China consumers are left out?

On September 8, Mark Gurman, a well-known Apple news expert, said that Apple Intelligence was excluded from its launch in the China market and may have to wait until the end of the year before it can be launched through a system update at the earliest, and there is even a risk of postponing it again.

Gulman said that although Apple has completed most of the Chinese adaptations and has tried to cooperate with local technology giants such as Alibaba and Baidu to introduce local large models as a technology base to avoid compliance issues, it is limited by a series of policy factors such as data supervision, model review, and computing power deployment still cannot ensure implementation as scheduled.Currently, Apple Intelligence has been tested online in North America and some European markets, but in China, testing is still limited to internal employees of the company, which generally disappoints consumers, channel operators and even investors.

Apple originally planned to fully deploy its newly launched native AI system, Apple Intelligence, in iOS 18, which is a key step in its competition with Microsoft and Google in the field of AI hardware integration.The suite will deeply embed core functions of the operating system, including intelligent writing, image generation, email sorting, calendar assistant, notification priority management, etc., combined with large model capabilities to significantly improve user efficiency and interactive experience.A number of authoritative technology media pointed out that this AI solution is not only the core of system upgrades, but also an important selling point for the new generation of iPhone. Especially in the current context of serious homogenization of smartphones, AI functions are regarded as driving users to change phones. important driving force.

Behind the obstruction of AI implementation, it highlights the dual pressures Apple faces in the China market for technology localization and regulatory compliance.Unlike Microsoft and Google, Apple adopts an AI hybrid architecture with deep end-to-side reasoning and partial cloud processing. To run this solution in China, it must rely on local servers and data governance standards.Although this move is expected to use local model companies to share policy pressure, it also significantly increases the cost and time period of technology implementation, making it difficult to have a foundation for sustainable promotion in the short term.

