EUR/USD Edges 0.20% Lower as Dollar Strengthens Amid Trade Uncertainty and Easing Signals from ECB EUR/USD Edges 0.20% Lower as Dollar Strengthens Amid Trade Uncertainty and Easing Signals from ECB

Key Moments:EUR/USD slipped near 1.1390 during Tuesdays North American session as the Dollar stabilized.ECB policymakers Rehn and Villeroy supported additional interest rate cuts to combat weak inflat

Key Moments:

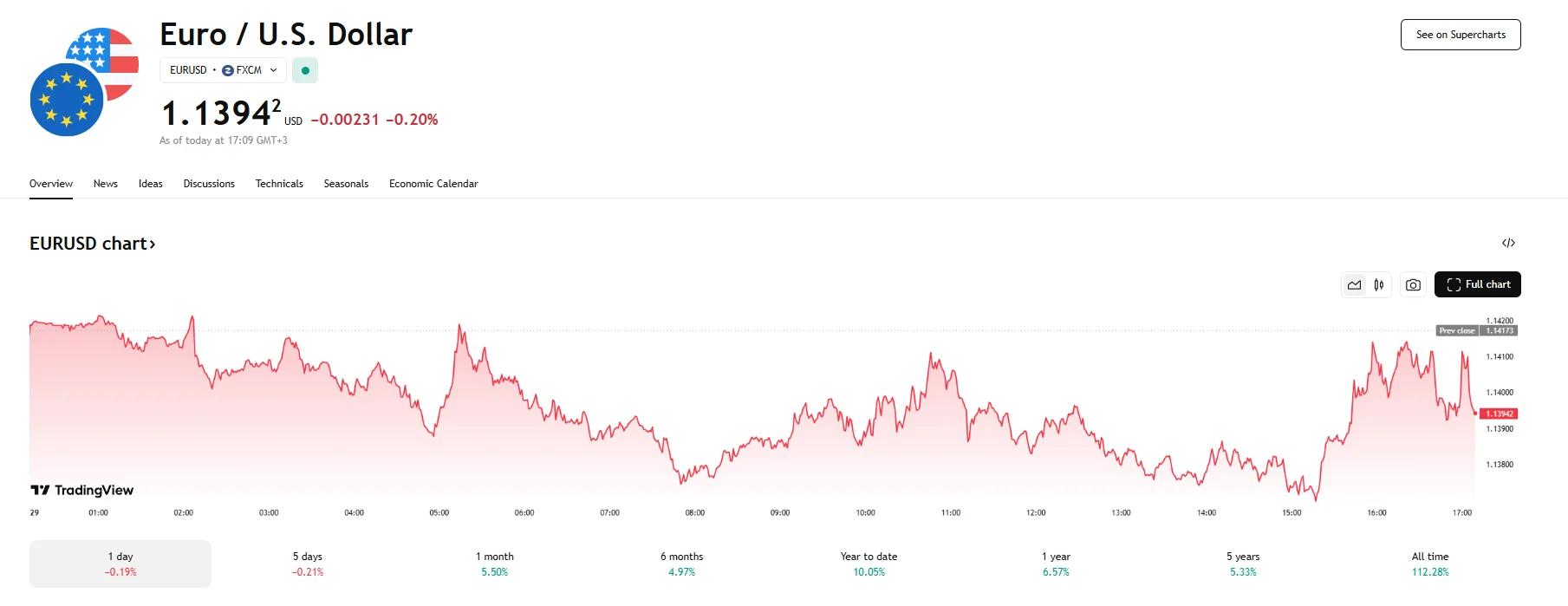

- EUR/USD slipped near 1.1390 during Tuesday’s North American session as the Dollar stabilized.

- ECB policymakers Rehn and Villeroy supported additional interest rate cuts to combat weak inflation potential.

- Spain’s Q1 GDP data missed forecasts, with inflation reaching 0.6% against expectations of 0.7%.

Euro Pressured by ECB Dovish Tone

The euro declined slightly against the dollar on Tuesday, with EUR/USD slipping 0.20% to hit 1.1394. This rate movement occurred as investors digested dovish remarks from key European Central Bank (ECB) officials who reinforced the case for additional monetary policy easing.

Olli Rehn, Governor of the Finnish central bank and ECB policymaker, highlighted risks to Eurozone inflation, stating due to external headwinds like US tariffs, they could fall short of the bank’s 2% target. According to a Reuters report, he recently argued in favour of approaching all available options “with an open mind and not a priori rule out rate cuts below the neutral rate.” Similarly, Bank of France Governor François Villeroy de Galhau indicated during an RTL Radio interview that the central bank still has room to lower interest rates. He also expressed confidence that inflation would eventually return to its 2% goal.

