Even gold denominated in the Swiss franc, which has always been considered a hard currency, has come out of the bull market.

Recently, gold has experienced a wave of decline as yields on Bitcoin and 10-year government bonds have risen.Now, as US dollar and government bond yields stabilize and geopolitical events intensify, gold is showing signs of bottoming out.Well-known financial analyst Cam Hui expressed his opinion on bullish gold market outlook:

Looking forward to 2025, we reiterate the view that gold is more bullish than stocks for the following reasons.

Dating back to 1980, gold went through several distinct bull-bear cycles.For example, in early 1980, gold peaked at 850, starting a bear market and bottomed out in 1985.Subsequently, gold started to fluctuate sideways. It bottomed twice in 1999, hit a recovery high in 2004, and peaked in 2011.Subsequently, gold broke through 2,100 points again in early 2024 and continued to rebound.

Currently, gold prices are forming a saucer-shaped multi-year base relative to equity assets in various regions.(Note: The "dish shape" here may mean that the price of gold shows a pattern that falls first, then rises, and then falls again over a period of time, similar to the shape of a dish.) The gold/Dow ratio is the weakest due to the strength of the U.S. stock market, but it is still very distinctive.The gold/EAFE ratio is expected to achieve a relative breakthrough, while the gold/emerging markets ratio slightly exceeded its 12-year bottom.

These technical patterns suggest that from an asset allocation perspective, investors in all major currencies should be bullish on gold in 2025 and beyond.

