Another leading company, A+H, has arrived. Haitian Flavor Industry, known as the "Soy Sauce Moutai", has passed the hearing and is about to enter Hong Kong stocks.

Currently, only the sponsors Deluxe (CICC, Goldman Sachs, and Morgan Stanley) are known, and the specific information on the IPO has not been disclosed.Brother notes will make a simple forward-looking first, and wait until the specific IPO plan is out to look at the new plan.

Let's make a brief review first. Recently, Ningde and Hengrui have both eaten big meat. Let's first congratulate the friends who got on the bus; in addition, Pege and Shouhui, who warned about the risks, also broke without any surprises.

Recently, there have been too many queues for the IPO of Hong Kong stocks, with speculation on the performance of blue chip stocks and speculation on evil stocks-there is too much noise.If you don't know how to identify it, you can pay attention. Brother Notes will help you avoid the routine and only make high-quality tickets.

In addition, the number of port opening cards has been tightening recently, and behind them are Haitian, Dongpeng, Muyuan, Sany, Weil, Selis and others queuing up to share shares. If you don't want to miss it, hurry up and send a private letter from the background. Brother Notes will teach you how to get on the bus.

1. Company Profile

Haitian Flavor Industry, whose full name is Foshan City Haitian Flavor Food Co., Ltd., is one of the largest seasoning manufacturers in China. It mainly produces soy sauce, sauces, oyster sauce and other products. Among them, soy sauce production, sales and market share rank first in the country. The company is headquartered in Foshan, Guangdong.

As the absolute leader in China's condiment industry, Haitian Flavor Industry accounts for 12.6% of the domestic soy sauce market and 39.4% of the oyster sauce market, and its share has more than three times the second place.What's even more astonishing is that the company has been the largest condiment company in China for 27 consecutive years. Nearly 800 million China consumers have purchased its products, and the household penetration rate is as high as 80%. It can be called capillary-level channel hegemony in the food industry.

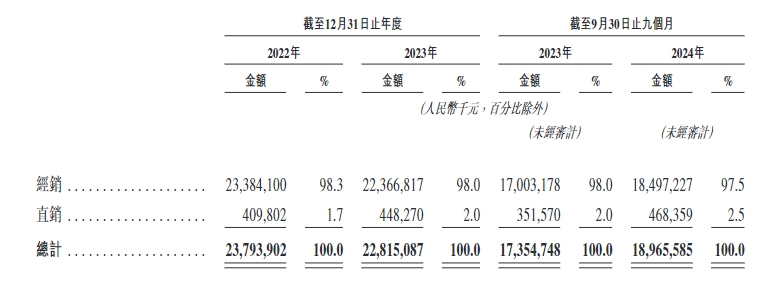

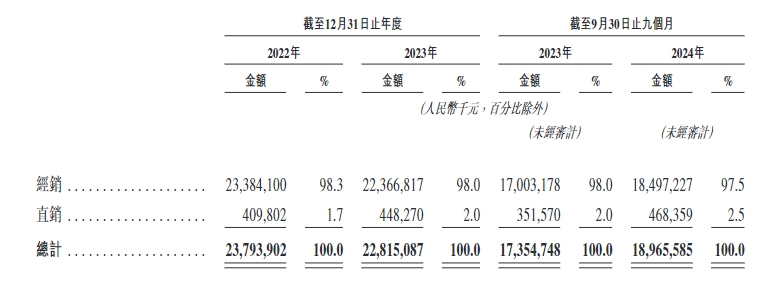

Different from some consumer goods that are mainly sold by e-commerce and counters, the condiment industry such as soy sauce and oyster sauce is an industry that is highly dependent on offline distributors. E-commerce channels for ordinary consumers and direct sales channels for major customers such as food processing companies account for a very low proportion of revenue.

Haitian Flavor's prospectus shows that as of September 30, 2024, its dealer network includes nearly 7000 dealers.With more than 2000 sales salesmen in its marketing system, Haitian Flavor covers almost all prefecture-level cities and nearly 90% of county-level cities across the country, becoming the most widely covered condiment company in the country.

Haitian's biggest highlight is its extremely high channel efficiency. Its channel inventory turnover days are only 28 days, far lower than the industry average of 45 days.

2. Financial situation

Judging from the financial report, Haitian has abundant cash flow and does not seem to be short of money.

