USD/CHF Breaches 0.8300 as SNB Voices Tariff Concerns USD/CHF Breaches 0.8300 as SNB Voices Tariff Concerns

Key momentsUSD/CHF advanced beyond 0.8300 on Friday, climbing 0.43%.The US Dollar Index recorded an increase of 0.41% to 99.697, while the US treasury yield stayed near 4.30%.SNB Chair Martin Schlegel

Key moments

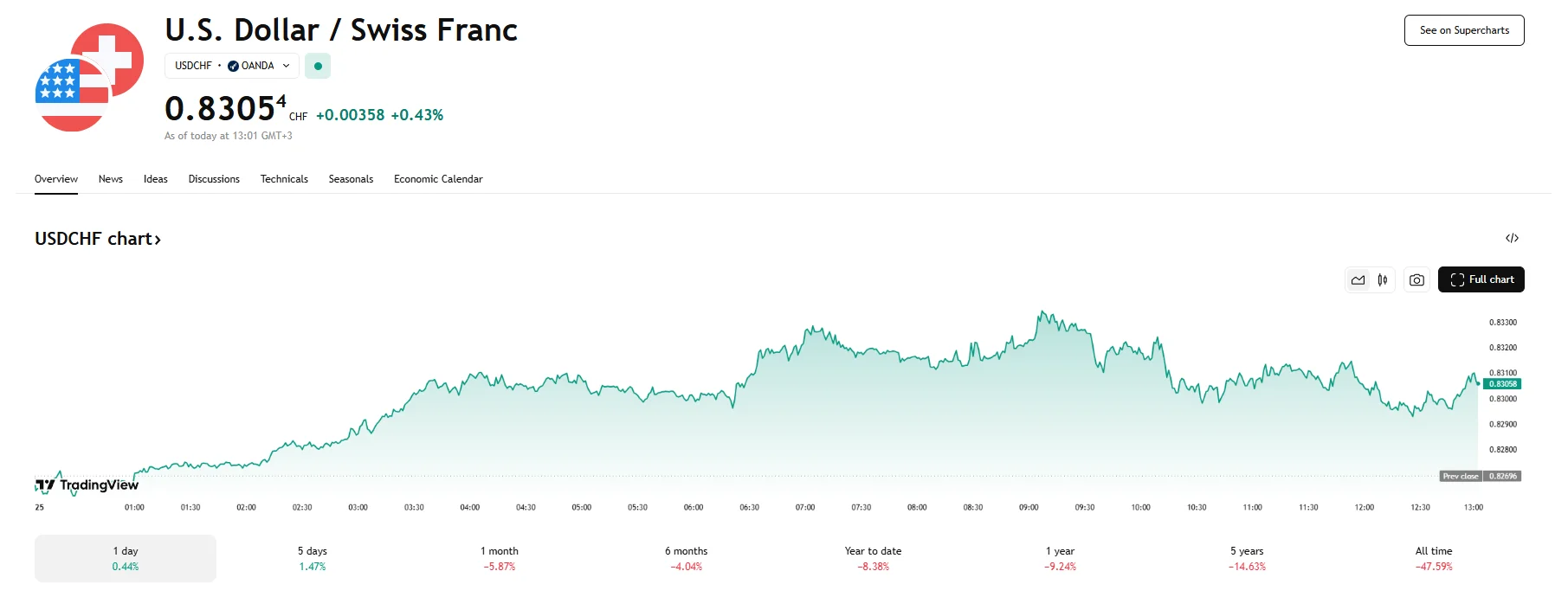

- USD/CHF advanced beyond 0.8300 on Friday, climbing 0.43%.