Judging from technical indicators, gold prices still have room to rise

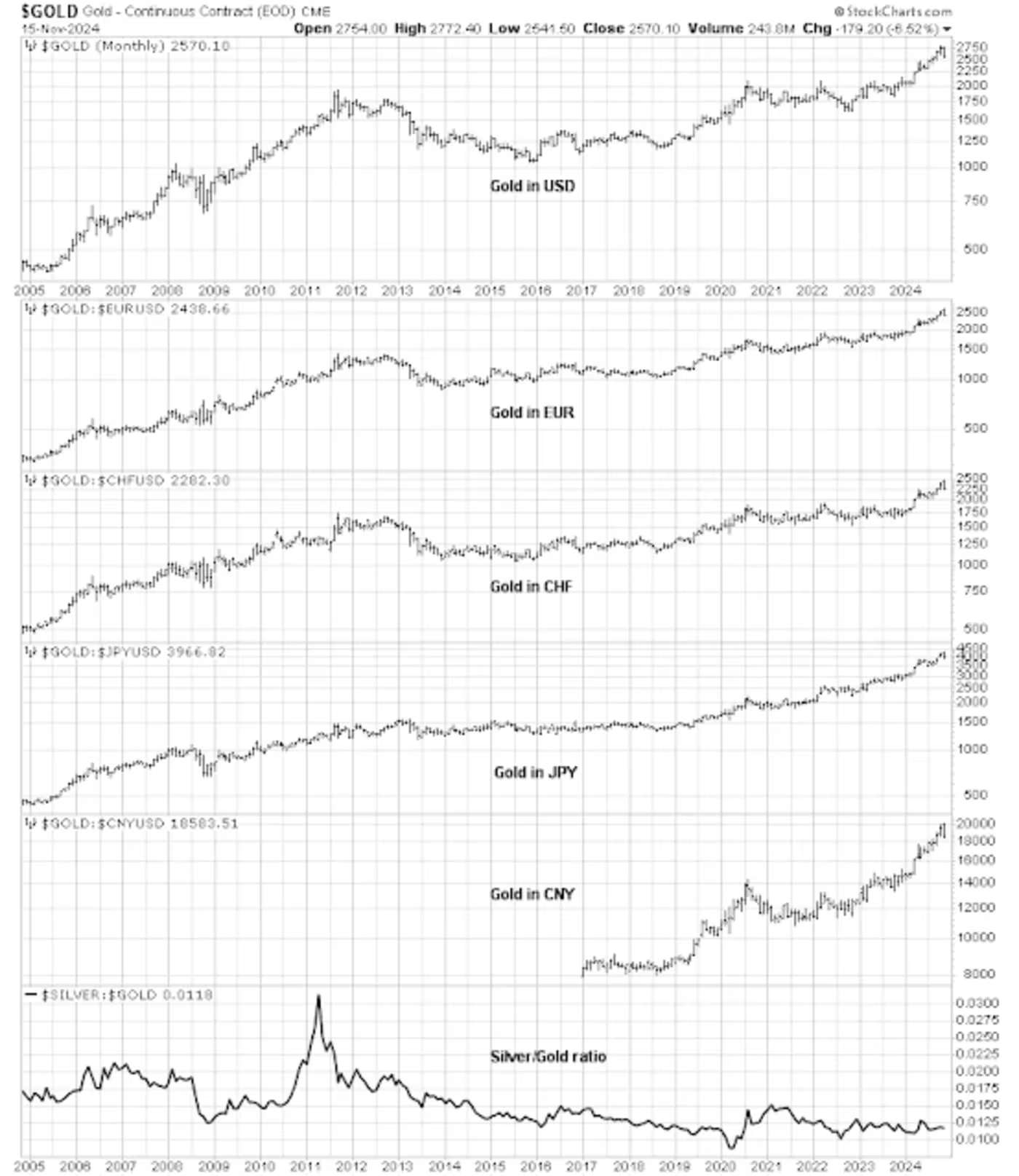

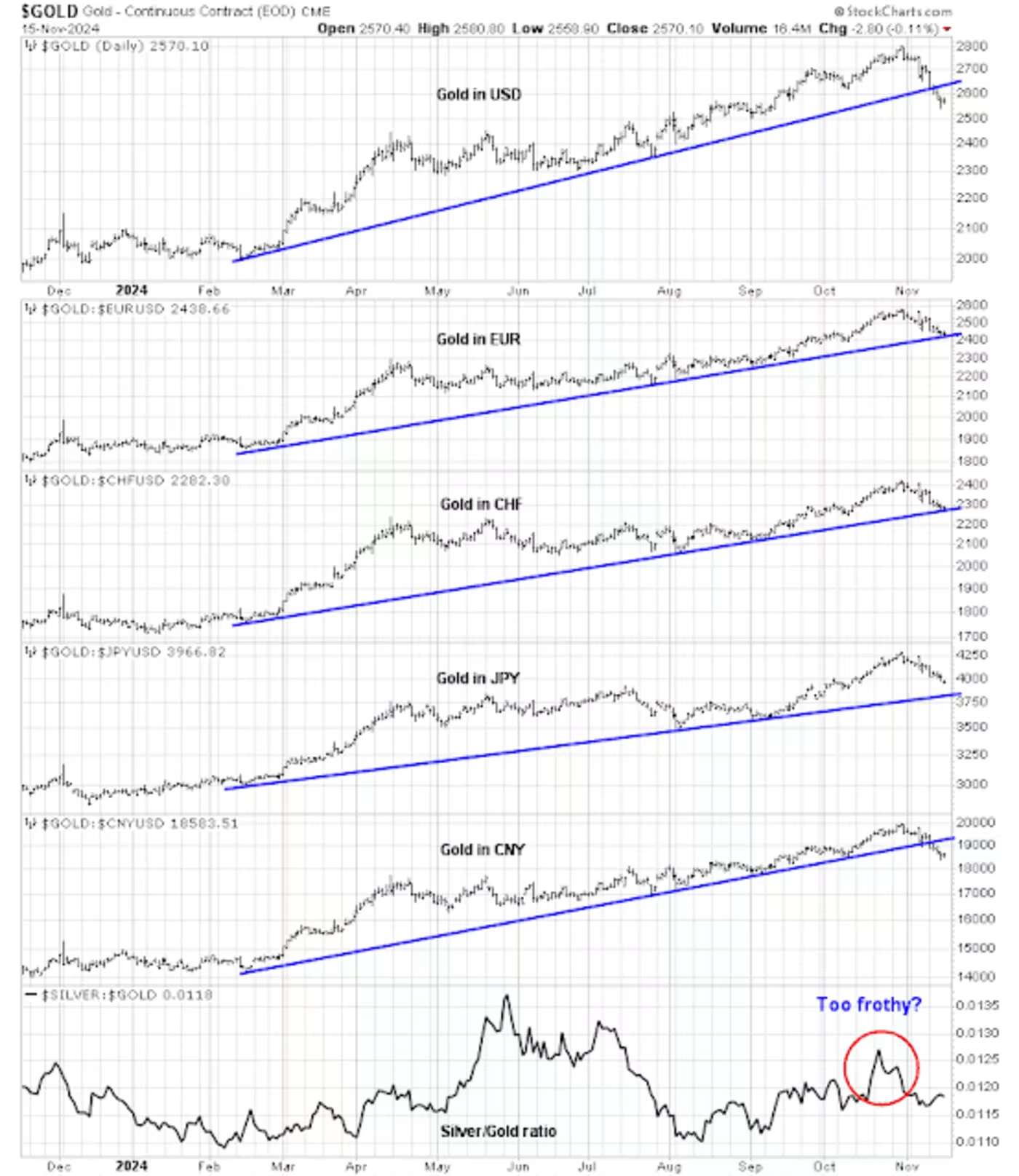

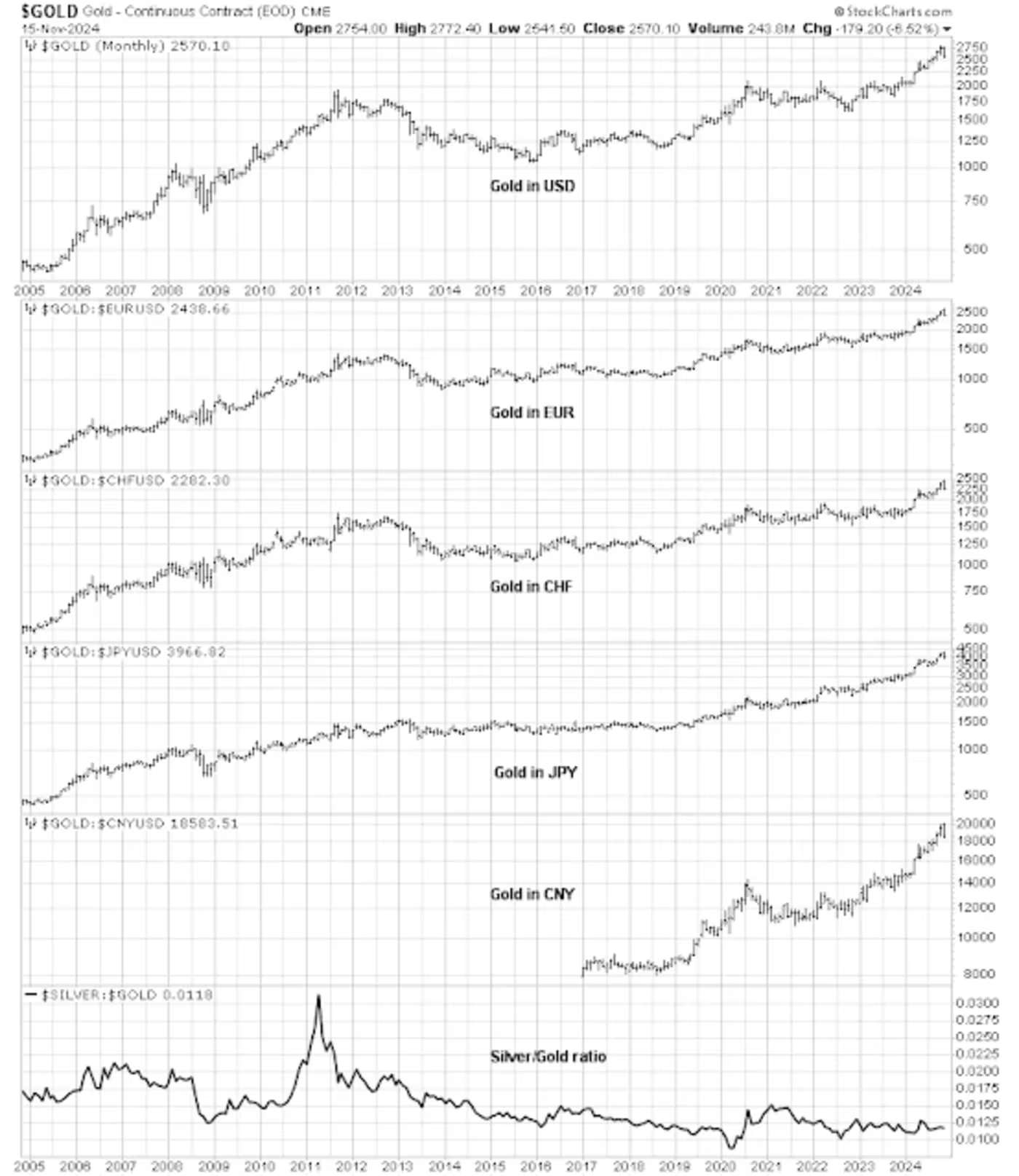

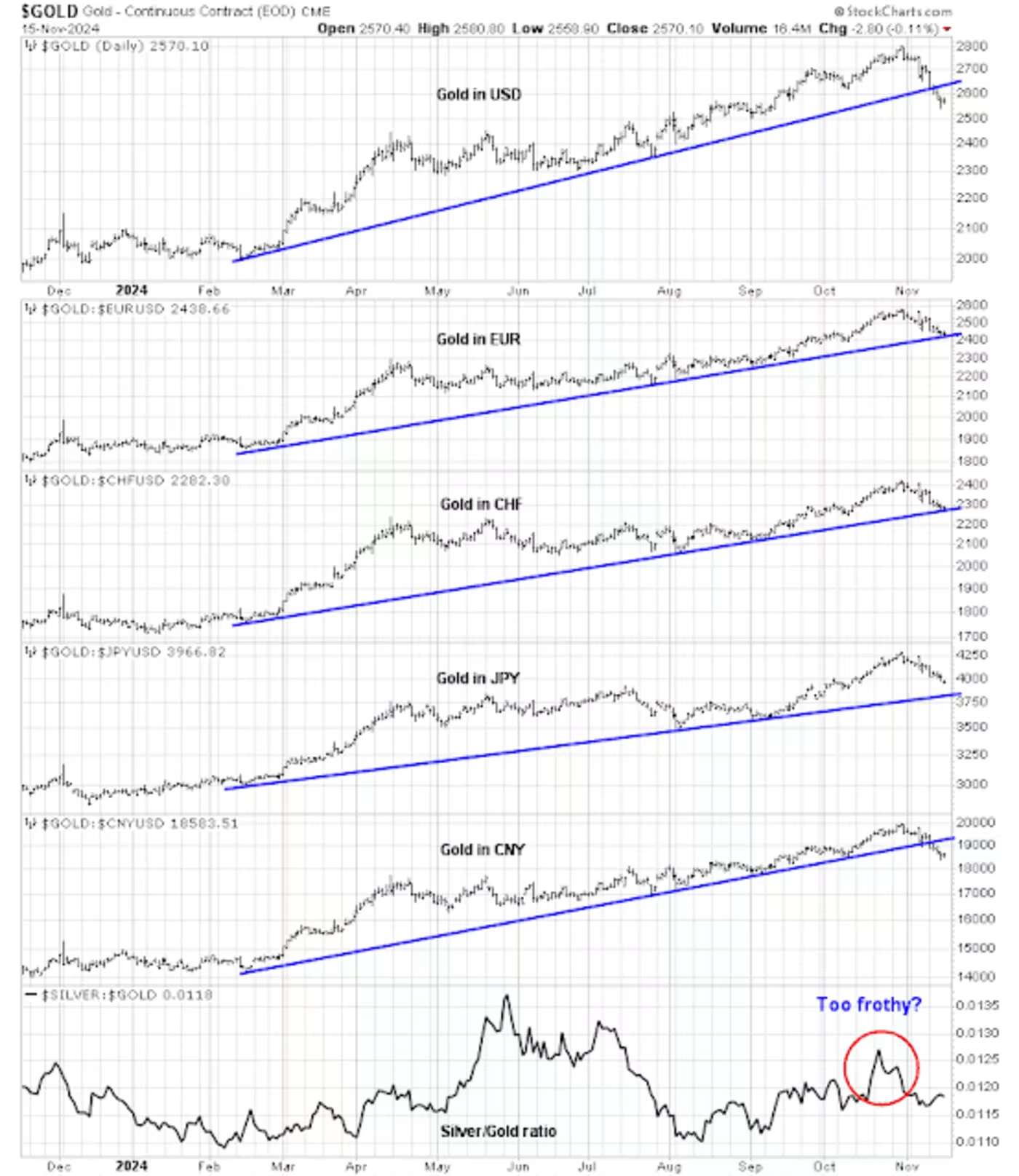

There is also a technical reason to be bullish for the long term.Not only did the gold price denominated in US dollars experience an upward breakthrough, but gold denominated in other major currencies hit new highs.The chart below shows how gold broke through long-term highs denominated in some currencies. Even gold denominated in the Swiss franc, which has always been considered a hard currency, has emerged from the bull market.

Another strong indicator of gold prices: the silver/gold ratio, surged at the top of the last gold rally, a phenomenon that has not been observed in this gold bull market.This may indicate that current sentiment readings do not yet signal that the gold bull market is over.

