Polymarket Tracker: Iran’s 80% Retaliation Odds Fuel Oil and Gold Surge

Tensions in the Middle East escalated sharply this week after Israel reportedly launched airstrikes on Iranian military and nuclear targets, prompting a wave of market volatility. Risk assets plunged,

Tensions in the Middle East escalated sharply this week after Israel reportedly launched airstrikes on Iranian military and nuclear targets, prompting a wave of market volatility. Risk assets plunged, while oil and gold prices surged as traders braced for possible Iranian retaliation.

The strike reportedly killed multiple senior Iranian military commanders and nuclear scientists. In a public statement, Iran’s Supreme Leader Ayatollah Ali Khamenei condemned the Israeli attack and vowed “severe punishment.

Markets React: Safe Havens Up, Risk Assets Down

Brent crude oil jumped over 10% at one point on Friday, and remains up 6% as of publication, as fears of a broader regional conflict raised cncerns over oil supply disruptions. Gold also surged more than 1%, benefiting from a global rush into safe-haven assets. Meanwhile, global equities and Bitcoin saw heavy selling amid growing geopolitical risks.

“We’re staring down the barrel of a prolonged conflict that’s almost certain to keep oil prices elevated,” said Michael Alfaro, CIO at Gallo Partners, a hedge fund focused on energy and industrials. “This marks a seismic escalation in the region.”

Will Oil Stay Elevated? Watch OPEC and Saudi Arabia

The trajectory of oil prices now hinges not only on whether Iran retaliates, but also how OPEC+ responds. Saudi Arabia—one of the group's most powerful members—has already condemned Israel’s actions. If tensions escalate or impact production or shipping routes, especially through the Strait of Hormuz, prices could climb even higher.

Investors are now watching for any emergency statements or production adjustments from OPEC+ that could stabilize supply or calm markets.

Polymarket Bets Signal High Risk of Retaliation

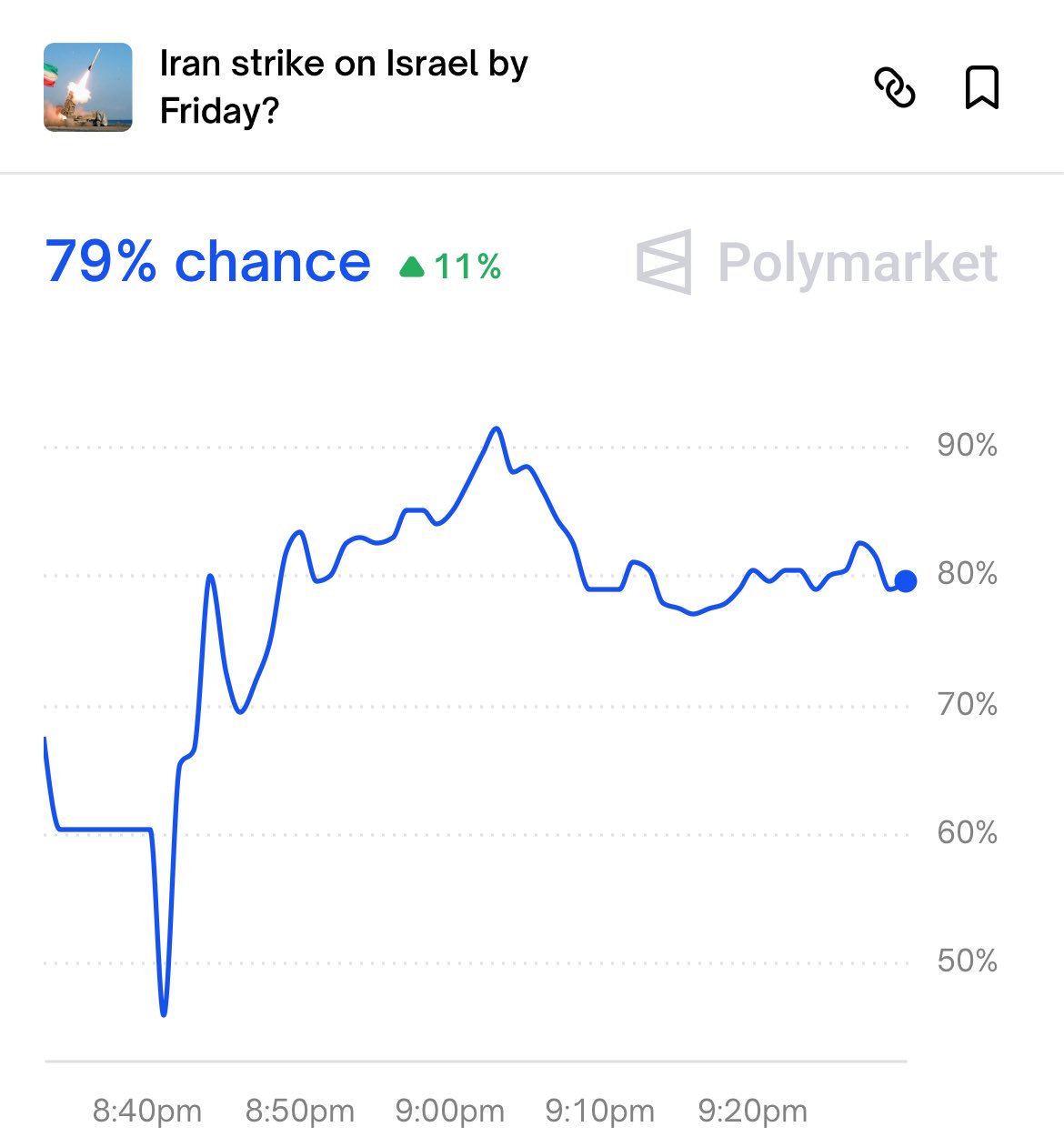

Prediction market data from Polymarket underscores the gravity of the situation. As of Friday evening, traders were pricing in a 79% chance that Iran would strike Israel by the end of the day, up 11 percentage points within hours.

