【2025 Guide】How to Deposit Funds to Longbridge (HK): Methods, Processing Time & Bonus Offers

Discover all the ways to deposit funds to Longbridge Securities (Hong Kong) in 2025. Compare eDDA, FPS, wire transfers and more. Learn about deposit requirements, timelines, and how to claim up to HK$1,118 in new user rewards.

What fund deposit methods does Longbridge Securities (Hong Kong) support? Which one offers the fastest arrival time? Can non-Hong Kong bank cards be used? What should I do if the deposit fails? This article will provide a comprehensive overview of multiple fund deposit channels, operation procedures, arrival times, and considerations for Longbridge Securities (Hong Kong), along with the latest deposit benefit strategies for June 2025, helping you complete your first deposit efficiently and securely.

I. Introduction to Longbridge Securities (Hong Kong): A Technology-Driven Compliant Hong Kong and US Stock Broker

Longbridge Securities (Hong Kong) (Longbridge) is a new-type tech broker focused on Hong Kong and US stock investments, established in 2019, dedicated to providing investors with low-threshold and intelligent trading experiences. It has currently obtained Hong Kong SFC Type 1/2/4/9 licenses and has licensed operations in Singapore, the United States, New Zealand, and other regions.

Longbridge's technology platform is developed by former Alibaba engineers, supporting trading across web, iOS, Android, and PC terminals, featuring intelligent investment research (PortAI), convenient IPO subscriptions, low-commission US stock trading, and other functions, popular among young investors.

II. [June 2025] Overview of Longbridge Securities Deposit Benefits: New Users Can Receive Up to HK$1,118!

Currently, deposit can enjoy the following exclusive new-user benefits:

| Conditions | Reward |

|---|---|

| First deposit ≥ HK$10,000 | Permanent commission-free Hong Kong and US stocks trading |

| First deposit ≥ HK$20,000 |

Additional benefits: HK$218 stock card HK$200 stock card HK$200 stock card 4% annualized money market fund HKEX cash IPO subscription fee waiver |

| First account transfer ≥ US$10,000 |

Additional reward: HK$500 stock card |

⚠️ Benefits are valid until June 30, 2025 and must be claimed through the designated channel.

III. Overview of Longbridge Securities Deposit Methods: Multiple Options, Supporting Telegraphic Transfers from Non-Hong Kong Bank Cards

Longbridge Securities offers multiple fund deposit methods to meet the needs of users in different regions. The following is a comparison of current main deposit channels:

| Deposit Method | Supports Hong Kong Cards | Supports Non-Hong Kong Cards | Arrival Time | Fee | Requires Uploading Proof? | Remarks |

|---|---|---|---|---|---|---|

| Bank-SEcurities Transfer | ✅ | ❌ | As fast as 5 minutes | Free | No | Exclusively for Minsheng Hong Kong |

| eDDA | ✅ | ❌ | As fast as 5 minutes | Free | No | Supports major Hong Kong banks |

| FPS (Faster Payment System) | ✅ | ❌ | As fast as 2 hours | Free | ✅ | Bank-side transfer |

| Online Banking Transfer | ✅ | ✅ (Telegraphic transfer) | 1-3 working days | Bank fees apply | ✅ | Universal for all banks |

| ATM/Counter | ✅ | ❌ | 1-3 working days | Bank fees apply | ✅ | Recommended to attach a receipt |

| Check Transfer | ✅ | ❌ | More than 2 working days | Bank fees apply | ✅ | Submit checks in Hong Kong |

| Telegraphic Transfer | ❌ | ✅ (FATF countries) | 2-5 working days | Bank fees apply | ✅ | Supports non-Hong Kong bank cards |

IV. Illustrated Tutorial: Full Process of Longbridge Securities Fund Deposit

Recommended Method 1: eDDA Fast Deposit (As Fast as 5 Minutes)

Suitable for: Users with local Hong Kong bank accounts

Operation Process:

