The market has been good recently, and Hong Kong stocks have been listed in batches. The performance of Ningde H shares that I told everyone before exceeded expectations. Hengrui has also eaten a lot of meat. Congratulations to the friends who got on the bus ~

Today, I will let you see a company that is about to start a new company and has the potential to be a monster stock-Shouhui Group.

1. Company Profile

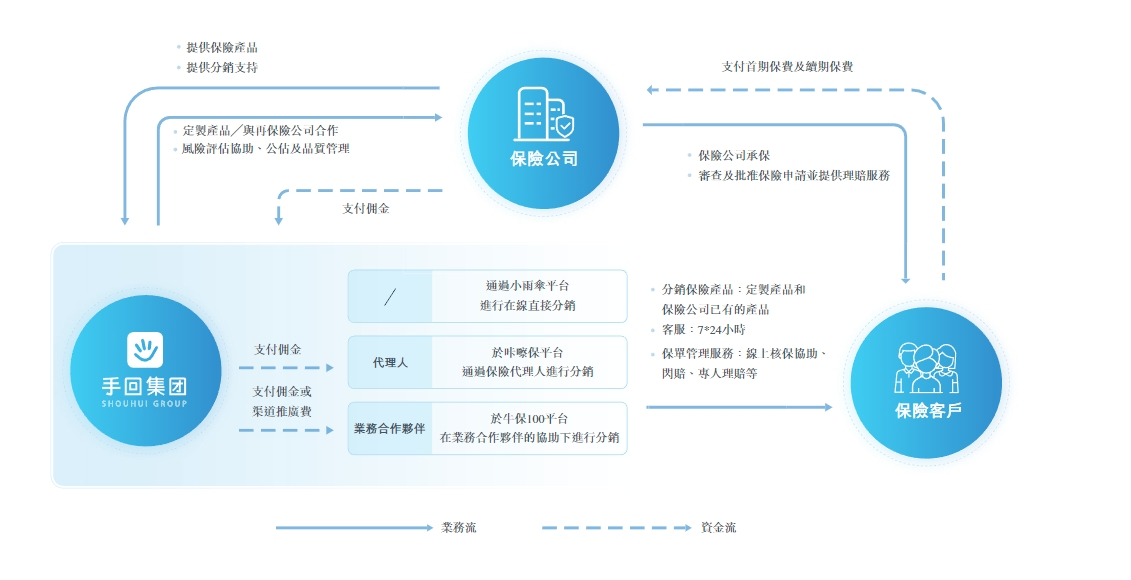

The business of handback is very simple. It is called the second largest online life insurance intermediary agency in China. It is actually a middleman who helps insurance companies sell insurance.In 2023, it will rank second in the industry with a share of 7.3%.China's online insurance intermediary market is in a period of rapid growth. The online penetration rate is expected to reach 35.9% in 2028, with a compound growth rate of 28%.

