Stocks Advance as Rate-Cut Bets Offset Weak Jobs Data; Trump Urges Fed to Move Faster

U.S. stocks closed higher Monday as investors looked past evidence of a slowing labor market and instead bet on easier monetary policy ahead.The Dow Jones Industrial Average rose 50.03 points, or 0.11

U.S. stocks closed higher Monday as investors looked past evidence of a slowing labor market and instead bet on easier monetary policy ahead.

The Dow Jones Industrial Average rose 50.03 points, or 0.11%, to finish at 45,884.3. The Nasdaq Composite gained 207.65 points, or 0.94%, closing at 22,348.8. The S&P 500 added 31.04 points, or 0.47%, ending the session at 6,615.33

The upward move came despite fresh warnings about labor market softness. Fresh data reinforced concerns about the economy’s cooling pace. According to the Bank of America Institute, non-farm payrolls averaged just above 63,000 over the past six months as of August, highlighting that “the labor market has cooled significantly.” Still, equities have remained resilient, supported by expectations of rate cuts and by households holding $19 trillion more in cash than the pre-pandemic trend.

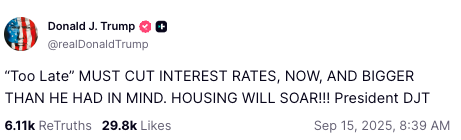

President Donald J. Trump intensified calls for lower borrowing costs, writing on Truth Social: “Too Late” MUST CUT INTEREST RATES, NOW, AND BIGGER THAN HE HAD IN MIND. HOUSING WILL SOAR!!! President DJT.

The post came as markets already priced in the likelihood of a Fed move this fall, with investors split on the size and speed of the adjustment.

TikTok Deal and Tariff Debate

Yahoo Finance reports that discussions over a potential TIKTOK deal are resurfacing, again spotlighting U.S.–China trade tensions.

In a separate debate, Trump suggested that public companies might benefit from reporting earnings twice a year instead of quarterly. Rick Newman, author of The Rick Report , responded: “It’s an open question whether less frequent reporting would help companies perform better. But if Trump really wanted to help companies save money and focus on properly running their companies, he could make an immediate impact by canceling thousands of new tariffs that impose billions of dollars of direct costs on companies and make strategic planning a nightmare.”

Newman added that Trump’s tariffs, “which are import taxes imposed on goods from almost every country in the world, have raised taxes on businesses by about $19 billion per month so far this year. On an annualized basis that’s a $158 billion tax hike. Importers pay the tax first, then they try to pass on as much of it as they can to their own customers, all the way to shoppers buying everyday products. Just about everybody pays more." Commodities markets also reflected investor hedging. Gold futures for December delivery climbed 0.87% to $3,718.30, while crude oil futures for October delivery advanced 0.96% to $63.29. The moves suggested some investors continue to seek safety in hard assets even as equities trend higher.

Broader momentum continues to hinge on themes beyond monetary policy. Investment in artificial intelligence and data centers remains a key driver of productivity expectations, according to Bank of America’s research unit. That optimism has contributed to the market’s resilience in the face of weaker macroeconomic indicators.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.