A Low Nuclear Probability—But a High-Stakes Tail Risk

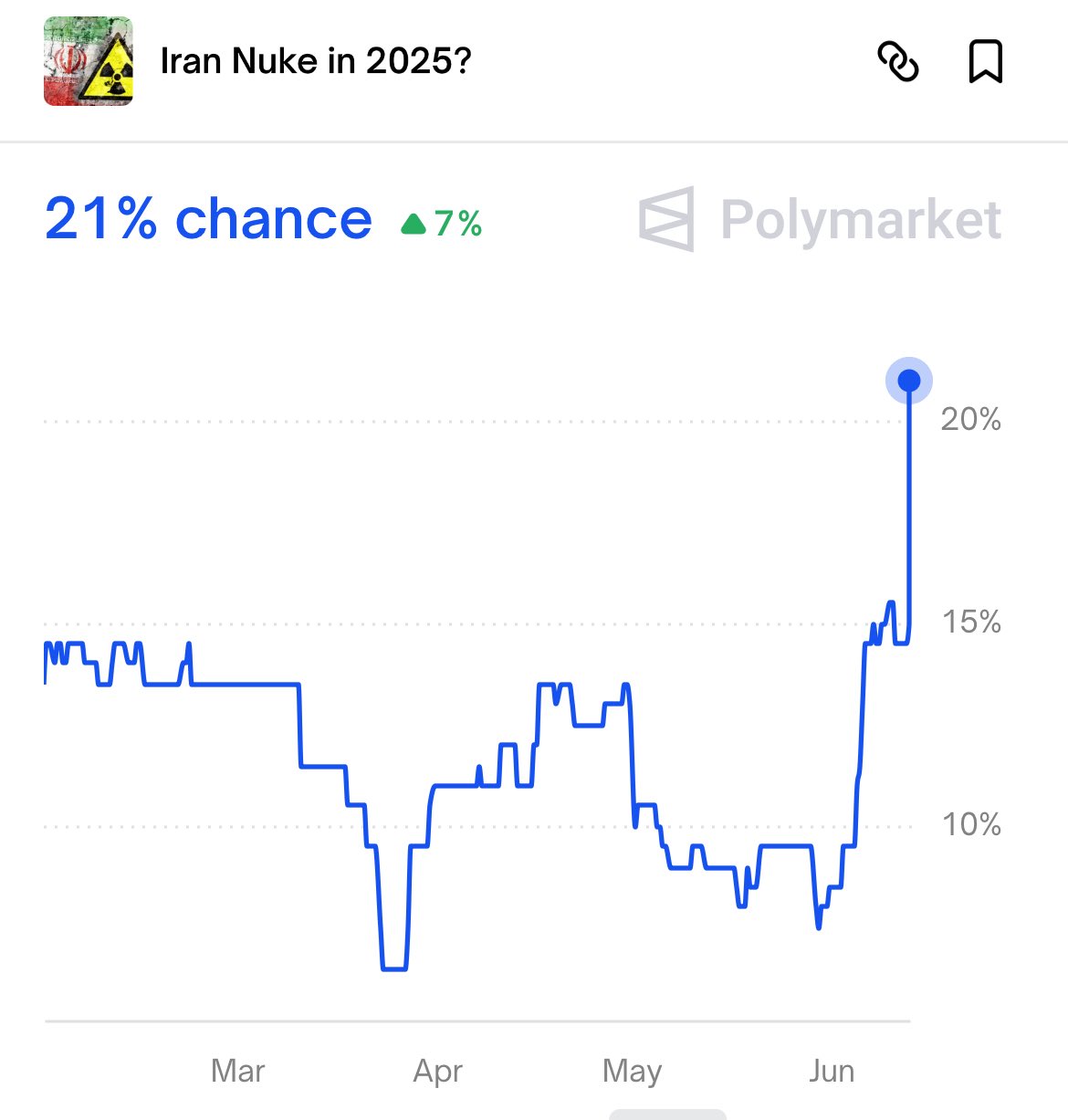

The International Atomic Energy Agency (IAEA) Board of Governors on Thursday formally censured Iran for violating its non-proliferation commitments—the first such move in two decades.

In a separate market, the probability of Iran obtaining a nuclear weapon in 2025 has surged to 21%, up from under 10% just a few weeks ago. This follows years of nuclear brinkmanship, with Iran enriching uranium near weapons-grade levels despite insisting its nuclear program is peaceful.

Should a nuclear escalation occur, the geopolitical and economic implications would be profound and far-reaching, reshaping alliances and military strategies worldwide.Should a nuclear escalation occur, the geopolitical and economic implications would be profound and far-reaching, reshaping alliances and military strategies worldwide.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.