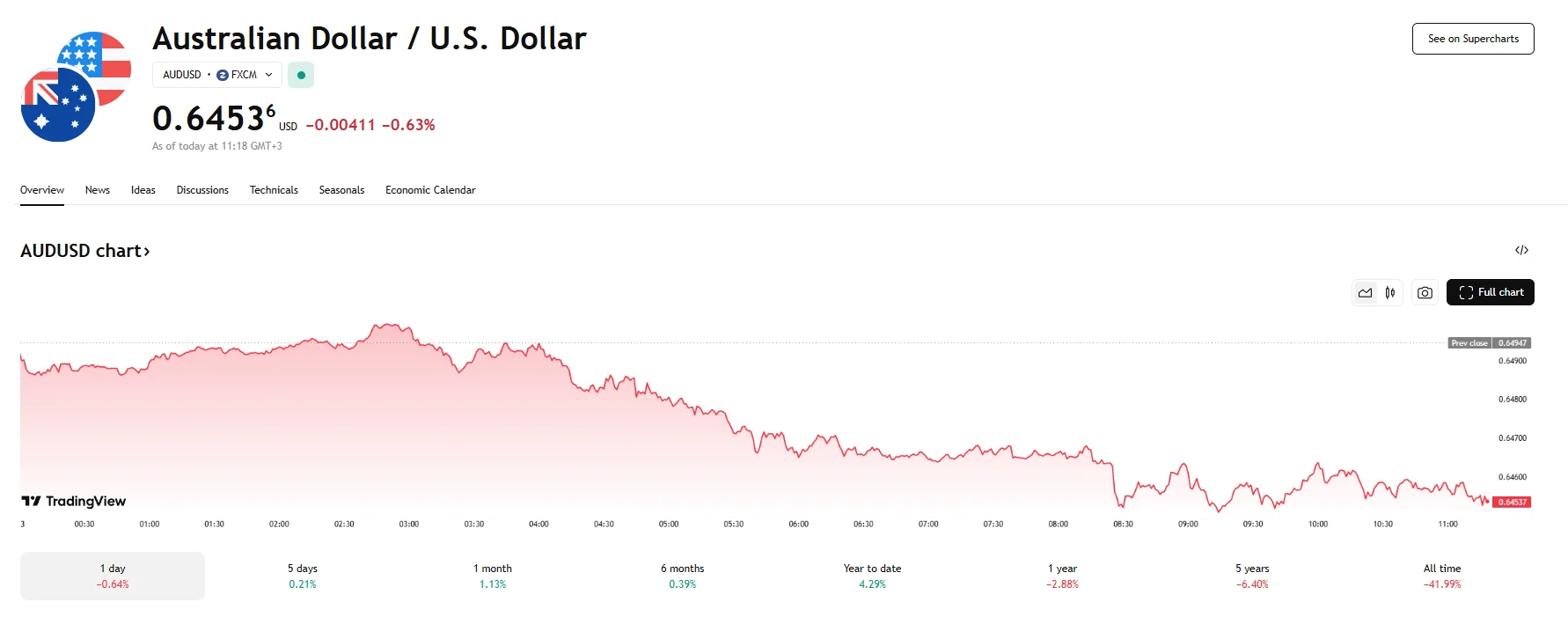

AUD/USD Retreats 0.63% to 0.6453 as Markets Anticipate Further RBA Rate Cuts AUD/USD Retreats 0.63% to 0.6453 as Markets Anticipate Further RBA Rate Cuts

Key Moments:The Australian dollar fell to 0.6453 following the release of the RBA’s May meeting minutes.Policymakers discussed a potential 50-basis-point rate decrease.According to market participants

Key Moments:

- The Australian dollar fell to 0.6453 following the release of the RBA’s May meeting minutes.

- Policymakers discussed a potential 50-basis-point rate decrease.

- According to market participants, the chances of further interest rate reductions being implemented in June now stand at around 70%.

Australian Dollar Reverses Previous Day’s Gains

The AUD/USD pair declined by 0.63% to 0.6453 on Tuesday, giving up strong gains recorded in the prior session. The shift followed new insights from the Reserve Bank of Australia’s (RBA) May policy meeting, which revealed that board members had debated the merits of slashing rates by 50 basis points to mitigate rising global trade risks before settling on a 25-basis-point cut.

Investor sentiment now reflects a roughly 70% probability of the RBA lowering interest rates further during its upcoming policy meeting. However, many analysts suggest the central bank may postpone additional action until second-quarter inflation data becomes available, aligning with its cautious approach described in the meeting minutes.

Mixed Domestic Economic Signals

Economic data released during the same period showed Australia’s current account deficit narrowed in the first quarter of 2025 to A$14.7 billion, an improvement when compared to the revised A$16.3 billion reported in 2024’s fourth quarter. However, the figure missed market forecasts for a deficit of A$12 billion.

In addition to domestic developments, the AUD also faced downward pressure as the US dollar attempted to rebound amid a backdrop of ongoing economic uncertainty in the United States and an escalation in global trade conflicts. Although the greenback saw weakness on Monday, partly due to escalating tariff tensions and weak PMI reports, a partial rebound contributed to the Aussie’s retreat on June 3rd. At press time, the US Dollar Index, which measures the greenback’s performance against a basket of currencies, is trading near the 99,000 mark.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.