Tesla Shares Soar as Musk Buys $1 Billion Stake After 5 Years, Targeting $8.5 Trillion Market Cap Plan

Tesla shares surged more than 7% on Monday, extending last week’s 13% rally, after CEO Elon Musk disclosed a $1 billion stock purchase. The world richest man just bought 2.57 million shares of Tesla i

Tesla shares surged more than 7% on Monday, extending last week’s 13% rally, after CEO Elon Musk disclosed a $1 billion stock purchase.

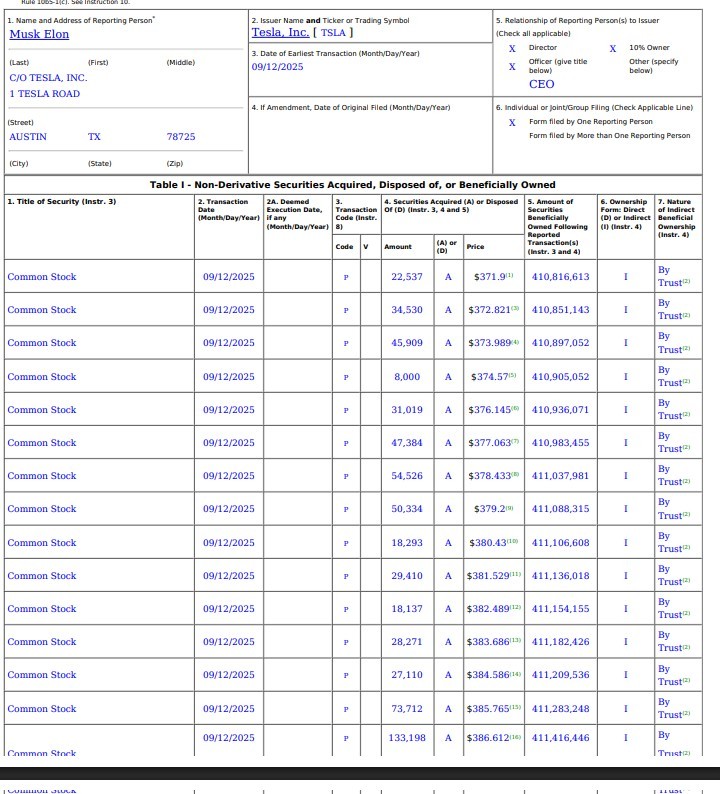

The world richest man just bought 2.57 million shares of Tesla in the open market on September 12, at prices ranging from $372.37 to $396.54 per share. It was his first open-market purchase since February 2020, following more than $20 billion in stock sales in 2022 to help finance his acquisition of Twitter.

The rally comes as Tesla shows signs of renewed sales momentum in both China and Europe. In China, demand for the Model Y L has been so strong that estimated delivery times on Tesla’s website have now been pushed to November 2025, signaling that October allocations are already sold out. In Europe, Tesla is also experiencing a rebound from recent weakness. The company plans to increase production at its German factory for the remainder of the year after stronger-than-expected demand, according to plant chief Andre Thierig, who said “very good sales figures” prompted revisions to third- and fourth-quarter production plans.

At the same time, Tesla has unveiled an ambitious new performance-based compensation plan for Musk. The package would grant him up to 423.7 million restricted shares, or about 12% of Tesla’s current shares, split into 12 tranches. To unlock them, Tesla must achieve a combination of market capitalization, operational, and product milestones. The market value goals begin at $2 trillion and scale up through a series of increases, ultimately requiring Tesla to reach and sustain an $8.5 trillion valuation.

In addition, the company has tied the plan to operational targets such as rolling out robotaxis and humanoid robots, alongside raising profitability as measured by adjusted EBITDA. Product milestones include delivering 20 million Tesla vehicles, reaching 10 million paid Full Self-Driving subscriptions on a sustained basis, deploying one million Optimus robots, and putting one million driverless robotaxis into commercial service.

The sweeping plan highlights Musk’s vision to propel Tesla far beyond its current position as the world’s most valuable automaker. He once said Tesla could be the most valuable company in the world one day, with a bigger market capitalization than the next top five companies combined, which include, Nvidia, Microsoft, Apple, Amazon, and Alphabet.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.