The most conflicted thing about Sanhua New is not whether to fight, but after fighting Haitian, you find that there is no money to fight Sanhua.

The most conflicted thing about Sanhua New is not whether to fight, but after fighting Haitian, you find that there is no money to fight Sanhua.

In fact, when two big meat collide together, it still has some impact.

Haitian will close its subscription on June 16 (next Monday), announce its winning bid on the 18th (next Wednesday), and go public on the 19th (next Thursday).

The subscription deadline for Sanhua is 9 a.m. on June 18 (next Wednesday). That is to say, if the funds that Haitian failed to win the lottery can be refunded on the evening of the 17th, it can still catch the last bus of Sanhua on the 18th.

It's just that at this stage, unless the brokerage company has sufficient quotas, it can only purchase in cash.

For the quota, TOP3 is definitely enough. For those who don't know how to open an account, hurry up with the background Didi (yes, account opening will be tightened again).

1. Issuing core information and market positioning

Let's briefly introduce Sanhua.

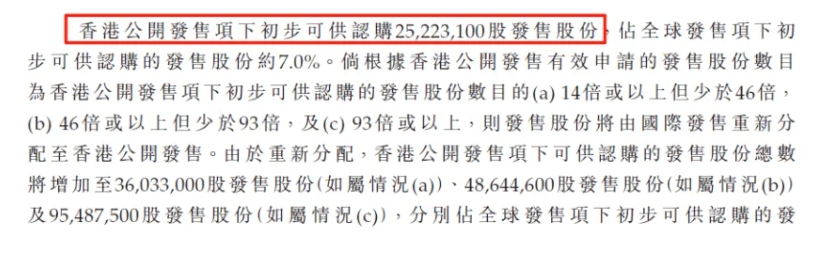

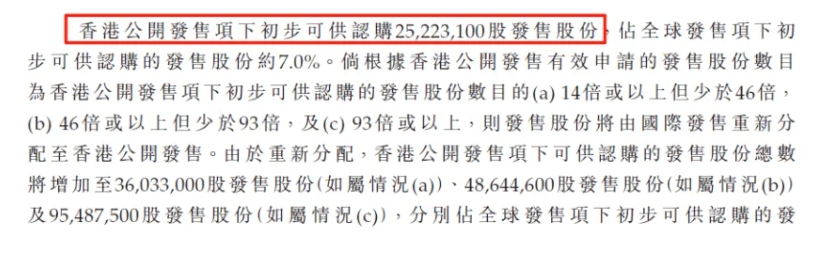

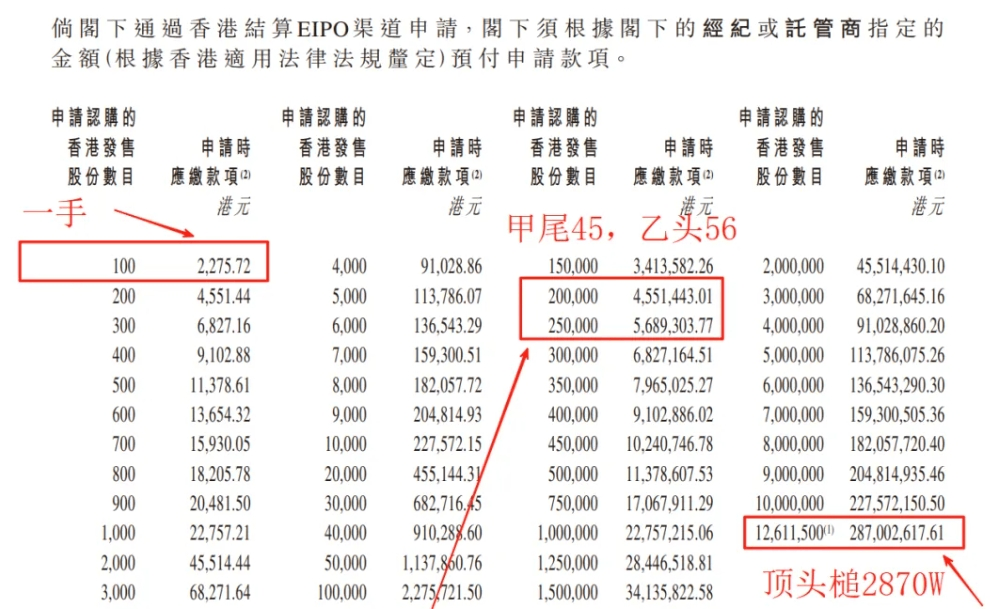

Sanhua Intelligent Control is the absolute leader in the field of refrigeration and air-conditioning control components and thermal management for new energy vehicles. The IPO price range of this Hong Kong stock is 21.21-22.53 Hong Kong dollars/share, which is approximately 20%-25%, and the admission fee is approximately HK$2,275.72 per lot (100 shares per lot).

