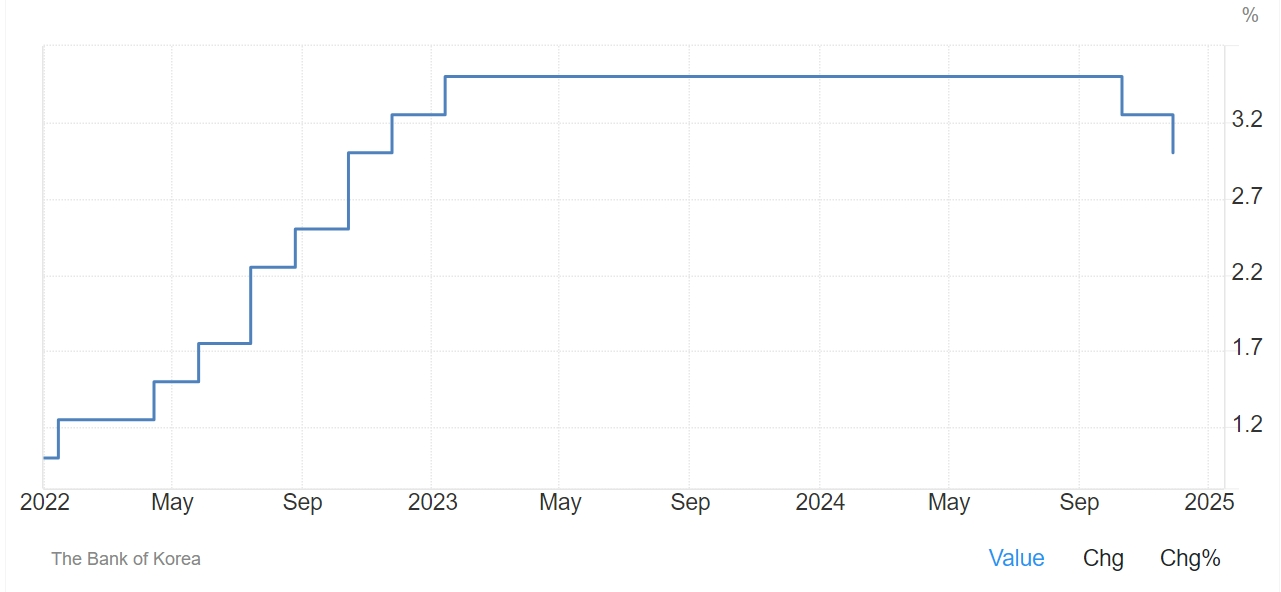

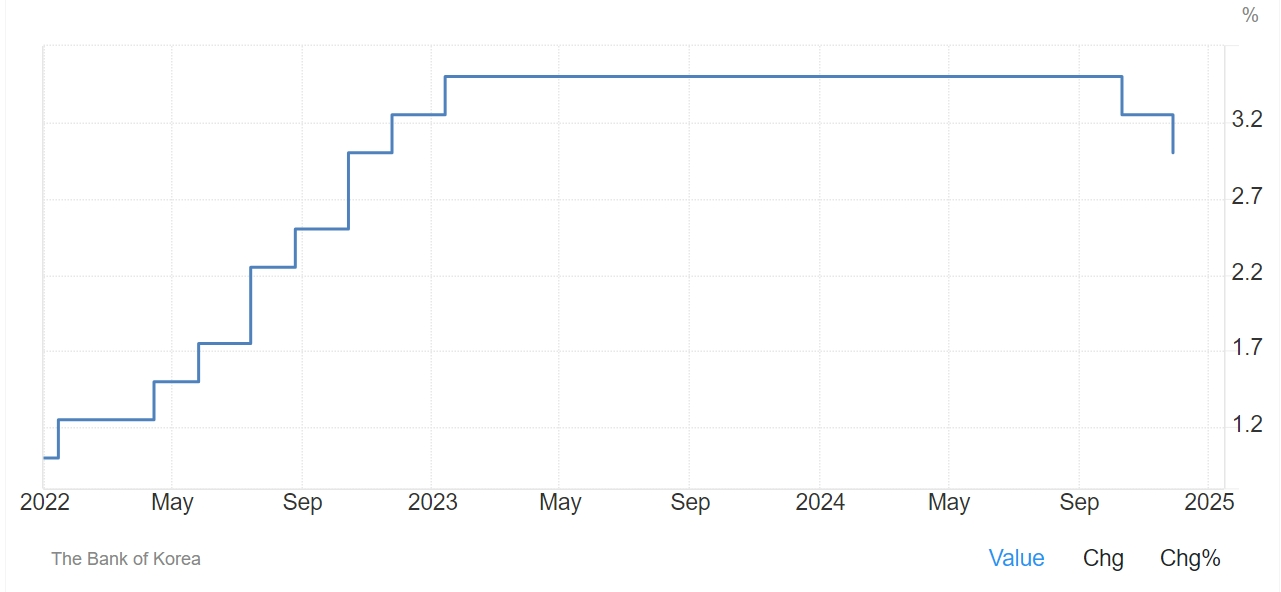

The Bank of Korea had previously warned that it would not cut interest rates continuously unless an economic crisis occurred.

