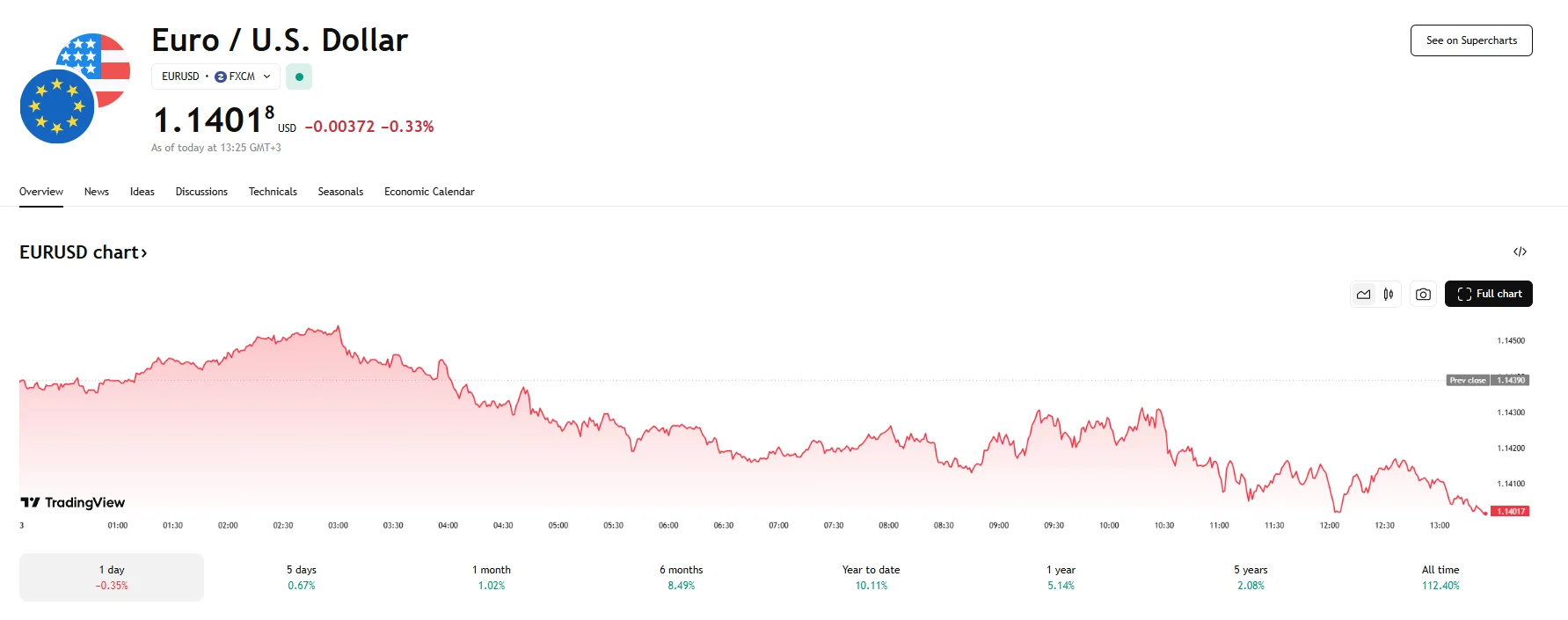

EUR/USD Tumbles 0.33% to 1.1401, Cooling Eurozone Inflation of 1.9% Sets Stage for ECB Rate Cut EUR/USD Tumbles 0.33% to 1.1401, Cooling Eurozone Inflation of 1.9% Sets Stage for ECB Rate Cut

Key Moments:The eurozones inflation dropped to 1.9% in May, falling below the ECB’s 2% target.According to market participant expectations, the ECB will reduce rates by 25 basis points this week.The E

Key Moments:

- The eurozone’s inflation dropped to 1.9% in May, falling below the ECB’s 2% target.

- According to market participant expectations, the ECB will reduce rates by 25 basis points this week.

- The EUR/USD pair fell by 0.33% to 1.1401 on Tuesday.

Inflation Retreats Below Target Just Before ECB Decision

The eurozone’s inflation rate declined to 1.9% in May, slipping under the European Central Bank’s official target and heightening expectations that the central bank will move forward with another rate cut. Eurostat data released Tuesday confirmed the drop from April’s 2.2% reading, coming in below economist estimates of 2.0%. This is a significant development ahead of the ECB’s meeting on Thursday. The news caused the euro to depreciate against the US dollar, with the EUR/USD exchange rate dropping 0.33% and hitting 1.1401.

The pullback in May’s figures was largely influenced by a drop in services inflation, which eased to 3.2%, nearly 1% lower than what was reported in April. This marked its lowest level since March 2022. The decline came partly due to a later Easter holiday, alongside a notable slowdown in wage growth, reducing cost pressures in service sectors. However, Eurostat data showed that local labor markets remain tight as the unemployment rate sank to 6.2% in April.

According to market expectations, the ECB is likely to lower its benchmark interest rate by 25 basis points during its upcoming policy meeting. This would bring it to 2% and mark the seventh consecutive cut in recent months.

External Trade and Tariff Risks Add Complexity

Globally, US inflation edged down to 2.3% in April. However, concerns persist around potential inflationary pressures due to President Donald Trump’s evolving tariff policies. Meanwhile, in Europe, higher tariffs on US imports may act as a disinflationary force by dampening demand for European products and redirecting low-cost exports from countries like China into European markets.

Looking ahead, the ECB is expected to update its quarterly projections on Thursday. Should trade negotiations between the European Union and the US collapse before a potential July deadline, the central bank may opt for further monetary easing. Analysts expect the ECB to revise down its projections for both inflation and economic expansion in response to these risks.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.