Trump: I Think We Will Have A Big Cut This Week

The Federal Reserve is set to hold its interest rate meeting. Market consensus suggests that the Fed will implement its first rate cut in nine months at this critical meeting.As the Fed's decisio

The Federal Reserve is set to hold its interest rate meeting. Market consensus suggests that the Fed will implement its first rate cut in nine months at this critical meeting.

The Federal Reserve is set to hold its interest rate meeting. Market consensus suggests that the Fed will implement its first rate cut in nine months at this critical meeting.

As the Fed's decision approaches, U.S. President Donald Trump stated on September 14 local time that he expects the Fed to announce a "significant rate cut" at this week's meeting.

"I think you have a big cut," Trump told reporters on Sunday on his way back to Washington. "It's perfect for cutting."

If the Fed decides to cut rates this week, it will mark the first rate cut since December of last year. The Fed initiated its first rate cut since March 2020 last September, followed by a total of three rate cuts, cumulatively reducing rates by 100 basis points. Specifically, it cut rates by 50 basis points in September last year, and by 25 basis points each in November and December. However, due to concerns over Trump's tariff policies, the Fed has kept rates unchanged this year.

Despite persistently high inflation in the U.S., the market widely expects the Fed to cut rates this week in response to a slowing labor market.

Recent weak economic reports have raised concerns that the job market may slow further, threatening consumer spending and economic growth. At the same time, the inflation rate remains above the Fed's 2% target, and if tariffs drive up costs, inflation could rise further, leading some Fed officials to caution against cutting rates too quickly.

Currently, the Fed is facing unprecedented pressure from Trump to cut rates. For months, Trump has been pressuring Fed Chair Jerome Powell to lower rates. Last week, Trump posted on his social media platform, Truth Social, claiming that the U.S. has "no inflation" and that the Fed "must cut rates significantly immediately," calling Powell "a complete disaster."

Recently, Trump has escalated his battle with the Fed by ordering the dismissal of Fed Governor Cook, though this order faces legal challenges, and its outcome remains uncertain.

The current target range for the U.S. federal funds rate is 4.25%–4.50%. Trump has repeatedly stated that U.S. interest rates are at least 300 basis points too high and should be reduced to around 1%.

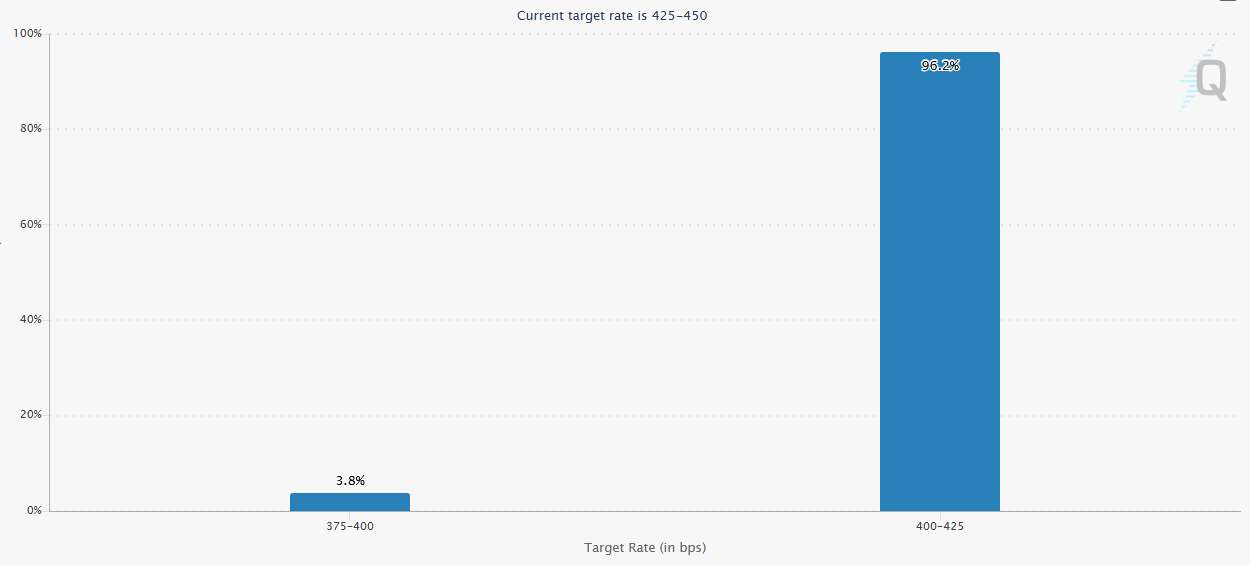

Although Trump claims the Fed will implement a "big rate cut," the likelihood of a 50-basis-point cut this week appears low. According to CME's "FedWatch Tool," the probability of a 25-basis-point rate cut this week is 96.2%, while the chance of a 50-basis-point cut is only 3.8%.

However, if the Fed were to cut rates by 50 basis points at once, it could trigger market panic—a scenario Trump would not want to see.

Historically, significant rate cuts by the Fed have often occurred during times of major economic crises. Data shows that since 1987, every time the Fed started a rate-cutting cycle with a 50-basis-point reduction, the U.S. economy subsequently entered a recession.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.