Oil Surges Amid Israel-Iran Conflict, Raising Inflation Fears and Delaying Fed Rate Cuts

Oil prices have vaulted to their highest levels in months as the intensifying clash between Israel and Iran sends jitters through global markets, stoking fears of supply disruptions in a region that p

Oil prices have vaulted to their highest levels in months as the intensifying clash between Israel and Iran sends jitters through global markets, stoking fears of supply disruptions in a region that pumps roughly a third of the world’s crude.

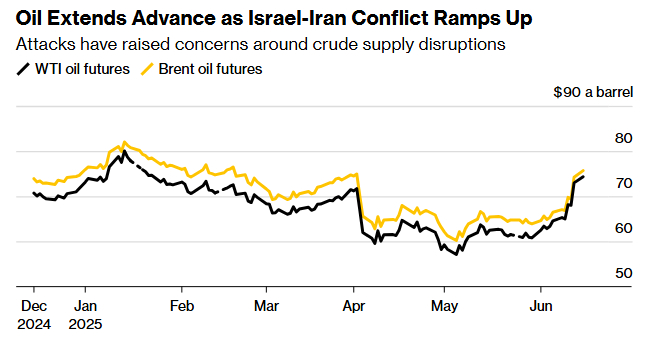

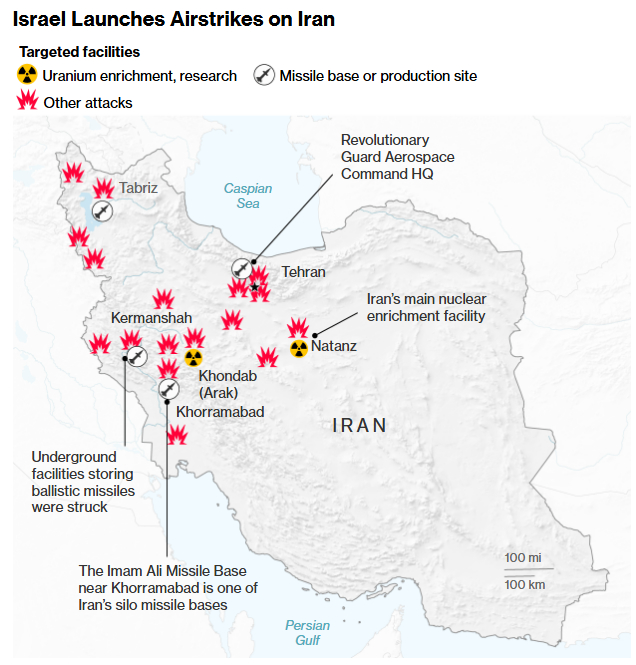

The rally kicked into high gear over the weekend as Brent crude soared as much as 5.5% before settling below $76 a barrel, while West Texas Intermediate hovered near $74. The trigger? Israel’s precision strikes on Iran’s nuclear facilities and military leadership, followed by a daring attack on the giant South Pars gas field, which sparked a massive explosion and fire at a processing plant, according to Iran’s Tasnim news agency. With tensions boiling over, financial markets are on edge, and the specter of inflation is looming larger than ever.

Market Jitters: Oil Prices Spike as Supply Risks Mount

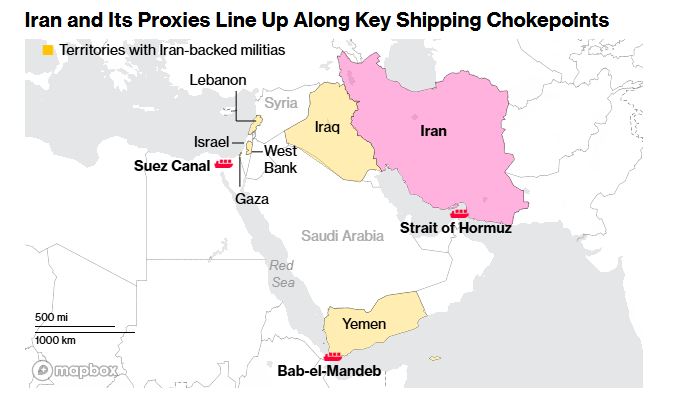

The escalation has lit a fire under oil markets. Prices jumped more than 13% on Friday alone before paring some gains, as investors scrambled for cover in safe-haven assets like gold. The conflict’s epicenter—a region that accounts for about 30% of global oil production—has traders fixated on the Strait of Hormuz, a narrow chokepoint through which one-fifth of the world’s daily oil shipments flow.

“A potential blockage of the Strait of Hormuz by Iran remains the most important market-moving event to watch for, which could tip oil markets into unprecedented territory,” said Mukesh Sahdev, an analyst at Rystad Energy AS. While Tehran hasn’t signaled plans to choke off the route, the mere possibility has sent market metrics into overdrive.

