On September 23, Powell poured cold water on the market.

After the Federal Reserve announced its first interest rate cut in the year, Chairman Powell once again expressed a high degree of caution about the future direction of monetary policy in his public speech on September 23.He emphasized that the current economy faces a "dual threat"-inflation risks and a weak job market, warning that no policy path is risk-free.Although this speech continued the previous tone, the market reacted strongly, especially after Powell mentioned that the stock market valuation was "quite high", the three major U.S. stock indexes quickly turned from rising to falling.

The labor market experienced substantial weakness

Powell said that although inflation has not yet been completely controlled, the labor market has experienced substantial weakness, employment growth has slowed down, corporate recruitment is hesitant, and employment pressure on young people has increased significantly: "In the short term, there are upward risks to inflation, and there are downward risks to employment."

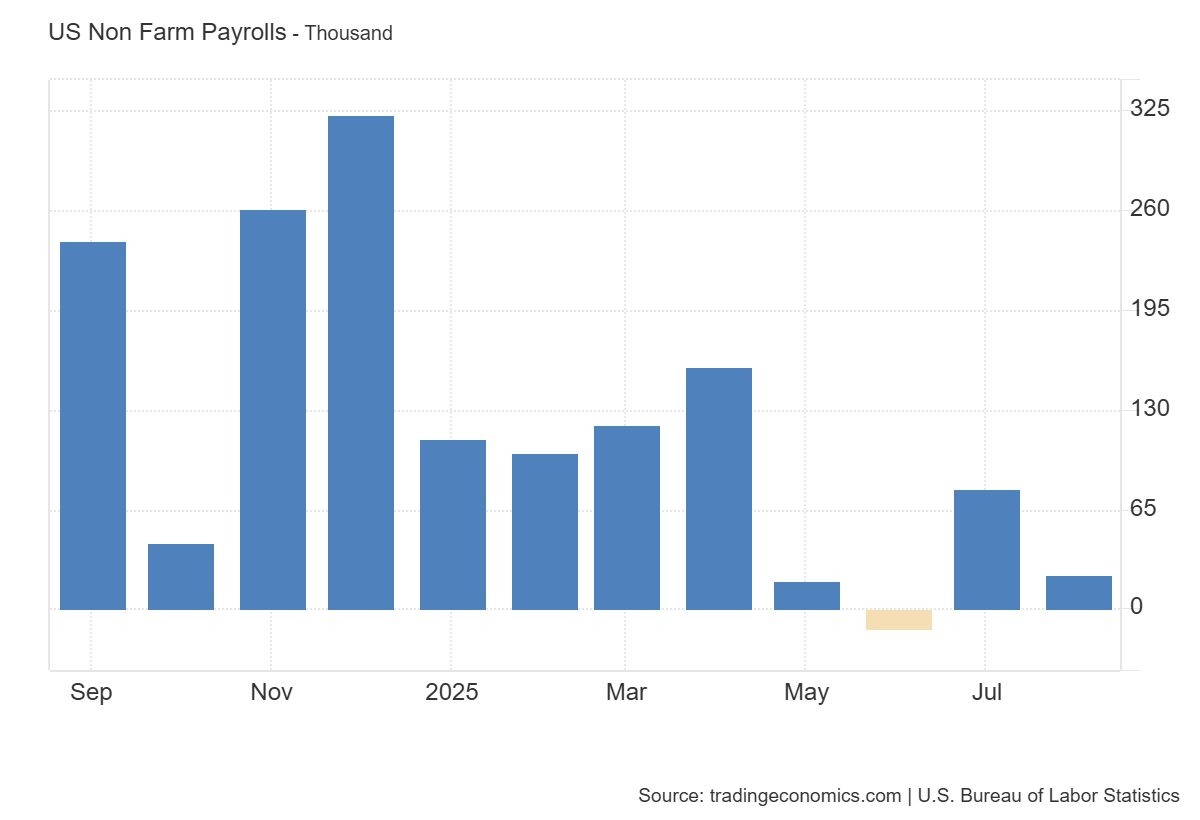

According to recent data from the U.S. Bureau of Labor Statistics and several think tanks, non-farm employment growth in the United States has been lower than expected for several consecutive months. Although the unemployment rate remains at a low level of around 3.8%, there are signs of a decline in participation rate and a decrease in new job vacancies. It shows that the "resilience" of the labor market is no longer the same period last year.This weak employment environment means that maintaining high interest rates may lead to a deeper slowdown in the economy or even close to the brink of recession.

