Ethereum, Bitcoin Prices Drop Over 1% Despite Combined ETF Inflows of $1.05B Ethereum, Bitcoin Prices Drop Over 1% Despite Combined ETF Inflows of $1.05B

Key Moments:Bitcoin and Ethereum ETFs attracted a total of $1.05 billion in net inflows on Thursday.Ethereum ETFs saw $110.5 million in net inflows, their best since February 4The figures failed to ai

Key Moments:

- Bitcoin and Ethereum ETFs attracted a total of $1.05 billion in net inflows on Thursday.

- Ethereum ETFs saw $110.5 million in net inflows, their best since February 4

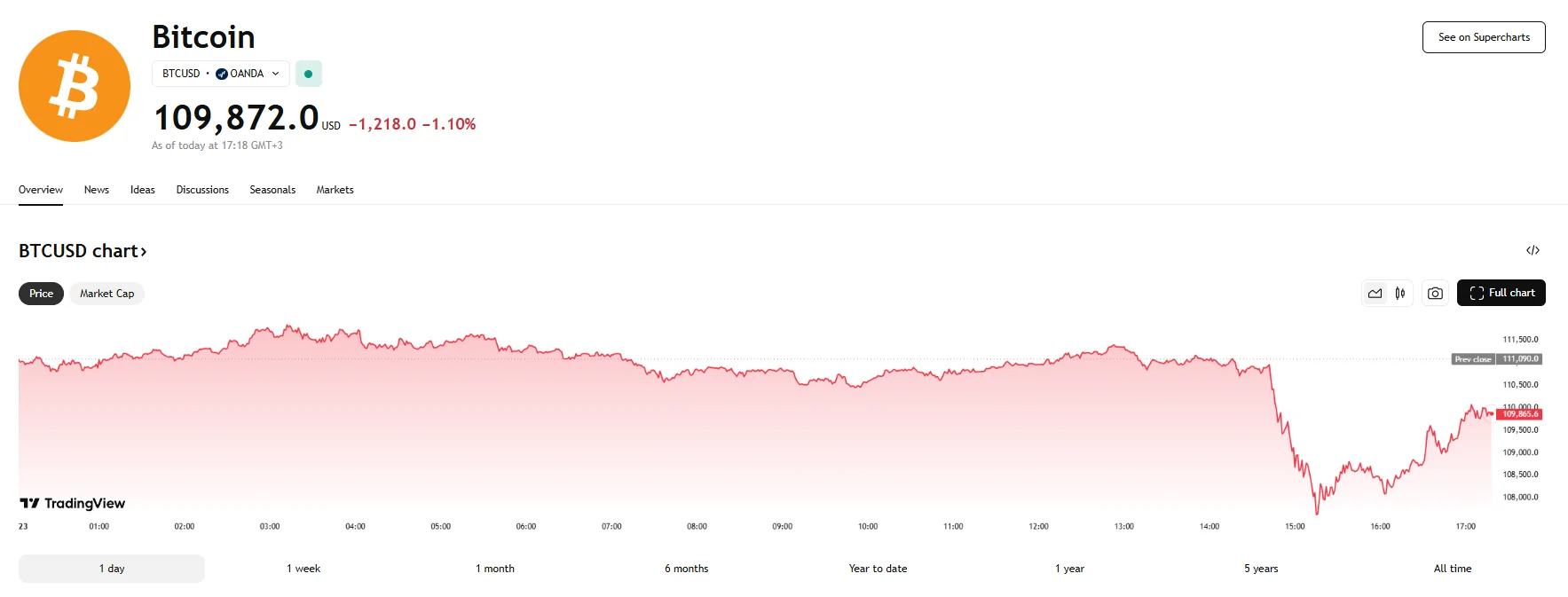

- The figures failed to aid prices on Friday, as Bitcoin dropped 1.1% to 109,872, while Ethereum fell 3.19% to 2,579.37.

Bitcoin ETFs Attract Highest Daily Inflows Since January

US spot Bitcoin and Ethereum exchange-traded funds pulled in a combined total of $1.05 billion in net inflows on Thursday, marking the largest daily intake since January. The surge coincided with Bitcoin reaching a new all-time high and Ethereum enjoying its most positive market trend in months.

Data from The Block revealed that Bitcoin ETFs alone drew $934.8 million in inflows on May 22nd, and BlackRock’s IBIT led the charge with $877.2 million in net inflows. This also placed IBIT among the top five ETFs by year-to-date inflows. Fidelity’s FBTC, meanwhile, enjoyed an inflow of $48.7 million, while Ark Invest’s ARKB contributed $8.9 million.

Ethereum ETFs Log Best Daily Flows in Over Three Months

US spot Ethereum ETFs brought in $110.5 million in net inflows on Thursday, their largest one-day increase since February 4th. Grayscale’s ETHE was at the top with $43.7 million, followed by Fidelity’s FETH with $42.2 million. ETH, also tied to Grayscale, saw $18.9 million, and Bitwise’s ETHW added $5.7 million.

The Ethereum ETF category is now on a five-day winning streak, accumulating $211.8 million in net flows during that time. Year-to-date net inflows stand at $61.9 million, while cumulative inflows since inception total $2.7 billion.

Spot Prices Fall

While news of robust ETF inflows may often aid the spot prices of Ethereum and Bitcoin alike, such a surge did not come to fruition on Friday.

Bitcoin fell by 1.1%, down from yesterday’s record-high valuation above the $111,000 mark.

Ethereum’s own decline was even sharper, as it lost 3.19% of its value and hit $2.579.37. It should be noted that Ethereum is up when it comes to its five-day performance, however.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.