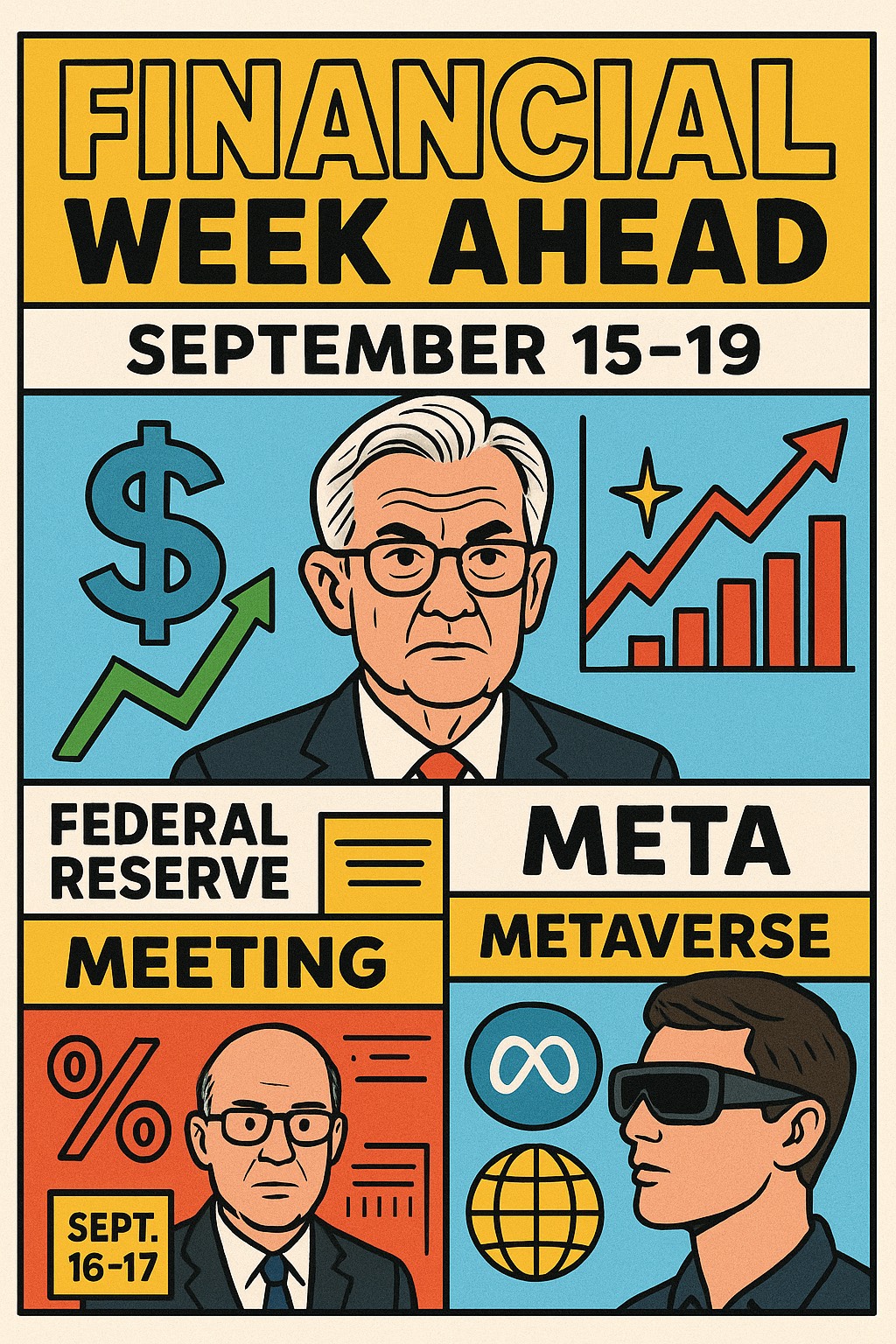

Financial Week Ahead: Fed's Shadow Looms Large as Meta Ready for Connect Conference

As markets grind toward the midpoint of September, the air crackles with anticipation. The U.S. Federal Reserve's two-day confab, kicking off Tuesday, stands as the undisputed gravitational force

As markets grind toward the midpoint of September, the air crackles with anticipation. The U.S. Federal Reserve's two-day confab, kicking off Tuesday, stands as the undisputed gravitational force, pulling in everything from equity futures to currency swings.

With inflation stubbornly above target yet labor markets flashing warning lights, Jerome Powell and his cohort face a high-stakes pivot—one that could either soothe jittery investors or ignite fresh debates over the central bank's autonomy. Beyond the Fed, a cascade of global policy calls and tech unveilings promises to ripple through portfolios, from Toronto to Tokyo.

This week, September 15-19, isn't just about rates; it's a litmus test for economic resilience in an election-tinged world.

The Fed's Pivotal Moment: Cuts, Projections, and Independence Under Fire

The Federal Open Market Committee's gathering, spanning September 16-17, culminates Wednesday at 2 p.m. ET with the rate announcement and updated Summary of Economic Projections—affectionately known as the dot plot.

Traders, glued to CME FedWatch tools, are baking in a near-certain 25-basis-point trim, dropping the federal funds rate to 4%-4.25%. That's the first easing move since 2022, a nod to softening job growth and revised unemployment figures hovering near 4.3%.

Yet, the whisper of a bolder 50-basis-point slash lingers, with odds ticking up to around 7% amid recent data dumps showing consumer spending cooling faster than expected.

Analysts are a chorus of cautious optimism, but with discordant notes. A Reuters poll of economists pegs a 60% likelihood of at least 50 basis points of total cuts by year-end, reflecting bets on persistent disinflation despite sticky services prices.