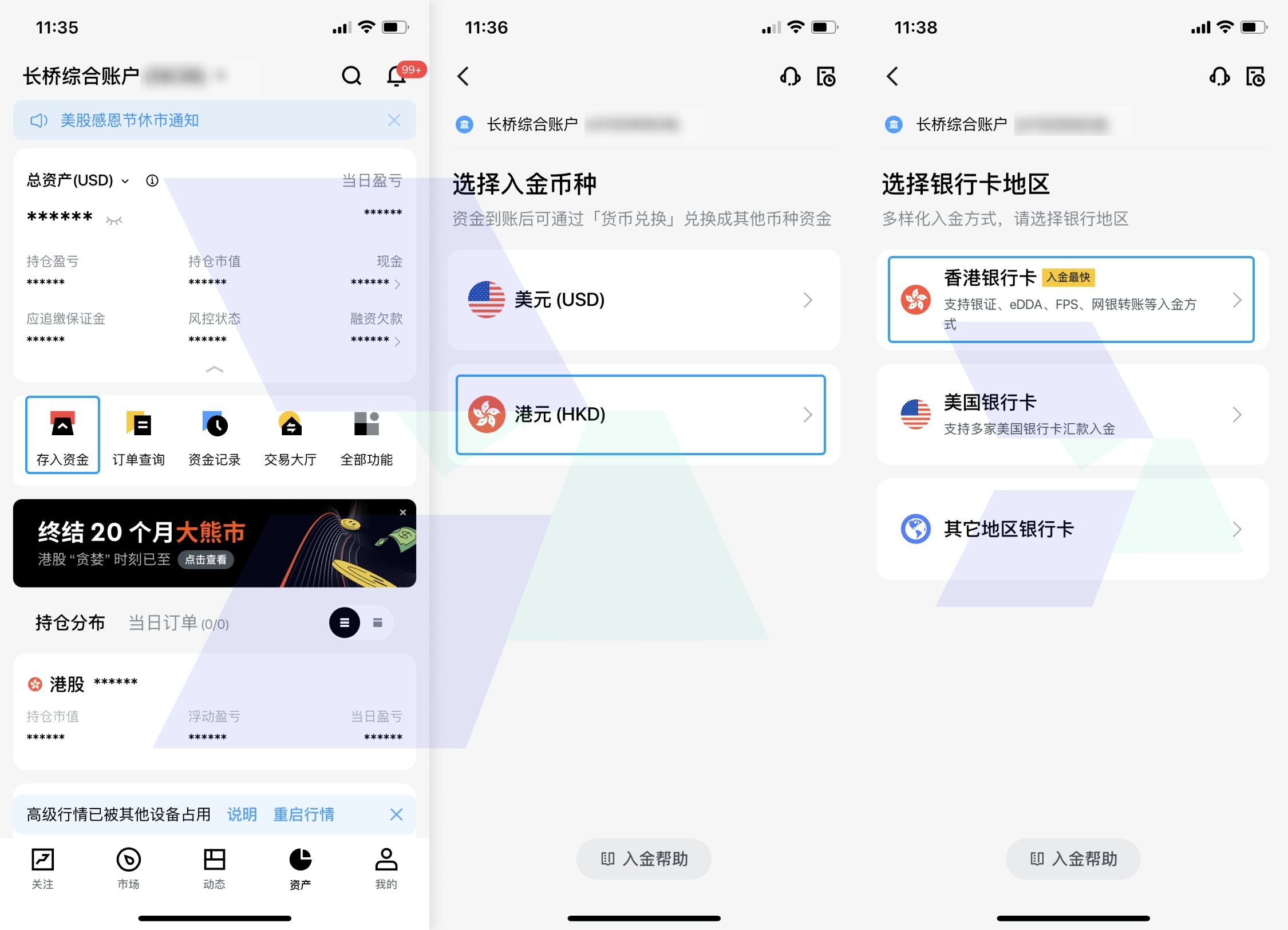

1. Open the Longbridge App → [Assets] → [Deposit Funds] → [Deposit HKD] → Select [Hong Kong Bank Card]

2. Select the bank (e.g., Bank of China Hong Kong, HSBC, etc.). After selecting the specific deposit bank, click [eDDA Deposit] to apply for authorization.