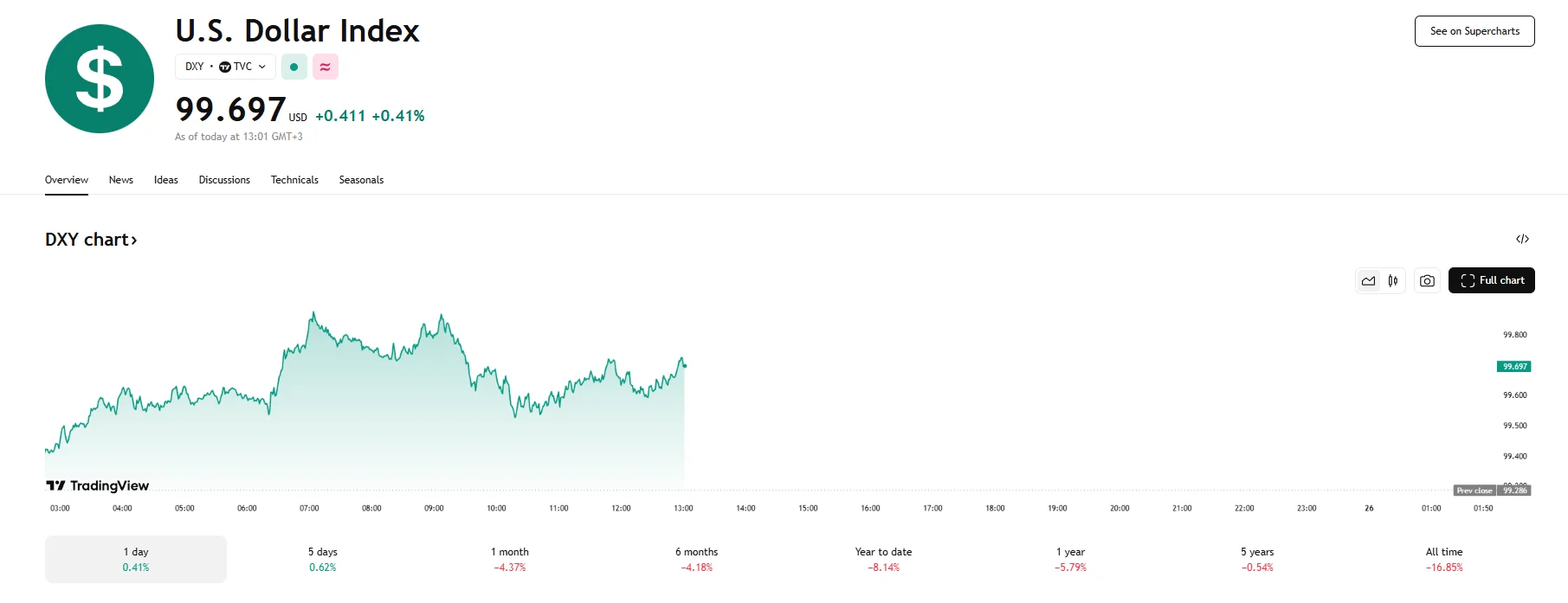

- The US Dollar Index recorded an increase of 0.41% to 99.697, while the US treasury yield stayed near 4.30%.

- SNB Chair Martin Schlegel commented on the potential consequences of US tariffs on global markets and the economic health of Switzerland.

USD/CHF Gains Momentum as SNB’s Tariff Warning Weighs on Franc

On Friday, the US dollar demonstrated strengthening momentum against the Swiss franc, with the USD/CHF currency pair edging upwards by 0.43% to trade at 0.8305. This upward movement reflected a broader improvement in sentiment surrounding the greenback, partially fueled by ongoing speculation regarding de-escalations of trade tensions between the United States and China.

The US Dollar Index, which measures the dollar’s strength against a basket of major currencies registered a gain of 0.41%, almost reaching the 99.700 mark. This broad-based strengthening of the dollar underscored the positive sentiment surrounding the currency on Friday.

Additionally, the yield on the benchmark 10-year US Treasury note remained relatively stable, standing at 4.31%. This provided a degree of support for the dollar, as it reflects the underlying health and stability of the US economy and its government debt. Regional Chief Investment Officer at UBS Global Wealth Management Kelvin Tay told Bloomberg of the benchmark yield’s significance of this benchmark yield, suggesting that markets could react negatively should it consistently climb beyond the 4.5% level.

As for the Swiss franc, its depreciation can also be sourced from statements by the Swiss National Bank. Earlier, Chairman Martin Schlegel issued a warning concerning the potential ramifications of the Trump administration’s tariff policies, emphasizing the significant uncertainties these policies pose to the global economic landscape and Switzerland’s own economy. The unpredictable nature of trade relations was focused on, as was the potential for disruptions to international commerce due to the duties that remain a concern. The SNB also expressed its readiness to take further action to support the Swiss economy, stating that it remained open to the possibility of cutting interest further if such measures are proven necessary to maintain price stability in the face of these external headwinds.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.