The Bank of Korea still couldn't hold on.

On November 28, the Bank of Korea unexpectedly announced its second consecutive interest rate cut, lowering the benchmark 7-day repo rate by 25 basis points from 3.25% to 3.00%.

How surprised was the Bank of Korea's interest rate cut this time that surprised the market?Among the 22 economists surveyed by the media, only 4 predicted that the Bank of Korea would cut interest rates today, while the other 18 economists unanimously expected the bank to maintain interest rates at 3.25%.

The Bank of Korea had previously warned that unless an economic crisis occurred, it would not cut interest rates continuously. Now, South Korea's economic growth has indeed reached a point where it must be saved.

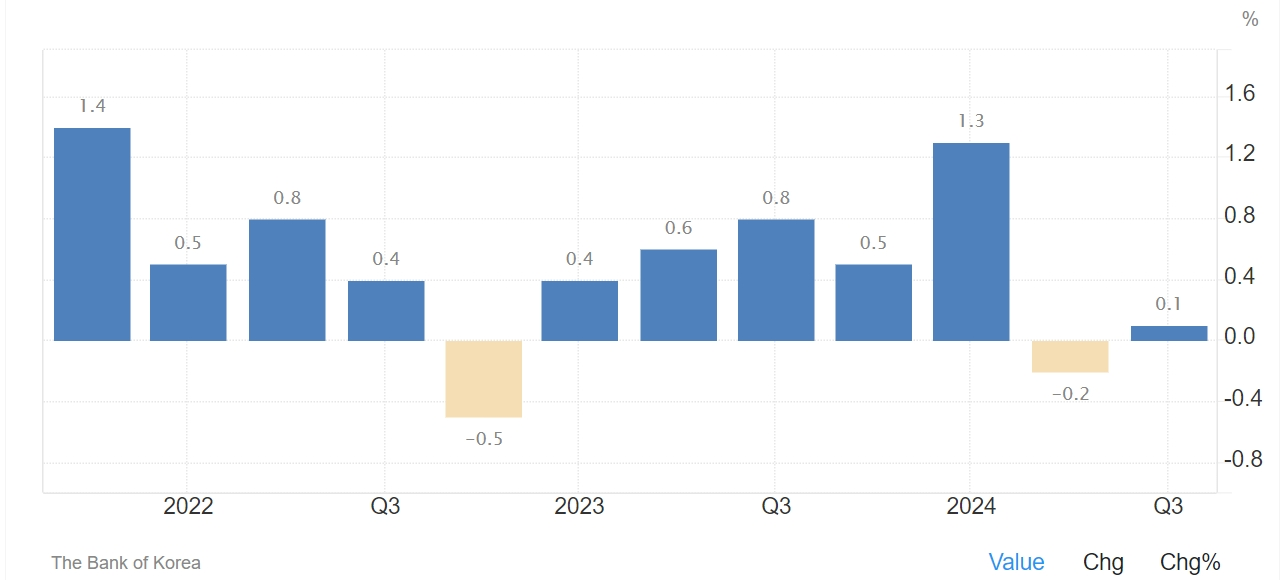

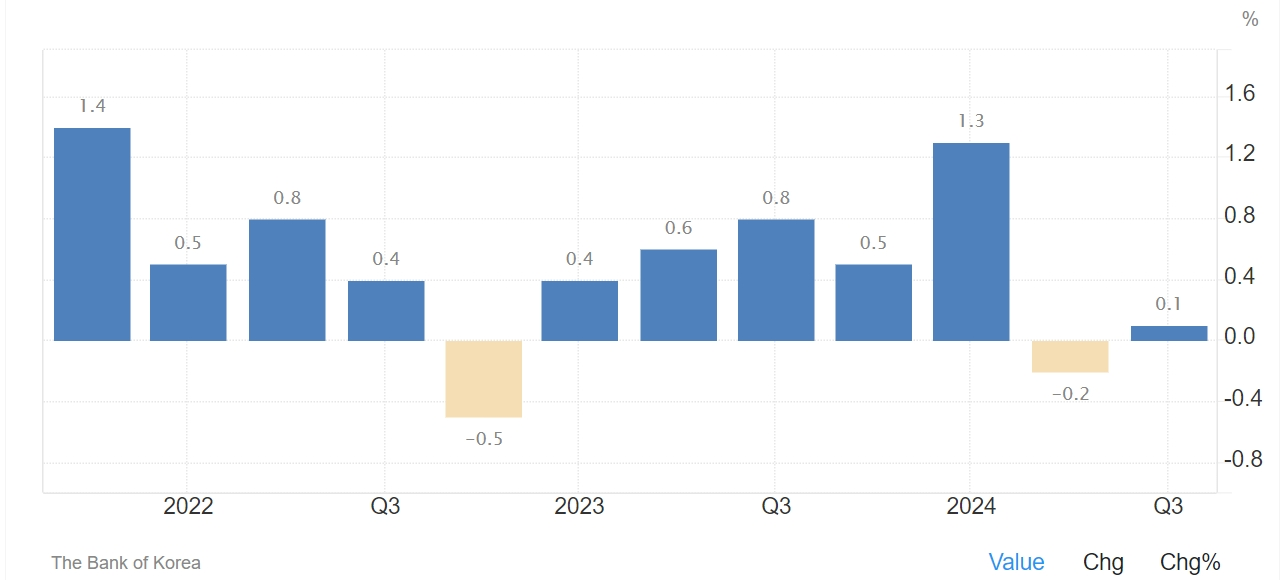

In terms of economic growth, South Korea's seasonally adjusted GDP increased only slightly by 0.1% month-on-month in the third quarter, far lower than economists 'expectations of 0.5%, and lower than the quarterly forecast released by the Bank of Korea in August.Construction and exports have deeply dragged down South Korea's GDP. South Korea's construction investment fell by 2.8% in the third quarter, and exports fell by 0.4%.As an important export commodity, semiconductors have also slowed down for several consecutive months, which has worried the market.

