This AI Company Was Once Invested In By NVIDIA, And Now It Is Believed To Be The Next AI Dark Horse

There is no doubt that artificial intelligence (AI) will be the most promising growth opportunity of this decade. Although AI-related stocks are constantly emerging in the market, the most promising c

There is no doubt that artificial intelligence (AI) will be the most promising growth opportunity of this decade. Although AI-related stocks are constantly emerging in the market, the most promising companies have already captured significant attention from investors.

However, there is one stock, priced at just $12, that seems to have gone unnoticed by most AI investors. Its growth potential should not be underestimated, but before jumping in, investors should remain cautious of one critical risk factor.

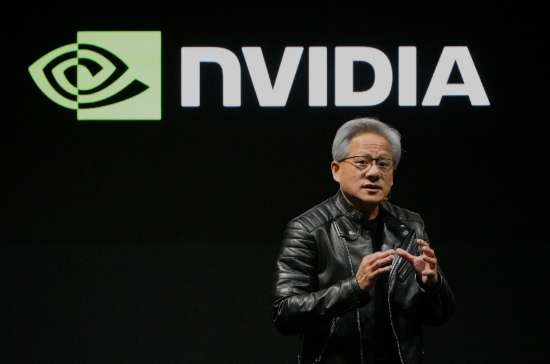

An AI Company Once Favored by NVIDIA

In 2023, when NVIDIA (NVDA.US) disclosed its $3.7 million investment in SoundHound AI (SOUN.US), it instantly ignited Wall Street's imagination. At that time, NVIDIA was broadly investing in a range of AI companies, making small-scale investments to accelerate the development of the AI ecosystem.

Subsequently, NVIDIA established formal partnerships with many of these invested companies. For example, it collaborated with SoundHound to develop an in-vehicle AI platform, combining NVIDIA's expertise in GPU and software architecture with SoundHound's voice assistant technology to create an unprecedented in-car interaction experience. This allows drivers to communicate with their vehicles in a more natural way through dialogue.

In 2024, NVIDIA sold its shares in SoundHound at a considerable profit. During the approximately one year that NVIDIA held the stock, its "star effect" helped drive SoundHound's share price from $5 to $25. Since NVIDIA's exit, the stock price has retreated to around $12 but remains significantly higher than its valuation before NVIDIA's investment.

Now, with the stock down 50% from its peak, should investors take another look at this former "AI darling"? Although NVIDIA no longer holds shares, the previous collaboration not only brought SoundHound into the public eye but also provided this relatively small company with crucial market recognition. So, can SoundHound become the next rising star in the AI field?

Conversational AI Technology

SoundHound focuses on applying AI technology to the field of sound. The company has partnered with several major automakers to develop in-car voice assistants, collaborated with national fast-food chains to launch AI-driven drive-thru ordering systems, and built AI-powered customer service chatbots for countless businesses. Wherever AI voice can replace human speech, SoundHound is there.

Within the broader AI industry, this niche market remains substantial. It is estimated that the global voice AI market will grow from approximately $2 billion in 2024 to over $47 billion by 2034, with a compound annual growth rate exceeding 30%.

SoundHound's growth performance reflects its active pursuit of this underlying opportunity: its sales increased by 47% year-over-year in 2023, and this growth accelerated to 85% in 2024. Analysts project a sales growth of 96% this year (though growth may slow to 29% in 2026).

The Hidden Risk Behind the Opportunity

Despite its current price-to-sales ratio of 36.3, the market clearly recognizes SoundHound's potential to sustain high growth over the coming years or even decades. However, the real challenge the company faces is not a lack of market growth but intense competition within the industry.

Nearly all tech giants are developing their own voice AI technologies. Can SoundHound's annual R&D budget of $90 million support its long-term competitiveness? Whether the company possesses a sustainable competitive advantage against deeper-pocketed rivals remains an open question.

Can SoundHound become the next dark horse in the AI world? The answer is undoubtedly yes. But its success will depend on its long-term competitiveness rather than the market opportunity itself.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.