Biggest in 20 years! ExxonMobil spends nearly $60 billion to buy Pioneer

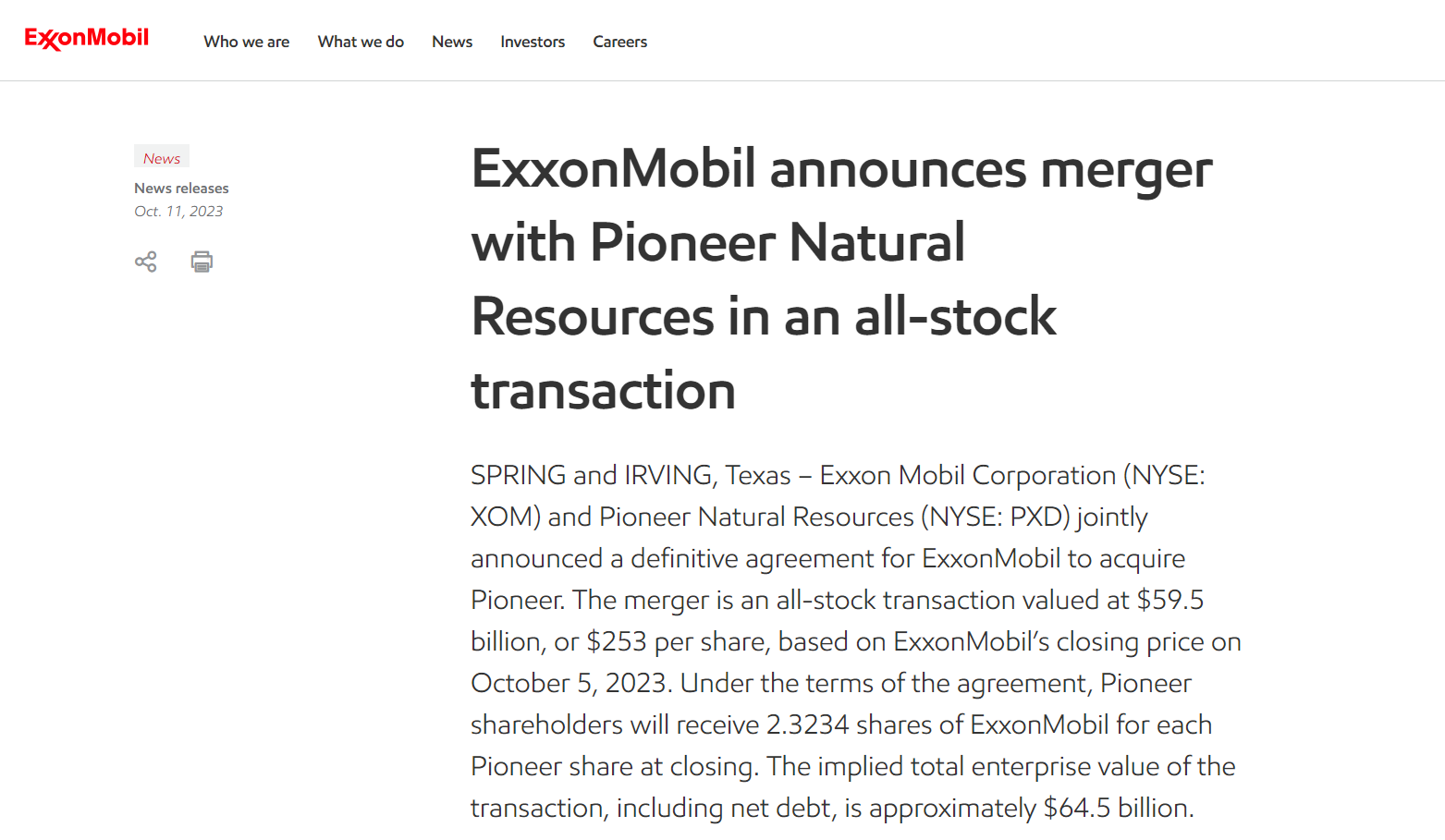

On October 11, ExxonMobil and Pioneer Natural Resources jointly announced ExxonMobil's final agreement to acquire Pioneer。

