Haitian Flavor Industry has been priced out. This time, there is a gap between the first end and the second end. Stud is also difficult and requires leverage. TOP2 supports ten times zero interest rates, and the link and the subscription plan are placed at the end of the text.

Company profile & financial status. Brother notes has written it before. This article mainly talks about purchase plans and risk points.

Hong Kong stocks new| Reserve your bullets "Soy Sauce Moutai" Haitian Flavor Industry is here

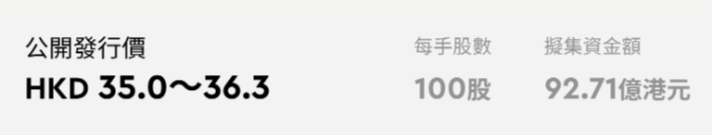

1. Issuing core information

The IPO price range of Haitian Flavor's Hong Kong stocks is HK$35 -36.3 per share, which is a discount of 20%-25% to the current price of A shares (41.72 yuan ≈ HK$48.46)-this discount is not more or less, and retail investors and institutions can get the meat.

Of course, Haitian's A-share market notes will continue to track Haitian's A-share market until next week's listing. As long as nothing unexpected happens, there is a high probability that this price will not break.

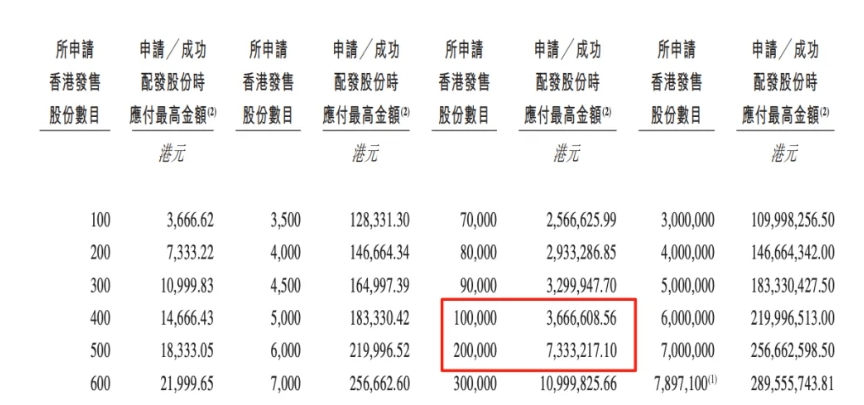

The admission fee is approximately HK$3,666.62 per lot (100 shares per lot), 263 million shares are sold globally, and the net amount raised is approximately HK$9.27 billion, which is used for research and development (20%), production capacity expansion (30%), globalization layout (20%) and channel upgrades (20%).

The admission fee was indeed not high, but if he did not dial back, it would be difficult to win the lottery.

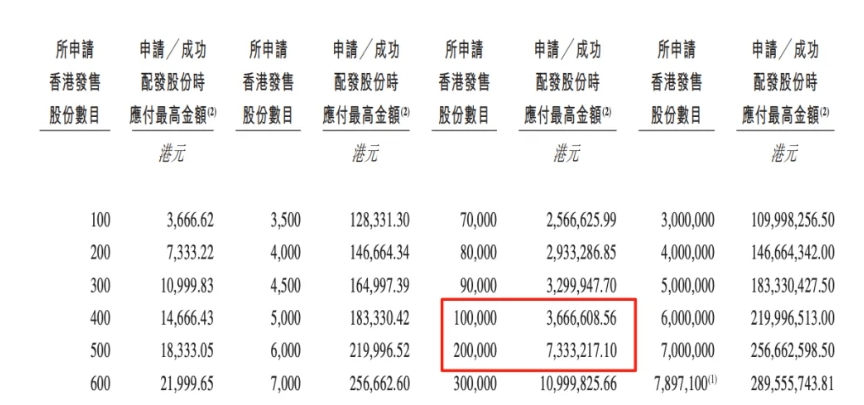

As long as a callback is triggered, it will be easy to handle.The largest proportion of public callbacks is 21%. In the end, Group A and B were 276,000 respectively. Considering Hengrui's 120,000 and Ningde's 40,000, Haitian's callbacks are still very good for retail investors.It is expected that the first-hand winning rate will be around 20%-30%.