The gap between Brent’s two nearest December contracts—a key gauge of long-term supply and demand—widened by as much as $1.29 a barrel to $3.48, reflecting deep unease about near-term risks. Options markets are equally jittery, with a pronounced tilt toward bullish calls and trading volumes spiking far above normal levels.

JP Morgan, meanwhile, is holding steady on its 2025 base-case forecast, pegging Brent at the low-to-mid $60s. But the bank isn’t blind to the upside risks, warning that a full-blown military conflict could catapult prices to $120–$130 a barrel if the Strait shuts down—a scenario that would upend global energy flows.

Israel’s strike on South Pars, which produces condensate alongside gas for domestic use, has only amplified the tension. Although Iran’s oil export infrastructure remains intact for now, the attack underscores the vulnerability of the region’s energy network. The cancellation of nuclear talks with the US, originally slated for Oman, has dashed hopes of a diplomatic off-ramp, leaving markets to price in a prolonged standoff.

War Without End: Israel and Iran Trade Blows

The conflict roared into its third day with no sign of abating. Israel reported a fresh barrage of Iranian missiles on Sunday, hours after pummeling Tehran with simultaneous strikes.

The toll is mounting: 13 dead and 380 injured in Israel, per emergency services, while Iran counts at least 80 fatalities. Defense Minister Israel Katz has vowed to target the “regime in Tehran,” signaling a no-holds-barred approach. Iran, meanwhile, hit back with strikes on Israeli infrastructure near Haifa, forcing residents into bomb shelters.

The tit-for-tat began Friday when Israel unleashed jets and drones on Iran’s nuclear and military sites, gaining air superiority over the Islamic Republic. Explosions rocked Iran on Saturday, including at the South Pars facility, while the UN’s atomic watchdog reported serious damage to a uranium-conversion plant in Isfahan. Prime Minister Benjamin Netanyahu has promised to “strike at every site and every target of the Ayatollah regime,” while Iran’s Supreme Leader Ayatollah Ali Khamenei insists Israel will “pay a very heavy price.” The enmity, rooted in decades of hostility, has erupted into the most serious confrontation yet between the two nations.

Global leaders are scrambling to contain the fallout. Middle Eastern stock markets—from Saudi Arabia to Qatar—tanked on Sunday, and the Egyptian pound shed 1.8% against the dollar. Russian President Vladimir Putin and Germany’s Foreign Minister Johann Wadephul have urged de-escalation, with the latter calling for regional dialogue with Iran. The Group of Seven is poised to tackle the crisis at its upcoming Canada summit, but with both sides dug in, a resolution feels distant. US President Donald Trump, caught between his push for a nuclear deal and Israel’s pleas for support, mused that “sometimes they have to fight it out,” even as he held out hope for an accord.

Inflation’s Shadow: Fed Faces a Tough Road Ahead

The ripple effects are hitting closer to home. Economists warn that soaring oil prices could stoke inflation, throwing a wrench into the Federal Reserve’s rate-cut timeline. Joseph Brusuelas, chief economist at RSM US LLP, predicts the Fed will stay pat through at least December, waiting for clarity on how the conflict reshapes domestic price pressures. Bloomberg Economics’ Anna Wong and Tom Orlik paint a starker picture: if oil hits $100 a barrel, US gasoline prices could leap 17% to $4.20 a gallon from $3.25, driving the year-over-year inflation rate to 3.2% by June.

That’s a headache the Fed can ill afford. Its June 17-18 meeting looms large, with markets now expecting just 1.9 quarter-point cuts through 2025, down from 2.1 earlier. Yet JPMorgan Chase & Co.’s Michael Feroli doubts the central bank will spotlight the Middle East in its post-meeting statement, suggesting it’s too soon to shift gears. Still, the stakes are high. With Trump’s trade tariffs already fanning inflationary flames, a sustained oil shock could force the Fed into a tighter stance, derailing hopes of monetary easing.

A World on Edge

For now, the global economy teeters on a knife’s edge. Iran faces an existential bind: back down and lose face, or double down and risk a wider war it can’t sustain, with its economy reeling from 40% inflation and public discontent simmering. Israel, emboldened by its early gains, shows no appetite for retreat. The Strait of Hormuz remains the ultimate wild card—any move to disrupt it could drag the US into the fray, a scenario Tehran likely dreads but can’t entirely rule out.

As oil claws back its yearly losses and markets brace for more volatility, the path forward is murky. The Group of Seven’s talks may offer a glimmer of hope, but with diplomacy faltering and missiles flying, the world can only watch—and wait. For energy markets, inflation watchers, and central bankers alike, the Israel-Iran crisis is a high-stakes drama with no clear end in sight.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.