This discount is still a conscience.

The company sold 360 million H shares globally and raised a net amount of approximately HK$7.741 billion, of which 55% was used for overseas production capacity expansion (bases such as Mexico and Poland), 30% was invested in the research and development of mechanical and electrical actuators for bionic robots, and the remaining funds were used for digital upgrades and repayment of debts.

Those with the concept of robots performed well this year.

Cornerstone investors have a luxurious lineup, including Schroders, GIC, Jinglin Assets, Green Better (Xiaomi related parties), etc., with a total subscription of 55.95% of publicly issued shares and a lock-up period of 6 months.

The green shoe mechanism (15% over-allotment option) is provided by sponsors CICC and Huatai.

Let's just say, can we kick Huatai?

2. Calculation of winning rate and callback mechanism

If the public offering is overpurchased by more than 50 times, the callback ratio will increase from the initial 7% to 26.5%, and the distributable shares of retail investors will increase by approximately 3.8 times:

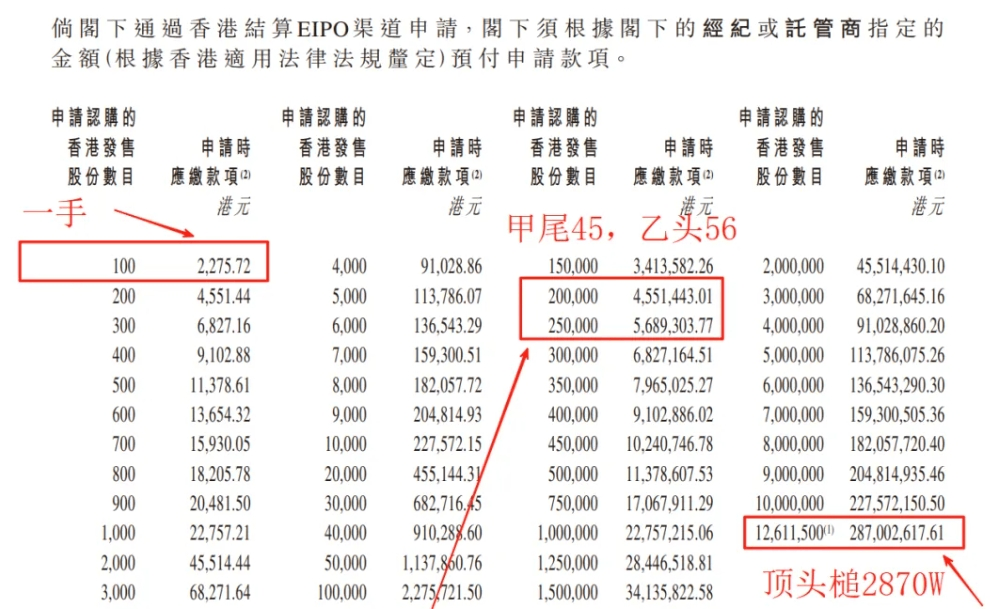

- Group A (Xiaosan): It is estimated that the first-hand winning rate will be about 20%-30%, and more than 30 lots (approximately HK$68,000) need to be subscribed to increase the probability;

- Group B (Dasan): The threshold for Group B is about HK$569,000, and the winning rate is expected to be better than Group A (about 1.5%-2.5%), suitable for high net worth investors.InvalidParameterValue

Referring to the 16.4% increase in Hong Kong stocks on the first day of Ningde Era and the technical premium of Sanhua Intelligent Control's A shares with a market value of 100 billion yuan, it is expected that the overpurchase multiple may exceed 80 times.InvalidParameterValue

The principal required for a tail is HKD 45.5W, the principal required for a head is HKD 56.8W, and the principal required for a head hammer is 2870W.

The difference between tail A and head B is not too much. If there are conditions, the upper group B will be filled 10 times.If there is more money, it will be distributed equally to Group A to increase the winning rate.

3. Risk warnings

In general, Sanhua is still worth fully purchasing, but the periphery has not been peaceful recently, so we need to be vigilant about risks.If the trend of Hong Kong stocks in the next few days is so bad that it affects market sentiment, you can only regret missing out.

There are still several risk points.

1. Performance growth slows down: Net profit growth will drop to 6.1% in 2024, mainly due to the surge in management expenses (+38.7% year-on-year) and the lengthening of accounts receivable turnover days to 91 days. Attention should be paid to the health of cash flow.InvalidParameterValue

2. Technology iteration risk: The popularity of solid-state batteries may weaken the value of existing liquid cooling solutions, while the bionic robot business has not yet generated large-scale revenue (accounting for less than 1% in 2024).

Recently, opening accounts for Hong Kong and U.S. stocks has become more and more stringent. If you want to open an account, hurry up.Hong Kong and U.S. stocks are new, communicate, please add the WeChat belowˇ