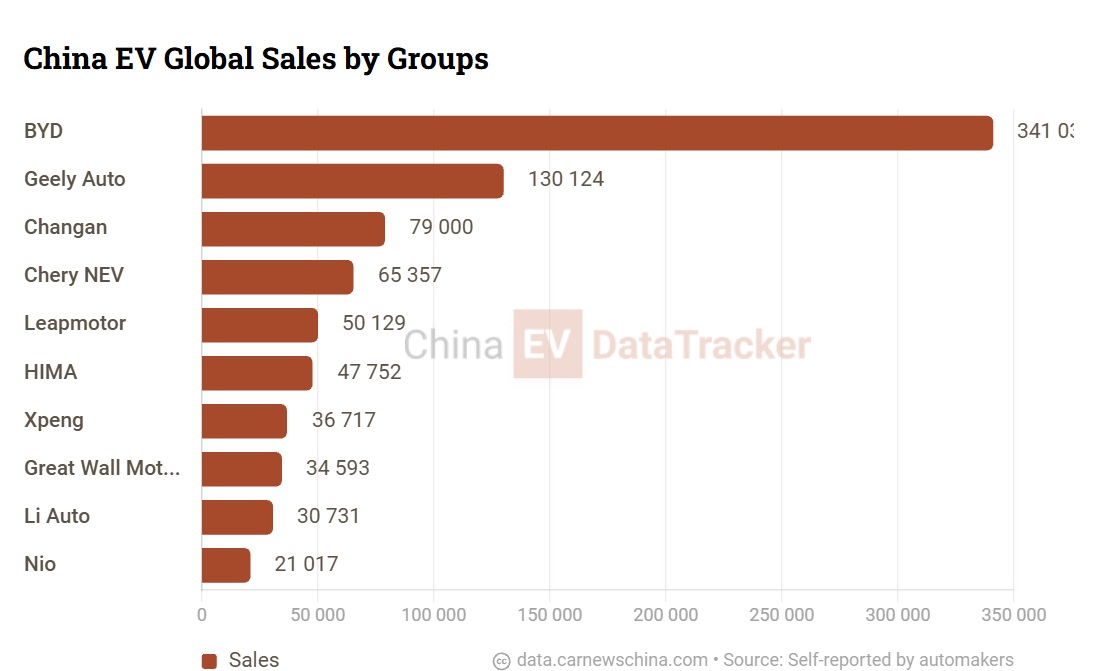

China EV global sales in July: Nio 21,017, HIMA 47,752, Geely 130,124, BYD 341,030

Nio Group was up 2.5%, Huawei's HIMA alliance was up 8.3%, Geely was up 120.4% and BYD was nearly flat with 0.1% growth.

In July, China automakers’ EV sales were mostly up. Nio Group was up 2.5%, Huawei’s HIMA alliance was up 8.3%, Geely was up 120.4% and BYD was nearly flat with 0.1% growth compared with the same month last year.

Xiaomi do not report their exact numbers, just mentioned that the company sold over 30,000 EVs. In June, it was over 25,000. Tesla China also doesn’t share its numbers, but in the first four weeks of July, it registered 37,830 EVs, meaning the China sales will be around 41,000. The Tesla China export will be revealed later this month by CPCA.

The sales represent passenger vehicle (PV) sales of new energy vehicles (NEV) of Chinese automaker groups globally for July. NEV is a Chinese term for all-electric vehicles and plug-in hybrids. At the bottom of the article, the breakdown of group sales to particular brands is available. Some automakers didn’t publish their results at the time of publication (SAIC, for example) and will be updated later.

