Federal Reserve's October meeting minutes: core inflation slowly declines, continue to cut interest rates in December

It is unlikely that the Federal Reserve will cut interest rates on a large scale in the future.

The minutes of the first meeting after Trump was elected were released.

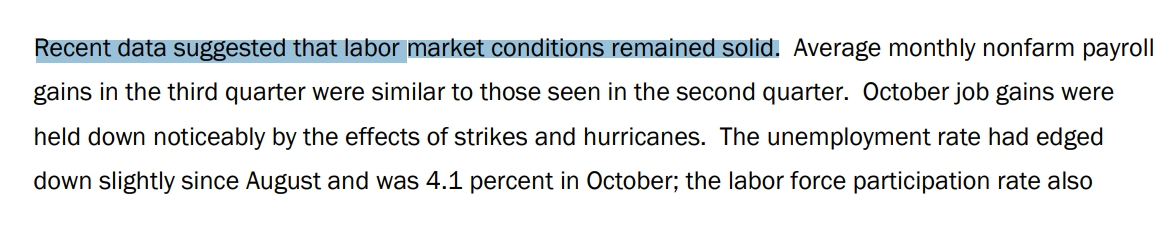

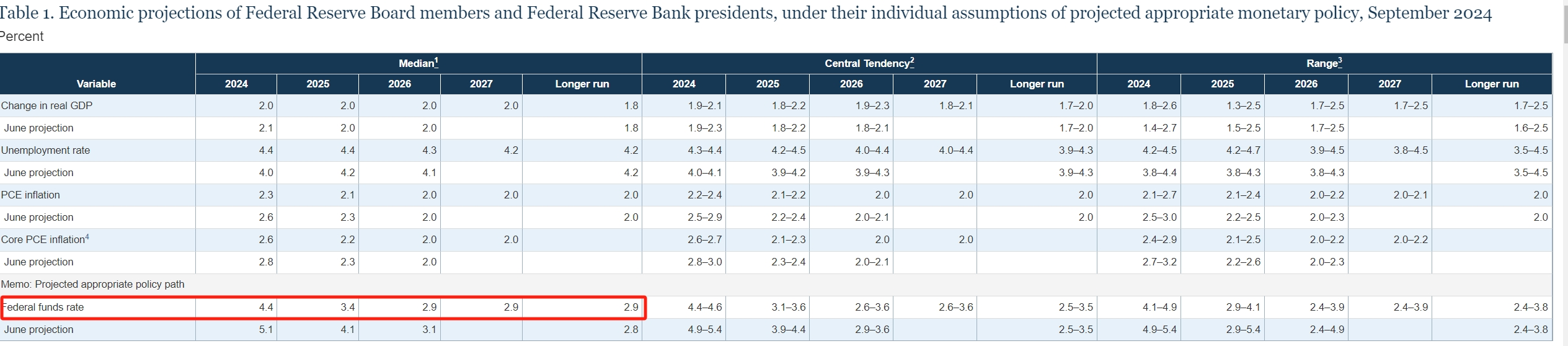

On November 26, U.S. Eastern Time, the Federal Reserve released the minutes of the Federal Open Market Committee (FOMC) meeting from November 6 to 7.At that time, while the market generally expected inflation to rise, the dollar soared and U.S. bond yields rose. However, the Federal Reserve still resolutely cut interest rates by 25 basis points.

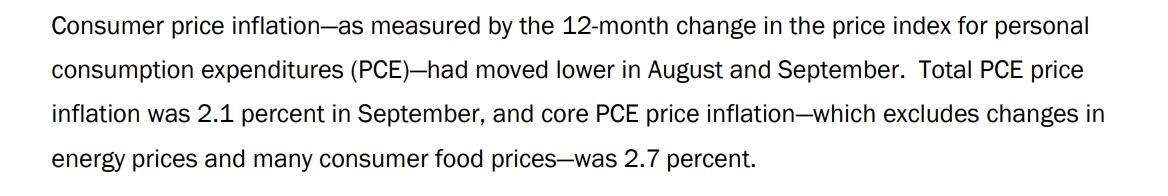

Among the latest October CPI data, rents and used cars contributed the most to inflation.Since the category of "owner-equivalent rent" accounts for a large proportion in the CPI, and this project is a follow-up project, the market generally expects that core inflation in the United States will only decline slowly rather than fall off a cliff.

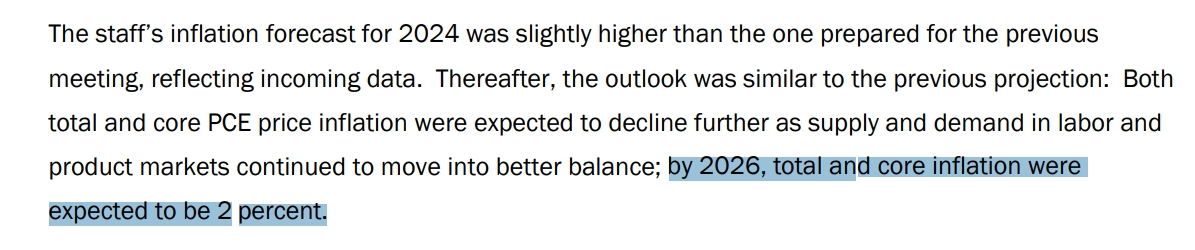

Regarding neutral interest rates, officials are generally in agreement-as long as the data is generally in line with expectations-that inflation continues to approach 2%, and the economy remains close to maximum employment, so over time,"a gradual shift to a more neutral policy stance may be appropriate."

However, after Trump gave aggressive tariff expectations and fiscal stimulus expectations, the market needs to be alert to the risk of a rebound in inflation, which may affect the Federal Reserve's interest rate cut process.Some FOMC officials already believe that if inflation remains high, the FOMC can suspend easing and keep interest rates at restrictive levels.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.