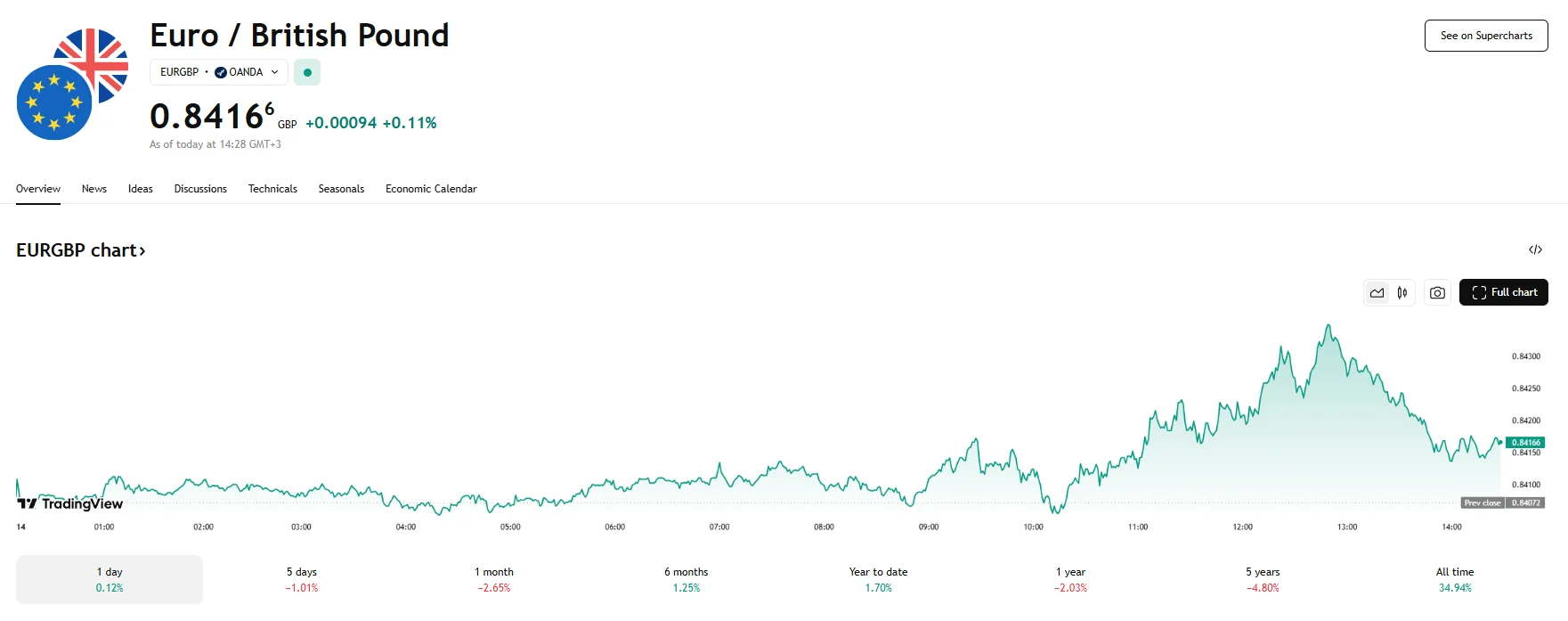

Sterling Slips 0.11% Against Euro, Ending a 7-Session Winning Streak Sterling Slips 0.11% Against Euro, Ending a 7-Session Winning Streak

Key Moments:The pound lost ground to the euro, with the EUR/GBP rate reaching 0.8416.Investors await upcoming UK GDP data amid uncertain growth outlook.Recent labor market data indicated a decrease in

Key Moments:

- The pound lost ground to the euro, with the EUR/GBP rate reaching 0.8416.

- Investors await upcoming UK GDP data amid uncertain growth outlook.

- Recent labor market data indicated a decrease in employment.

Pound Falls Back Amid Growth Concerns

On Wednesday, the British pound declined versus the euro, interrupting a seven-day stretch of appreciation. The EUR/GBP rose 0.11% to 0.8416, marking a reversal of the euro’s recent downward trend against the UK currency and a return to rate levels last seen in early April.

Jane Foley, head of FX strategy at Rabobank, observed that the 0.84 level appeared to be providing significant support. She also noted that further gains may be impeded unless the UK’s growth data proves to be stronger than anticipated. Foley also pointed out that a risk remained that growth in 2025 could be below 1%. She added that should these risks become more pronounced, sterling may find itself in a weaker position against the euro again.

Investors are looking ahead to the release of UK GDP figures for March and for the first quarter, scheduled for Thursday. According to Deutsche Bank Senior Economist Sanjay Raja, the data could show a solid increase for the quarter, although he expects it to be temporary and followed by a contraction in 2025’s Q2. This potential reversal adds to the uncertainty surrounding the Bank of England’s next interest rate decisions.

Recently released labour data showed a decline in employment, though economists deemed the drop minor. Wednesday saw Bank of England policymaker Catherine Mann claim she had been in favor of keeping interest rates unchanged during the recent BoE vote. Mann had previously advocated for a 50-basis-point reduction back in February, but changed her mind due to resilience in the UK labor market. Analysts currently expect that the BoE will cut interest rates by 50 basis points by the end of 2025.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.