Li Auto posts flat Q2 net income, weak Q3 guidance

Li Auto's second-quarter net income and revenue both fell short of analyst expectations, with weak guidance signaling continued pain ahead.

- Li Auto's second-quarter net income and revenue both fell short of analyst expectations, with weak guidance signaling continued pain ahead.

The company guided for third-quarter vehicle deliveries between 90,000 and 95,000 units, representing a year-on-year decline of 41.1 percent to 37.8 percent.

Li Auto (NASDAQ: LI) delivered a disappointing second-quarter earnings report, with more pain potentially ahead this quarter.

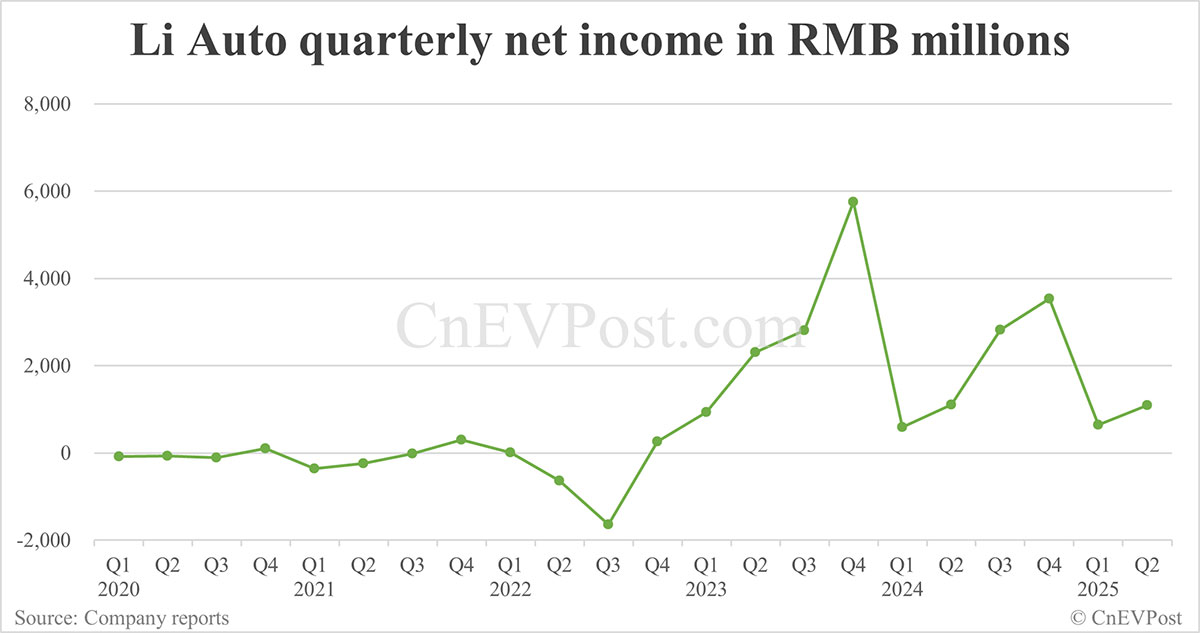

The company posted a net income of RMB 1.1 billion ($153 million) for the second quarter, below the RMB 1.3 billion forecast by analysts in a Bloomberg survey, according to unaudited financial results released today.

This represents a 0.4 percent year-on-year decline, though it marks a 69.6 percent increase from the first quarter.

Revenue for the second quarter was RMB 30.2 billion, below Wall Street's forecast of RMB 32.47 billion. This represents a 4.5 percent year-on-year decline but a 16.7 percent increase from the first quarter.

Li Auto delivered 111,074 vehicles in the second quarter, a 2.30 percent increase year-on-year and a 19.61 percent rise from the first quarter.

The deliveries exceeded Li Auto's revised guidance announced on June 27, when the company lowered its second-quarter delivery forecast from the previously announced range of 123,000 to 128,000 units to 108,000 units, citing temporary impacts from its sales system upgrade.

However, these impacts appear to persist as the company issued weak quarterly guidance.

Li Auto now expects third-quarter vehicle deliveries to range between 90,000 and 95,000 units, representing a year-on-year decline of 41.1 percent to 37.8 percent.

It guided third-quarter revenue to be between RMB 24.8 billion and RMB 26.2 billion, a year-on-year decrease of 42.1 percent to 38.8 percent.

This guidance implies the company currently expects combined August and September deliveries to range from 59,269 to 64,269 units, averaging around 30,000 units per month.

Li Auto has delivered weaker performance year-to-date as hybrid vehicle growth slows in China, while pure electric models maintain robust expansion.

The company delivered 30,731 vehicles in July, a 39.74 percent year-on-year decline, marking the second consecutive month of year-on-year contraction. This has also resulted in its year-to-date deliveries being 2.21 percent lower than the same period last year.

Li Auto's gross margin for the second quarter was 20.1 percent, higher than the 19.5 percent recorded in the same period last year but lower than the 20.5 percent achieved in the first quarter.

Its vehicle margin for the second quarter was 19.4 percent, compared to 18.7 percent in the second quarter of 2024 and 19.8 percent in the first quarter of 2025.

The company's R&D expenses for the second quarter were RMB 2.8 billion, a 7.2 percent decrease from RMB 3.0 billion in the second quarter of 2024 but an 11.8 percent increase from RMB 2.5 billion in the first quarter of 2025.

Second-quarter SG&A (selling, general and administrative) expenses totaled RMB 2.7 billion, down 3.5 percent from RMB 2.8 billion in the second quarter of 2024 but up 7.4 percent from RMB 2.5 billion in the first quarter of 2025.

As of June 30, Li Auto held cash position of RMB 106.9 billion.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.