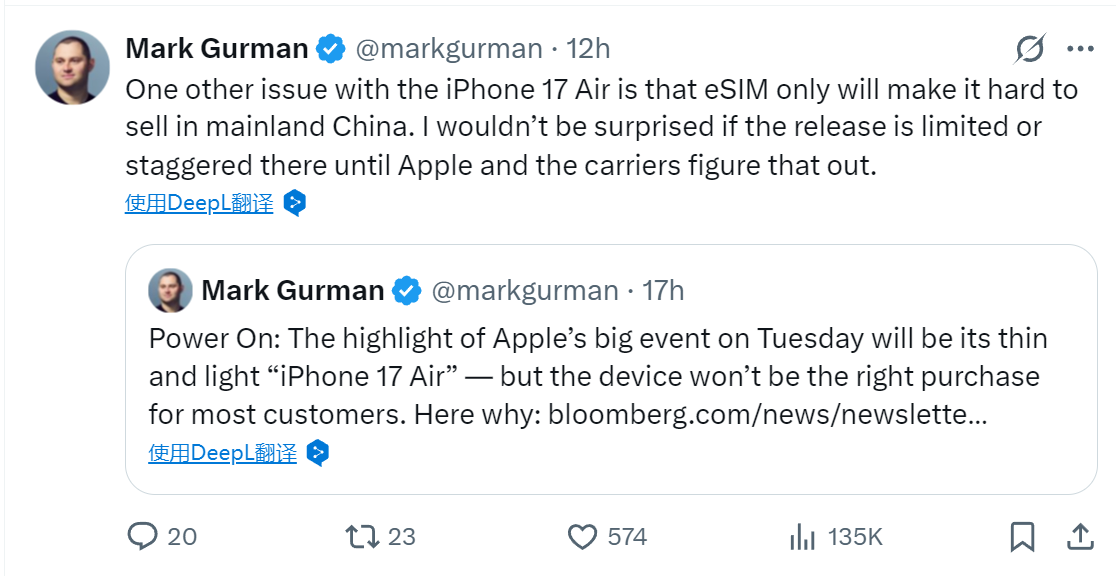

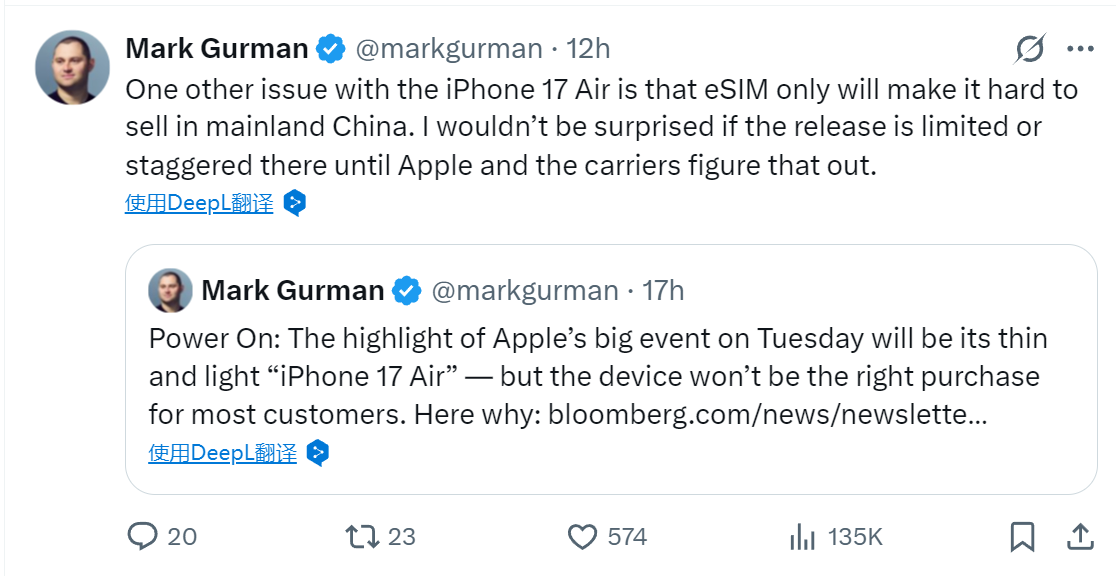

In addition, as the new thin and light model "iPhone 17 Air" in the iPhone 17 series completely eliminates the physical SIM card slot and fully switches to eSIM design, the access of this technology is still pending in China.If regulators do not approve it, the iPhone 17 Air may not be able to launch this fall in China, a market that does not yet widely support eSIM technology.

According to data from GSMA, Counterpoint Research and other institutions, as of the end of 2024, the proportion of eSIM users in China has not exceeded 15%. The vast majority of consumers, especially middle-aged and elderly users and business users, still strongly rely on physical SIM cards.At the same time, due to the lack of unified standards for operators in eSIM activation and card replacement processes, as well as high security review requirements, the commercialization of eSIM in China is progressing slowly.Apple has previously tested the eSIM-only design on some overseas models. Although initial results have been achieved, if it does not provide a physical card version in China, it will not be able to meet the needs of mainstream users in the market and may directly affect the sales scale.

More realistically, Apple has gradually lost the brand stickiness of some high-end users in the China market.Local brands such as Huawei, Xiaomi, vivo, and Glory have continued to innovate in AI photography, satellite communications, and localized service experience in recent years. Coupled with more competitive price strategies, they have successfully seized Apple's share in the high-end market.IDC data shows that in the first half of 2024, Apple's shipments in China fell by more than 8% year-on-year, and the strong rebound of Huawei's Mate 60 series has become an alternative choice.If the iPhone 17 Air cannot be released in China as scheduled, this trend will undoubtedly be further expanded.

Analysts said that the iPhone 17 Air also has some ambiguity in its product positioning.In order to pursue a thin and light body, it made certain compromises on core parameters such as camera and battery, and even retreated to the single-camera design, which made it not as comprehensive as the standard version of the iPhone 17 in terms of functionality and not as outstanding as the Pro version in terms of performance.Industry insiders generally believe that this "eclectic" product is prone to pricing embarrassment in the mid-to-high-end market and is difficult to form a clear audience.Referring to Samsung's previous weak sales cases of the S25 Edge series, if Apple cannot reach a clearer strategy between price and configuration, it will face pressure to launch a price war with rivals.

From the perspective of the capital market, although Apple's share price has remained high in the near future, the market has become wary of the prospects of implementing its AI capabilities, iPhone 17 sales performance and uncertainty in the China market.Investment banks such as Morgan Stanley and Goldman Sachs all pointed out in their latest research reports that China factors will become an important variable affecting Apple's fourth-quarter financial performance.If AI functions are absent in China and Air models are difficult to market due to eSIM, it will put pressure on their hardware shipment expectations and may trigger adjustments to sales guidelines.