IF Everyone has drunk coconut water, right?The parent company IFBH is also legendary. It is registered in Thailand and its production is completely outsourced. Coconut water is the best seller in China. The mainland market contributes 92.4% of its revenue, but none of the company's 46 employees is China.。。

Yes, the world's second-largest company has only 46 people. Last year, IFBH's average income per employee reached US$3.4271 million (approximately RMB 24.61 million), and the per capita profit also reached US$724,300 (approximately RMB 5.2 million).

Coconut water dries up and gives the feeling of a big Internet factory.。

1. Issuing core information and market positioning

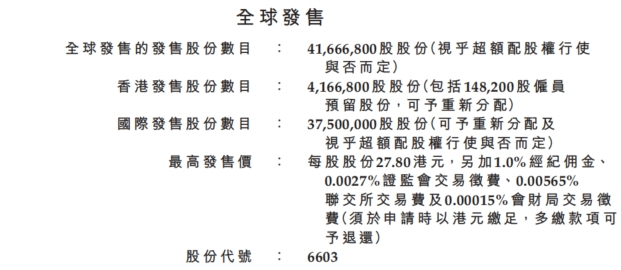

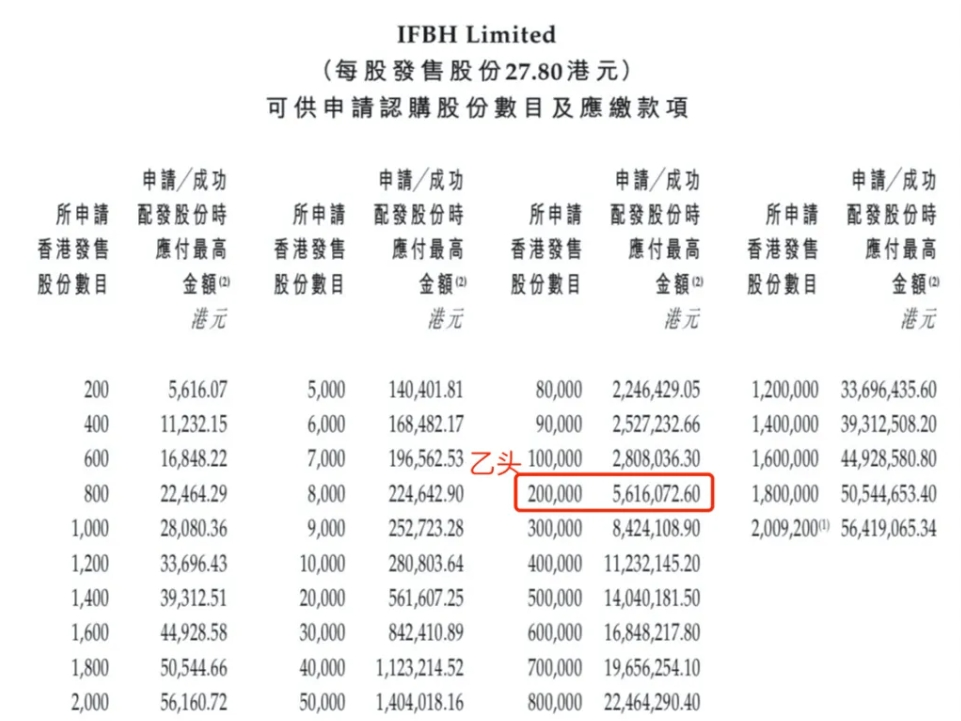

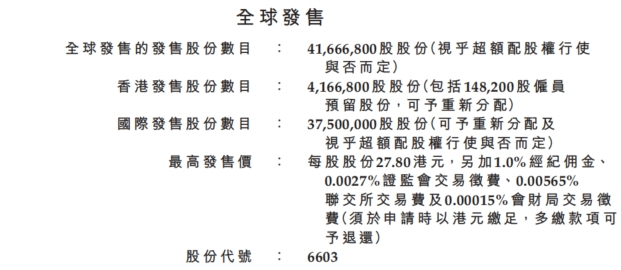

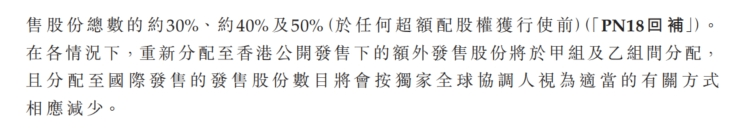

IFBH (its parent company is a Thai food and beverage company) is the world's second largest in the coconut water segment and the double champion in the mainland China and Hong Kong markets. The IPO price range of this Hong Kong stock is 25.3-27.8 Hong Kong dollars/share, and the admission fee is approximately 5,616.07 Hong Kong dollars/lot (200 shares per lot). 41.6668 million shares were sold globally, with a net raise of approximately 1.024 billion Hong Kong dollars, and a valuation of approximately 6.747 - 7.413 billion Hong Kong dollars.

