What happened behind the scenes, Hawk Insight brings you a piece.

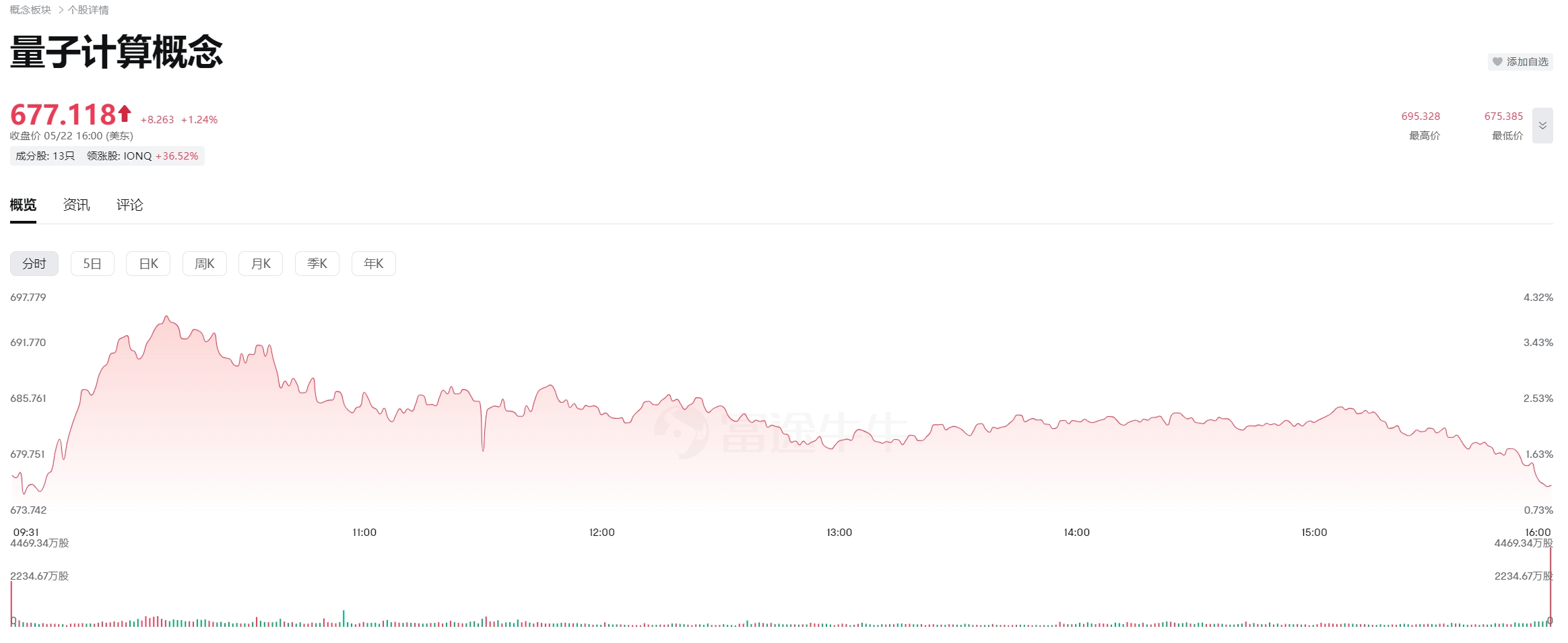

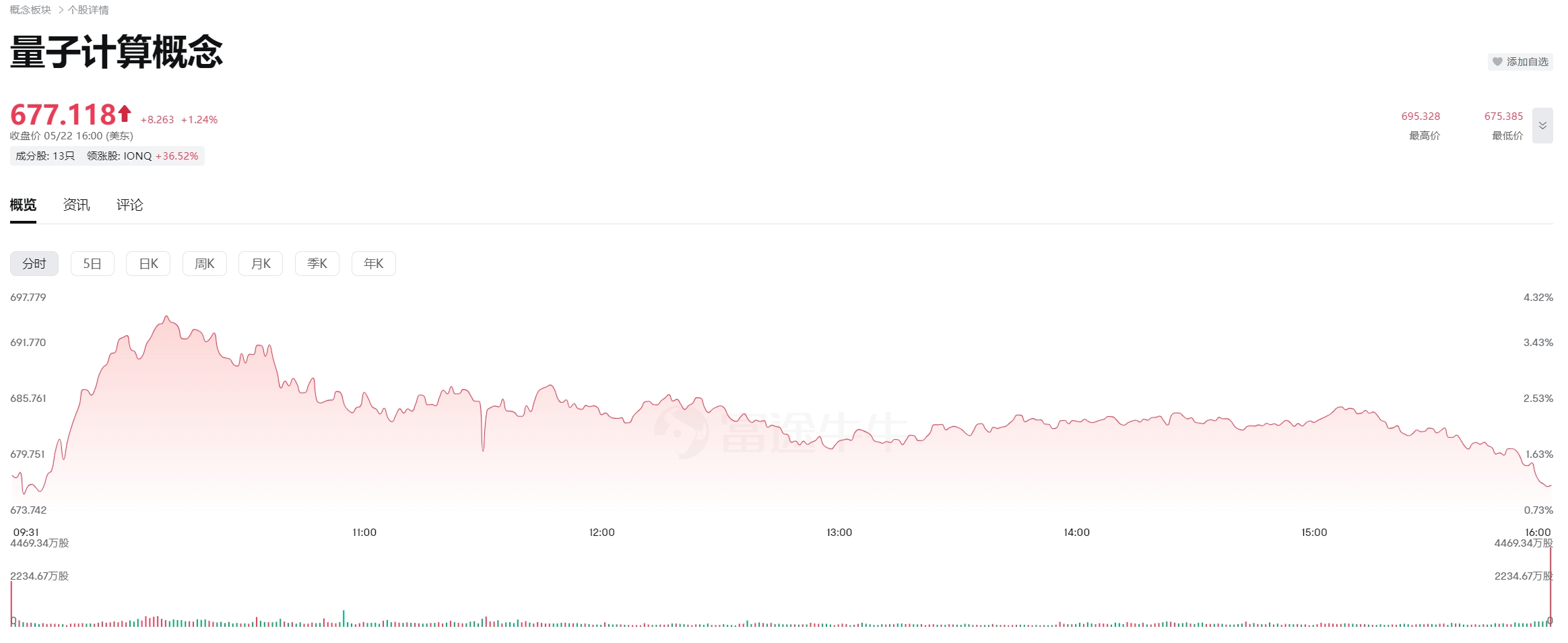

On May 23, the U.S. stock quantum computing sector ushered in a collective explosion. Leading stock IonQ rose nearly 37% in a single day. The stock prices of D-Wave Quantum, Rigetti Computing, Quantum Computing and other companies all rose more than 20%. Both market turnover and market value climbed.

What happened behind the scenes, Hawk Insight brings you a piece.

First, technological breakthroughs have become the direct trigger that ignites market sentiment.

