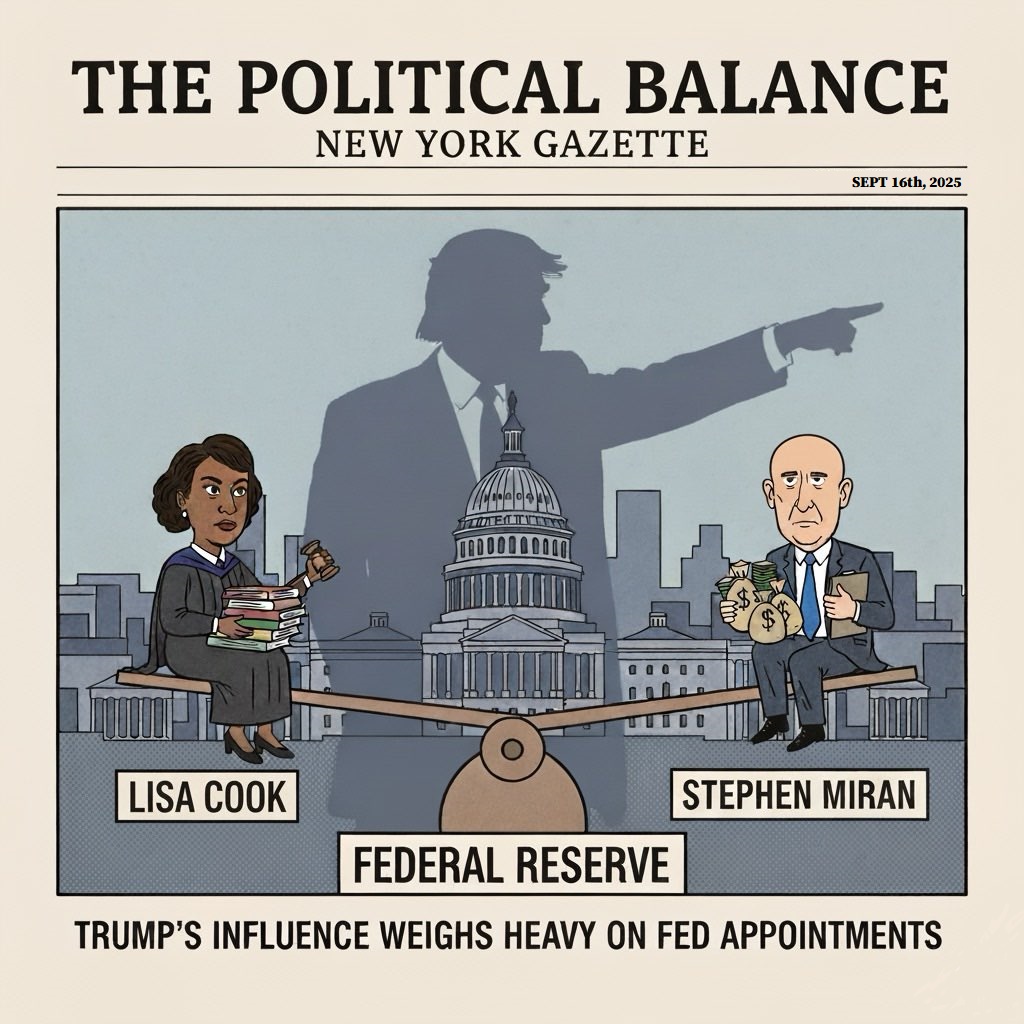

Fed's Fragile Autonomy: Cook Defies Ouster, Miran Bolsters Trump's Influence

In the shadowed corridors of power where monetary policy meets political brinkmanship, the Federal Reserve stands at a crossroads. As markets brace for the central bank's pivotal interest-rate de

In the shadowed corridors of power where monetary policy meets political brinkmanship, the Federal Reserve stands at a crossroads. As markets brace for the central bank's pivotal interest-rate decision this week, two seismic shifts underscore the fragility of its independence: Governor Lisa Cook's courtroom victory against dismissal and Stephen Miran's swift confirmation as her ideological foil. These moves, unfolding mere hours before the Federal Open Market Committee's gathering, inject unprecedented drama into deliberations that could reshape borrowing costs and economic trajectories for millions. With softening labor signals demanding action, the specter of White House meddling looms larger than ever, testing the 111-year-old institution's resilience against executive overreach.

Cook's Stand: A Judicial Shield Against Presidential Fury

The gavel fell decisively on Monday when a divided federal appeals court rebuffed the Trump administration's bid to oust Lisa Cook, the trailblazing Black woman economist who has served on the Fed's Board of Governors since her 2022 confirmation. The ruling preserves her seat just as the central bank convenes Tuesday and Wednesday to weigh its first rate cut of the year—a move markets crave amid cooling job growth and persistent inflation pressures.

President Donald Trump's crusade against Cook, launched in late August with accusations of mortgage fraud, smacks of raw political calculus. He claims the alleged 2021 improprieties—predating her nomination by President Joe Biden—justify her removal under the Federal Reserve Act's "for cause" clause.

Yet no charges have materialized from the Justice Department's probe, and documents unearthed by The Washington Post cast doubt on the claims' substance. Cook, a sharp-minded academic with a Ph.D. from Harvard, vehemently denies the allegations, framing her potential firing as a sham to stack the board with allies eager to slash rates at Trump's behest.