Inflation judgment is complex

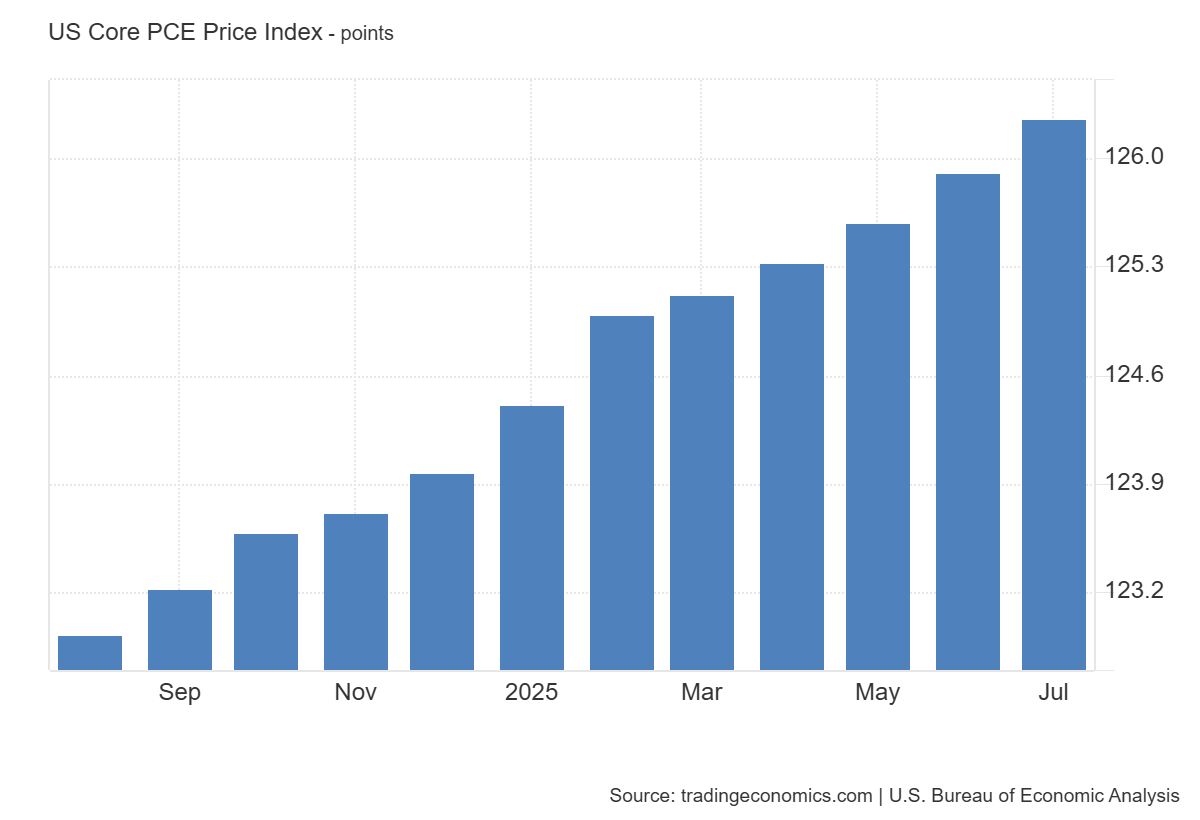

On the other hand, the Fed's judgment on inflation remains complex.On the one hand, Powell emphasized that although inflation has dropped from high levels, the overall policy target is still above the 2% policy target. On the other hand, he expressed concern about the persistence of inflation.He pointed out that tariffs, energy prices and supply chain disturbances may still bring short-term upward pressure on prices, especially in the current context of rising geopolitical risks.Powell reminded the market that although the impact of tariffs on prices is "short-term," this short-term does not mean an "immediate end" and may last for multiple quarters or even 2026.

