PPI Surprisingly Declined in August Even as More Tariffs Kicked In, Further Supporting Rate-Cut Optimism Next Week

Wholesale prices unexpectedly fell slightly in August, paving the way for moderate inflation readings even as more tariffs took effect—bolstering expectations that the Federal Reserve will cut rates n

Wholesale prices unexpectedly fell slightly in August, paving the way for moderate inflation readings even as more tariffs took effect—bolstering expectations that the Federal Reserve will cut rates next week.

Wholesale prices unexpectedly fell slightly in August, paving the way for moderate inflation readings even as more tariffs took effect—bolstering expectations that the Federal Reserve will cut rates next week.

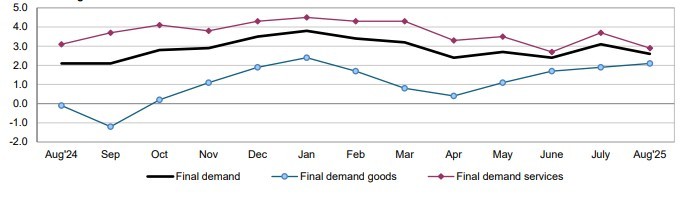

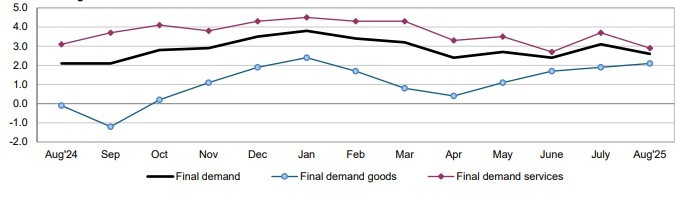

The Producer Price Index (PPI), which measures input costs across a broad array of goods and services, declined 0.1% for the month. That followed a downwardly revised 0.7% increase in July and came in well below the estimate of a 0.3% gain. Core PPI, which excludes volatile food and energy costs, also slipped 0.1% against expectations for a 0.3% rise. However, excluding food, energy, and trade services, PPI advanced 0.3%, marking the fourth straight monthly increase.

On a 12-month basis, the index for final demand less foods, energy, and trade services climbed 2.8%, the largest annual gain since March 2025, when it rose 3.5%.

The August decline was largely driven by services prices, which fell 0.2%—the steepest drop since April. A 1.7% slide in trade service margins was the primary factor, with machinery and vehicle wholesaling margins tumbling 3.9%. Other categories showing declines included professional and commercial equipment, chemicals, furniture retailing, food and alcohol retailing, and data processing. Offsetting some of that weakness, prices for portfolio management rose 2.0%, while transportation and warehousing services advanced 0.9%.

Goods prices inched up 0.1% in August, the fourth consecutive increase. Core goods prices, excluding food and energy, rose 0.3%. Food costs edged higher by 0.1%, while energy prices fell 0.4%. Tobacco products surged 2.3%, along with increases in beef, processed poultry, printed circuit assemblies, and electric power. By contrast, utility natural gas dropped 1.8%, and prices for vegetables, chicken eggs, and copper scrap also fell.

Traders are now betting heavily on Fed action, with markets pricing in a 90% chance of a 25-basis-point cut next week and a 10% probability of an even larger move. All eyes are on Thursday’s CPI report, but with wholesale inflation showing signs of easing, a moderate CPI outcome could strengthen the case for a rate cut.

Though inflation remains above the Fed’s 2% target, officials have voiced confidence that easing housing and wage pressures, combined with softer wholesale prices, will gradually bring inflation lower. While tariffs under President Donald Trump’s trade policies have added uncertainty, historically such measures have not been a lasting driver of inflation. For now, the August PPI report offers reassurance that price pressures are easing.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.