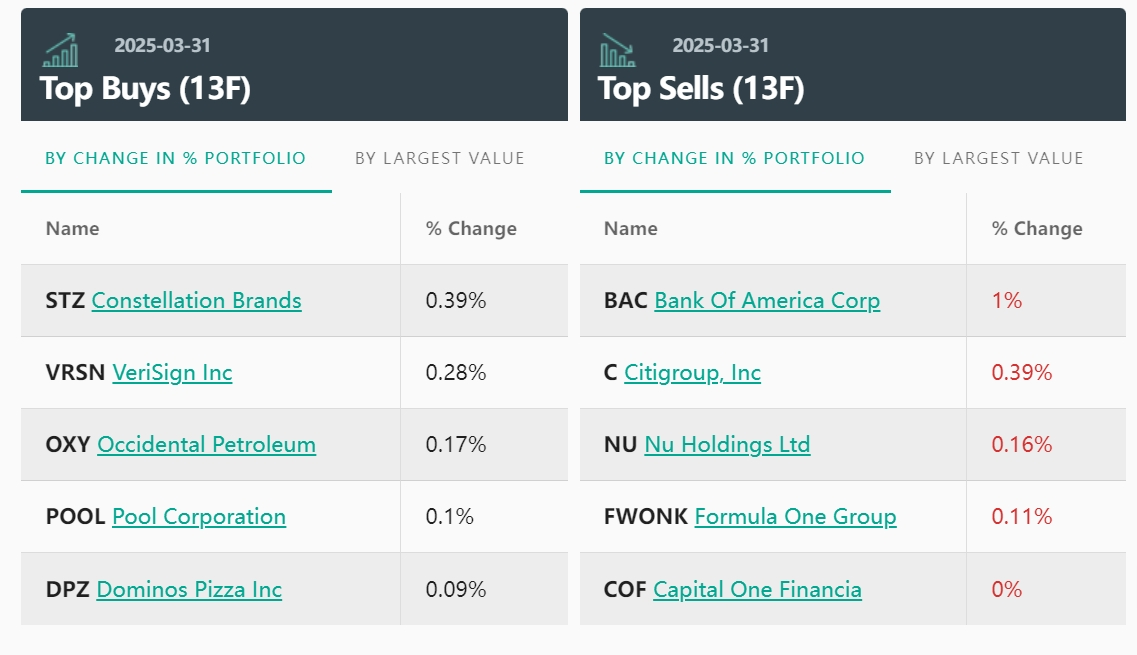

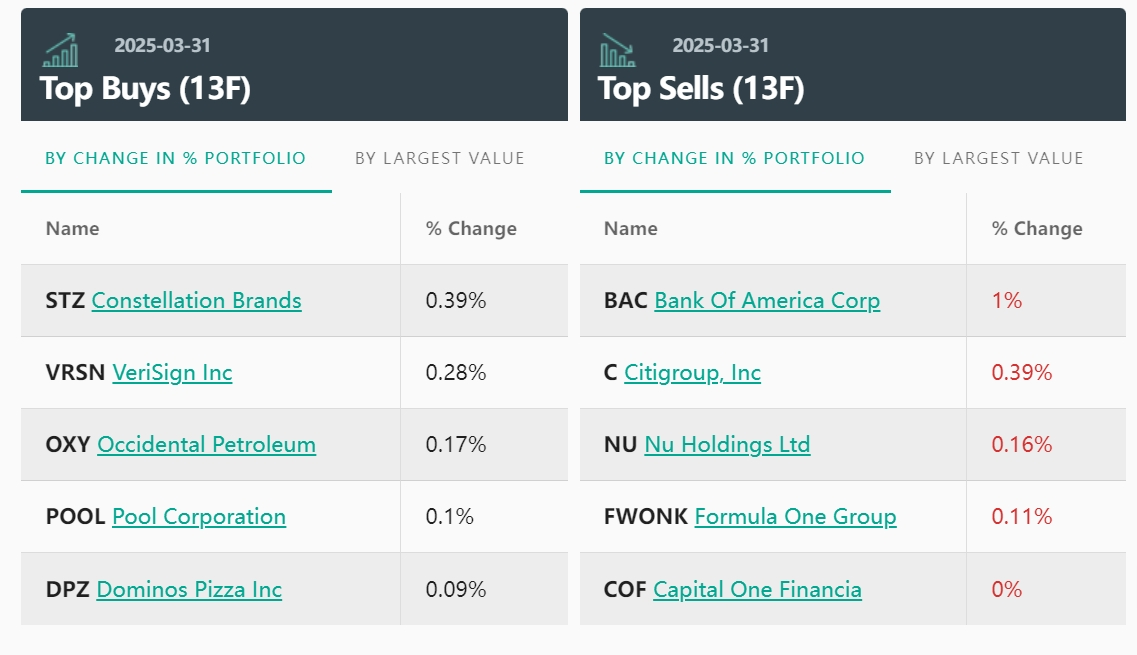

Berkshire's correction of bank stocks was the most significant move this quarter.

