Bitcoin Acts Less Like Gold, More Like Tech Stock

During last week’s Israel-Iran conflict, financial markets reacted in largely predictable ways: global stock markets dropped, oil prices surged, and gold spiked as safe-haven demand soared.However, Bi

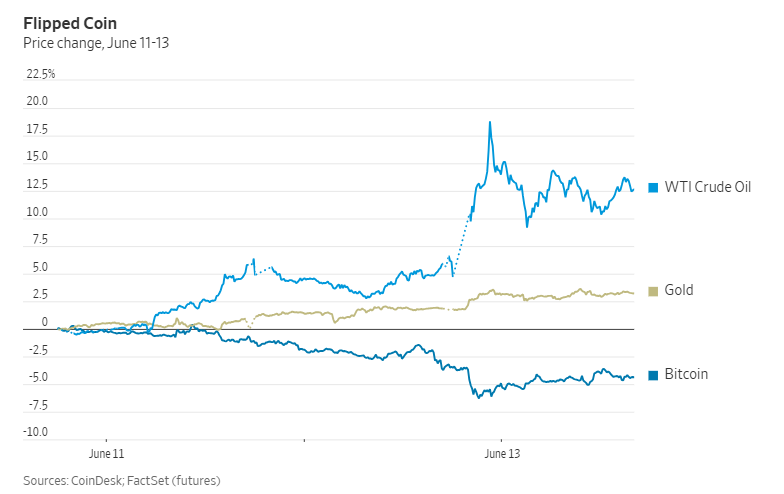

During last week’s Israel-Iran conflict, financial markets reacted in largely predictable ways: global stock markets dropped, oil prices surged, and gold spiked as safe-haven demand soared.

However, Bitcoin—often dubbed “digital gold”—failed to serve a similar safe-haven role, instead falling in tandem with global equities. At present, Bitcoin behaves more like a risk asset, with its price movements highly correlated with tech stocks. Narratives around Bitcoin as digital gold or an inflation hedge have effectively collapsed.

Although Bitcoin has lost some of its anti-establishment symbolism, it still shares several key characteristics with gold: limited supply, no need for sovereign backing, immunity to destruction, and—unlike gold—greater ease of transfer and concealment.

So why has Bitcoin failed to function as “insurance” against geopolitical risks?

One reason is its digital nature. If society were to collapse, cryptocurrencies stored on trading platforms—or even a USB stick in your pocket—may become useless. Physical gold, by contrast, could still retain value in such a scenario.

Another reason is that most people now buy cryptocurrencies out of speculation, not for risk protection. Bitcoin tends to attract speculators more than gold. According to the CME Group, over the past five years, Bitcoin has shown a positive correlation with equities.

When investor sentiment runs high, there's a clear preference for cryptocurrencies or other assets with little intrinsic value—such as “meme stocks.”

That said, Bitcoin isn’t without merit. The Wall Street Journal points out that if a scenario arises where confidence in fiat currencies like the U.S. dollar collapses—something investors have increasingly feared in recent years—Bitcoin may shine like gold.

With global government debt levels on the rise, inflation could become the “easiest” solution, boosting assets not backed by liabilities of any particular entity.

While Bitcoin isn’t an all-weather insurance asset like gold, it does offer greater upside potential under favorable conditions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.