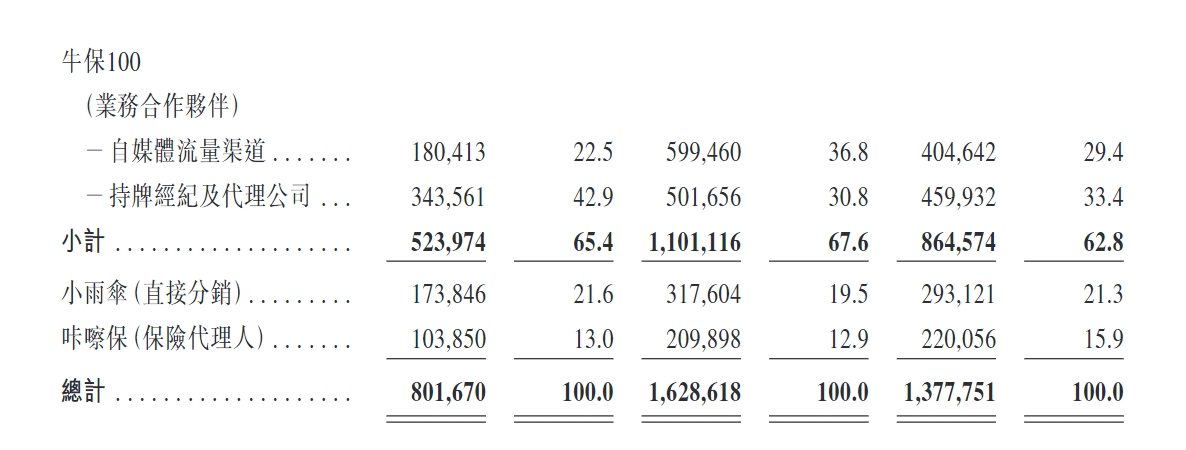

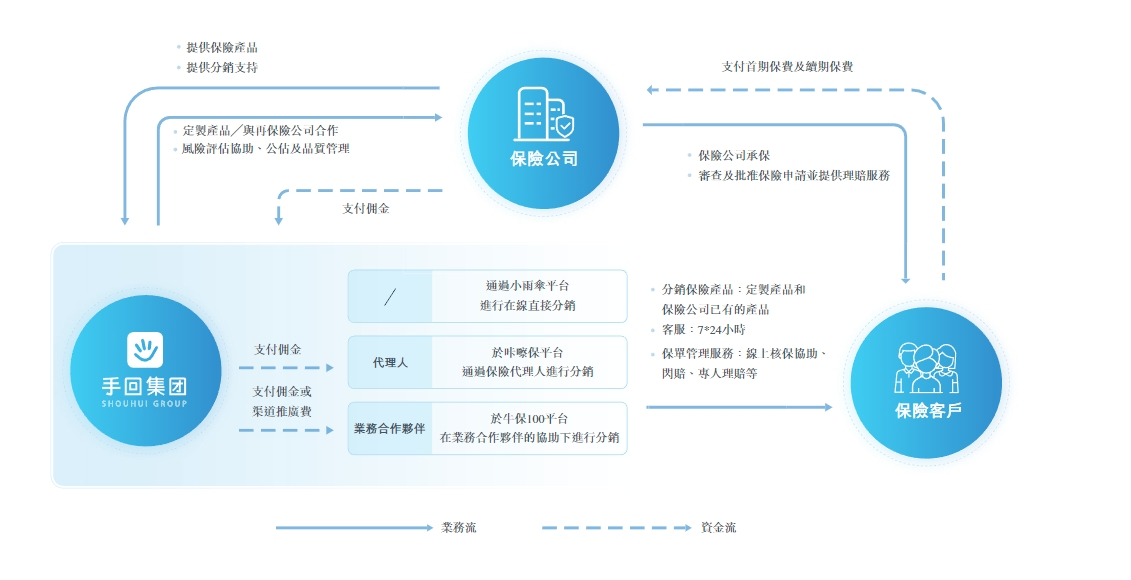

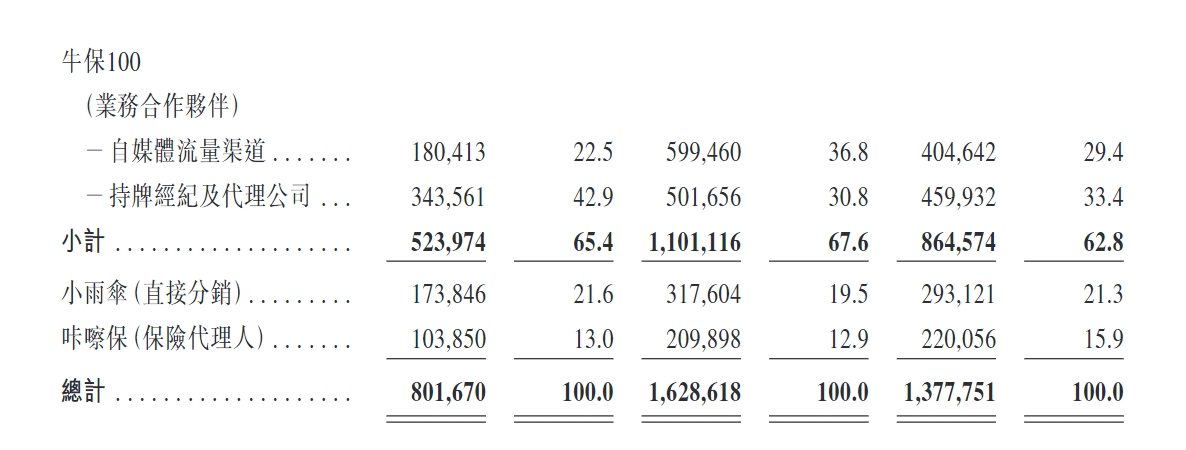

The company covers direct sales, agent and partner distribution channels through three major platforms (Xiaoanzhu, Kakabao, and Niubao 100). In 2024, the total premium will be 8.195 billion yuan, and the premium for the first year will be 3.051 billion yuan.InvalidParameterValue

Being able to become the second largest player in the industry, the ability of the company and the industry to open the gap on average is reflected in customization.With customized insurance products as its core competitiveness, Shouhui has developed more than 280 exclusive products (such as Super Mario Critical Illness Insurance, Golden Medical Insurance), forming an IP matrix covering children, adults, and the elderly.At the technical level, independently developed tools such as "Woodpecker Risk Control System" and "Chuangxin Flash Record" will improve underwriting efficiency. In 2024, R & D investment will be 50.95 million yuan, accounting for 3.7% of revenue.

Looking at the model from the perspective of channels and technology alone, it seems that there is no fault with it.

2. Financial situation

But judging from the financial report, this is completely different.

