NFP Revision Preview: Big Downward Adjustment Ahead

Nonfarm payrolls larger revision is coming—one that could imply between 475,000 and 900,000 fewer jobs were added from April 2024 through March 2025, equivalent to an average monthly reduction of abou

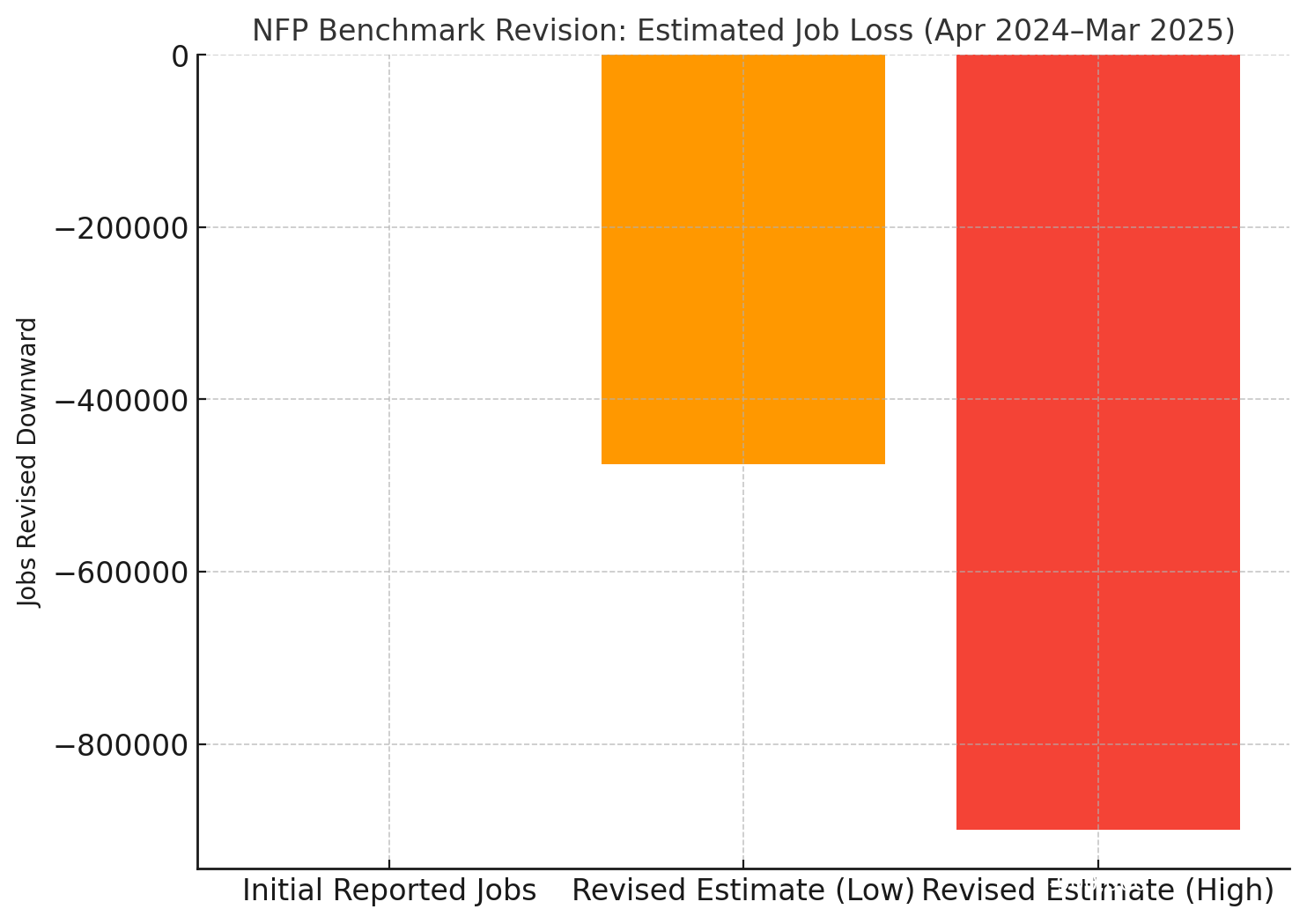

Nonfarm payrolls larger revision is coming—one that could imply between 475,000 and 900,000 fewer jobs were added from April 2024 through March 2025, equivalent to an average monthly reduction of about 67,000 jobs.

Nonfarm payrolls larger revision is coming—one that could imply between 475,000 and 900,000 fewer jobs were added from April 2024 through March 2025, equivalent to an average monthly reduction of about 67,000 jobs.

This annual revision aims to align the monthly employment reports, which are based on surveys, with the more accurate but lagging Quarterly Census of Employment and Wages (QCEW).

Although the revision reflects past employment conditions, such a large downward adjustment would suggest that the U.S. labor market slowdown began well before this summer’s hiring weakness. It would also strengthen expectations for the Federal Reserve to begin a series of rate cuts.

Bill Adams, chief economist at Comerica, said:

“The large downward revision to job growth through March 2025 may have less direct impact on monetary policy than revisions to more recent months, but it shapes our understanding of the broader economic backdrop. All else equal, downward revisions increase pressure on the Fed to ease policy.”

Fed Governor Christopher Waller expects the benchmark revision to reduce average monthly job growth by around 60,000. Notably, Waller voted for a rate cut at the July Fed meeting, when most officials favored holding rates steady.

Why Are Job Data Revised?

The U.S. Bureau of Labor Statistics (BLS) publishes monthly employment reports to track job trends more frequently, but this timeliness comes at the cost of accuracy.

To estimate monthly payrolls, the BLS surveys about 120,000 U.S. employers across 600,000 worksites, covering roughly one-third of employment. Respondents have three chances each month to report payroll changes.

The initial employment report (based on ~60% of responses) is revised twice, with over 90% of respondents included in later updates.

Why the Large Downward Revision?

Pantheon Macroeconomics noted in a recent report that the revision may stem from the BLS birth-death model overestimating job creation by new businesses. Since the end of the pandemic, the U.S. has seen a surge in new business formations. These firms are smaller and more prone to failure, meaning the model likely overstated their employment contributions.

Wells Fargo argued that lower survey response rates also make monthly estimates more difficult. For the 12 months ending March 2025, the average response rate was 43%, well below the 59% recorded in 2019.

In addition, asylum seekers and undocumented workers are counted in the employment report, but they generally face weaker competitiveness in the labor market. Considering the Trump administration’s crackdown on illegal immigration, the revised data may more accurately reflect the true state of the labor market.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.