Bitcoin Hits $96,978 After New Hampshire Signs Crypto Reserve Bill Bitcoin Hits $96,978 After New Hampshire Signs Crypto Reserve Bill

Key Moments:Bitcoin’s price experienced an increase on Wednesday, reaching $96,978 after an earlier climb saw the currency jump past $97,000.Enthusiasm surrounding crypto assets surged after it was re

Key Moments:

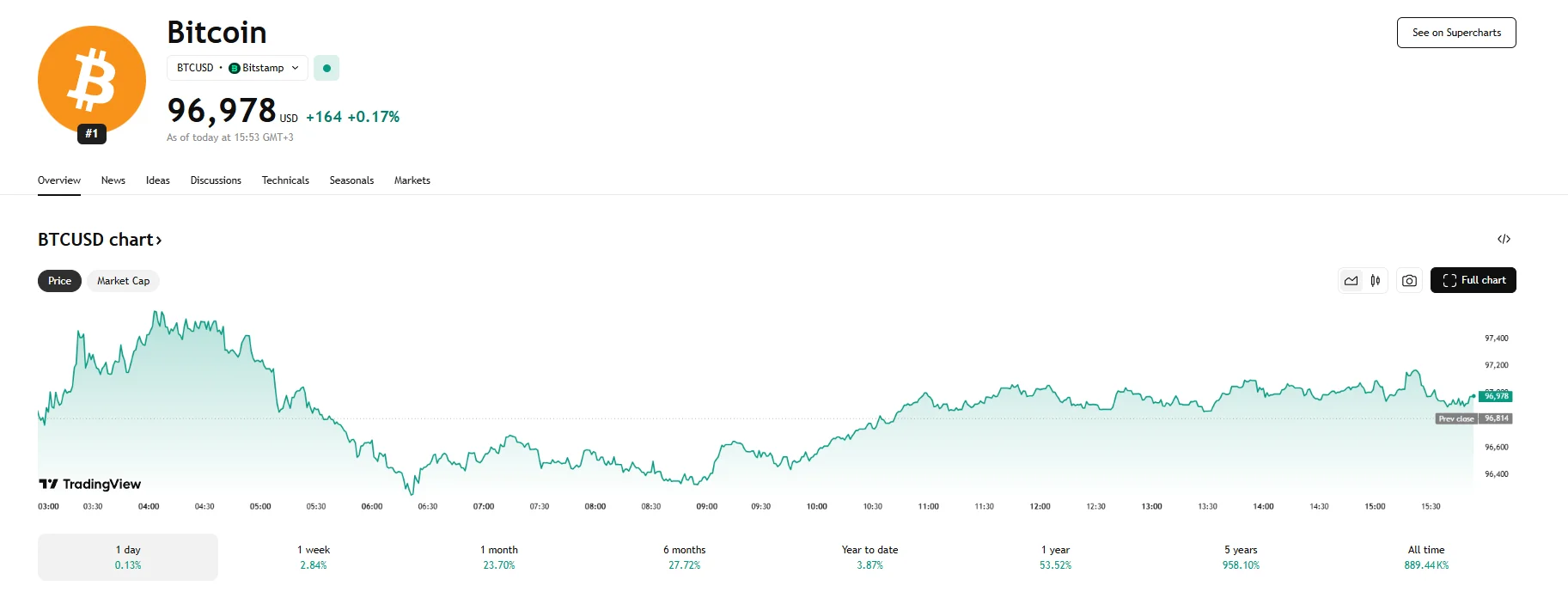

- Bitcoin’s price experienced an increase on Wednesday, reaching $96,978 after an earlier climb saw the currency jump past $97,000.

- Enthusiasm surrounding crypto assets surged after it was reported that Washington and Beijing will meet to discuss trade relations later this week.

- New Hampshire’s Governor authorized state investments in digital assets and precious metals by signing bill HB 302 on Tuesday.

Bitcoin Climbs Above $96,900

Fueled by a burgeoning optimism surrounding prospective dialogues on trade between the United States and China, the digital currency Bitcoin enjoyed a surge in value on Wednesday. The coin edged 0.17% higher near the $97,000 mark.

This upward movement in the cryptocurrency’s price was largely attributed to an emergent positive sentiment bolstered by the anticipation of trade discussions between the US and China, which will reportedly take place on Saturday and Sunday. US Treasury Secretary Scott Bessent remarked that while the existing tariffs and trade barriers were not sustainable, the United States did not seek “to decouple.”

Pioneering Legislation Signed into Law

Bitcoin’s Wednesday followed Tuesday’s disclosure that New Hampshire had enacted HB 302, making it the first US state with a crypto reserve. The said bill permits the state to allocate part of its public funds to select digital assets and precious metals. Governor Kelly Ayotte announced the bill’s signing on the social media platform X (formerly Twitter) and commented that “New Hampshire is once again First in the Nation!”

The legislation authorizes the New Hampshire Treasurer to direct up to 5% of public funds into investment-grade cryptocurrencies and precious metals such as gold and silver. Specifically, any cryptocurrency considered for investment must have had a market capitalization of at least $500 billion in the previous calendar year. This makes Bitcoin the only digital asset that qualifies.

State Representative Keith Ammon expressed that federal monetary policy has spurred interest in alternative assets, suggesting investments in digital and tangible stores of value could help protect against inflation.

The law outlines multiple mechanisms for holding digital assets. The treasury may pursue direct custody through secure solutions, utilize the services of a qualified custodian, or invest via regulated exchange-traded products offered by investment firms that have been issued a relevant license.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.