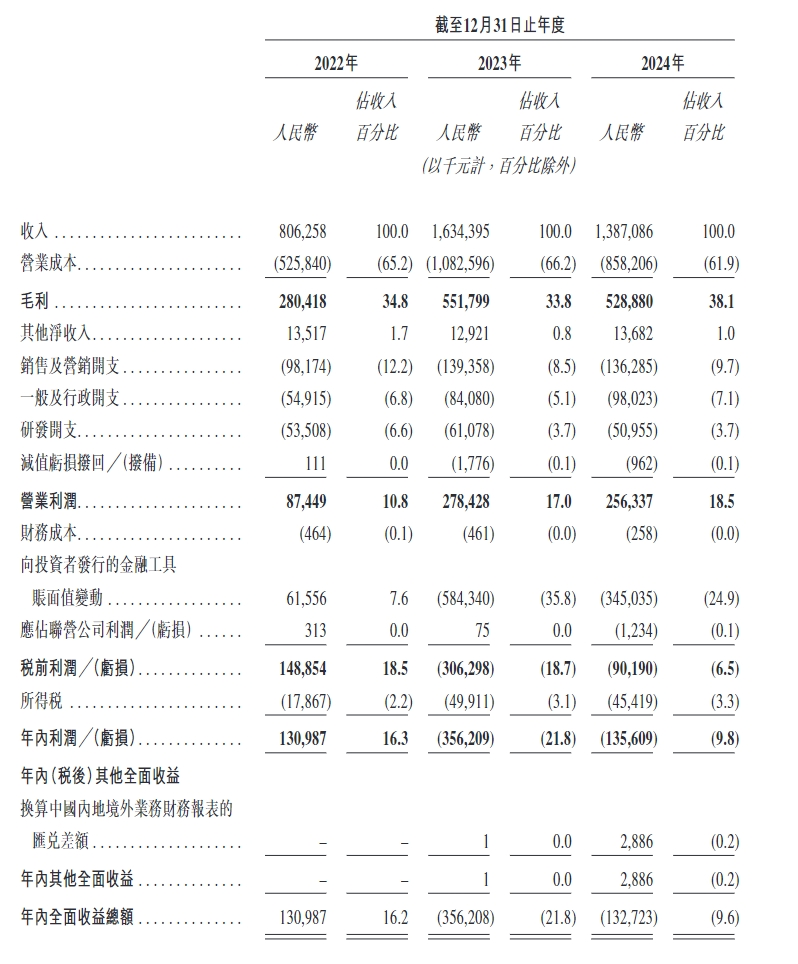

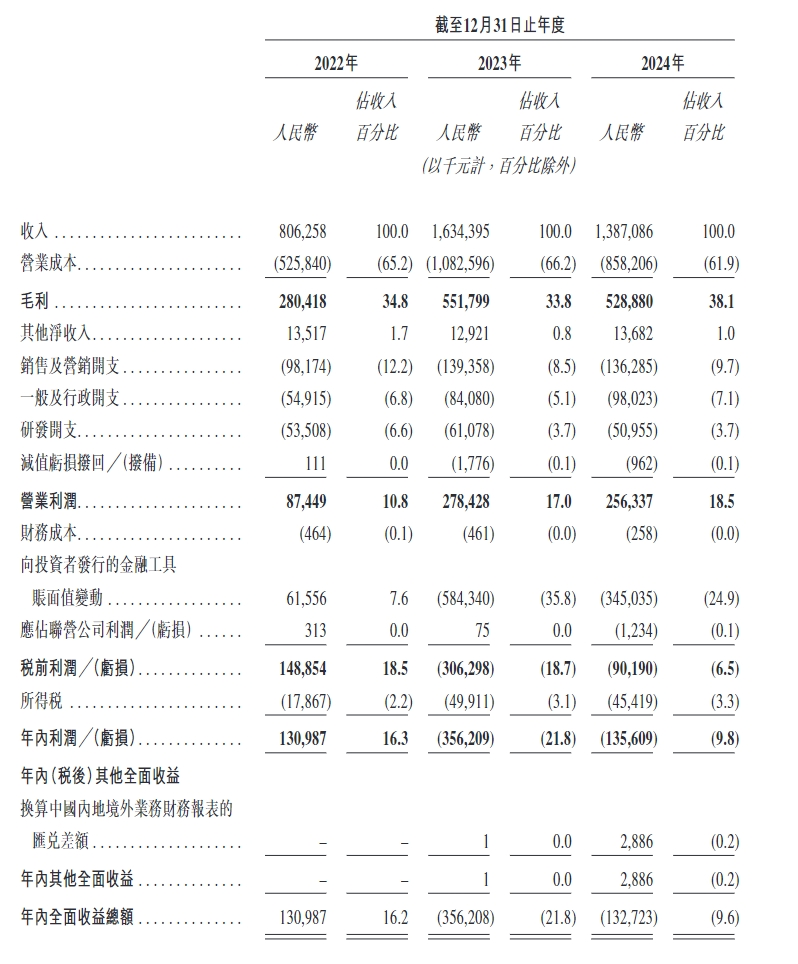

First of all, the profitability of core businesses is in doubt: revenue from 2022 to 2024 will be 806 million yuan, 1.634 billion yuan, and 1.387 billion yuan respectively. In 2023, due to the hot sales of long-term life insurance, the year-on-year increase of 102.7%, but in 2024, revenue will be affected by the "integration of reporting and banking" policy. 15%; net profit has shifted from a profit of 131 million yuan in 2022 to a loss for two consecutive years.

First of all, the profitability of core businesses is in doubt: revenue from 2022 to 2024 will be 806 million yuan, 1.634 billion yuan, and 1.387 billion yuan respectively. In 2023, due to the hot sales of long-term life insurance, the year-on-year increase of 102.7%, but in 2024, revenue will be affected by the "integration of reporting and banking" policy. 15%; net profit has shifted from a profit of 131 million yuan in 2022 to a loss for two consecutive years.

Secondly, the increase in gross profit margin cannot conceal the shortcomings of the promotion model: although the gross profit margin will increase from 33% in 2022 to 38.1% in 2024, it will benefit from the increase in the proportion of high-margin medical insurance and the optimization of supply chain management.However, self-media promotion expenses account for 46.5% of operating costs (2024), and reliance on traffic channels limits bargaining power.InvalidParameterValue

Looking to the future, new and old insurance companies are all deploying on the sprint line, and their hands are too much linked to external traffic, which may lead to higher customer acquisition costs and squeeze profits.In addition, online compliance issues are also a cliché among insurance companies, and Shouhui has stepped on thunder many times before.

The above two flaws have three impacts on the business model of the company.

