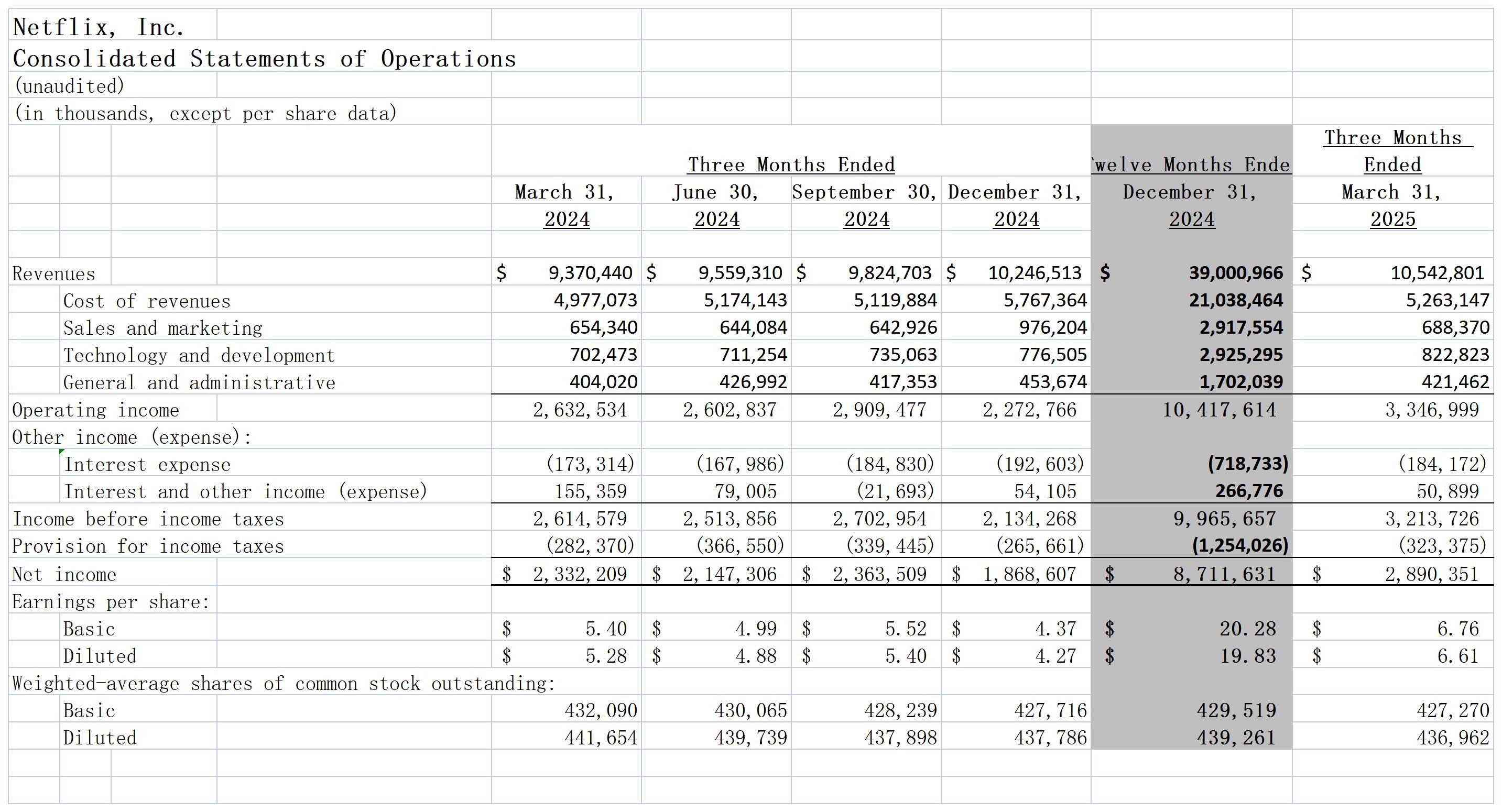

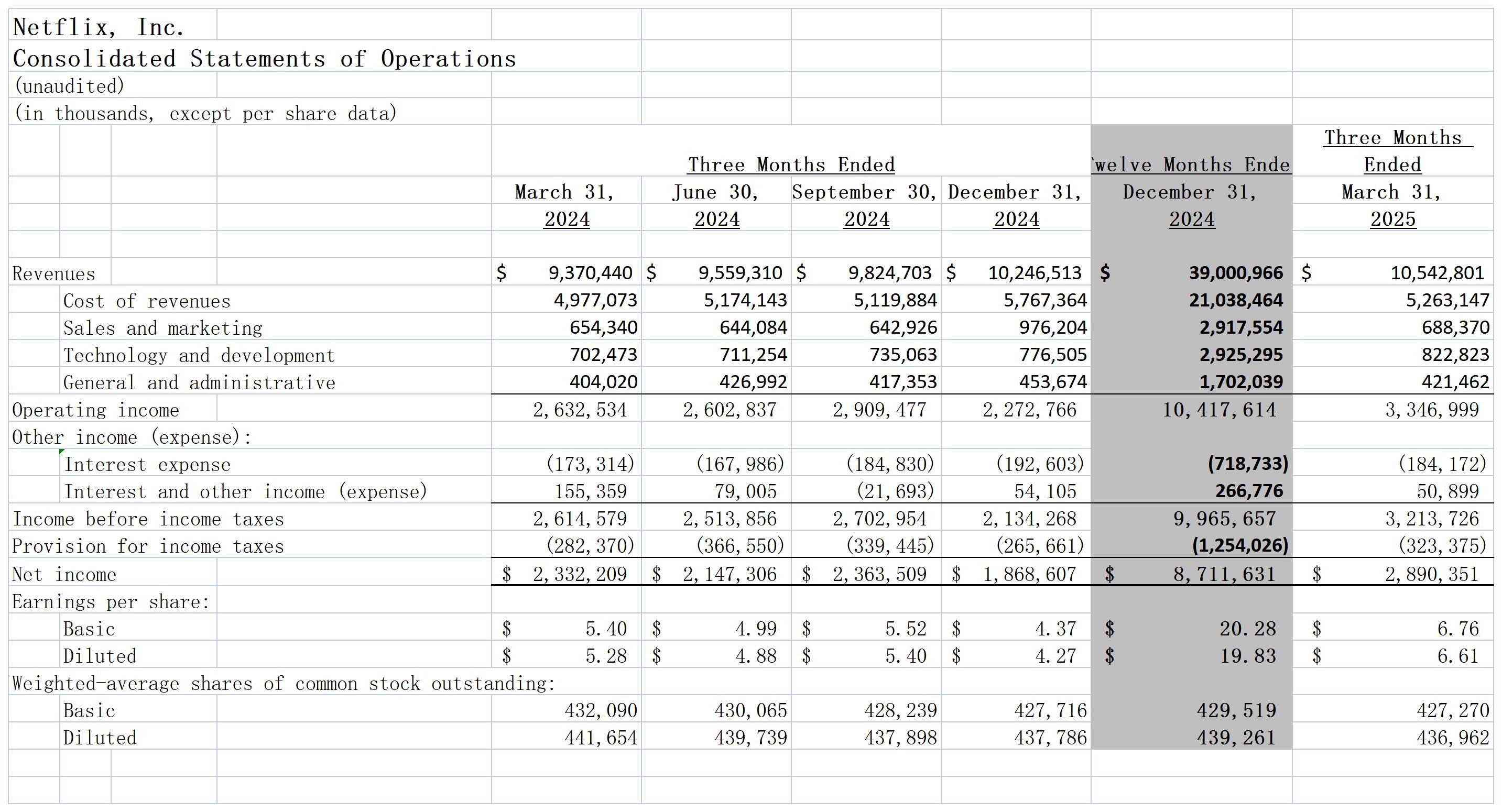

Net income surged 24% year-on-year to $2.9 billion, and earnings per share were $6.61, significantly higher than analysts 'expectations of $5.68.

On April 18, Netflix delivered a quarterly report card that surprised the market.Against the background of macroeconomic fluctuations and intensified industry competition, the streaming media giant has achieved comprehensive exceeding expectations in revenue, profits and free cash flow through member price increases, increased advertising business volume and global layout.After the financial report was released, its share price soared nearly 5% after hours, and its market value approached US$400 billion, making it a rare defensive target among technology stocks.