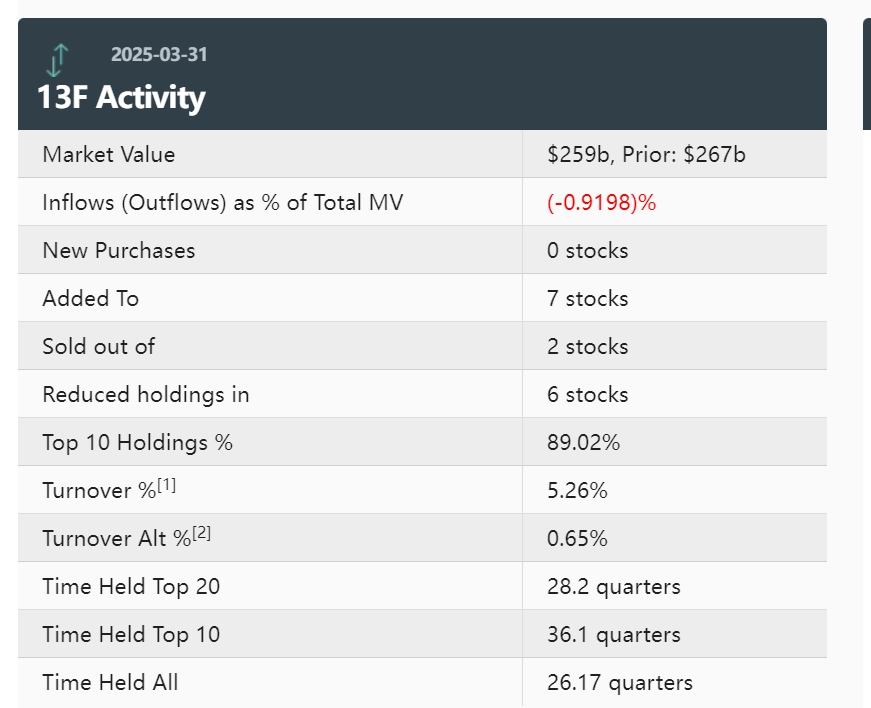

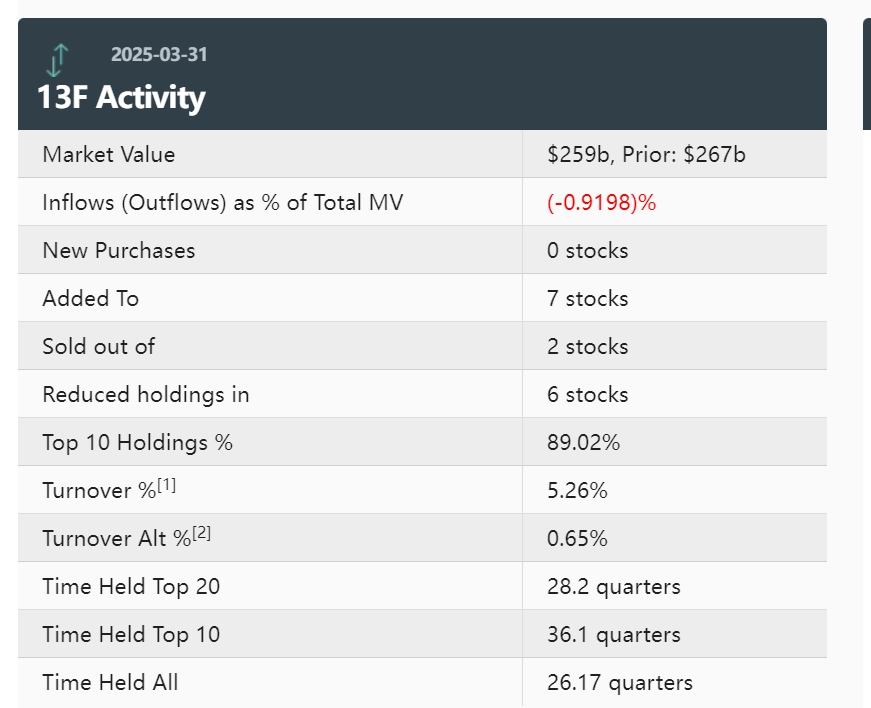

On May 15, Berkshire, a subsidiary of Buffett, the "stock god", announced its first-quarter position report.Documents show that the agency not only emptied all of Citibank's shareholding, reduced its holdings in Bank of America and Capital One by 7% and 4% respectively, but also doubled the position of beer manufacturer Constellation brand to 12 million shares, while maintaining Apple's absolute position as its largest single position.

Financial stocks shrink

Berkshire's correction of bank stocks was the most significant move this quarter.

The clearance of 14,639,502 shares in Citigroup and the reduction of 48.66 million shares in Bank of America showed a cautious attitude towards the traditional financial sector.This operation was not an isolated incident.Looking back in 2024, Berkshire has continuously reduced its holdings of core positions such as Apple and Bank of America. At that time, Buffett emphasized the worry that "U.S. stocks are overvalued."Combined with the current market environment, the end of the Federal Reserve's interest rate hike cycle and the pressure of narrowing the banking industry's net interest margin are combined, and the profitability of financial stocks is facing challenges.

In particular, Citi has made slow progress in its strategic restructuring in recent years. Net profit in the fourth quarter of 2024 fell by 12% year-on-year, which may become a direct incentive for Berkshire to withdraw.However, Bank of America still retains a position of 631.5 million shares, indicating that Buffett's long-term confidence in the head bank has not been completely shaken, and that the reduction is more of a tactical position management.InvalidParameterValue

Consumption track plus code

In contrast to the contraction in financial stocks, Berkshire has significantly increased its holdings in the consumer sector.

The holdings of Constellation brand (which owns brands such as Corona Beer) surged 113%, and pool equipment supplier Pool Corp doubled its shareholding. This combination reveals a deep layout of household consumption scenarios in the "post-epidemic era".

