This year's Hong Kong stocks hit new markets. It is not an exaggeration to say that it will happen once in ten years.

There have been new year calls before, but only limited to the large number of waiting hearings. However, in 2025, not only will the number of new calls be large, but the money-making effect will be considerable, and the break rate is also declining.

Wind shows that Hong Kong stocks have welcomed 27 new shares in 2025, of which only 7 have closing prices lower than the issue price on the first day of listing, with a break rate of 26%.In the same period last year, 19 companies were listed in Hong Kong stocks, with a break rate of 32%.

At the same time, 10 of the 27 new shares rose more than 20% on the first day of listing. En Bio, the premiere of the "Big Meat Lot", even closed up 116.7%. Regardless of handling fees, the winning lot can earn more than 10,000 yuan.

There are still many opportunities for those who want to get on the bus.

According to Wind statistics, as of May 30, there are still 158 companies with submission status showing "processing".Among them, there are many top-notch industries such as Dongpeng Beverage, Muyuan, Sany Heavy Industry, Weil, and Selis.

Brother notes observes that this year's market is so popular because two types of companies are queuing up to go public.

The first is to switch from applying for IPOs in overseas markets such as A-shares and U.S. stocks to applying for IPOs in Hong Kong stocks (the reason is that everyone understands); the second is that many A-share listed companies choose to go to Hong Kong for dual listings, commonly known as A+H.

A lot of friends have left messages backstage recently. Today, I want to talk to you in detail about what it is to compete for new stocks in Hong Kong stocks, how to participate in the competition, and what are the rules for new competition?

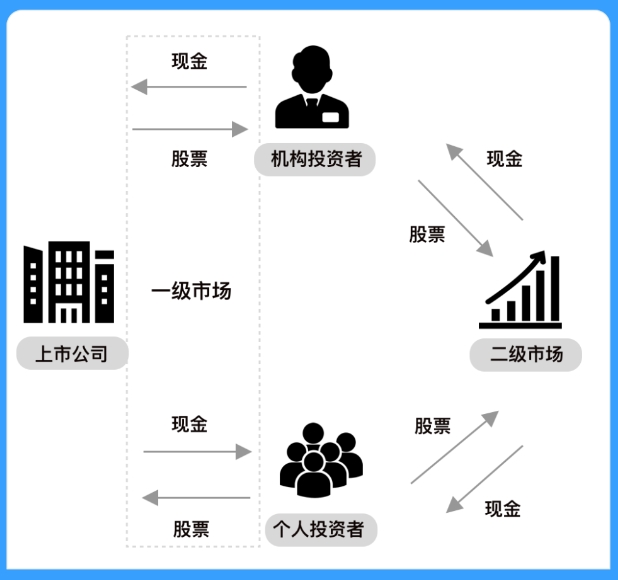

1. What is the new market for Hong Kong stocks?

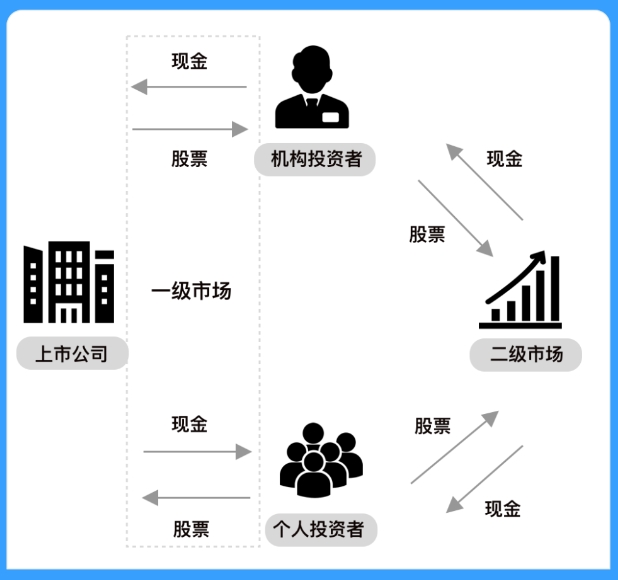

New Hong Kong stocks is not a traditional investment, but a short-term arbitrage behavior that uses the Hong Kong Stock Exchange IPO mechanism to obtain institutional dividends.When a company launches an initial public offering (IPO), retail investors subscribe for new shares at the issue price through brokerage channels. If they successfully win the bid, they will profit through the secondary market spread on the first day of listing.The uniqueness of this model lies in:

l The time window is extremely short: only 5 trading days on average from purchase to sale

l System protects retail investors: The Hong Kong Stock Exchange's "red shoe mechanism" mandates that at least 30% of new shares be allocated to retail investors

l Historical returns are impressive: 62.8% of new shares with profits on the first day of 2020-2023 (Data source: Jiali Trading)