-

- Tip: Banks marked with an eDDA label support eDDA deposits; otherwise, they do not.

3. Confirm the bank authorization information and click [Confirm Authorization].

-

- For bound cards: Confirm the card number/name and click [Confirm Authorization]. If the card number or name is incorrect, modify it in the tab-bank card module.

- For unbound cards: Fill in the bank account name/remittance bank account number/remittance account type step by step, then click [Confirm Authorization].

- Tip: The type of identification document/name order must match the information registered with the bank. Inconsistencies may cause authorization failure. If unsure, confirm with the remittance bank's customer service.

4. After successful submission, wait for bank authorization. You will be notified of the authorization status via push messages and emails.

-

- Tip: eDDA authorization processing times vary by bank. Most are completed within 5 minutes, while individual banks may take 2-14 working days.

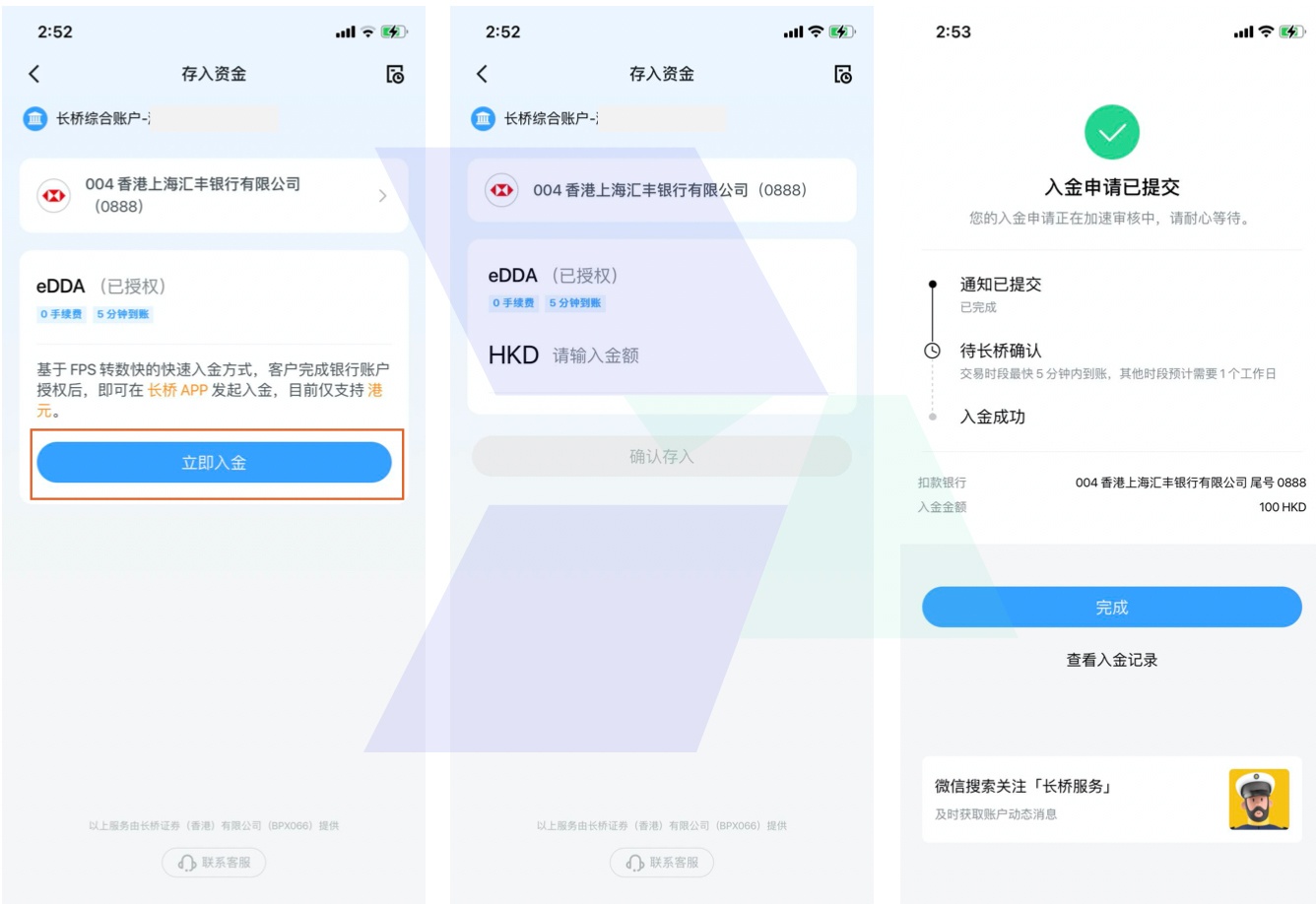

5. After successful authorization, directly click [Deposit Now] on the eDDA deposit page in the Longbridge App and enter the deposit amount as prompted.

| Deposit Initiation Time | Estimated Availability Time |

| HK Stock Trading Day 08:00-16:00 | Within 2 hours |

| Non-HK Stock Trading Hours | By 10:00 on the next HK stock trading day |

Notes:

- If there is a HK stock market holiday, all availability times will be postponed.

- Transfer fee: Free

- If the account has insufficient funds, some banks (e.g., HSBC) may deduct a handling fee. Ensure sufficient account balance before transferring to avoid operation failure and bank fees.

Recommended Method 2: FPS Fast Payment System Deposit (Approx. 2 Hours)

Suitable for: Most Hong Kong bank users

Operation Process:

1. Obtain Longbridge Securities' receiving account: Longbridge App > Assets tab > [Deposit Funds] > [Select Deposit Currency] HKD > [Select Deposit Bank Card] > [FPS Fast Payment System], then directly copy the FPS ID.

_328376658_488.jpg)

2. Log in to the bank App or online banking (take Bank of China Hong Kong as an example) > Select the [FPS Fast Payment System] function to make a transfer (currently only supports FPS deposits in HKD).

_328377729_417.jpg)

