Analyst Firewire Interpretation!

On June 13, the Israeli Defense Ministry stated that Israel launched a strike against Iran.Subsequently, the Iranian side confirmed that Mohammad Baghari, Chief of Staff of the Iranian Armed Forces, had been assassinated.

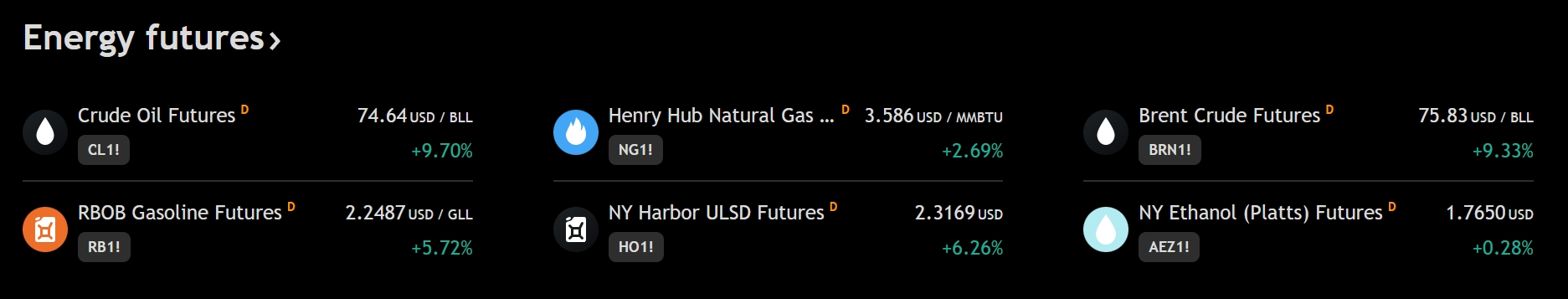

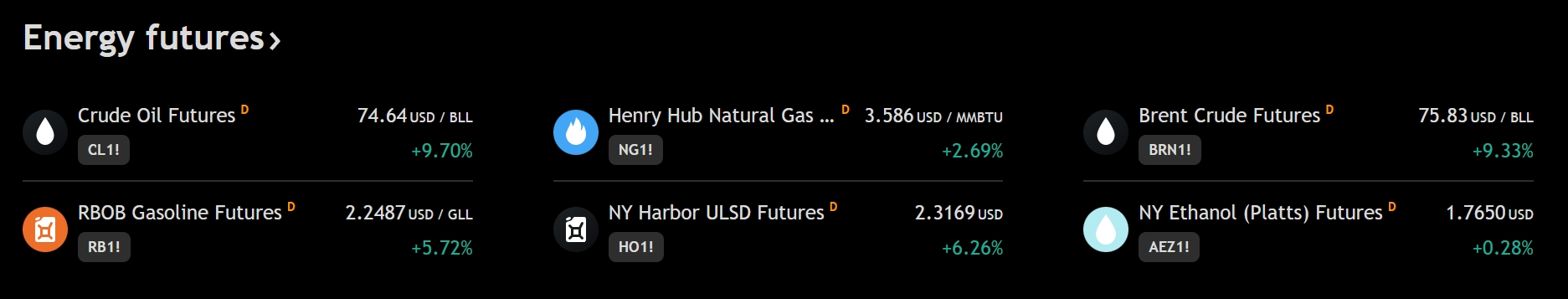

After the incident, Israeli Defense Minister Israel Katz declared a special state of emergency across the country, warning that Iran was about to launch missile and drone attacks, and the global market instantly fell into risk-haven mode.The price of gold soared to US$3430 per ounce, Brent crude oil surged 5% and broke through the US$70 mark, and Japanese and South Korean stock markets plunged sharply.

Here are the analysts 'views:

Michael O'Rourke, chief U.S. market strategist at JonesTrading, said,"I really just try to keep track of the situation, which obviously changes rapidly-but the risk to the market should be greater than last year's strike.The market has experienced a strong rebound without much correction, which has left the market in a more fragile position.

The current situation is that the situation is escalating. The question is: How will Iran respond? Will they retaliate more violently? This is a question that can't get out of my mind.During this rally, markets have been relatively complacent, which is a key risk in our current situation.There is now a good chance of retaliatory incidents over the weekend, which will keep people on the sidelines and maintain some hesitation.

Billy Leung, investment strategist at Global X ETFs in Sydney, believes that the key focus for investors is whether the recent attacks can be contained and provide traders with the opportunity to downplay market volatility."This is in sharp contrast to last night's bullish sentiment, when technological optimism, weak inflation and light positions made markets prone to risk-a statement that Israel's direct strike on Iran immediately shattered.

"This is exactly the same as some past events such as the Sulay attack in 2020 and the oil tanker attack in 2019, when we saw the same initial reaction: rising oil prices, strengthening U.S. Treasuries and the Swiss franc.The key now is whether the situation can be controlled-history shows that markets often downplay the impact if upgrades are limited.”

Wei Liangchang, macro strategist at DBS Group Holdings Limited in Singapore, said that safe-haven assets such as the yen and U.S. Treasury bonds will continue to be sought after as the market focuses on any signs of escalating tensions between Israel and Iran.As geopolitical risks in the Middle East become more prominent, markets may react subconsciously.The market will assess the impact of the strike and focus on the risk of escalation

"Risky assets may fall back, while safe-haven assets such as the yen and U.S. Treasuries may be sought after.”

Matthew Haupt, portfolio manager at Wilson Asset Management in Sydney, assessed: "Typical risk-averse measures are underway, with bond and gold prices rising and oil prices soaring.These measures usually fade after the initial shock.What we are looking at now is the speed and scale of Iran's response, which will determine the duration of the current trend.”

Charu Chanana, chief investment strategist at Saxo Bank in Singapore, believes that headlines about Israeli air strikes in Iran have reignited the geopolitical risk premium.Whether this risk-averse tone can last depends on the next 24-48 hours.Experience shows that if Iran's response is limited and energy supplies are uninterrupted, the premium may shrink quickly.But any sign of retaliation or supply disruption could keep volatility rising and push up the prices of oil and safe-haven assets.

Rodrigo Catril, strategist at Australia National Bank in Sydney, said one theme worth watching was whether the safe-haven nature of the dollar was being weakened by the US government's trade policies (tariffs), fiscal profligacy and its challenges to the rule of law.The evidence to date suggests that this is indeed the case.

"If Israel's unilateral actions are confirmed, it also highlights the changes that may be taking place in the world order.The United States seems to be abandoning its geopolitical dominance, opening the door for other countries to pursue their own agendas."

"The worry is that Israel is only one of them, and other countries may follow suit and believe that the United States will not stop them.Geopolitics is becoming a more disruptive force for markets, further exacerbating uncertainty.Safe haven assets will rise, but the dollar may not.”