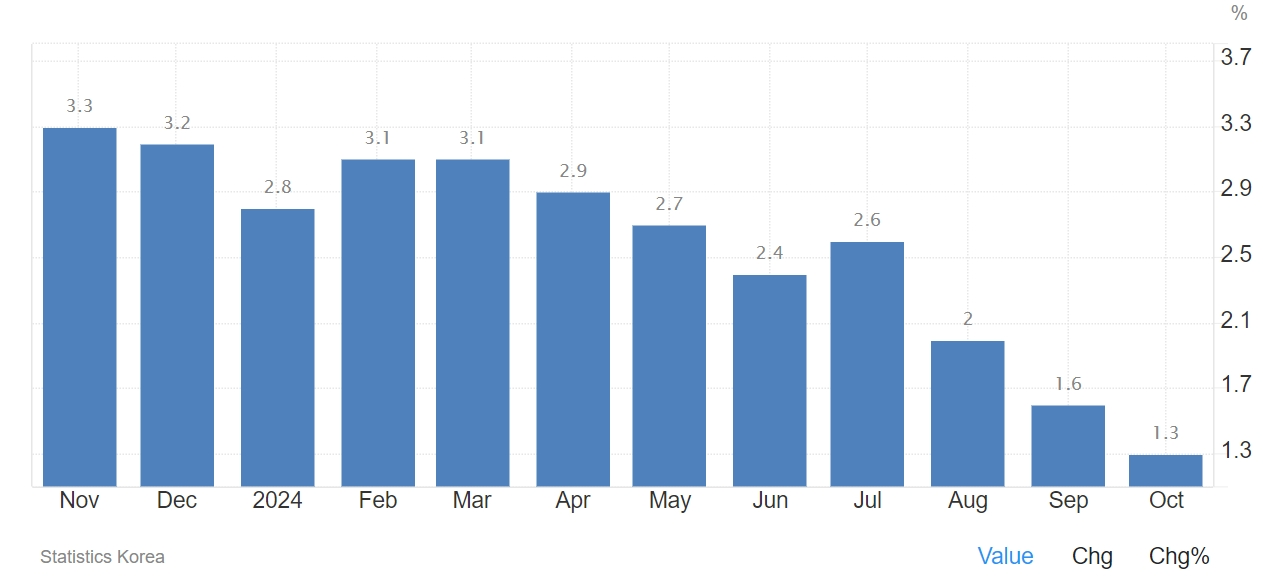

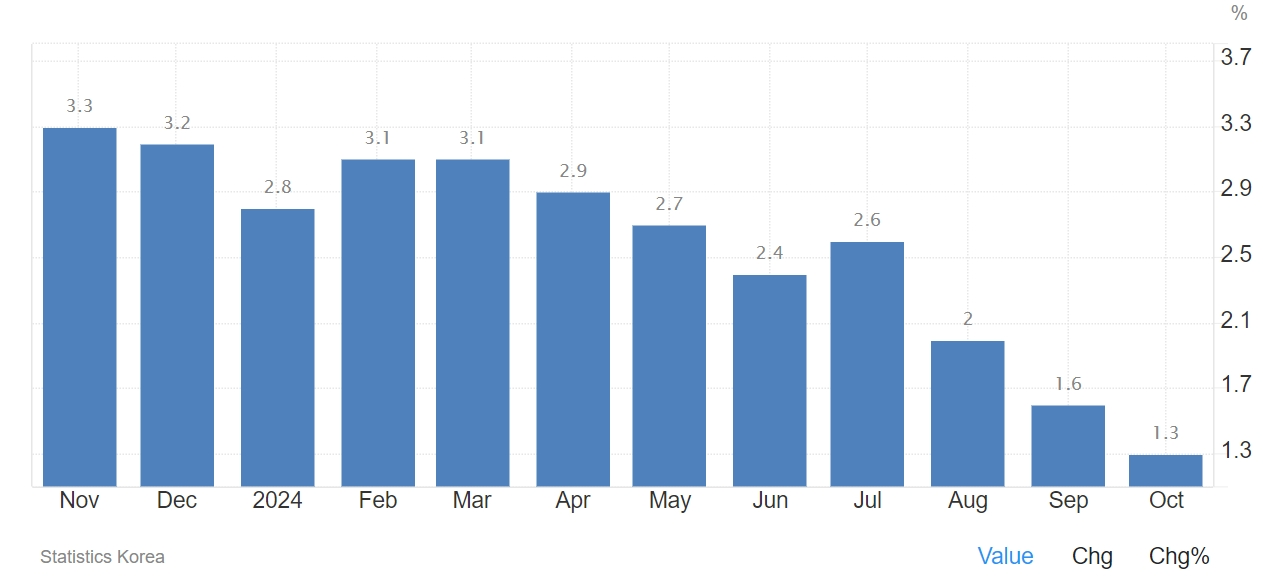

In terms of inflation, South Korea's CPI increased by only 1.3% year-on-year in October, lower than the market forecast of 1.4%, the lowest since the beginning of 2021.Core CPI, which excludes energy and food, rose 1.8%, also down from September's 2% increase.At the same time, Seoul's real estate industry has also experienced a major cooling down.

In terms of employment, new jobs for South Korean youth hit a record low in October.According to data released by the Korea Statistics Office on the 24th, the number of new wage jobs for young people aged 10 to 20 in the second quarter of this year was 1.454 million, a decrease of about 136,000 from 1.59 million in the same period last year, setting a record since the beginning of relevant statistics in 2018.

Under multiple blows from data, the Bank of Korea today announced its second consecutive interest rate cut.

Under multiple blows from data, the Bank of Korea today announced its second consecutive interest rate cut.

At the same time, the Bank of Korea also announced a downgrade of its economic growth and inflation outlook, lowering its forecast for domestic GDP growth this year and next from 2.4% and 2.1% to 2.2% and 1.9% respectively. The forecast for average inflation rate this year and next will be lowered from 2.5% and 2.1% to 2.3% and 1.9%.

On the market side, affected by the news of interest rate cuts, South Korea's three-year government bond yield fell to a low of 2.65% during the day, and the US dollar against the Korean won once rose above the 1396 line.South Korea's Composite Index rose 0.4% intraday, but gradually narrowed its gains and closed up only 0.064% at 2,504.67 points.

Analysts said that although the results of the interest rate decision were unexpected, the slowdown in the real estate market, cooling inflationary pressures and slowing export growth did lay the foundation for this week's interest rate cut.Trump's victory also prompted South Korea's central bank policymakers to consider how to support South Korea's trade-dependent economy to withstand a potential surge in tariffs when he takes office.

Lee Seung-suk, a researcher at the Korea Economic Research Institute, said,"You can view this as a pre-emptive response to Trump's targeting of U.S. trading partners, including South Korea, next year.Once the economy cools down, investment and consumption will inevitably decline.The Bank of Korea may also have taken into account the increasing debt burden on households and businesses.Therefore, this was an unexpected rate cut.”

Regarding the future interest rate path, the Bank of Korea said it will comprehensively assess the impact of benchmark interest rate cuts on inflation, economic growth and financial stability.The Bank of Korea expects consumption to continue to recover moderately, inflation will continue to maintain a stable trend, and the future inflation path will be affected by exchange rate changes, oil prices, economic growth and adjustments in public utility costs.

Under multiple blows from data, the Bank of Korea today announced its second consecutive interest rate cut.

Under multiple blows from data, the Bank of Korea today announced its second consecutive interest rate cut.