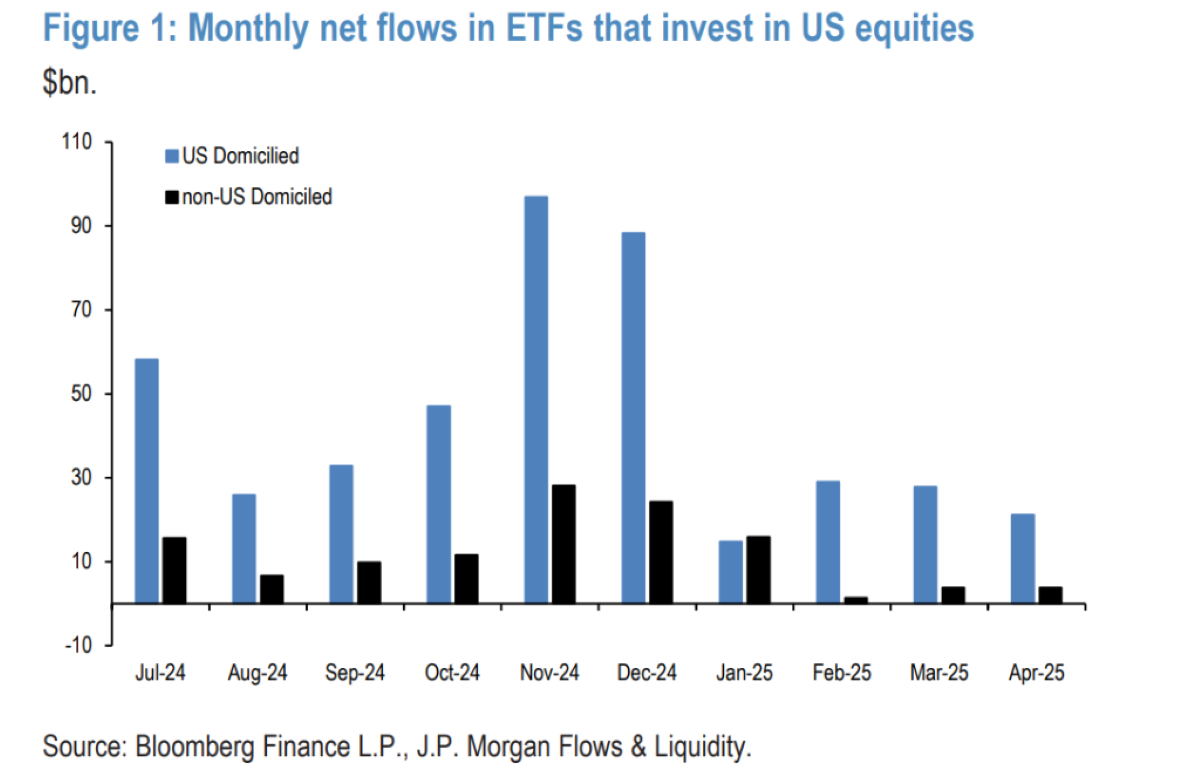

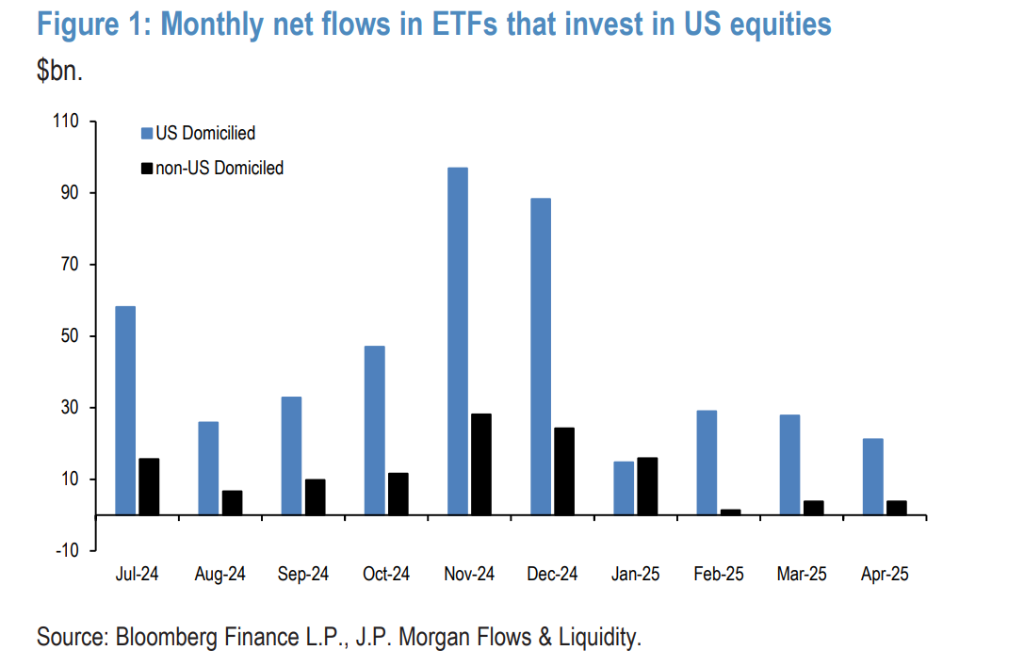

In stark contrast to hedge funds, U.S. retail investors have consistently been net buyers of U.S. equity ETFs, with monthly inflows averaging around $50 billion. Meanwhile, European equity ETFs and gold ETFs have seen even larger inflows relative to their assets under management—13% and 18%, respectively.

Historically, foreign investors have steadily increased their holdings of U.S. corporate equities due to the U.S. dollar's status as the world's primary reserve currency. However, foreign flows have proven volatile, with outflows seen in 2013, 2015–2016, 2019, and 2021–2022. The analysts stressed that even if international investors begin to pull out, U.S. equities could still perform well—as long as domestic investors, particularly retail, continue to buy.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.