3. Upload the bank transfer receipt (JPG/PDF) in the Longbridge App: Upload location: [Assets] > [Deposit Funds] > [Upload Transfer Receipt].

_328378527_96.jpg)

| Deposit Initiation Time | Estimated Availability Time |

| HK Stock Trading Day 08:00-16:00 | Within 2 hours |

| Other Periods | By 09:40 on the next HK stock trading day |

Notes:

- If there is a HK stock market holiday, all availability times will be postponed.

- Transfer fees:

- Longbridge does not charge any fees.

- Most banks/payment tools currently do not charge fees, but different fee arrangements may be introduced in the future. For details, consult the bank's customer service.

- Transfer limits: Currently, there is no limit for FPS deposits, but please note any transfer limits set by the bank.

Recommended Method 3: Telegraphic Transfer (Non-Hong Kong Bank Cards)

Suitable for: Cross-border bank card transfers, with an estimated arrival time of 2-5 working days. Fees are determined by the bank. Users need to obtain the bank's beneficiary information, transfer funds to the receiving bank account via mobile banking or online banking, and then upload a photo of the transfer receipt.

Telegraphic Transfer Information (Please confirm the telegraphic transfer details again on the Longbridge App or official website before depositing)

| Beneficiary Name | Long Bridge HK Limited |

| HKD Receiving Account Number | 861520160012 |

| USD Receiving Account Number | 861530198867 |

| Receiving Bank |

Industrial and Commercial Bank of China (Asia) Limited |

| Bank Code | 072 |

| SWIFT Code | UBHKHKHHXXX |

| Bank Address | 33/F, ICBC Tower, 3 Garden Road, Central, Hong Kong |

| Transfer Fees | Specific fees are subject to the bank's actual charges. Longbridge Securities does not charge fees. |

| Arrival Time | Estimated to arrive within 2-5 working days, subject to the bank's processing time. |

| The current telegraphic transfer information was updated on 2025/06/04. Please confirm the telegraphic transfer details again on the Longbridge App or official website before depositing. | |

Notes:

- Customers must register valid mobile phone numbers or email addresses, as well as the latest issued identification documents and other important information with their respective banks.