China EV sales in July by Group

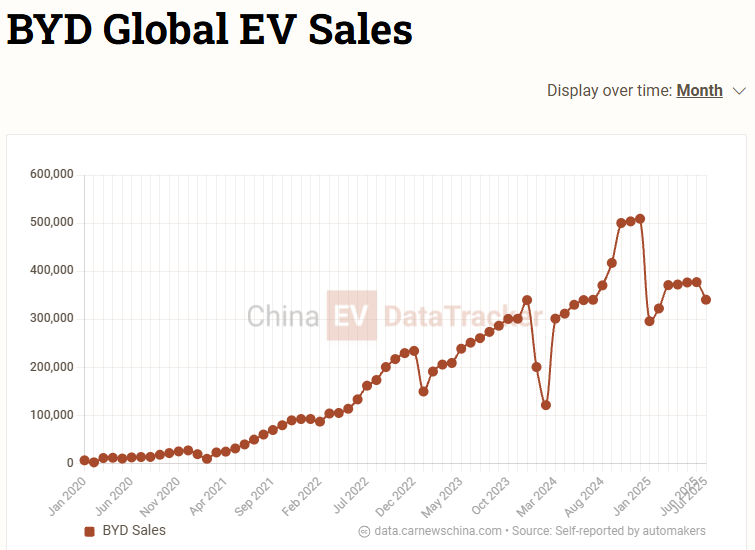

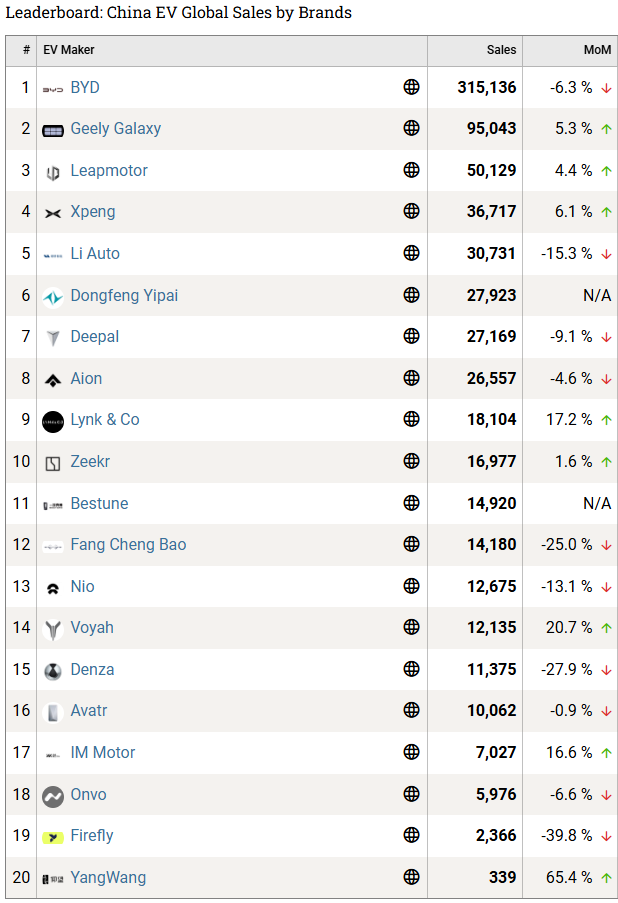

BYD sold 341,030 vehicles, down 9.7% from June and up 0.1% from the same month last year.

In 2025 so far (January – July), BYD sold 2,458,914 passenger vehicles, up 26.2% from the same period last year.

The automaker has a sales target of 5.5 million vehicles for 2025.

Geely sold 130,124 vehicles, up 6.3% from June and up 120.4% from the same month last year.

In the first seven months of 2025 (January – July), Geely Auto sold 855,275 vehicles, up 125.5% year-on-year.

Geely sales include Geely-badged cars, Galaxy series, Zeekr and Lynk & Co brands, which Geely merged under the Zeekr umbrella in November 2024.

Chery NEV sold 65,357 vehicles, down 8.7% from June. In 2025 so far, Chery NEV has sold 424,817 vehicles.