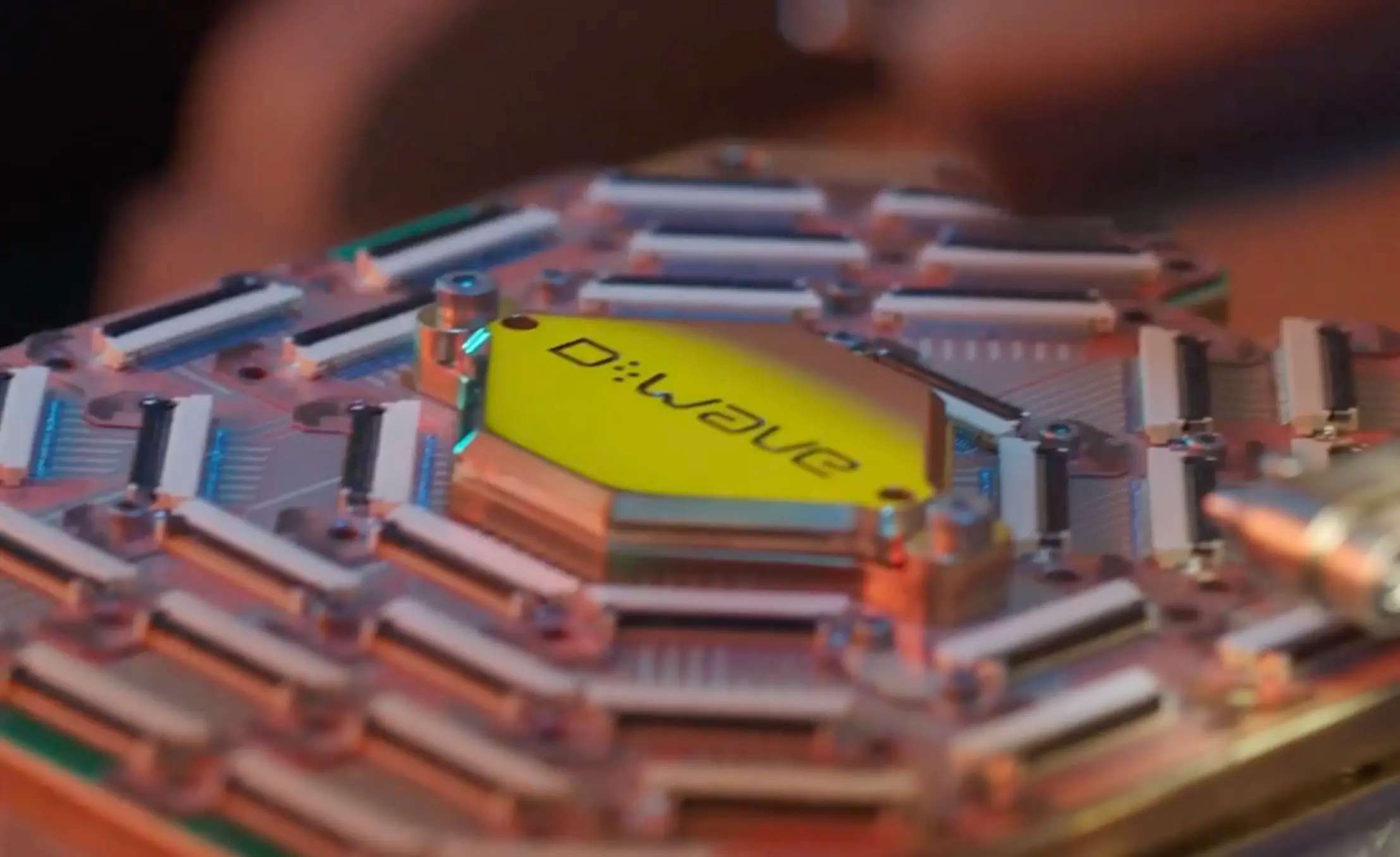

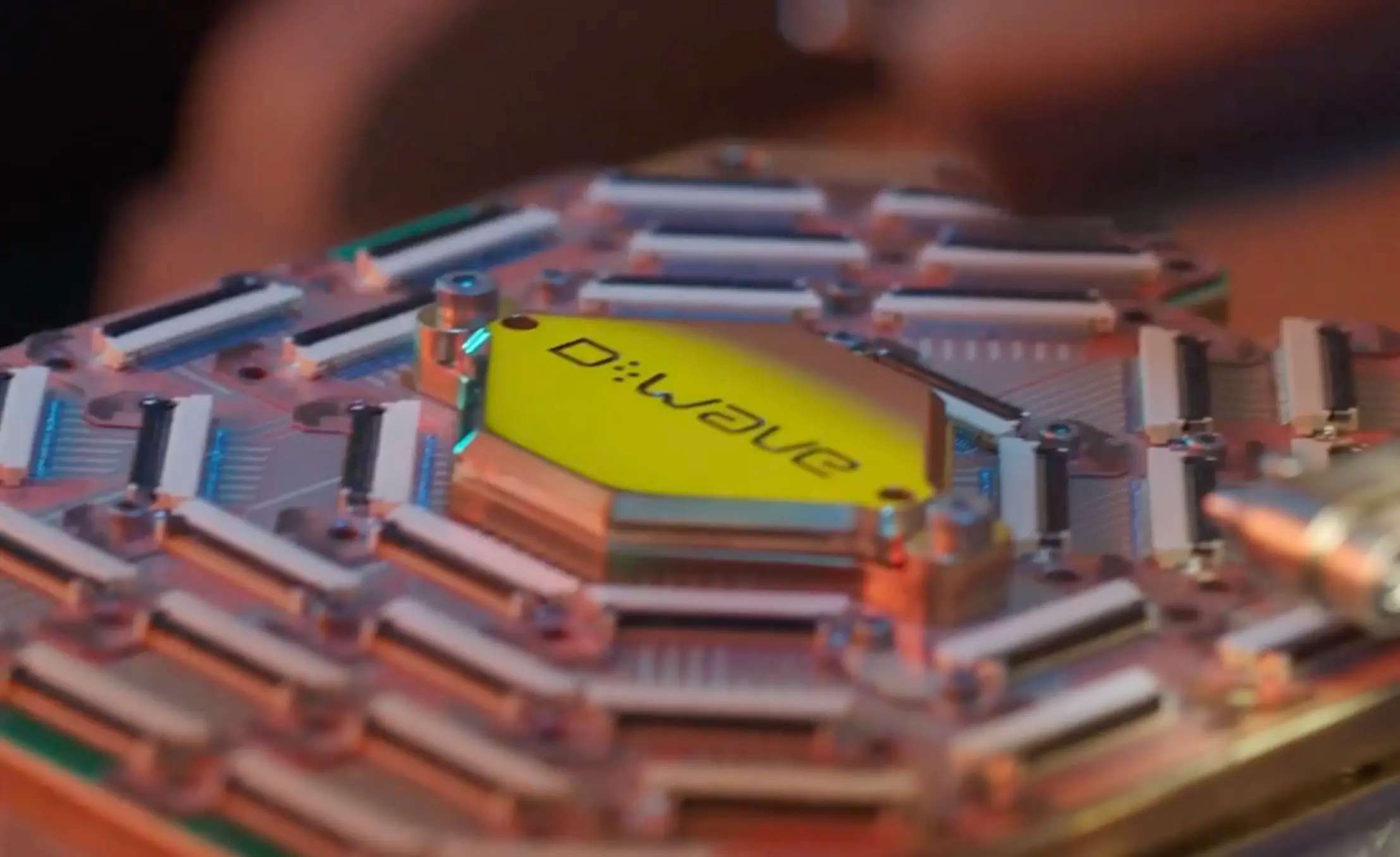

D-Wave Quantum released the sixth-generation quantum computer Advantage2 on May 20. Its quantum processor adopts Zephy topology, which increases the connection capacity between quantum bits to 20 channels, reduces system noise by 75%, improves energy efficiency by 40%, and supports real-time access through Leap Quantum Cloud Services.The company claims that the device demonstrates far superior performance in complex tasks such as material simulation-for example, it takes only 20 minutes to complete a magnetic material simulation, while traditional supercomputing takes millions of years.

Although there is controversy in the academic community about the expression of "quantum hegemony", the market is more concerned about its commercialization potential: Advantage2 has covered customers in more than 40 countries around the world, and has achieved initial applications in fields such as logistics optimization and AI training.At the same time, IonQ relies on its ion trap technology route to emphasize the stability advantages of its qubits in room temperature environments, claims to have achieved a record performance of 79 qubits, and plans to launch a modular quantum computer to further reduce the threshold for use.