The lineup of cornerstone investors is luxurious, including Hillhouse Capital, Singapore Government Investment Corporation (GIC), UBS Asset Management, etc., with a subscription ratio of 49.74%, locking in nearly HK$4.7 billion in chips, significantly reducing circulation selling pressure.

The threshold for Group B is a little exaggerated. This time, 3.6666 million yuan was added to the first end, and when it reached the second end, it directly rose to 7.3332 million, doubling.Based on the leverage of 10 times, the minimum threshold for entering Group B is also 730,000 principal, which is not conducive to small groups.However, the water level of 20% is really too tempting, and it is expected that many "people with Yuanyuan" will go to B to harvest rice.

The green shoe mechanism (15% over-allotment option) and the historical performance of co-sponsors CICC, Goldman Sachs and Morgan Stanley (Goldman Sachs broke rate of only 12%) provide dual protection for the stock price.InvalidParameterValue

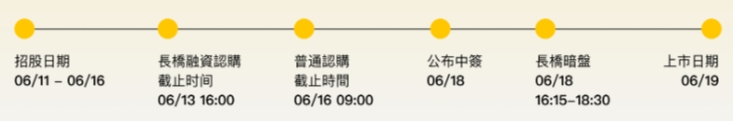

2. Issuance Schedule

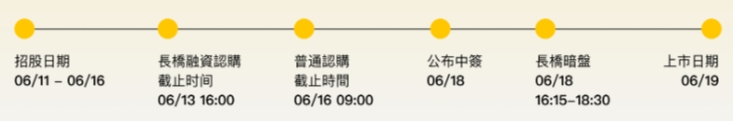

- Subscription window: June 11 to 16, 2025 (deadline next Monday morning)

Pricing date: June 12

Announcement date of the winning bid: June 18

- Dark trading: June 18 (16:15-18:30)

- Launch date: June 19

Funds unfreezing: Under the new FINI regulations, funds that have not been successfully signed will be unfrozen on T+2 days, increasing turnover efficiency by 60%.InvalidParameterValue

3. Calculation of winning rate and callback mechanism

If the public offering is overpurchased by more than 50 times, the callback ratio will increase from the initial 6% to 21%, and the distributable shares of retail investors will increase by 3.5 times:

- Group A (retail investors): It is estimated that the first-hand winning rate will be approximately 20%-30%, and more than 30 lots (approximately HK$110,000) need to be subscribed to increase the probability;

- Group B (large amount): The threshold for Group B is HK$7.33 million, and the winning rate is expected to be better than Group A (approximately 1.5%-2.5%), suitable for high net worth investors.InvalidParameterValue

Referring to the precedent of 143 times overpurchasing Hong Kong stocks in the Ningde era and Hengrui Pharmaceutical triggering a 50% callback, Haitian, as a leader in scarce consumption, is expected to exceed 80 times overpurchasing times.InvalidParameterValue

4. Risk warnings and hedging strategies

1. AH share linkage risk: If A shares correction significantly (such as falling more than 5%), it may compress the upside of Hong Kong stocks;

2. Policy risk: In 2027, the new regulations to ban the "zero-addition" logo may impact high-end product lines, and attention should be paid to the research and development progress of alternatives;

3. Liquidity trap: If the average daily turnover of Hong Kong stocks is less than HK$300 million, the valuation premium may shrink. It is recommended to give priority to withdrawing through dark trading.

V. Summary

Soy sauce Maohaitian flavor industry is finished just dry, and the problem of more meat and less meat.I hope everyone can hit it!

TOP2 has ten times leverage and zero interest. I don't know how to get on the bus.

Recently, opening accounts for Hong Kong and U.S. stocks has become more and more stringent. If you want to open an account, hurry up.Hong Kong and U.S. stocks are new, communicate, please add the WeChat belowˇ

If you think the article is not bad, you are welcome to like it and forward it. Your support is my biggest motivation!