Judging from the recent correction in gold prices, it is worrying that gold prices have fallen below the dollar-denominated uptrend line, but gold has not violated most other commodity uptrend lines.However, the sharp rise in the silver/gold ratio since October is a dangerous sign for bullish investors, indicating that market sentiment has become increasingly impetuous and a correction is imminent.Despite this, the overall technical structure of price movements remains bullish.

The end of deflation?

In an investment portfolio, gold is a useful diversification tool because it can hedge against unexpected inflation.The latest October CPI report shows that the deflationary trend is weakening.Various consumer price indices are above the Fed's 2% target and may have stopped falling.Inflation in core services other than housing (what the Fed calls super core inflation) and housing inflation both rose slightly and remained above 4%.

Taken together, these data may not justify another rate cut next month.However, the Fed has a dual task.The latest employment data shows weakness, so overall, the path to least resistance is to cut interest rates again, but by only 25 basis points.In addition, the market is widely expected to cut interest rates again, and with markets already turbulent after the election, it may be dangerous to betray these hopes.

However, Federal Reserve Chairman Powell said in a recent speech that the Fed may not need to cut interest rates at the December FOMC meeting: "We are gradually shifting policy towards more neutral settings... We will carefully evaluate new data, changing prospects and the balance of risks.The economy is not sending any signal that we need to rush to cut interest rates."

All of these trends existed even before U.S. President-elect Donald Trump took office, and none of them were caused by his policies.Trump plans to raise tariffs, extend tax cuts, and expresses intention to intervene in the Federal Reserve's monetary policy, which will trigger inflation.Even as gold prices pull back, inflation expectations, measured at a five-year break-even rate, are rising.

Waiting for the bottom

Tactically speaking, I am waiting for the gold adjustment to bottom out.Here's what I'm looking at: According to Jason Goepfert of SentimenTrader, gold usually bottoms out when it breaks below the 2% 50-day moving average. This has just happened. Will history repeat itself?

Another way to spot possible corrective bottoms is to monitor the technical condition of gold mining stocks.The VanEck Gold Miners ETF, which represents this group, is currently in a significant correction phase and appears oversold.The ratio of gold miners to gold is near the bottom of its historical range, but the reading has not reached its recent bottom.Also, before turning tactical bullish, I would watch the bullish percentage drop into or at least close to oversold territory.

Finally, please pay attention to the US dollar index.The dollar rebounded to the top of the range after Trump's victory, and technical conditions appeared to be extended.If the dollar is rejected at resistance, its decline will be positive for gold prices, as the two tend to be inversely proportional.