Stocks Edge Higher as Fed Meeting Kicks Off; Retail Sales Beat, AI Productivity Looms Large

U.S. stocks opened slightly higher Tuesday as investors digested fresh retail sales data, a pivotal Federal Reserve policy meeting, and new research underscoring the long-term economic impact of artif

U.S. stocks opened slightly higher Tuesday as investors digested fresh retail sales data, a pivotal Federal Reserve policy meeting, and new research underscoring the long-term economic impact of artificial intelligence.

The Dow Jones Industrial Average added 15 points, or 0.03%, to 45,898.8. The S&P 500 rose 0.14% to 6,624.42, while the Nasdaq Composite gained 48.44 points, or 0.22%, to 22,397.2. Commodities diverged, with crude oil climbing 1.24% to $63.80 and gold inching up 0.15% to $3,724.70.

The market’s focus squarely shifted to the Federal Open Market Committee meeting, which convenes today amid heightened political and economic drama. A federal appeals court late Monday blocked the White House from removing Governor Lisa Cook, permitting her to cast votes during the two-day deliberations. The ruling came as President Trump’s nominee, Stephen Miran, was confirmed to the Fed board, intensifying political pressure for rate cuts.

In an interview with AInvest, Jay Hatfield, CEO of Infrastructure Capital Advisors, described the meeting as “pivotal,” saying, “The terminal Fed funds rate is the only financial condition that matters — and right now it’s set up for growth.”

Hatfield expects at least two rate cuts before year-end, citing weakness in housing and construction. “There’s no AI that builds houses or installs carpet — housing is the real engine of American jobs,” he added

Fresh government data showed resilience in consumer demand. The U.S. Census Bureau reported that August retail and food services sales rose 0.6% from July and 5.0% from a year earlier, reaching $732.0 billion. Nonstore retailers advanced 10.1% from last year, while restaurants and bars gained 6.5%

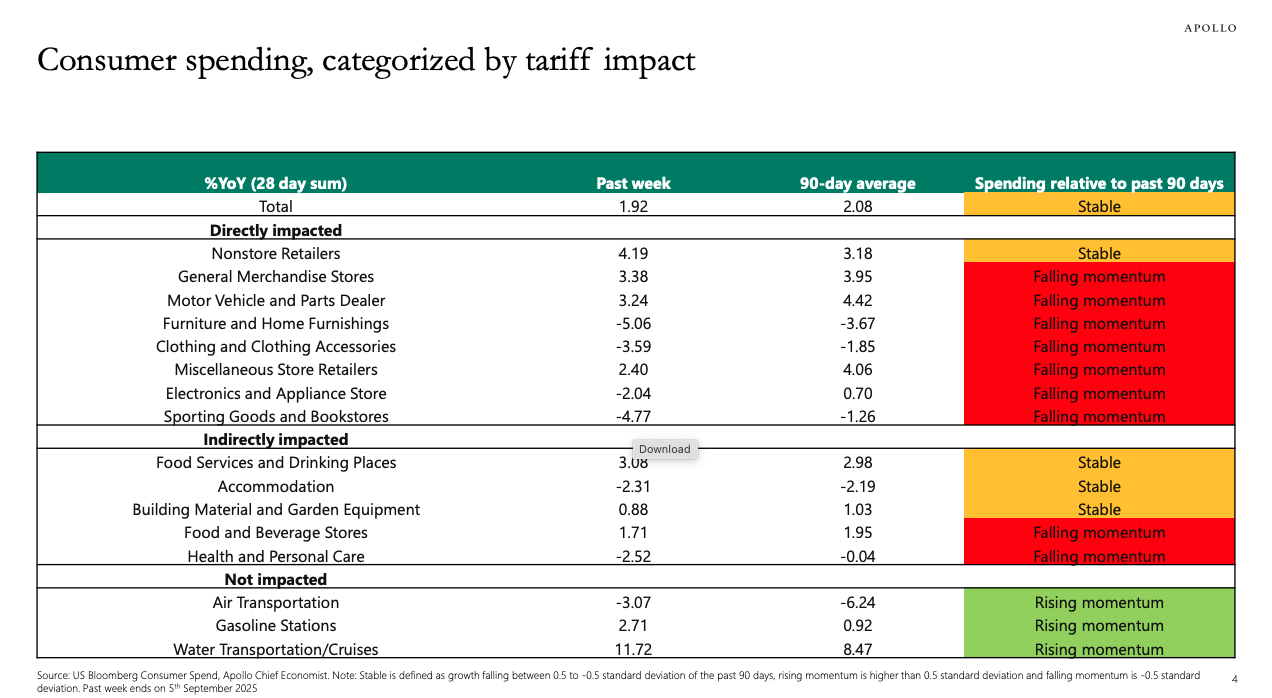

Still, spending momentum appears to be moderating. Torsten Slok, chief economist at Apollo Global Management, noted, "The daily data for consumer spending has slowed down modestly in recent weeks, and the slowdown is more pronounced in sectors impacted by tariffs.”

Beyond near-term data, investors are weighing the long-run implications of artificial intelligence. A Citi Research report released last week argued AI could lift U.S. productivity by as much as 16% over the next decade, with profound consequences for markets. “The further diffusion of AI would also have first-order implications,” the analysts wrote, including higher real bond yields, lower gold prices, and a structural lift to equities.

That prospect underscores a key divide in markets: short-term monetary easing to offset cyclical weakness versus long-term technological tailwinds that could reshape growth, inflation, and valuations.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.