First, the "integration of reporting and banking" policy has reduced the long-term life insurance commission rate. In 2024, the average first-year commission rate will drop from 31.7% to 21.5%, directly affecting the income structure.

Second, the Niubao 100 platform contributes 62.8% of revenue, but the promotion costs of cooperation with self-media are high, and the company has been subject to regulatory penalties for illegal sales.InvalidParameterValue

Third, and the most restrictive point-large customers are too concentrated.At present, the top five customers have contributed more than 70% of revenue, while traditional insurance companies are building their own online channels.Perhaps one day, big insurance companies will no longer need to fight back. Every time they go, it will be a fatal blow to the company.

3. Issue of new shares

project |

details |

|

company name |

Shouhui Group |

|

industry |

insurance |

|

IPO date |

May 22-May 27 |

|

number of shares issued |

A total of 24.3584 million shares were issued, of which 10% were public offerings and 90% were international placements |

|

offer price |

6.48~ HK$8.08 |

|

board lot |

400 shares |

|

company's market value |

1467 - 1829 billion |

|

price-earnings ratio |

loss |

|

Minimum subscription amount |

HK$3,265 |

|

Announcement of the winning vote |

May 29 |

|

listing date |

May 30 |

|

sponsor |

CICC, Huatai |

|

green shoes |

have |

|

cornerstone |

Haitai (Hong Kong) Co., Ltd. and Taoyue Industrial Co., Ltd. jointly subscribed for 27.66% |

|

Margin data |

As of 17:00 on May 22, the total margin margin of Handback Group on the first day was approximately HK$185 million, and the margin subscription multiple was approximately 9.4 times. |

Shouhui Group's IPO shares account for 10.76% of the total shares. Based on the upper offer price limit of HK$8.08, it raised approximately HK$197 million. The two cornerstones locked in HK$4950, with a circulation of HK$148 million, which is not a big plate.According to the usual market situation, there is no need to pay attention to this kind of small-cap ticket with performance losses.

However, recently, the market has been hot + the margin ratio of hand-back has exceeded expectations, and there is a high probability that callbacks will be initiated in the end.If an overpurchase of 15 times triggers a callback, the circulating market value may be less than HK$100 million, making it easy to be hyped by funds.InvalidParameterValue

Moreover, for such a small plate, the cornerstone is still 66%, and short-term liquidity is also supported, which adds a bit of potential for a demon stock.

4. Develop new strategies

The issue price range is HK$6.48 -8.08, corresponding to a market value of approximately HK$3.16 - 3.94 billion.Recently, the Hong Kong stock insurance technology sector has become more popular (for example, Yingen Biotech rose 116.7% on the first day), which combined with positive RRR cuts may push up market sentiment.InvalidParameterValue

Aggressive investors: If the margin exceeds 50 times and the turnover rate on the first day is>15%, you can test the water in a small position.InvalidParameterValue

Steady investors: Avoid the risk of break (sponsor CICC has a high historical break rate) and pay attention to subsequent margin data and choose opportunities to intervene.

Risk warning: Policies are tightened beyond expectations, traffic costs are rising, and self-operated channels are expanding less than expected.

Recently, Hong Kong and the United States stocks are booming. Friends who are considering starting a new market but have not prepared their accounts can add WeChat consultation

First of all, the profitability of core businesses is in doubt: revenue from 2022 to 2024 will be 806 million yuan, 1.634 billion yuan, and 1.387 billion yuan respectively. In 2023, due to the hot sales of long-term life insurance, the year-on-year increase of 102.7%, but in 2024, revenue will be affected by the "integration of reporting and banking" policy. 15%; net profit has shifted from a profit of 131 million yuan in 2022 to a loss for two consecutive years.

First of all, the profitability of core businesses is in doubt: revenue from 2022 to 2024 will be 806 million yuan, 1.634 billion yuan, and 1.387 billion yuan respectively. In 2023, due to the hot sales of long-term life insurance, the year-on-year increase of 102.7%, but in 2024, revenue will be affected by the "integration of reporting and banking" policy. 15%; net profit has shifted from a profit of 131 million yuan in 2022 to a loss for two consecutive years.