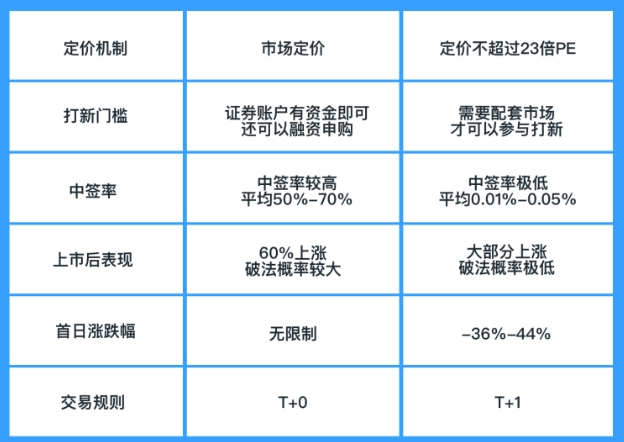

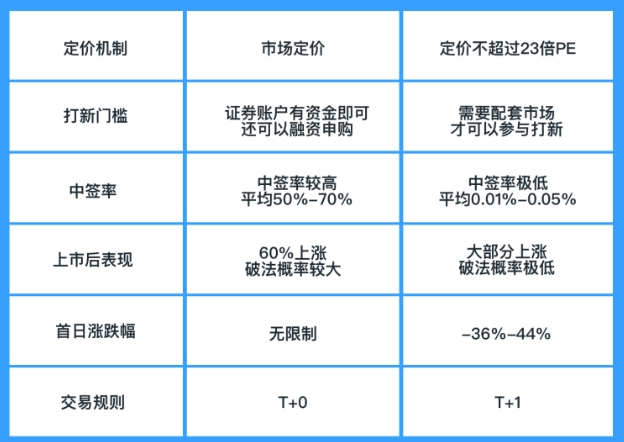

The difference between Hong Kong stocks and A-shares:

l The threshold for participation in Hong Kong stocks is low: New A-shares require investors to hold stocks with a certain market value in their accounts, and must meet the average market value of RMB 10,000 for 20 consecutive trading days.In contrast, there is no requirement to hold market value in Hong Kong stocks. As long as investors have a Hong Kong stock brokerage account and deposit a small amount of cash (usually only a few thousand Hong Kong dollars), they can participate in the new market. The threshold for participation is much lower.

l High winning rate for Hong Kong stocks: The new Hong Kong stocks adopt a priority allocation mechanism of "one household, one lot", which tends to take care of small and medium investors. Since 2018, the new first-hand winning rate for Hong Kong stocks has remained at a high level of 60%.The winning rate of A-shares is relatively low, only about 0.03%.

l The exit mechanism for Hong Kong stocks is efficient: the trading rule for Hong Kong stocks is T+0, which means that investors can freely buy and sell new shares on the first day of listing, and funds can be quickly withdrawn.A-shares adopt the T+1 trading rule. After new shares are listed, they usually have a continuous daily limit. Investors need to wait for the opening of the market before selling, and the holding time is relatively long.In addition, there is no price limit on the first day of listing of Hong Kong stocks and new shares, and there is a large room for stock price fluctuations; while the increase on the first day of listing of new shares on the main board of A-shares is limited to 44%.

