Bitcoin's \"Digital Gold\" Narrative Is Facing Its Toughest Test Yet

After a week-long selloff that wiped out hundreds of billions of dollars from the digital asset market, Bitcoin has once again failed to live up to its reputation as a “safe-haven asset.”Once hailed a

After a week-long selloff that wiped out hundreds of billions of dollars from the digital asset market, Bitcoin has once again failed to live up to its reputation as a “safe-haven asset.”

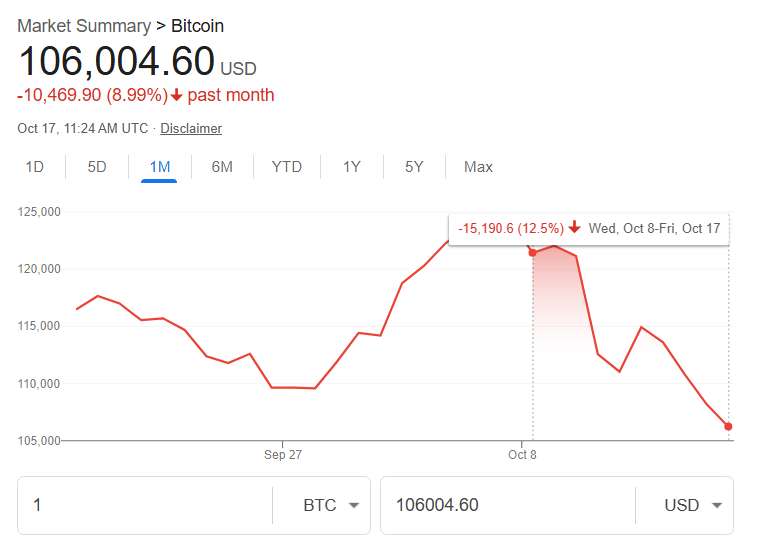

Once hailed as a hedge against market turmoil — the so-called “digital gold” of the blockchain era — Bitcoin extended its losses in early London trading on Friday, sliding as much as 3% and falling below the $105,000 mark, according to data. Ether, the world’s second-largest cryptocurrency, dropped below $3,800, more than 20% off its August peak.

Meanwhile, Binance’s native token BNB plunged as much as 11% on Friday. Analysts noted that the world’s largest crypto exchange was a key driver behind the record liquidation wave between October 10 and 11 — a period marked by user losses due to technical glitches and pricing errors. Binance has since offered nearly $600 million in compensation to individual and institutional clients affected by the crash.

Just days earlier, on October 6, Bitcoin had reached an all-time high of $126,251. But as U.S.- China trade tensions escalated, more than $19 billion in positions were liquidated, triggering a broad selloff across nearly all major cryptocurrencies.

Despite major industry players like Kraken, Circle, BitGo, and Ripple pushing deeper into the regulated financial sphere - by applying for trust licenses, building payment rails, and launching credit card products - the crypto market has yet to show signs of lasting recovery.

“What’s striking is the timing of the crash coinciding with major players pursuing banking licenses,” said Rachael Lucas, an analyst at BTC Markets. She added that the shift toward traditional financial infrastructure “signals a strategic hedge against volatility, aiming to build legitimacy.”

Risks stemming from the ongoing U.S. - China trade conflict continue to weigh on risk assets, including cryptocurrencies.

The bankruptcies of First Brands Group and Tricolor Holdings have reignited concerns over hidden credit losses, while Zions Bancorp and Western Alliance Bank saw their market value plunge by over $100 billion in a single day due to write-downs linked to fraudulent loans.

On Thursday, as risk aversion swept global markets, investors withdrew a net $593 million from U.S.-listed Bitcoin and Ethereum exchange-traded funds (ETFs). Over the past 24 hours, the put-to-call ratio for Bitcoin options on derivatives platform Deribit rose to 1.33 - signaling that traders are increasingly hedging against further downside risk. Put options grant holders the right to sell an asset at a predetermined price, offering protection against declines.

Against a backdrop of surging traditional safe-haven assets like gold and silver, Bitcoin’s performance has been disappointing. For the week ended October 12, Bitcoin fell as much as 6.3% - its steepest weekly drop since early March - and has yet to show signs of recovery. Most major cryptocurrencies have followed the same downward trajectory.

“More than anything, I think crypto is acting like a canary in the coal mine, suggesting the market is on edge because of emerging credit worries,” said Matthew Hougan, Chief Investment Officer at Bitwise.

![]() Wallstreet Insight

Wallstreet Insight

Expert analysis on U.S. markets and macro trends, delivering clear perspectives behind major market moves.

Latest Articles

Disappearing Data Is About to Force The Fed To Make Its Toughest Call Yet?

Oct.17 2025

Bitcoin's "Digital Gold" Narrative Is Facing Its Toughest Test Yet

Oct.17 2025

The $1 Trillion Question: When Everyone's Betting on AI, Who's Left Holding the Bag?

Oct.16 2025

How a Crypto Empire Powered Trump's $10 Billion Comeback

Oct.16 2025

Watch Christopher Waller: Economic Outlook

Oct.16 2025

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.