USD/CHF Drops 0.71% as Swiss Economic Growth Outpaces Expectations USD/CHF Drops 0.71% as Swiss Economic Growth Outpaces Expectations

Key Moments:Switzerland’s GDP rose by 0.7% in 2025’s first quarter.USD/CHF declined to 0.8362 on Thursday, reversing the previous days upward movement.US April PPI dropped more than expected, reinforc

Key Moments:

- Switzerland’s GDP rose by 0.7% in 2025’s first quarter.

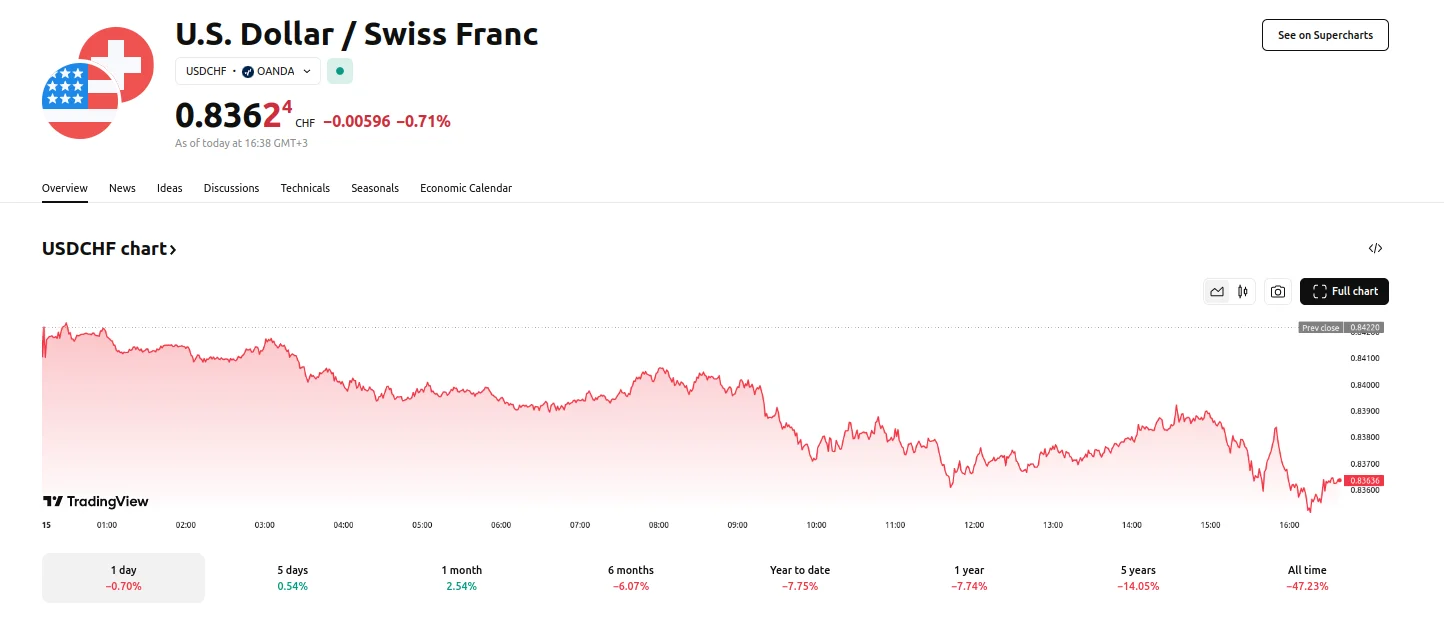

- USD/CHF declined to 0.8362 on Thursday, reversing the previous day’s upward movement.

- US April PPI dropped more than expected, reinforcing pressure on the US Dollar despite an uptick in Retail Sales.

Swiss Economy Records Faster Growth in Q1

Switzerland’s economy expanded by 0.7% in the first quarter, a notable acceleration from the revised 0.5% growth logged in the fourth quarter of 2024. This represents the most robust pace of expansion since early 2023. The State Secretariat for Economic Affairs attributed the gain largely to robust performance in the services sector alongside modest growth in industrial activity.

Despite solid economic momentum, inflationary pressures in Switzerland continue to weaken. Producer and Import Prices fell by 0.5% on a YoY basis, widening from the 0.1% decline observed in March. On a monthly basis, prices ticked up by only 0.1%, below the forecasted 0.2% increase, and underscoring persistent deflationary trends.

Meanwhile, the Swiss government has been working on strengthening its trade ties with the US in an effort to avoid potential tariffs. According to Finance Minister Karin Keller-Sutter, recent talks with Fed Secretary Scott Bessent were “constructive,” and there is potential for a bilateral trade agreement similar to the one established between the US and the UK.

USD/CHF Retreats

The USD/CHF pair weakened on Thursday, giving up gains from the prior session as it continued to consolidate within this week’s range. The downward momentum saw the dollar depreciate by 0.71% against the Swiss franc, with the rate hitting 0.8362.

In the United States, April’s macroeconomic data painted a mixed picture that served to exert pressure on the greenback. Retail Sales edged up by 0.1% in April, surpassing expectations for no change and reflecting steady consumer demand. However, the Producer Price Index (PPI) declined by 0.5% month-over-month, contrary to expectations for a 0.2% increase. Compared to the same period last year, the PPI dropped by 2.4%, down from the 2.7% annual decline in March. Core PPI’s monthly rate also fell 0.4%, while its annual rate eased to 3.1%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.