As another A+H company, Haitian was listed on the A-share market in 2014. As of the close on June 5, the price of Haitian A-share was 43.10 yuan and the market value was 246.891 billion yuan.This time, the main purpose of seeking a secondary listing in Hong Kong is to go to sea.

Although Europeans don't use soy sauce and oyster sauce much for cooking, soy sauce products still have a considerable market in Asia: According to statistics, in 2023, the global market size of soy sauce and soy sauce products will be 260.5 billion yuan, of which Asian countries are both major producers of soy sauce. It is also a major consumer of soy sauce.China has the largest consumption, accounting for 100.4 billion yuan, accounting for 38.54%, followed by Japan, South Korea, and Southeast Asia.

In 2024, Haitian Flavor will achieve both revenue and profit increases.Among them, operating income was 26.901 billion yuan (+9.53%), net profit attributable to the parent company was 6.344 billion yuan (+12.75%), and the revenue growth rate was higher than the industry average.Gross profit margin will rebound to 36.2% in 2024 (2023: 34.1%), mainly benefiting from the 18% year-on-year decline in soybean prices and the improvement in production efficiency, but still lower than the peak of 40.7% in 2021.

In terms of products, revenue from soy sauce/sauce/oyster sauce increased by 8.87%/9.97%/8.56% respectively, and gross profit margins increased by 2.07/1.95/4.69 percentage points respectively. The proportion of high-end products increased and cost control was effective; revenue from other products (such as cooking wine and compound seasonings) increased by 16.75%, becoming a new growth point.

Cash flow is stable: monetary funds are 22.115 billion yuan (including restricted funds of 83.92 million yuan), trading financial assets are 7.618 billion yuan (+30.42%), mainly bank wealth management (7.519 billion yuan) and equity investment (Midea Group shares of 99.09 million yuan), liquidity accounts for 41.7% of total assets.

3. IPO status

According to the prospectus, Haitian plans to issue 710 million H shares and raise HK$7.8 - 11.7 billion. The issue price range is expected to be HK$38 -42, corresponding to a market value of approximately HK$270 - 300 billion.

As I said earlier, the current price of Haitian A shares is 43.10 yuan, which is converted to HK$47.08 based on the exchange rate of the day. Even if Hong Kong stocks are issued at the top price of HK$42, Haitian will still have a water level of about 10%. I feel like I can get a little touch.

The past records of co-sponsors CICC, Goldman Sachs and Morgan Stanley are clearly divided: the Ningde Times Hong Kong stocks sponsored in 2024 rose by 16.4% on the first day, but the break rate of biomedical projects in which CICC participated was as high as 66.7%.

In terms of market popularity, referring to the precedents of 143 times overpurchasing Hong Kong stocks in the Ningde era and Hengrui Pharmaceutical triggering a 50% callback, combined with the current valuation depression where PE in the food and beverage sector is 15% lower than the five-year average, Haitian is expected to attract more than 50 times subscriptions., the retail success rate may be less than 5%.InvalidParameterValue

Make a new timetable (forecast)

IPO launch on June 9 → pricing on June 12 → dark trading on June 18 → official listing on June 19

According to the new FINI regulations, the fund freezing period is shortened to 2 days, and investors can unfreeze unwon funds on T+2, which means that the turnover efficiency of new funds will increase by 60%.

Calculation of the winning rate shows that if the public offering triggers a 50% callback, the winning rate per lot in Group A will be approximately 1.2%, and more than 30 lots must be subscribed to have a higher probability of being allocated; the threshold for Group B is approximately HK$6 million, but it is subject to cornerstone investors locking in most chips, and the actual winning rate may be only 0.8%-1.5%.InvalidParameterValue

In calculating the winning rate, if you make a small promotion or promote a brokerage APP created to win new talents, you will be able to trade treasure.

This software not only embeds various easy-to-use functions on the front page, such as "latest submission","cornerstone investors","subscription popularity" and other data that should be deeply explored, but also can measure the probability of "being stable", maximize and optimize the efficiency of fund use and avoid stepping on traps. Even if you don't open an account, it is extremely convenient to keep it as a new information software.

However, if you want to open an account, the broker also offers a time-limited gift package for June, which can send up to 100 shares of ETF. The number is not much. If you are interested, you can ask me to get an invitation code.

All in all, at present, we can still get a hand on this ticket. The details will depend on the future stock price trend and issue price of Haitian A shares. A new plan will be updated as soon as possible.

Hong Kong and U.S. stocks are new, Hong Kong banks, and securities firms can add WeChat consultation to open accounts and scan the codeˇ