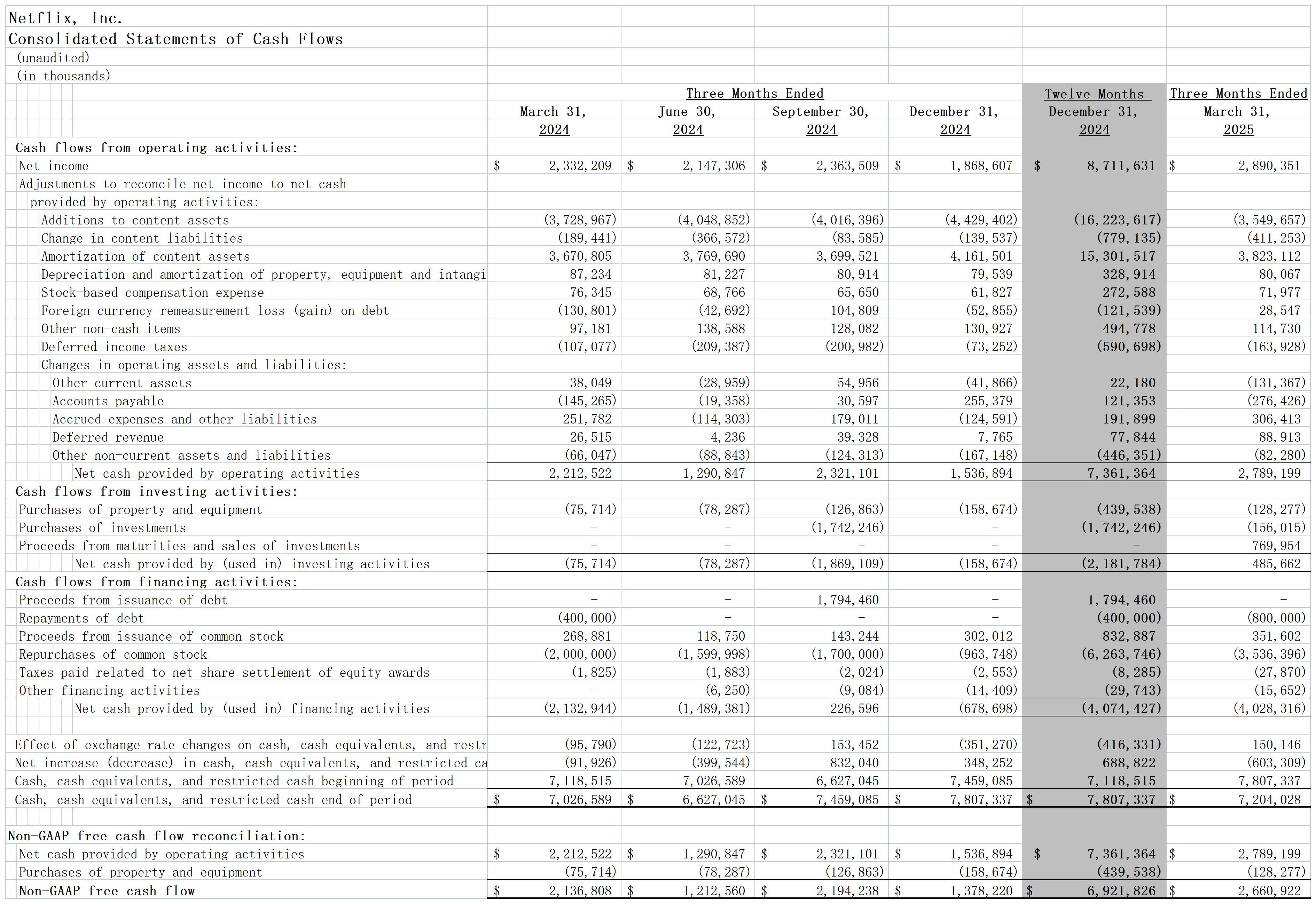

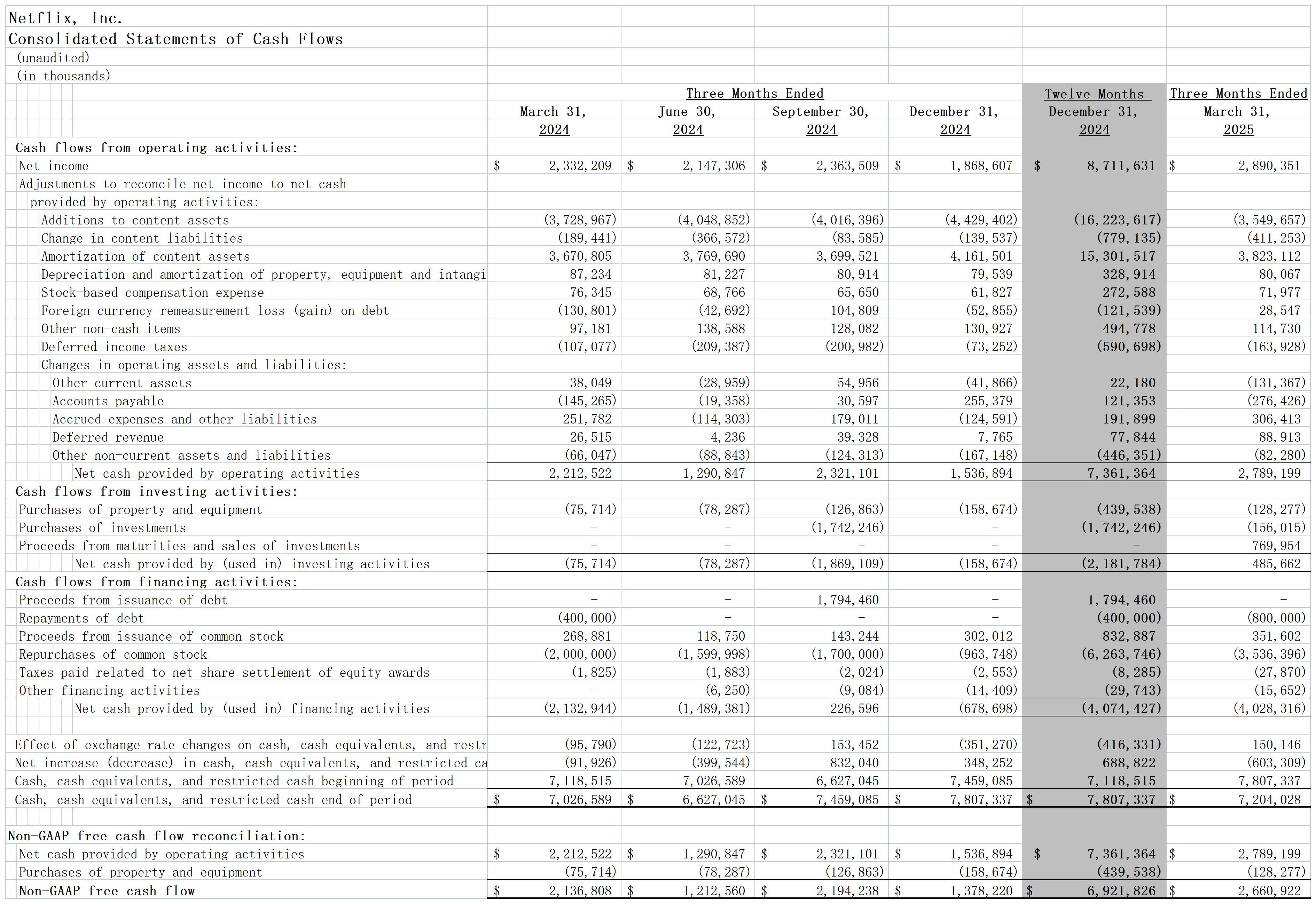

In terms of core financial indicators, Netflix's revenue in the first quarter was US$10.54 billion, a year-on-year increase of 12.5%, exceeding market expectations of US$10.5 billion.Net income surged 24% year-on-year to $2.9 billion, and earnings per share were $6.61, significantly higher than analysts 'expectations of $5.68.It is worth noting that its operating profit margin climbed to 31.7%, an increase of 360 basis points from the same period last year, and free cash flow increased by 25% month-on-month to US$2.7 billion, demonstrating strong earnings quality and capital operation efficiency.