Data shows that the scale of the outdoor leisure industry in the United States will exceed US$500 billion in 2024. Among them, the demand for swimming pool equipment continues to grow due to the solidification of home lifestyles. Pool Corp's revenue compound growth rate in the past three years has reached 14%.Alcoholic beverages, as a typical anti-cyclical category, often show resilience during economic slowdowns-Constellation Brand's 2024 financial report shows that sales of its high-end beer line increased by 9% year-on-year, and its profit margin increased to 38%, which is in line with Berkshire. The value investment logic of "buy and hold" is highly consistent.

Apple's persistence

Although Berkshire has gradually reduced its position in Apple in recent years, its position of 300 million shares, accounting for 25%, remained unchanged this quarter, and its market value still reached US$66.6 billion, which shows its "ballast stone" status.

Buffett's praise of Cook's leadership at the shareholders 'meeting suggested that Apple's successful transformation from a hardware company to a service ecosystem has been recognized-Apple's services business revenue exceeded US$100 billion in 2024, accounting for 22% of total revenue., gross margins are as high as 72%, a structural change that may offset concerns about slowing hardware sales.

More noteworthy, however, is that Berkshire's cash reserves climbed to a historical peak of $333 billion, equivalent to nearly 70% of the total market value of its stock holdings.JPMorgan Chase estimates that the annualized return on the US$314 billion in short-term treasury bonds it holds alone reaches US$13.7 billion. This "cash is king" strategy is not only a defense against highly valued markets, but also reserves ammunition for future bottom-hunting.InvalidParameterValue

The mystery of confidential positions

Berkshire's request for a confidential position with the SEC has once again triggered speculation about "Buffett's hidden prey."

Referring to the 2024 Chubb case, confidential positions usually point to core targets that have not yet been completed.This new investment, which is approximately US$1 billion to US$2 billion, is likely to be concentrated in the commercial and industrial sectors and may be related to supply chain localization or energy transformation themes.

At the same time, Buffett announced that he would step down as CEO at the end of the year, and the investment style of successor Greg Abel became the focus.Abel's previously led renewable energy and infrastructure investments (such as Berkshire Energy) have contributed 15% of the group's profits. Its layout ideas that are closer to industrial trends may push Berkshire's tilt towards technology and green economy, but the core of "value investment" is not expected to change in the short term.InvalidParameterValue