Nvidia's $100 Billion Bet on OpenAI: Forging a Powerful AI Triumvirate with Oracle

In the high-stakes arena of artificial intelligence, where computing power dictates dominance, Nvidia has just placed one of the boldest wagers in tech history. On Monday, the chip giant announced pla

In the high-stakes arena of artificial intelligence, where computing power dictates dominance, Nvidia has just placed one of the boldest wagers in tech history.

On Monday, the chip giant announced plans to invest up to $100 billion in OpenAI, the trailblazing AI lab behind ChatGPT.

This isn't merely a cash infusion—it's the cornerstone of a massive data center expansion that could redefine the AI landscape.

But peel back the layers, and a deeper story emerges: a tightly knit alliance among Nvidia, OpenAI, and Oracle, where investments, contracts, and chip deals interlock to fuel mutual growth.

Powerful Union Between OpenAI and Nvidia

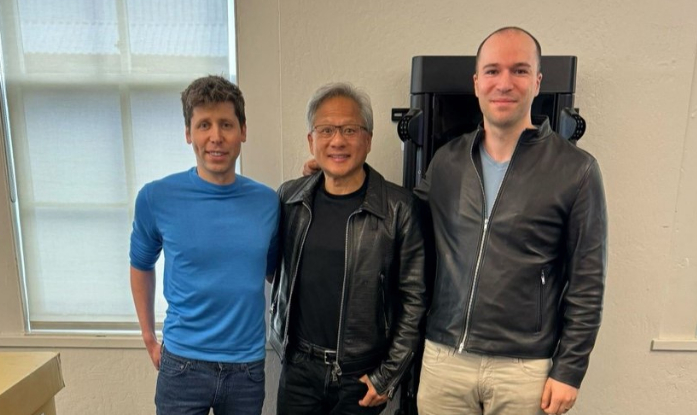

Jensen Huang, Nvidia's visionary CEO, sat alongside OpenAI's Sam Altman and Greg Brockman to unveil this "monumental" partnership, signaling not just financial muscle but a strategic symbiosis that's propelling these companies into an era of unprecedented scale.

The deal underscores how Nvidia's GPUs—graphics processing units that have become the lifeblood of AI training and deployment—are at the epicenter of this expansion. OpenAI's ambitious blueprint calls for Nvidia systems demanding 10 gigawatts of power, equivalent to 4 million to 5 million GPUs. That's roughly what Nvidia expects to ship across its entire business this year, double last year's volume. Huang described the project as "giant," and for good reason: the first $10 billion tranche from Nvidia will flow once the initial gigawatt comes online, with subsequent investments pegged to current valuations. This progressive rollout ensures alignment as infrastructure scales, positioning Nvidia as OpenAI's preferred supplier for chips and networking gear.

Market reaction was swift and euphoric. Nvidia's shares surged nearly 4% on the announcement, ballooning its market cap by $170 billion to approach $4.5 trillion. Investors see this as a virtuous cycle: Nvidia funds OpenAI, which in turn funnels billions back through massive GPU purchases. As Bryn Talkington of Requisite Capital Management put it, it's a loop where OpenAI "turns back and gives it back to Nvidia." This intimacy traces back to 2022, when ChatGPT's launch ignited explosive demand for Nvidia's hardware. Today, with OpenAI boasting 700 million weekly active users, the need for more chips is insatiable, driving the lab's push for next-generation AI models that surpass current capabilities.

A Symbiotic Ecosystem Takes Shape

Yet this isn't a bilateral affair. Oracle emerges as the third pillar, orchestrating the infrastructure backbone that binds the trio. Just weeks earlier, on September 10, OpenAI inked a staggering $300 billion cloud deal with Oracle, committing to purchase computing power over five years starting in 2027. This contract, one of the largest ever in cloud services, demands 4.5 gigawatts—enough to power four million homes or rival more than two Hoover Dams. Oracle's shares rocketed 43% on the news, catapulting Chairman Larry Ellison's net worth past $400 billion and into Elon Musk territory.