This performance is due to multiple structural factors: although user growth in the North American market has slowed down due to price increases, the increase in customer unit prices has offset the total pressure; the Asia-Pacific region has become the growth engine with a year-on-year growth rate of 23%, especially in markets with high broadband penetration such as India and Japan, subscriptions continue to rise.InvalidParameterValue

Deepening the price increase strategy was Netflix's key tactic this quarter.

Since cracking down on account sharing in 2023, the company has gradually increased the prices of all packages in the United States and announced plans to increase prices in France this quarter.Currently, its ad-support plan ($7.99/month) accounts for 55% of new user registrations, while the Premium plan ($24.99/month) targets high-net-worth customers through differentiated services.

This strategy not only drives average user revenue (ARM) growth, but also optimizes user structure through tiered pricing.Analysts at Morgan Stanley pointed out that Netflix's pricing power is scarce in the streaming industry, and its service cost is only equivalent to one-fifth of the ticket price of an IMAX movie, making it more resilient during the economic downturn.

The explosive growth of the advertising business is another fulcrum for Netflix to break through the growth ceiling.

The company expects advertising sales to double in 2025 and plans to increase advertising revenue to $9 billion by 2030.Currently, its advertising technology platform has been deployed in Canada and the United States, and plans to expand to 10 other markets within the year.The appeal of the advertising support package is that its monthly fee is 30%-40% lower than that of traditional non-ad-free packages. However, through precise delivery and high user stickiness (average daily viewing time exceeds 3 hours), Netflix's single-user advertising revenue is close to traditional linear TV level.It is worth noting that the gross profit margin of the advertising business is as high as 70%-80%, which is much higher than that of the subscription business, which will continue to improve the overall profit structure.

The advancement of the globalization strategy has further consolidated Netflix's industry position.

In the first quarter, revenue in the Asia-Pacific region increased by 23% year-on-year, making it the fastest-growing region.Netflix has quickly gained customers in emerging markets such as India and Southeast Asia through a combination of localized content (such as the Korean drama series "Adolescence" and Japanese anime adaptations) and low-cost packages.At the same time, revenue in the Europe, Middle East and Africa (EMEA) market increased by 15%, and the Latin American market also remained stable.This diversified layout not only reduces dependence on mature markets in North America, but also dilutes content costs through economies of scale-Netflix's content investment budget will reach US$18 billion in 2025, a record high, covering the seventh season of "Black Mirror" and other top IP.InvalidParameterValue

Leadership changes and strategic focus are also worthy of attention.Co-founder Reed Hastings officially stepped down as executive chairman and transferred to non-executive director, marking the company's transition from entrepreneurial governance to a professional manager system.At the same time, Netflix announced that it would no longer disclose the number of subscribers regularly, but instead emphasized financial indicators and user engagement.The logic behind this decision is that when the user base exceeds 300 million, the monetization efficiency of existing users is more strategic than incremental expansion.Analysts at Bank of America pointed out that Netflix's core goals in the next five years are to increase operating profit from US$10 billion to US$30 billion and build an "entertainment super platform" through new formats such as advertising, games, and live streaming.InvalidParameterValue

Despite the optimistic outlook, Netflix still needs to address multiple challenges.The first is the continuous rise in content costs-its content spending in 2025 will increase by US$1 billion compared with 2024, but the success rate of popular content still needs to be improved; secondly, the scale problem of the advertising business. Currently, advertising revenue only accounts for total revenue. About 5%, to achieve the US$9 billion target, we need to continue to invest in advertising technology, data mining and partner ecosystem.In addition, geopolitical risks cannot be ignored: although the Trump administration's recent escalation of tariffs on China has not directly affected Netflix, if it triggers a global recession, it may lead to a contraction in advertisers 'budgets and a downgrade of users' consumption.InvalidParameterValue

Judging from feedback from the capital market, Netflix's current valuation implies a high recognition of its long-term growth potential.Although its dynamic P/E ratio has reached 35 times, higher than the industry average, most institutions still raise their target prices.TD Cowen gave a "buy" rating with a target price of US$1150, believing that Netflix's moat in the streaming media industry (content library size, algorithm recommendations, global distribution) is difficult to subvert.However, the GF Value model shows that its current share price is 35% overvalued compared to its fair value, indicating short-term correction risks.InvalidParameterValue