2. How to participate in the new competition of Hong Kong stocks?

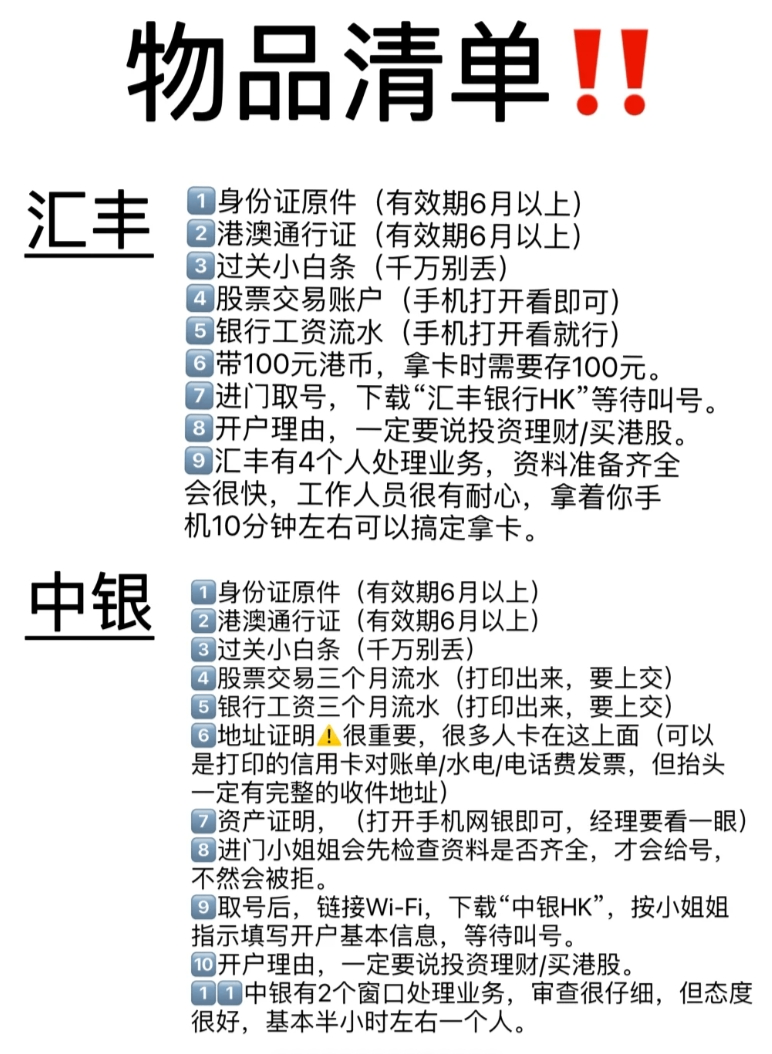

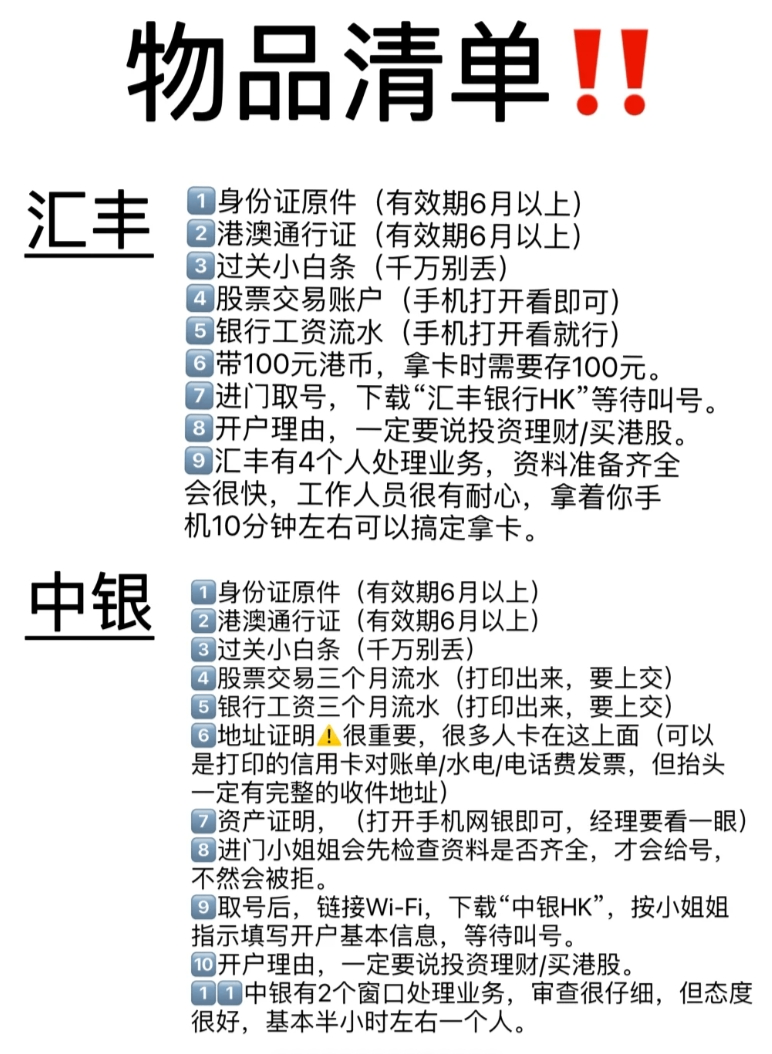

1. Apply for a Hong Kong bank card

Due to foreign exchange controls, mainland bank cards cannot be directly connected to Hong Kong stock brokers, so Hong Kong accounts have become the only channel for deposits.

