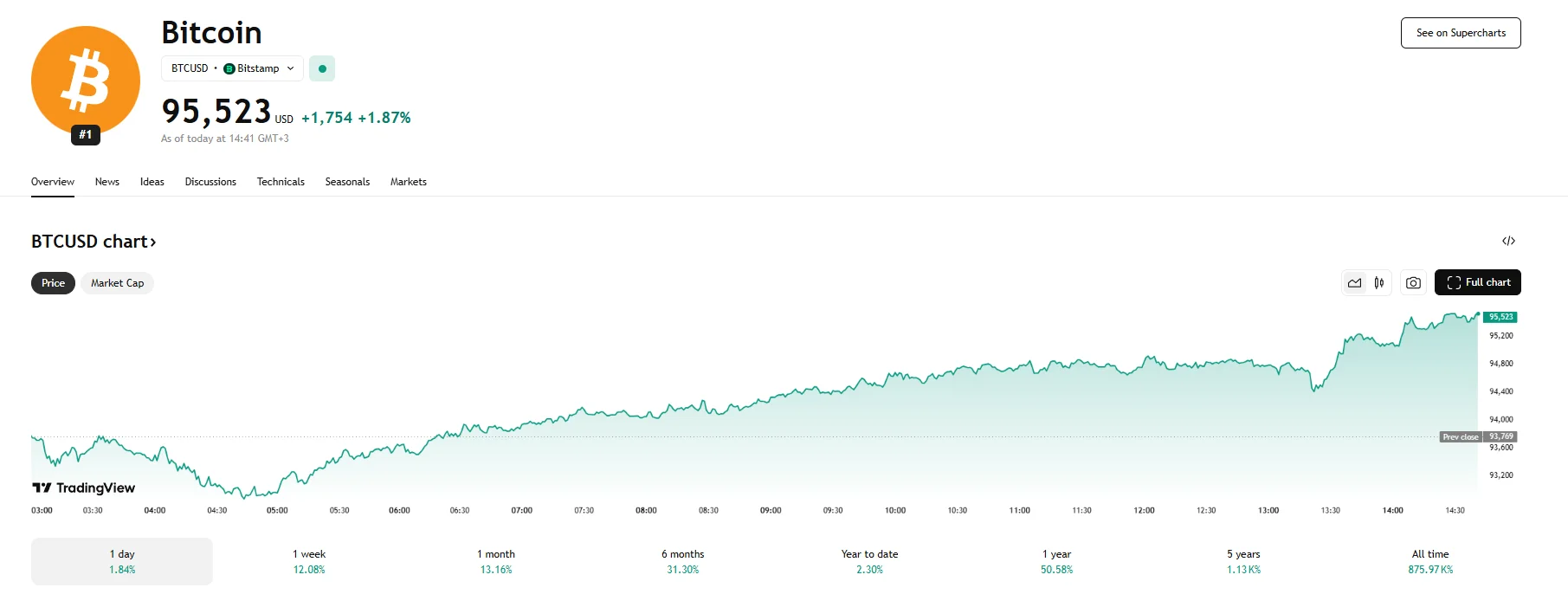

Bitcoin Skyrockets Above $95,500 as ETF Inflows Surge to $3.06B Bitcoin Skyrockets Above $95,500 as ETF Inflows Surge to $3.06B

Key Moments:Bitcoin hit $95,523 on Monday during a 1.87% rally.Over $3.06 billion in net inflows into US Bitcoin ETFs were observed over the past week.A weakening dollar may be contributing to investo

Key Moments:

- Bitcoin hit $95,523 on Monday during a 1.87% rally.

- Over $3.06 billion in net inflows into US Bitcoin ETFs were observed over the past week.

- A weakening dollar may be contributing to investors’ pivot toward Bitcoin.

Bitcoin Breaches $95,500 Amid $3.06B Inflow Into Bitcoin ETFs

On Monday, Bitcoin experienced an upward trajectory of 1.87%, breaching the $95,500 price level. This notable surge in value coincided with the revelation of substantial capital inflows into US-based Bitcoin spot Exchange Traded Funds (ETFs).

Unprecedented Institutional Demand Fuels Bitcoin’s Ascent

Data from SoSoValue indicates a remarkable wave of institutional interest in Bitcoin, with US spot ETFs absorbing a total of $3.06 billion in the past week. This figure represents the largest weekly influx of capital into these investment vehicles since last November. The sheer volume of capital entering the Bitcoin market through these regulated products signals confidence among larger investors regarding the asset’s long-term potential.

Dollar Weakness Enhances Bitcoin’s Appeal

Adding to the bullish momentum surrounding Bitcoin is the increasing concern over the stability of the United States dollar. Deutsche Bank analysts George Saravelos and Tim Baker have suggested that current economic conditions are creating a fertile ground for a potential bear cycle for the dollar. Factors contributing to this outlook include potential shifts in US commercial policy and an evolving global geopolitical landscape. In an environment where traditional safe-haven assets like the US dollar face potential headwinds, alternative stores of value like Bitcoin tend to gain traction. Jay Jacobs, a leading figure at BlackRock, has also highlighted the growing influence of “geopolitical fragmentation” as a significant force reshaping the global economy, further bolstering the case for alternative assets with resilient value propositions.

Technical Outlook Suggests Further Gains

Bitcoin’s successful climb above the $95,000 threshold is viewed as a significant bullish indicator. Market observers have suggested that if Bitcoin can maintain its position above this key level, it could pave the way for a further rally, potentially targeting the $97,000 mark in the near term. Analysts at QCP Capital have also commented on the current rally. Their latest report highlights that genuine adoption from traditional finance institutions, as opposed to speculative leverage, has played a key role in the recent gains.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.