Her legal team didn't mince words in weekend filings: Dismissing her now would plunge the rate vote into "chaos," with ripple effects across domestic and global markets. More damningly, it would erode the Fed's bedrock autonomy, morphing it from a bulwark against economic populism into a White House puppet, beholden to fleeting political gusts. This isn't hyperbole; in the Fed's storied history, no president has dared target a governor this way.

The Act's architects envisioned insulation from such interference, empowering the seven-member board to pursue maximum employment and stable prices—even if it means unpopular hikes that curdle voter approval.

U.S. District Judge Jia Cobb, a Biden appointee, laid the groundwork last week with a temporary restraining order on September 9, allowing Cook to retain her post. Cobb's reasoning cut to the core: The fraud claims, if true, stem from pre-nomination conduct, offering no valid "cause" tied to her official duties. She lambasted the administration for trampling due process by skipping notice and a hearing, a procedural sleight that reeks of haste over justice.

Administration lawyers countered fiercely in Sunday briefs, insisting "for cause" grants the president wide latitude, immune from judicial second-guessing—a stance rooted in over a century of precedent shielding executive discretion.

Yet the appeals court's affirmation signals deeper unease. Trump's broader assault on the Fed— including past threats to axe Chair Jerome Powell—has long rattled observers. Cook's suit argues her ouster is pretextual, aimed at engineering a compliant board to juice the economy through lower rates.

With the administration poised to escalate to the Supreme Court, the stakes escalate: A high-court intervention could redefine the Fed's firewall, especially given recent conservative rulings expanding presidential removal powers over agencies.

The justices' track record offers little comfort for purists of independence. In a string of decisions, they've greenlit Trump's firings of officials from labor boards to consumer safety watchdogs, often without "cause." Chief Justice John Roberts Jr. even fast-tracked a Federal Trade Commission ouster, bypassing full review. The court's rightward tilt has chipped away at Humphrey's Executor, the 1935 precedent that curbed presidential meddling in independent agencies. Justice Brett Kavanaugh has hinted at revisiting it outright, potentially unleashing executive fiat on bodies like the Fed. If the court sides with Trump, Cook's reprieve could prove fleeting, and the central bank's vaunted neutrality a relic.

Miran's Arrival: Dual Loyalty in the Heart of Policy

No sooner had Cook's defenders exhaled than the Senate delivered another jolt: a late-Monday confirmation of Stephen Miran, Trump's handpicked economist, to the Fed board. This lightning approval—cleared on party lines despite Democratic howls—positions Miran to join the rate deliberations starting tomorrow, filling the vacancy left by Adriana Kugler's abrupt August resignation. His term runs a scant four and a half months, until January 31, 2026, but the optics are incendiary.

As chair of the White House Council of Economic Advisers, Miran embodies Trump's economic vision: aggressive tariffs, deregulation, and rate relief to supercharge growth. He pledged an unpaid leave from the CEA post upon confirmation but demurred on outright resignation, a hedge that fuels suspicions of divided allegiance. At his hearing, Miran allowed that a longer nomination would prompt him to quit the White House role entirely—yet for now, his foot straddles both worlds, a White House whisperer inside the Fed's sanctum.

Markets, laser-focused on the meeting, anticipate a rate trim—the first since December 2024—as Powell navigates tariff-induced uncertainties and labor market wobbles. Last July's 9-2 vote to hold steady suggests Miran won't swing the outcome single-handedly.

But his presence amplifies Trump's months-long pressure campaign, where public broadsides against Powell have veered into threats. Critics, led by Senate Banking Committee's Elizabeth Warren, decry even a day's overlap as toxic: "One day serving as the President’s chief economist and a supposedly independent Governor at the Fed would be one day too many." Warren's salvo underscores a bipartisan dread—that Miran's dual hat erodes the Fed's impartiality, inviting undue sway over votes that shape everything from mortgage payments to stock valuations.

This confirmation dovetails perilously with the Cook saga, painting a portrait of a Fed under siege. Kugler's exit, unexplained but timed amid Trump's rate rants, cleared Miran's path; now, with Cook's seat in limbo, the board teeters toward alignment with administration priorities. Economists whisper of conflicts: Miran's CEA perch could funnel White House intel into FOMC debates, blurring lines Congress drew to safeguard policy from electoral tempests.

Independence Imperiled: Echoes for Markets and Beyond

These twin developments crystallize a profound tension: The Fed's mandate demands cool-headed stewardship, yet Trump's maneuvers evoke a zero-sum game where autonomy yields to agenda. As the board assembles, Powell's resistance—signaled last month amid tariff fog—faces fresh headwinds. A modest cut might soothe markets without capitulating, but deeper slashes could signal surrender, inflating asset bubbles while stoking inflation anew.

The broader fallout? Eroded credibility abroad, where central banks envy the Fed's insulation; volatile yields as investors price in political risk; and a precedent that chills future governors from dissenting. If the Supreme Court tips toward Trump on Cook, Humphrey's Executor could crumble, unleashing a presidency unbound by congressional guardrails. For now, Cook endures, Miran integrates, and the Fed's meeting becomes a referendum on resilience. In finance's unforgiving arena, where trust is currency, these tremors could reverberate far beyond this week's headlines—recalibrating not just rates, but the republic's economic soul.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.