Generally speaking, there are two ways to open a port card-online card issuance and online reservation & on-site processing.

To open a card online, you need to be in Hong Kong. You can download the APP and apply it online. The card can be slipped off in 5 minutes. The mainstream ones are HSBC and BOC.

The information required to open a card online is: ID card, pass, and customs clearance certificate (i.e. Hong Kong entry and exit records)

Online reservations and on-site processing also require people to go to Hong Kong. The more troublesome thing is to go to the outlets in person, so you need to make an appointment in advance to prevent queuing. You can choose some mainland holidays and Hong Kong work hours to make your comfort more comfortable.

The information needed for on-site processing is: ID card; Hong Kong and Macao Pass; entry record; address certificate with name (government-settled utility bills, credit card bills); stock investment records in the past three months; income/asset certificate, etc.(to improve success rate).

If you want a detailed guide, you can read this article by Brother Notes, which will not be repeated here.

Hong Kong Card Account Opening| Tips for applying for a card in Hong Kong during the Dragon Boat Festival holiday. You can open an account online and offline. Get another 100 to get Hong Kong and US stocks!

2. Open a Hong Kong stock brokerage account

After issuing the Hong Kong card, you can open a Hong Kong account and prepare to apply for a new one.

If you are doing a transaction, things like Futu, Changqiao, and Tiger are all good, and there is wool to pick up every month. The only trouble is to ask for stock certificates from these securities firms.If you need assistance in opening an account, you can send me privately in the background to avoid detours.

But if it is purely new, there is an APP that is not bad and it will trade treasures.

This software is simply created for the purpose of creating new products. The data is very dry, such as "Latest Submission Form","Keystone Investor", and "Subscription Popularity", which are difficult to find in other apps, but are very important, can be easily found on the homepage of Metropolis Trading Treasure, and the data is one step faster.

The best thing to use here is the IPO prediction function, because winning new lots is also a matter of learning. Buying too many or too few lots will easily lose the cost performance. However, Metropolis Trading Bao will directly give the number of purchases that are stable, effectively Avoid stepping on traps and improve the success rate of new bids.

Now that you open an account to deposit, you can also enjoy free commission benefits for buying Hong Kong and U.S. stocks, and you can also send 100 shares of ETFs to you. Interested partners can ask for my invitation code.

3. New rules and terminology for Hong Kong stocks

(1) Participation qualification requirements

Since the official launch of the FINI system of the Hong Kong Stock Exchange in November 2023, the new regulations restrict each investor to participate in the subscription of new shares through only a single brokerage account.Even if you hold multiple brokerage accounts, the system will automatically identify duplicate purchases and cancel all purchase records.

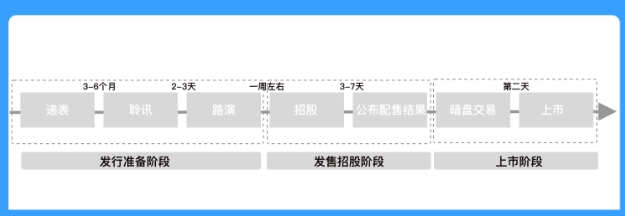

(2) Subscription cycle and time period

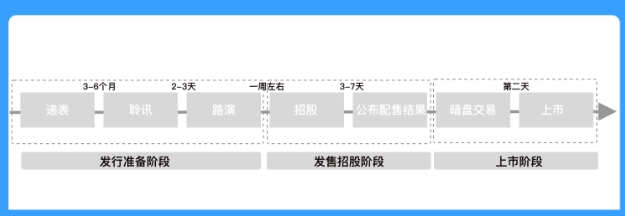

After a company passes the Hong Kong Stock Exchange hearing, it usually starts the IPO process within 30 days and lasts for 3 to 4 trading days.

