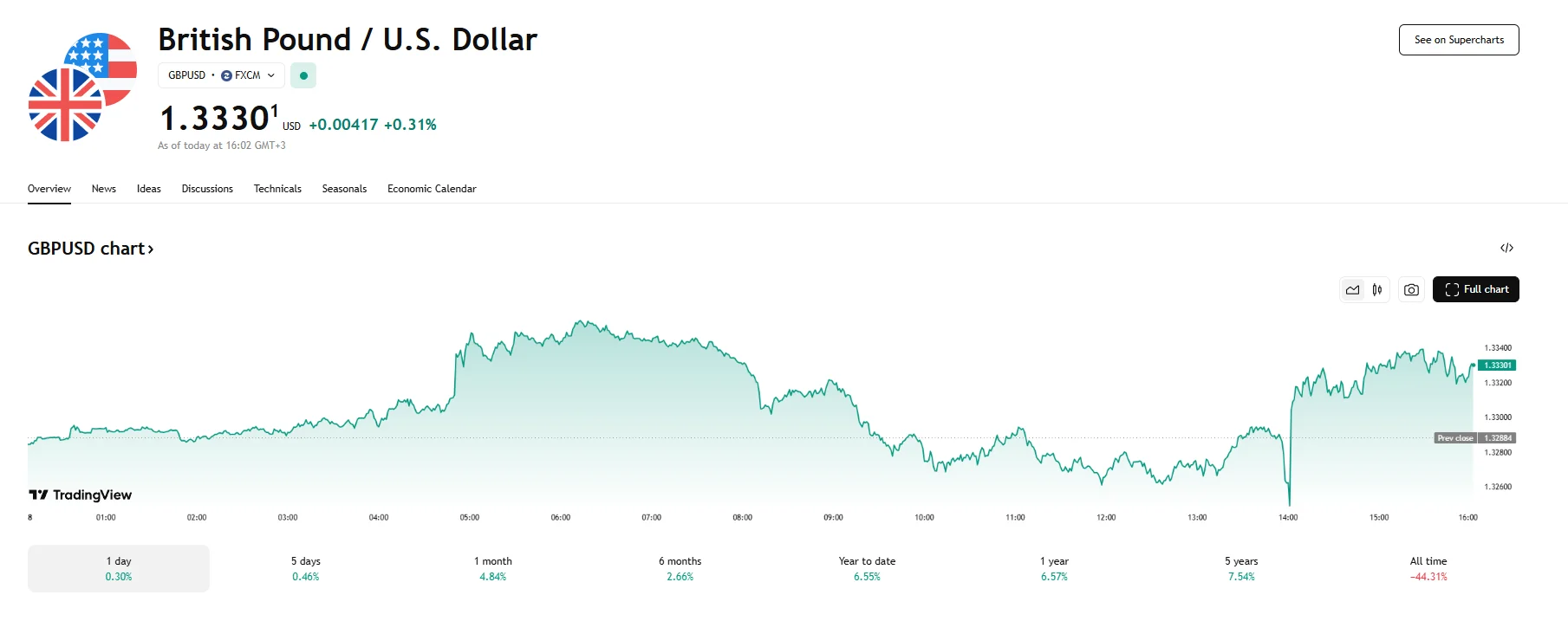

BoE Cuts Rates to 4.25%, GBP/USD Rises 0.31% to 1.3330 BoE Cuts Rates to 4.25%, GBP/USD Rises 0.31% to 1.3330

Key Moments:The Bank of England lowered its benchmark rate to 4.25% on May 8th.The sterling strengthened against the dollar, with the GBP/USD climbing 0.31% to 1.3330.Current BoE forecasts point to a

Key Moments:

- The Bank of England lowered its benchmark rate to 4.25% on May 8th.

- The sterling strengthened against the dollar, with the GBP/USD climbing 0.31% to 1.3330.

- Current BoE forecasts point to a 1% increase in economic growth in 2025.

Bank of England Lowers Rates

The British pound gained ground on Thursday after the Bank of England reduced its base interest rate by 25 basis points to 4.25%, citing the negative impact of trade tariffs on the UK’s economic prospects. The sterling appreciated 0.31% against the greenback, and the GBP/USD exchange rate rose to 1.3330. Prior to the rate decision, the pound had been relatively stable against the dollar, with market attention focused on an upcoming announcement about a potential trade deal between the United States and the United Kingdom.

In an unexpected move, the BoE’s nine-member Monetary Policy Committee was divided as Swati Dhingra and Alan Taylor pushed for a deeper 50-basis-point cut. Another two members, Huw Pill and Catherine Mann, voted in favor of leaving the rates unchanged. Ultimately, five members voted in favor of the 0.25% reduction.

According to Governor Andrew Bailey, the committee had room to reduce the rates due to the ongoing moderation of inflationary pressures. He explained that the preceding weeks had illustrated the global economy’s unpredictable nature, which is why a “gradual and careful approach” was necessary when it came to rate cuts. “Ensuring low and stable inflation is our top priority,” he concluded.

It should also be noted that despite underlying growth staying at a mere 0.1% per quarter, the BoE increased its full-year growth forecast for 2025 from 0.75% to 1%, attributing this estimate to a better-than-anticipated Q1. As for inflation, it is projected to reach its highest point (3.5%) in Q3 before declining. Previously, it was expected that inflation would hit 3.7%, but that forecast has been revised because of a decline in energy prices.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.