This statement has been interpreted by some market observers as paving the way for potential policy adjustments in the future.Fed reporter Nick Timiraos pointed out in his comments that Powell's speech was clearly intended to prepare for "flexibly responding to future uncertainties."He did not explicitly support or oppose another interest rate cut in October, but reiterated that policy will respond based on economic data.Timiraos specifically mentioned that the Fed still believes that policy rates are "moderately restrictive," which means that interest rates may still be further adjusted in the future based on employment or inflation trends.

Powell: U.S. stock market valuation 'quite high'

It is worth noting that in his speech, Powell also indirectly responded to U.S. Treasury Secretary Basent's criticism of the Fed's bloated institutions and expansion of power.He cited the 2008 financial crisis and the 2020 COVID-19 epidemic as examples, emphasizing that these "unconventional policy tools" are necessary measures to avoid economic disaster.Powell said that the U.S. economy still showed stronger resilience than other developed countries after two major shocks, suggesting that the Fed's policy path was overall successful.

Powell reiterated that the Fed will not make policy decisions based on partisan politics and criticized those who question the Fed's independence.He said the Fed's decisions were based on economic data and long-term goals rather than short-term political considerations.Although this statement is not the first time that it has been made, it is particularly important in the context of the approaching election and the warming political atmosphere.

But the market does not seem to fully buy this.During the Q & A session of the speech, Powell pointed out that from multiple indicators, the valuation of the U.S. stock market was "quite high", which triggered panic and selling among investors. The Dow Jones Industrial Average turned from rising to falling, the S & P 500 Index fell more than 0.7%, and the Nasdaq Composite Index fell nearly 1.1%.Investors are beginning to worry that monetary policy may not be easing as quickly as expected, or they may face the risk of policy suppression at high valuation levels.

Market analysts believe that Powell's remarks about high valuations may be an early warning signal for market sentiment.David Russell, global head of market strategy at TradeStation, believes that Powell is trying to maintain the independence of monetary policy without facing a head-on conflict with the White House.He pointed out: "Powell does not want to offend the White House, but he will not give in.He left room for possible inflationary pressures in the future.This shows that the current policy challenge facing the Fed is not only the economic variable itself, but also the delicate balance between political pressure and market expectations.

Attachment: Full text of Powell's speech (Federal Reserve):

Powell speaks at the Greater Providence Chamber of Commerce's 2025 Economic Outlook Luncheon in Warwick, Rhode Island

Thank you all.It's a pleasure to be in Rhode Island again.The last time I had the opportunity to speak at the Greater Providence Chamber of Commerce was in the fall of 2019.I said at the time,"If the situation changes significantly, policies will be adjusted accordingly."”

Who would have thought that just a few months later, the COVID-19 epidemic broke out.The economic situation and policies have undergone drastic changes that exceed everyone's expectations.While Congress, the government and the private sector took a series of measures, the Federal Reserve's decisive response also helped avoid a severe impact on the economy unseen in history.

The world has experienced a long and difficult economic recovery after the financial crisis, and the COVID-19 epidemic has followed.These two global crises have left indelible scars on mankind, and their impact will last for a long time.In democracies around the world, public trust in economic and political institutions is also being challenged.Those of us in public service positions need to focus more on performing our responsibilities with due diligence in stormy and turbulent situations.

In this turbulent period, central banks such as the Federal Reserve have had to innovate policies to meet the challenges of the crisis rather than use them for day-to-day economic management.Despite two unprecedented shocks, the performance of the U.S. economy remains stable or even better than that of other major developed economies.As in the past, we must continue to look back on these difficult times and learn from them, a process that has been going on for more than a decade.