Investors can submit applications through securities firms during this period, and the specific time periods are divided into:

- Early call bidding (9:00-9:30)

- Continuous trading (9:30-12:00, 13:00-16:00)

- Closing collective bidding (16:00-16:10, half-day market 12:01-12:10)

Note: Most securities firms stop accepting subscriptions at noon on the deadline and reserve processing time.

(3) Reporting unit and pricing mechanism

- Unit requirements: The minimum subscription unit is "lot", and the specific number of shares is set by the issuer (commonly 100/500/2000 shares)

- Pricing method: The issue price is presented in the form of an interval, and investors need to quote within the interval.The final pricing is jointly determined by the issuer and the underwriter based on market feedback after the subscription deadline.

(4) Announcement of placement rules and results

- Placing mechanism: Based on the principle of "one household, one signature", the issuer and the sponsor exercise allocation discretion based on the popularity of the subscription.The number of subscriptions is positively correlated with the probability of winning the lot.When the public subscription exceeds 15 times, the international placement share callback mechanism will be triggered (Note: Excessive callback may trigger concentrated selling pressure on the first day).InvalidParameterValue

- Results announced: Subscription ends at 10 a.m. on T day (subscription deadline) and pricing in the afternoon; winners will be announced one after another from 17:00 to 18:00 on T+1 (a few will be delayed until the morning of T+2).Winners must ensure that their accounts are in full before 16:00 on the day of announcement, otherwise the quota will be void.

(5) Subscription model and fee composition

- Cash subscription: Use account funds directly, which is convenient to operate, and unwon funds will be immediately unfrozen, suitable for primary investors.InvalidParameterValue

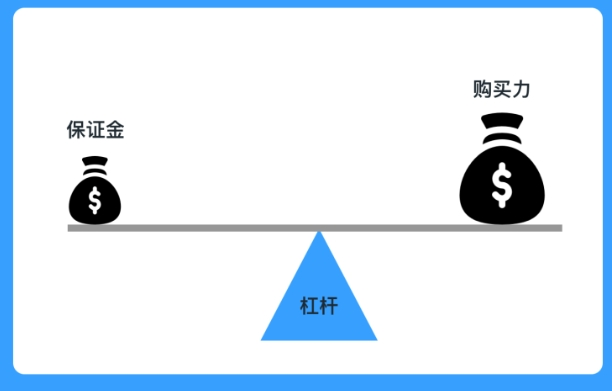

- Financing subscription (margin): Use brokerage leverage (usually 10-20 times) to expand the subscription scale and need to pay daily interest (0.03%-0.1%).We need to be vigilant about the risk of exceeding expectations leading to increased losses.InvalidParameterValue

Key points of dark trading operation

Dark-trading is conducted through the internal system of the securities firm from 16:15 to 18:30 on the day before listing. It belongs to non-exchange over-the-counter trading, and its transaction price does not affect the benchmark opening price of the next day.

This mechanism provides early profit/stop loss opportunities:

- If the dark market rises sharply, you can cash out in advance

- Falling below the issue price can lead to timely impairment

Note: Due to sufficient liquidity in the dark market of Futu Securities, the quoted price has high reference value.

New practical methodology for Hong Kong stocks

(1) Dimensions of new stock selection

1. Credit of underwriting institutions: Top investment banks such as Goldman Sachs and Morgan Stanley have better quality projects sponsored

2. Industry prosperity: New shares in hot industries have significant potential to rise

3. Market popularity indicator: The probability of new shares overpurchased by more than 100 times exceeds 70% on the first day (such as the case of Mixue Ice City 5125 times overpurchased)

4. Background of cornerstone investors: For example, the blessing of giants such as Tencent and Sequoia can enhance credibility (be wary of "platform" arbitrage behavior)

(2) Fund management strategy

- Dispersively subscribe for multiple new shares to hedge the risk of breakdowns

- Scientifically allocate funds to ensure multi-project coverage and balance risks and returns

(3) Control the timing of exit

- Statistics show that 85% of Hong Kong stocks and new shares are broken within one year, and it is recommended to close them on the first day

- Smooth earnings using a dark/first-day batch selling strategy

- When the dark market decline exceeds 5%, you should decisively stop your losses to avoid stepping on the next day

Hong Kong and U.S. stocks are new, Hong Kong banks, and securities firms can add WeChat consultation to open accounts and scan the codeˇ