No Panic! Why Smart Investors Buy When Geopolitical Fear Peaks

Israel’s airstrike on Iran sent global financial markets swiftly into risk-off mode. S&P 500 index futures plunged, while oil and gold prices surged. However, after several hours, investor panic began

Israel’s airstrike on Iran sent global financial markets swiftly into risk-off mode. S&P 500 index futures plunged, while oil and gold prices surged. However, after several hours, investor panic began to ease — oil pared gains by nearly half, and U.S. equity futures bounced off their lows.

“Financial markets are always incredibly quick to price in geopolitical fear, but tend to be equally quick to discount it again, seeing the risk premium fade in short order,” said Michael Brown, Senior Research Strategist at Pepperstone.

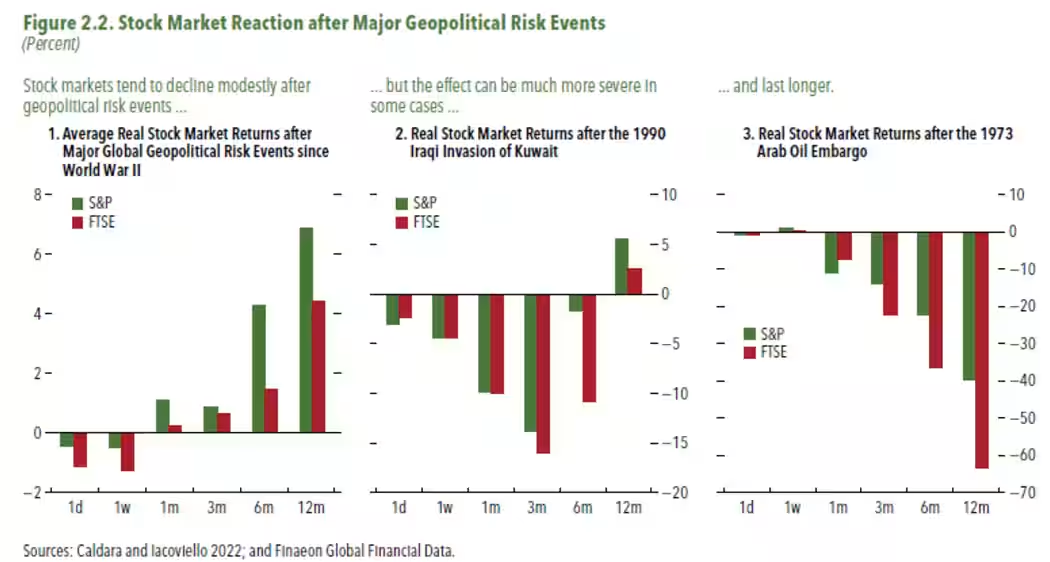

“Stock prices have generally had a modest reaction to geopolitical risk events, but major events — especially military conflicts — have a disproportionately larger and more persistent effect on asset prices,” noted IMF researchers Salih Fendoglu, Mahvash S. Qureshi, and Felix Suntheim.

To support their point, the IMF team studied how past geopolitical events impacted global stock markets. On average, when geopolitical shocks occur, national equity markets fall about 1% monthly, while emerging markets decline by up to 2.5%.

International military conflicts hit emerging market equities hardest — likely because they tend to cause greater economic disruptions. When such conflicts occur, emerging market stocks post average monthly returns of -5%, double the losses caused by other types of geopolitical events.

The good news? On average, following major geopolitical shocks, national stock markets typically return to positive territory within a month. However, this rebound depends on the nature of the conflict and its differential impact on asset classes, industries, and regions. For instance, if conflict in the Middle East drives up oil prices, energy stocks may benefit while energy-dependent sectors (such as airlines) may suffer.

One caveat: If a geopolitical conflict triggers real oil supply constraints, it may cause a more lasting market downturn — just like what happened on Friday. During Iraq’s invasion of Kuwait, the S&P 500 posted negative real returns for six months. During the 1973 oil embargo, the S&P 500’s real return was an astonishing -60%.

Deutsche Bank published a report last year suggesting markets have become more resilient in absorbing such shocks. “Geopolitical events have often created short, sharp market shocks, but with little lasting impact beyond weeks,” said Jim Reid and his strategy team at Deutsche Bank. “After the initial anxiety dies down, the macroeconomic drivers take back control.”

“So on this basis, you should generally buy into geopolitical risk,” Deutsche Bank concludes.

MarketWatch has laid out three baseline scenarios for the current event:

Base Case (60%): Tensions remain high but contained. Oil stabilizes between $70–$80. Defense, gold, bitcoin, and cybersecurity stocks gradually climb.

Escalation Scenario (25%): Iran launches a fierce retaliation — missile strikes, drone swarms, cyberattacks, or possibly blocks the Strait of Hormuz. Oil shoots past $120, equity markets drop 10%–15%, and safe-haven assets surge.

Diplomatic Miracle (15%): Optimistic but unlikely. A sudden breakthrough in diplomacy causes a sharp market rally — before quickly fading as geopolitical tensions inevitably return.

MarketWatch advises investors to monitor the following indicators:

Oil > $90: Indicates imminent supply disruption

USD/JPY > 155: Risk-off sentiment intensifying

Credit spreads > 150 bps: Rising corporate credit stress

VIX > 30: Market-wide panic in full swing

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.