Looking ahead, despite major changes taking place in areas such as trade, immigration, finance, regulation and geopolitics, the U.S. economy has shown strong resilience.These policies are still evolving, and their long-term impact will take time to emerge.

economic outlook

Recent data shows that economic growth is slowing.Although the unemployment rate is low, it has increased.Employment growth has slowed down and downside risks to employment have increased.At the same time, inflation has risen recently and remains at a high level.The balance of risk has shifted significantly in recent months, prompting us to shift our monetary policy stance closer to neutrality at last week's meeting.

In the first half of this year, GDP growth was about 1.5%, down from 2.5% last year.The slowdown mainly reflects the slowdown in consumer spending growth.The real estate market remains weak, but corporate investment in equipment and intangible assets has grown faster than last year's level.As pointed out in the September Beige Book, which collects economic information from places within the Federal Reserve's jurisdiction, companies still believe that uncertainty affects their future expectations.Consumer and business confidence fell sharply this spring; it then rebounded, but remained below levels at the beginning of the year.

On the labour market side, both labour supply and demand have slowed significantly-an unusual and challenging phenomenon.In such a sluggish and slightly weak labor market, downside risks to employment increase.Unemployment rose slightly to 4.3% in August, but has remained low for the past year.Job growth slowed sharply during the summer, with an average of only 29,000 new jobs added per month in the past three months.Current employment growth seems to be below the "balance point" needed to keep the unemployment rate constant.However, some other labor market indicators remained generally stable.For example, the ratio of job vacancies to unemployed persons remains close to 1.In addition, various measures of job vacancies and the number of people applying for unemployment benefits for the first time remained broadly stable.

Inflation has dropped significantly from its 2022 highs, but remains above our long-term target of 2%.The latest data shows that overall personal consumption expenditure (PCE) prices rose 2.7% in the past 12 months to August, up from 2.3% in August 2023.Excluding volatile food and energy prices, core PCE prices rose 2.9% last month, also higher than the same period last year.Commodity prices began to recover after falling last year, becoming the main factor driving up inflation.Available data and surveys show that these price increases mainly reflect higher tariffs rather than broader price pressures.Inflation in the service sector, including housing prices, is still declining.Affected by tariff news, short-term inflation expectations have generally shown an upward trend since the beginning of this year.However, looking forward to the next year or so, most indicators of long-term inflation expectations remain consistent with our 2% inflation target.

The overall impact of major changes in trade, immigration, fiscal and regulatory policies on the economy remains to be seen.It is reasonable to expect that the impact of tariffs on inflation will be short-lived-just a one-time price fluctuation.A "one-time" fluctuation does not mean an "immediate occurrence".Tariff increases may take some time to affect the entire supply chain.As a result, a one-time increase in price levels could last for several quarters and lead to a slight increase in inflation during that period.

However, uncertainty about the trend of inflation remains high.We will carefully assess and manage the risks of high and persistent inflation.We will ensure that this price increase does not turn into a persistent inflation problem.

monetary policy

In the near future, inflation risks are on the upward side, while employment risks are on the downward side-this is a challenging situation.Two-way risk means that there is no risk-free path.If monetary policy is relaxed too hard, we may not be able to effectively control inflation and may need to adjust policies in the future to achieve the 2% inflation target.If monetary policy is tightened for too long, the labor market may weaken unnecessarily.Where such goals are contradictory, the policy framework requires us to maintain balance in achieving our dual mission.

Increased downside risks to the employment outlook change the balance of risks to achieving goals.As a result, we decided at our last meeting to move further towards a more neutral policy stance by lowering the target range for the federal funds rate by 25 basis points to 4% to 4.25%.I believe that the current policy stance is still moderately restrictive, but it can allow us to better cope with changes in the economic situation.

Our policies are not predetermined paths.We will continue to determine appropriate policy positions based on the latest data, economic prospects and the balance of risks.We are committed to supporting full employment and maintaining inflation at a sustained target of 2%.Achieving these goals is crucial to all Americans.We know that our policy initiatives affect communities, families and businesses across the country.

Thank you again for inviting me to attend today's meeting.Looking forward to having in-depth discussions with you.