The Oracle pact isn't isolated; it's a direct conduit for Nvidia's technology. Back in May, Oracle shelled out $40 billion for 400,000 of Nvidia's cutting-edge GB200 "superchips" to power OpenAI's flagship U.S. data center in Abilene, Texas. Dubbed the first Stargate project—a $500 billion initiative spearheaded by OpenAI and SoftBank—this 1.2-gigawatt facility will span eight buildings and go live by mid-2026. Oracle leases the site for 15 years, financing it through $15 billion in debt and equity from partners like Crusoe and Blue Owl Capital, including hefty loans from JPMorgan.

This triangulation—Nvidia supplying chips to Oracle, which in turn provides cloud muscle to OpenAI—creates a self-reinforcing loop. OpenAI's computing crunch, which has bottlenecked product rollouts and model development, finds relief through Oracle's vast resources, all powered by Nvidia's dominance in AI silicon. The Abilene center alone rivals megaprojects like Musk's Colossus in Memphis or Amazon's Virginia expansion, both eyeing gigawatt-scale clusters. But here, the collaboration amplifies efficiency: Oracle's future revenue hinges on OpenAI's growth, while Nvidia secures locked-in demand for its hardware.

Financial Firepower and Valuation Vaults

The numbers are dizzying, reflecting AI's gold rush mentality. Nvidia's $100 billion pledge dwarfs its recent moves, like a $5 billion stake in Intel or $700 million in U.K. startup Nscale, not to mention absorbing talent and tech from Enfabrica for over $900 million. Yet it's additive to existing commitments, Huang assured, bolstering Nvidia's financial outlook without derailing Wall Street expectations. OpenAI, valued at $500 billion in a recent secondary round backed by Microsoft, SoftBank, and Thrive Capital, gains critical capital without diluting control—Altman calls Nvidia and Microsoft "passive" yet "critical" partners.

Oracle's bet is equally audacious. The $300 billion contract vaults its future obligations to $317 billion for the latest quarter, with OpenAI's portion delivering over $30 billion annually from 2027. CEO Safra Catz highlighted deals with three major clients, but OpenAI's scale stands out. This concentration—tying a huge revenue chunk to one money-losing startup—mirrors OpenAI's own fiscal acrobatics.

Altman, known for moonshot thinking, projects losses of $44 billion before profitability in 2029, while juggling chip designs with Broadcom and even an iPhone rival. OpenAI's $10 billion annual revenue pales against the $60 billion yearly outlay to Oracle, underscoring the high-wire act.

Still, the rewards tantalize. The first phase of Nvidia's investment, leveraging its next-gen Vera Rubin systems, launches in late 2026, complementing OpenAI's work with Microsoft, Oracle, SoftBank, and Stargate. Huang pegged a single gigawatt's build cost at $50 billion to $60 billion, with $35 billion flowing to Nvidia—multiplied across 10 gigawatts, it's a revenue bonanza. For Oracle, the deal cements its cloud resurgence, even as it shoulders debt to acquire Nvidia chips.

Navigating Risks in the AI Arms Race

Of course, such ambition courts peril.

OpenAI's computing famine isn't unique; the AI sector's data center frenzy strains power grids nationwide. Nvidia faces encroaching rivals like AMD and in-house chips from cloud titans, potentially eroding its market stranglehold. Oracle's gamble on OpenAI amplifies exposure—if the startup falters amid bubble fears, the fallout could ripple. And for Nvidia, tying $100 billion to one partner, albeit progressively, invites scrutiny on returns.

Yet the trio's interlocking deals mitigate some risks through diversification.

OpenAI's infrastructure push with multiple providers—Microsoft's Azure integration, Oracle's cloud, Nvidia's direct investment—spreads the load. The Abilene project's financing, blending debt from JPMorgan with equity from Crusoe and Blue Owl, exemplifies prudent scaling. As Altman teased "a lot" from OpenAI in coming months, focusing on research, user products, and infrastructure, the alliance positions them to outpace competitors.

In this AI triumvirate, Nvidia, OpenAI, and Oracle aren't just transacting—they're co-evolving. Nvidia's chips power Oracle's clouds, which enable OpenAI's breakthroughs, closing the loop with fresh investments. It's a model of collective ascent, where each player's success amplifies the others'. As Huang and Altman chart this course, the stakes couldn't be higher: trillions in market value, gigawatts of power, and the future of intelligence itself. Investors betting on this ecosystem aren't just buying stocks—they're wagering on a new industrial revolution.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.