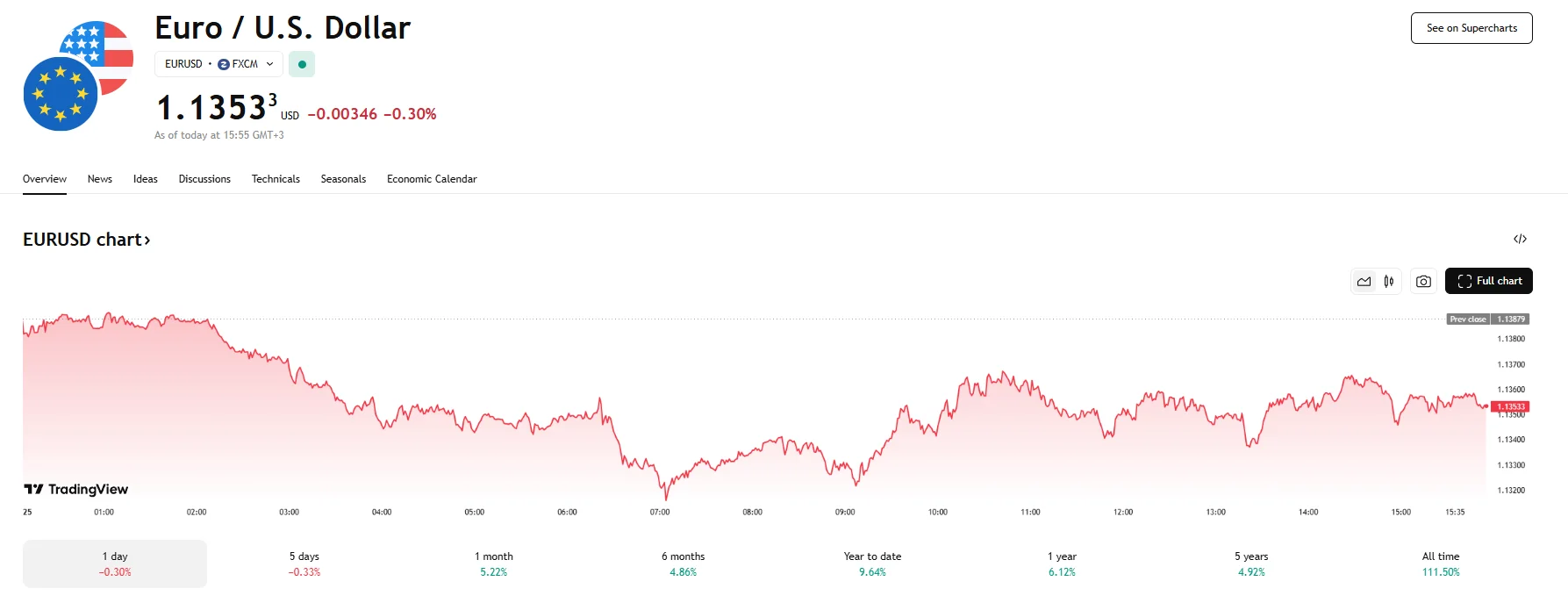

EUR/USD Slides 0.3% to 1.1353 as Dollar Rebounds EUR/USD Slides 0.3% to 1.1353 as Dollar Rebounds

Key momentsFriday witnessed the EUR/USD pair decline by 0.30%.The US Dollar Index (DXY) rose 0.36% to 99.647.Commentary by ECB officials and reports of trade dispute de-escalation in Asia contributed

Key moments

- Friday witnessed the EUR/USD pair decline by 0.30%.

- The US Dollar Index (DXY) rose 0.36% to 99.647.

- Commentary by ECB officials and reports of trade dispute de-escalation in Asia contributed to market sentiments.

Euro Under Pressure Amid Dollar Index Uptick

On Friday, the euro experienced a decline against the US dollar, with the EUR/USD currency pair falling by 0.30% to reach 1.1353. This downward movement occurred as the US dollar gained broader strength, buoyed by increasing optimism surrounding the potential easing of the trade disputes between the United States and key Asian partners. The improved sentiment regarding international trade appeared to favor the greenback, contributing to the euro’s relative weakness in the currency markets.

The strength of the US dollar was further reflected in the performance of the Dollar Index (DXY), which registered an increase of 0.36%, demonstrating a notable recovery and stabilizing above the 99.600 mark. Several factors contributed to these price movements. Notably, recent commentary from European Central Bank (ECB) policymakers played a role in shaping market expectations for the euro. On Thursday, ECB Governing Council member Olli Rehn voiced concerns regarding the potential for inflation in the Eurozone to fall below the central bank’s target of 2%. Rehn suggested that current economic conditions might warrant an interest rate cut as early as June, which could exert downward pressure on the euro.

Adding to the cautious outlook for the Eurozone economy was commentary from OeNB Governor Robert Holzmann. He expressed concerns about underlying structural weaknesses within the Eurozone and how potential economic shocks could persist, even if the tariffs imposed by the US were to be reduced. Holzmann’s remarks suggested a more pessimistic view of the Eurozone’s resilience.

Aiding the dollar were reports suggesting that China was considering a suspension of tariffs on certain US goods, including medical equipment and industrial chemicals. According to some Chinese microchip importers who reached out to CNN, tariffs on certain US-sourced semiconductors appear to be exempt from duties.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.