Core highlights include:

- Market position: China's mainland market share is 34%(first for five consecutive years), Hong Kong's market share is 60%(first for nine consecutive years), and its global share is second only to Vita Coco of the United States (7.5%).InvalidParameterValue

- Asset-light model: Only 46 employees (per capita profit is 5.26 million yuan), production and logistics are fully outsourced, focusing on brand operations and distribution networks.InvalidParameterValue

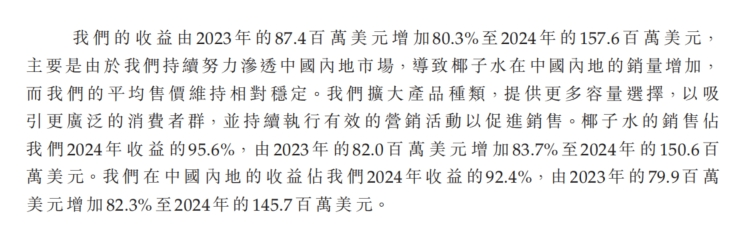

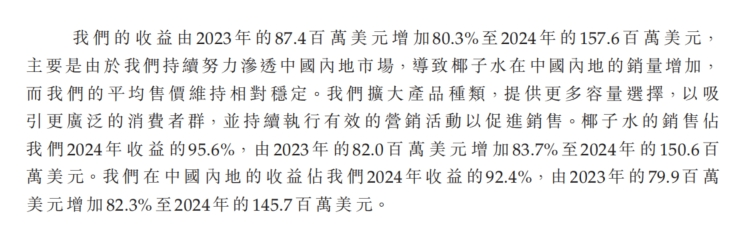

- High-growth performance: 2024 revenue of US$158 million (year-on-year +80.3%), net profit of US$33.31 million (year-on-year +98.9%), gross profit margin of 36.7%, and net profit margin of 21.1%.InvalidParameterValue

- Fundraising purposes: 30% is used for warehouse allocation capacity building, 22% is used for brand promotion, 13% is used to expand overseas markets (Australia, America, Southeast Asia), and 20% is used for mergers and acquisitions.InvalidParameterValue

2. Subscription schedule and capital efficiency

- Subscription window: June 20 - 25, 2025 (deadline at noon on June 25)

- Pricing date: June 26

- Dark trading: June 29 (16:15-18:30)

- Launch date: June 30

- Funds unfreezing: Funds that have not been successfully signed under FINI's new regulations will be unfrozen on T+2 days, improving turnover efficiency.InvalidParameterValue

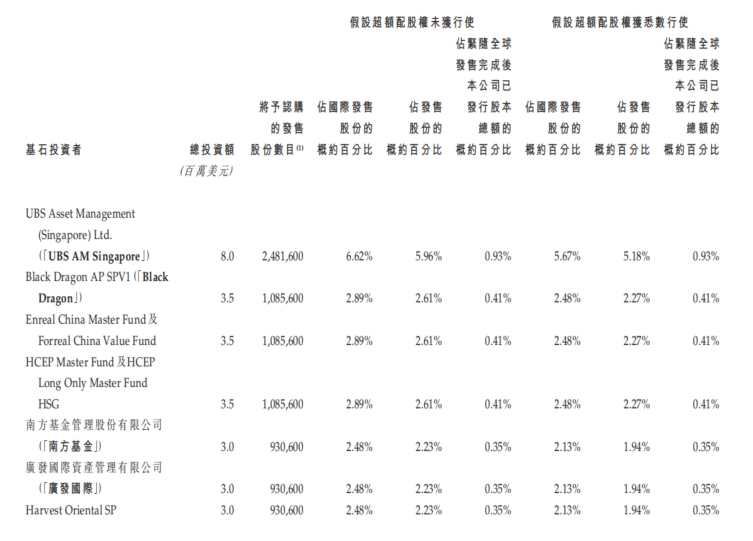

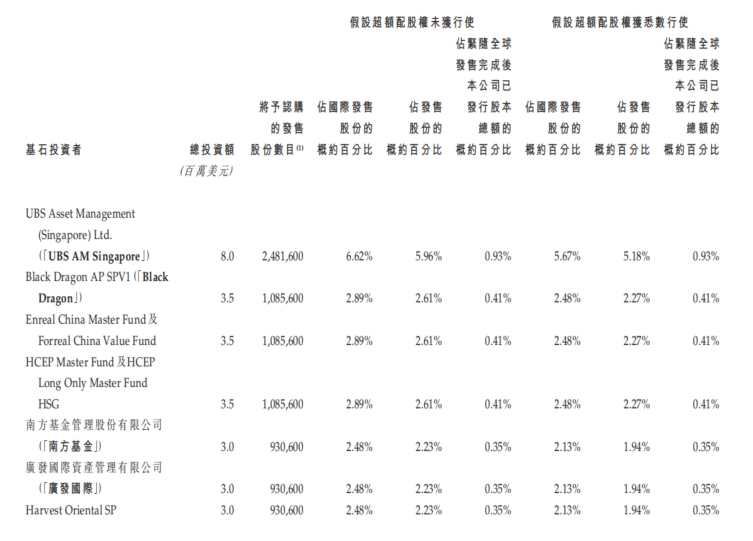

Cornerstone: IFBH introduced 11 cornerstone investors to subscribe for a total of HK$310 million (based on the median offering price of HK$26.5), accounting for approximately 28.07% of the global offering shares (The cornerstone lineup is luxurious, with a combination of overseas institutions and domestic institutions, especially the cornerstone of UBS, which has never been defeated in history!)

