Stocks Ease Ahead of Fed Decision Despite Strong Retail Sales

U.S. stocks slipped Tuesday as investors digested another upside surprise in retail sales, steady small business profitability, and fresh developments on TikTok while awaiting the Federal Reserve’s po

U.S. stocks slipped Tuesday as investors digested another upside surprise in retail sales, steady small business profitability, and fresh developments on TikTok while awaiting the Federal Reserve’s policy decision.

The Dow Jones Industrial Average fell 125.18 points, or 0.27%, to 45,758.3. The S&P 500 edged down 8.49 points, or 0.13%, to 6,606.79, while the Nasdaq Composite declined 14.79 points, or 0.07%, to 22,334.0. Crude oil futures for October delivery rose 1.92% to settle at $64.23 a barrel, while December gold futures gained 0.20% to $3,726.50 an ounce.

Fed in Focus

The Federal Reserve will announce its interest rate decision Wednesday, with markets broadly expecting a quarter-point rate cut. The Summary of Economic Projections and dot plot will clarify whether policymakers see growth as resilient or at risk of faltering. History shows equities often wobble in the days after an initial cut as investors reassess expectations, strategists say.

Consumers Stay Resilient

August retail sales rose 0.6% from July and 5.0% from a year earlier, marking a third straight monthly surprise. E-commerce climbed 2.0% month-over-month and more than 10% on the year, while back-to-school spending boosted apparel and sporting goods. Housing-linked categories such as furniture and building materials lagged, underscoring sectoral divergences. The robust report complicates expectations for an emphatically dovish Fed message. Analysts noted the data reinforces the view that upcoming rate cuts reflect policy “restrictiveness,” not recession risks.

Small Business Snapshot

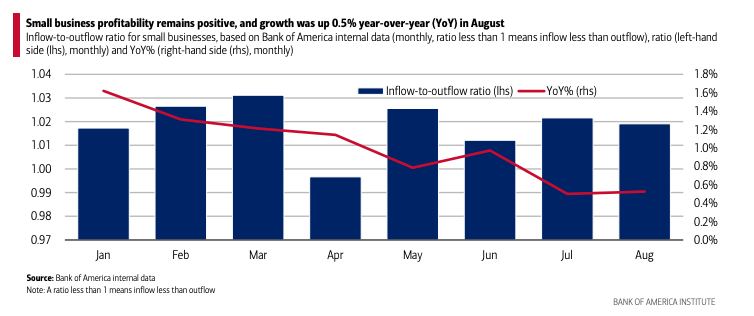

Bank of America Institute data showed small business profitability up 0.5% year-over-year in August, unchanged from July. That aligns with a modest rise in optimism reported by the National Federation of Independent Business. Still, profitability growth has slowed significantly this year amid tariffs and higher wage costs

TikTok and Trade Tensions

Separately, the Wall Street Journal reported that TikTok's U.S. arm would be overseen by a consortium of American investors including Oracle, Silver Lake, and Andreessen Horowitz. President Trump extended the deadline for enforcing restrictions on the app until December 16, 2025, granting more time for negotiations.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.