- Transfers must be made from a bank account with the same name as the Longbridge Securities account. Using others' accounts or third-party accounts for transfers is strictly prohibited. Otherwise, the customer will be responsible for any resulting refund fees.

- Back-office processing of remittance applications between banks takes time. A bank's notification of "remittance sent" does not mean Longbridge Securities has received the funds. After the funds arrive at Longbridge Securities, a settlement and approval process is required. Please note that both banks and Longbridge Securities do not process remittance services during Hong Kong public holidays. It is recommended to allow sufficient time for remittance processing.

- Direct cash deposits are currently not supported.

- Special reminder: Longbridge Securities does not accept transfers from bank cards issued by mainland Chinese banks (referred to as "mainland bank cards"). If a mainland bank card is used to transfer funds to the receiving account, the relevant funds will be returned, and the bank fees will not be refunded, which will be borne by the user. Please take note.

V. FAQ on Deposits

Q1: Can I use a mainland Chinese bank card for deposits?

A: No. It is recommended to use bank cards from Hong Kong or FATF member countries; otherwise, the funds will be returned, and the bank may charge fees.

Q2: How long does it take for the deposit to arrive?

A: eDDA and bank-securities transfers are the fastest, arriving within 5 minutes; FPS takes approximately 2 hours; telegraphic transfers take 2-5 working days.

Q3: What happens if I don't upload the deposit receipt?

A: For some methods (such as FPS and telegraphic transfer), failure to upload the receipt in a timely manner may result in delays or failure to receive the funds.

Q4: What should I do if the deposit fails?

A: Please contact official customer service or submit a [Manual Service] request for a refund through the App. The refund period is determined by the bank.

Q5: Can I use someone else's account for deposits?

A: No. Longbridge only accepts deposits from bank cards or accounts with the same name as the account holder.

VI. Summary and Deposit Recommendations

| User Type | Recommended Deposit Method | Remarks |

|---|---|---|

| Hong Kong Users | eDDA, FPS | Fast and no handling fees |

| Overseas Users | Telegraphic Transfer (FATF Countries) | Avoid using mainland Chinese banks |

| Minsheng Users | Bank-Securities Transfer | Instant arrival, recommended |

| New Users | eDDA First | Automatic arrival, no receipt upload required |

⚠️ Please confirm that the bank account name matches before depositing, and be sure to keep the transfer receipt for tracking.

VII. Open an Account Now to Get Up to HK$1,118 in Rewards! (Exclusive Benefits)

📲 Open an account through the Hawk Insight channel to enjoy exclusive benefits:

-

Permanent commission-free trading for Hong Kong and US stocks

-

Stock cards + fund rewards totaling over HK$1,118

-

Exclusive commission-free initial public offering (IPO) subscriptions for Hong Kong stocks

👉Click to Open an Account | Enjoy Longbridge's Deposit Benefits

For more information on Longbridge Securities' account opening guides, IPO subscription tutorials, and fund withdrawal methods, please browse more content on Hawk Insight.

- Good News! Longbridge Securities No Longer Requires Asset Proof for Account Opening, Greatly Reducing the Threshold for Investing in Global Markets!

- [2025 Update] Comprehensive Guide to Account Opening and Deposits for Longbridge Securities (Hong Kong)

- Latest Account Opening Guide for Longbridge Securities (Singapore) | With Detailed Step-by-Step Screenshots

- Essential Guide for Hong Kong and US Stock Investors! 2025 Longbridge Securities Singapore Deposit and Withdrawal Manual

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.