Sponsor: CITIC

Green Shoes: Yes, CITIC Lyon has maintained its price unbeaten since 2024.

3. Calculation of winning rate and callback mechanism

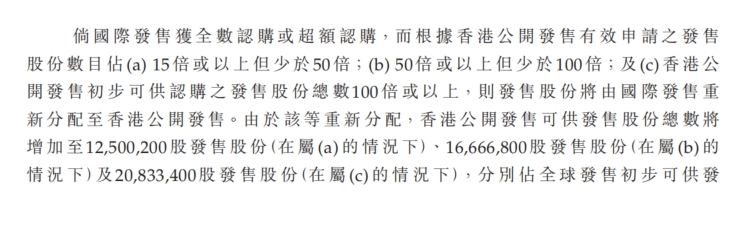

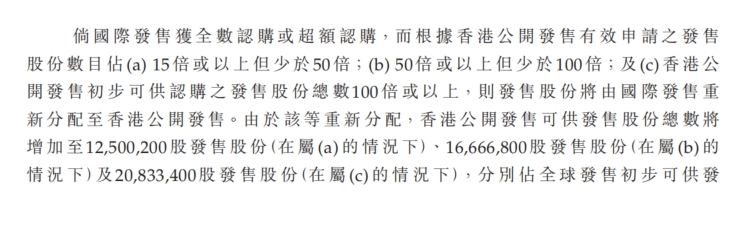

- Initial allocation: 10% for public offering (4.1668 million shares) and 90% for international placement.

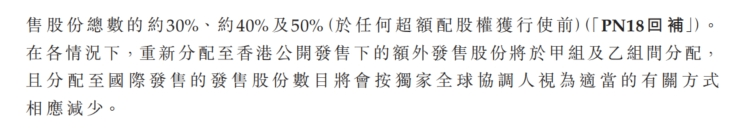

Callback rules:

- Overpurchased ≥15 times: Callback to 30%;

- Overpurchased ≥50 times: Callback to 40%;

- Overpurchased ≥100 times: Callback to 50%.

- IFBH now has a margin of 100 times, and in the end, there is a high probability that it will be overpurchased by 1000 times and will be called back to 50% of the public offering. Group A and B each have 520.83 million lots. Based on the subscription of 200,000 people, it is estimated that the winning rate of one hand will be 10%, and the subscription of 200 lots will be stable.

What is a bit problematic is the threshold.According to the 10 times leverage, the first tail is 28W and the second head is 56W, which is exactly twice the same.

If you have a small partner who does not have time to apply for a Hong Kong card and has leverage needs, you can choose to open an Internet brokerage account to deposit funds, such as Wealth Broker. The procedures are simple and the review is fast. Opening an account can be completed online in ten minutes.Each new stock is equipped with a Lighthouse Research Report, which is convenient for new partners to conduct analysis and research.Wealth Broker provides cash subscription and financing subscription methods.Financing subscriptions can provide leverage of up to 10 times (the specific multiple depends on the new shares).

4. Develop new plans

The core logic of IFBH's Hong Kong stock market is the triple driving force of "segmentation of leaders + high growth + CITIC sponsorship".Its operating efficiency under the asset-light model (per capita profit of 5.26 million yuan) and the high prosperity of the health drink track (CAGR of 19.4% in China's coconut water market) provide short-term hype, but supply chain fragility and product unity may become long-term valuation ceilings.

You can play a small trick, but you need to be vigilant about the recent external instability & Haitian Sanhua breaks successively, which dampens the enthusiasm for purchasing.We also need to be vigilant about the capital diversion effect of new shares (Ruyun Zhisheng and Taide Pharmaceutical) during the same period.Priority should be given to participating in dark arbitrage, and long-term holdings should pay attention to the diversification of the supply chain and the progress of increasing the volume of new products.

Risk Warning

1. Supply chain risks: 100% of raw materials rely on Thai coconut. Costs will increase by 70% due to drought in 2024. If extreme weather continues, profits will be squeezed.InvalidParameterValue

2. Channel concentration: The top two major distributors contribute 94.6% of revenue. If cooperation is terminated or commissions increase, traffic will be lost.InvalidParameterValue

3. Product unity: 95.6% of revenue comes from coconut water, and new products (such as plant-based snacks) contribute less than 0.3%, facing the impact of low-priced competitive products (such as box horse 9.9 yuan/liter).InvalidParameterValue

4. Gambling agreement: If it is not listed before 2026, it will need to repurchase shares at an annualized rate of 12%(approximately US$23 million).InvalidParameterValue