Spanish Inflation Data Milder Than Forecasts

Adding to euro weakness, Spain reported softer-than-expected GDP growth in the first quarter. Prices expanded by 0.6% between January and March, below the consensus forecast of 0.7%. The figure also dropped below Q4 2024’s 0.8%. In addition, April saw the Harmonized Index of Consumer Prices (HICP) in Spain climb 2.2% YoY.

Dollar Finds Footing Amid Trade Concerns

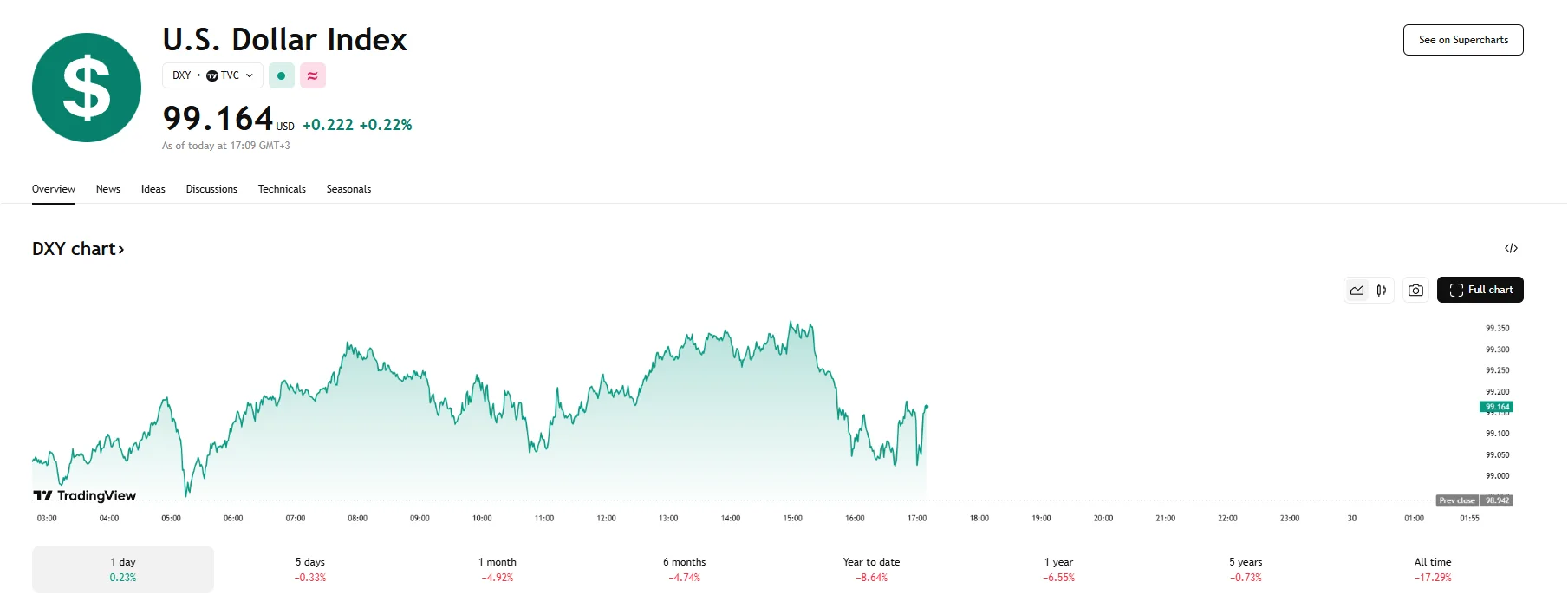

The US dollar regained some strength despite prevailing uncertainties surrounding the US-China trade relations. The US Dollar Index (DXY), which measures the greenback’s performance against a basket of six major currencies, rose to 99.164.

Contradictory signals from Washington and Beijing continued to stoke investor uncertainty. President Trump claimed multiple conversations with Chinese President Xi Jinping regarding the trade standoff, while China’s Foreign Ministry denied any such communications. Moreoever, Monday saw US Treasury Secretary Scott Bessent place the responsibility for progress in trade talks squarely on China’s shoulders.

EUR/USD Maintains Bullish Bias Above 20-Week EMA

Despite the latest pullback, the broader EUR/USD trend remains constructive. The pair continues to trade above its rising 20-week Exponential Moving Average (EMA), which currently sits at 1.0890.

In addition, the 14-week Relative Strength Index (RSI) has entered overbought territory, crossing the 70.00 threshold. This may reflect strong bullish momentum, though it may also suggest the potential for near-term consolidation or correction.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.