Claudia Sahm, the economist whose rule famously signaled recessions, anticipates the quarter-point move but warns of a "worst kind of setup" if Powell's presser at 2:30 p.m. ET veers too dovish, potentially stoking inflation fears anew. J.P. Morgan's team, factoring in recent board shifts like the addition of easing advocate Chris Miran, sees this as the opener to a series of reductions, possibly landing the funds rate at 3.9% by December. The dot plot will be scrutinized for hints on 2026—will it signal two more cuts, or dial back amid tariff threats from the Trump administration?

Lurking in the shadows is the fresh drama engulfing Fed Governor Lisa Cook, whose tenure has become a flashpoint for the institution's vaunted independence. President Trump, escalating his long-simmering feud with the central bank, has doubled down on efforts to oust Cook over allegations of mortgage fraud—a claim now muddied by newly surfaced documents questioning its validity.

A federal judge blocked the firing last week, but Trump's Sunday appeal to a Washington circuit court seeks to lift the injunction, framing it as essential for "accountability." Cook's lawyers fire back that such a move would shatter the Fed's firewall from politics, potentially ushering in an "era of non-independence" that erodes market trust and invites volatility.

Wall Street has largely shrugged it off so far—equities barely blinked—but don't count on it staying sidelined. During Wednesday's deliberations, expect probing questions on Fed autonomy, especially if Trump's rhetoric amps up.

Powell has historically deflected political barbs, but with the 2026 midterms looming, any perceived weakness could fuel bond yields and dollar strength. Investors should watch for subtle language in the statement: Phrases affirming "data-dependent" policy might reassure, while silence on external pressures could signal deeper rifts.

A dovish tilt here could propel the S&P 500 toward 6,000, but independence jitters risk a knee-jerk selloff in Treasuries.

Meta's Metaverse Push: Glasses That See the Future

Shifting gears from monetary policy to silicon ambition, Meta Platforms' Connect conference on Wednesday afternoon at 5 p.m. ET could redefine wearable tech—and inject some adrenaline into META shares.

Mark Zuckerberg's keynote is poised to spotlight the next frontier in augmented reality: the long-rumored Hypernova smart glasses, potentially rebranded as "Celeste" for a celestial nod to Meta's expansive vision.

These aren't your average shades. Building on the Ray-Ban Meta collaboration's success—over 1 million units sold—Hypernova promises a heads-up display (HUD) embedded in one lens, turning eyewear into a discreet AR portal. Weighing in at about 70 grams (a tad heavier than the 50-gram Ray-Bans), the glasses feature a waveguide display for overlaying notifications, mini-apps, and AI-driven insights directly in the user's field of view.

Imagine real-time translations during travel, contextual navigation without pulling out your phone, or even gesture controls via a companion wristband for hands-free operation. Powered by the latest Llama AI model, they could handle complex queries—like identifying landmarks or summarizing emails—while integrating seamlessly with Meta's ecosystem for social VR tie-ins.

Rumors swirl around pricing at $799 for the base model, positioning it as a premium play against Apple's Vision Pro heft. Expect teases of enhanced cameras for better low-light capture, longer battery life, and developer tools to spur third-party apps—perhaps even early access to Horizon Worlds expansions. Thursday's developer sessions will dive deeper, potentially unveiling APIs for the display tech.

For investors, this is Meta's bet on recapturing metaverse mojo after years of Reality Labs losses topping $50 billion. Success here could validate Zuckerberg's AR pivot, boosting ad revenues through immersive experiences and challenging Google and Apple in the wearables race. A flop, though? It risks widening the gap with Big Tech peers. Watch META stock for an immediate pop if demos wow; pre-event positioning has already lifted shares 5% this month.

A Global Central Bank Convergence: Divergent Paths Amid Shared Pressures

As the Fed steals the spotlight, a trio of major central banks convenes later in the week, each grappling with unique inflation demons and growth headwinds. Their verdicts, clustered on Thursday, September 18 (with Japan's wrapping Friday), could synchronize global easing or highlight fractures.

The Bank of Canada leads off Wednesday at 9:45 a.m. ET (its announcement is timed for Sept. 17 local), where a 25-basis-point cut to 2.25% is the consensus call, resuming the easing cycle paused over summer. Focus will zero in on the latest CPI print, which surprised to the upside but still trends toward 2%. Governor Tiff Macklem's remarks may underscore labor market slack and U.S. tariff risks, with over 70% of economists eyeing another chop by year-end to combat housing woes. A dovish surprise could weaken the loonie, aiding exporters but pressuring the Bank to align with the Fed's trajectory.

Across the Atlantic, the Bank of England holds at noon ET (8 a.m. London time), sticking to 4% amid resurgent inflation projected to hit 4% this month—fueled by energy and food spikes. Policymakers, split 5-4 in August's cut, will dissect wage data and services prices, with most forecasts pointing to a Q4 trim but no rush now.

Andrew Bailey's presser could flag fiscal prudence ahead of the budget, but sticky core inflation (highest in the G7) tempers bets on aggressive easing, potentially propping up sterling.

Finally, the Bank of Japan wraps the marathon Thursday at 2 a.m. ET Friday (3 a.m. Tokyo), widely expected to hold at 0.5% while signaling Q4 hikes. Governor Kazuo Ueda's tone will be key: Cautious optimism on core inflation persistence could hint at yen normalization, countering intervention fatigue amid USD/JPY near 150. A majority of economists see at least one more 25-basis-point lift by December, but global trade frictions loom large.

Navigating the Crosscurrents

This week's tapestry weaves monetary easing with innovation sparks, but risks abound—from Fed politics to AR hype. A synchronized dovish wave could lift risk assets, yet divergent paces might whip currencies into frenzy. Traders, brace for Powell's words to echo loudest; the rest of the globe will harmonize—or clash—in response.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.