Rigetti Computing announced its progress in research and development of its 36-qubit system, aiming to exceed 100 qubits by the end of 2025, and received US$5.4 million from the U.S. military to develop new annealed chips.These technical iterations send a clear signal: quantum computing is moving from theoretical verification to practical scenarios.

Second, the strategic layout of industry giants has injected a boost into the market.

Nvidia announced that it will set up a "Quantum Day" at the 2025 GTC conference to discuss quantum-classical hybrid computing architecture. Although its CEO Huang Renxun is conservative about the practical timetable, this action is regarded as a landmark event for the integration of quantum computing and AI.

Microsoft has launched the "Year of Quantum Readiness" program, joining forces with enterprises to develop hybrid applications and strengthen the security ecosystem in an attempt to build software standards for the quantum era.The entry of technology giants not only brings expectations of technological synergy, but also accelerates industry maturity through ecological chain integration-for example, IonQ has reached cloud service cooperation with Amazon and Microsoft, and D-Wave has received support from NEC, Goldman Sachs and other institutions.This pattern of "giants setting the stage and start-ups singing the opera" allows investors to see the possibility of quantum computing integrating into the mainstream technology paradigm.

Third, policy dividends and capital inflows constitute underlying support.

The JPMorgan Chase report pointed out that global public investment in quantum computing is expected to reach US$45 billion in 2025. If the US National Quantum Initiative Reauthorization Act is passed, it will further release government funds.China has also made quantum technology a strategic focus in the "14th Five-Year Plan", and basic research spending has increased by more than 10%.In the capital market, the SPAC model has become the mainstream path for quantum companies to go public: IonQ has a combined valuation of US$2 billion through SPAC, and D-Wave and Rigetti have also used this to land on the New York Stock Exchange and Nasdaq, raising a total of more than US$1 billion.

Venture capital is not willing to lag behind. Bill Gates 'funds, Samsung, Hyundai and other industries have made intensive bets, and IonQ alone has received US$734 million in financing.The dual support of policy and capital has significantly improved the industry's survival rate across the "Death Valley".

Under the resonance of the triple positive factors, the financial expectations and business model valuation of the quantum computing concept have ushered in reshaping-IonQ's first-quarter revenue of US$7.6 million exceeded expectations, and its full-year guidance was raised to US$75 million to US$95 million. Although it is not yet profitable, its dual-engine model of hardware sales and cloud subscriptions has begun to take shape.D-Wave uses Leap cloud services to expand customers into materials, finance and other fields, while Rigetti focuses on government and defense orders, and the path of differentiation is gradually clear.

It is worth noting that the valuations of these companies are not based on short-term profits, but anchor long-term market space-BCG predicts that the quantum application market will reach US$50 billion in 2030 and exceed US$850 billion in 2040.Driven by this "market dream rate", even if IonQ's financial model with revenue of US$522 million and gross profit margin of 85% in 2026 is still radical, capital is willing to pay for the option value of disruptive technologies.

However, behind the carnival, we need to be vigilant about the technological divide and market bubble.Quantum computing still faces core challenges such as qubit stability, error correction capabilities, and algorithm adaptation. Industry leaders such as Meta CEO Zuckerberg believe that it will still take more than ten years for practical use.At the commercial level, existing applications are mostly limited to optimization and simulation scenarios, and there is still a way to go before large-scale commercialization.Market volatility cannot be ignored either: although D-Wave claims to achieve "quantum hegemony," academic circles question the deviation of its comparative experiments.The market needs to be aware that the current market reflects more expectations than reality. Competition in technology routes (such as superconducting VS ion traps) may lead to industry reshuffle, and changes in policy support may become triggers for valuation adjustments.

I wish you all a smooth investment ~