On October 11, according to the official website of Exxon Mobil (Exxon Mobil), the company and Pioneer Natural Resources (Pioneer) jointly announced the final agreement for Exxon Mobil's acquisition of Pioneer.。

The merger is an all-stock deal that will be based on ExxonMobil's closing price on October 5, 2023 (i.e., $253 per share), a deal worth $59.5 billion, a premium of nearly 7 percent over its closing price on Tuesday.。Under the terms of the agreement, Vanguard shareholders may exchange each share of Vanguard's stock for 2.3234 ExxonMobil shares。The total enterprise value (including net debt) implied by the transaction is approximately $64.5 billion.。

It was the oil giant's biggest deal since Exxon bought Mobil for $81 billion in the late 1990s.。

For ExxonMobil, the most immediate benefit of the deal is the expansion of the company's resources and capacity。

The deal with Pioneer would greatly expand ExxonMobil's operations in the Permian Basin, a large oil field straddling the Texas-New Mexico border.。According to the U.S. Energy Information Administration, Permian gas production accounted for 18 percent of total U.S. natural gas production last year.。

The merger combines Pioneer's more than 850,000 acres in the Midland Basin with ExxonMobil's 570,000 acres in Delaware and the Midland Basin.。Upon completion of the merger, the company will have 16 billion barrels of oil equivalent in the Permian region and about 15 to 20 years of remaining inventory, ExxonMobil said.。

Upon completion of the transaction, production in the Exxon Permian Basin will more than double from 2023 to 1.3 million barrels of oil equivalent per day.。It is expected to climb to about 2 million barrels of oil equivalent per day by 2027.。

In addition to significantly increasing ExxonMobil's capacity, the merger changes ExxonMobil's upstream product portfolio by increasing production with lower supply costs and short-cycle capital flexibility.。

According to government data, the number of natural gas rigs in operation in the United States has fallen by more than 26 percent since the beginning of the year, mainly due to rising drilling materials and labor costs over the past two years.。

ExxonMobil expects cost of supply of Vanguard assets to be less than $35 a barrel。ExxonMobil CEO Darren Woods said that by 2027, about 60 percent of the combined company's production will come from low-cost, high-growth strategic assets, including Permian, Guyana, Brazil and LNG.。

In addition, by 2027, short-cycle barrels will account for more than 40% of the company's total upstream production, which will allow the company to respond faster to changes in demand and better capture price and volume upside。

The deal will no doubt cement ExxonMobil's position as the dominant player in the U.S. fracking industry, which is currently concentrated in western Texas, where Pioneer has more drilling sites than almost any of its competitors.。ExxonMobil will form an industry-leading, high-quality, high-return untapped U.S. unconventional inventory position through this transaction.。The company says it is expected to generate double-digit returns by recycling more resources more efficiently and reducing its environmental impact.。

The boards of both companies have unanimously approved the transaction, which is subject to customary regulatory review and approval.。In addition, Vanguard shareholder approval is required。The transaction is expected to close in the first half of 2024.。

Alastair Syme, an analyst at Citi, believes the deal could bring multiple benefits to ExxonMobil。

Syme said: "Across the industry, the integration logic of the highly fragmented Permian shale remains compelling, and huge gains can be made from economies of scale by minimizing facility spending, optimizing drilling and reducing general expenditures.。"

Notably, ExxonMobil and Pioneer have been increasing their asset consolidation efforts in recent years through acquisitions of outside companies。

On the one hand, ExxonMobil "deep pockets" and abundant cash flow。The company posted an unprecedented profit of $55.7 billion last year, surpassing the 452 recorded in 2008 when oil prices hit record highs..A record of $200 million。

ExxonMobil's pace of acquisitions is accelerating, supported by ample cash flow and asset positions。The acquisition of Pioneer comes just three months after the company announced the acquisition of pipeline operator Denbury in an all-stock deal worth $4.9 billion.。

Pioneer has been taking similar initiatives。In 2020, the company said it would buy Parsley Energy in an all-stock deal worth about $4.5 billion.。The company then acquired DoublePoint Energy in 2021 in a cash-and-stock deal worth about $6.4 billion.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.