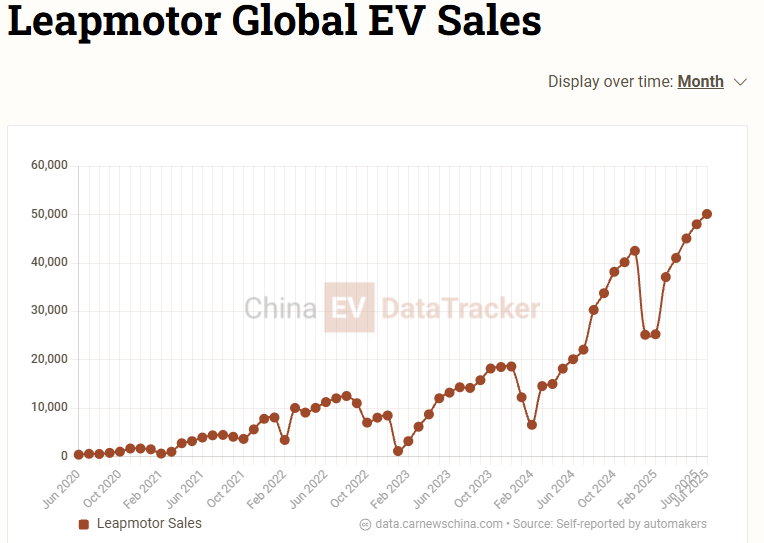

Steallantis-based Leapmotor sold record-breaking 50,129 vehicles, up 4.4% from June and up 126.9% from the same month last year.

In the first seven months of the year (January – July), Leapmotor sold 271,793 vehicles, up 149.8% year-on-year.

For Leapmotor, this is the first time it has surpassed 50,000 sales. It is also the 27th consecutive month of year-over-year growth since April 2023.

Leapmotor aims to reach 500,000 units sales target in 2025.

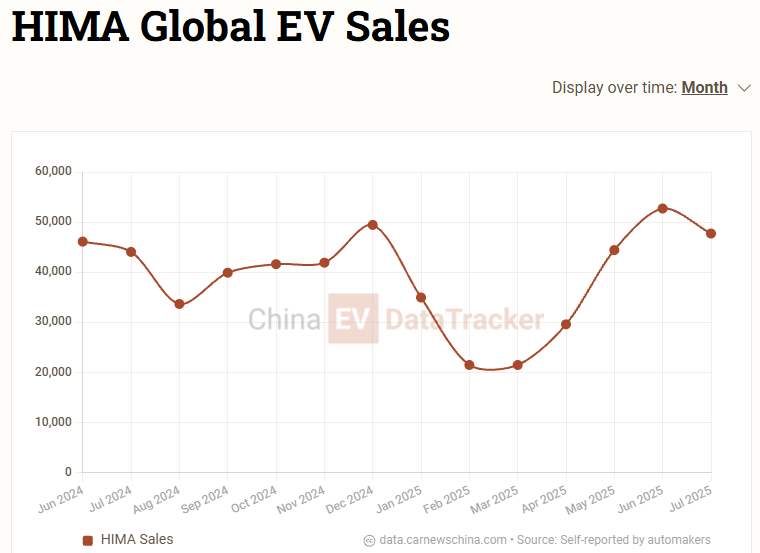

Huawei’s HIMA sold 47,752 vehicles, down 9.5% from June and up 8.3% from the same month last year. In 2025 so far, HIMA sold 252,606 vehicles, down 14.9 % year-on-year.

Volkswagen-backed Xpeng sold 36,717 vehicles, up 6.1% from June and up 229.4% from the same month last year.

In 2025 so far, Xpeng sold 233,906 vehicles, up 270.3% year-on-year.

Great Wall Motor sold 34,593 vehicles, down 5.0% from June and up 43.3% from the same month last year.

In 2025 so far, Great Wall Motor sold 195,007 vehicles, up 24.6% year-on-year.

Li Auto sold 30,731 vehicles, down 15.3% from June and down 39.7% from the same month last year.

In 2025 so far, Li Auto sold 234,669 vehicles, down 2.2% year-on-year.

For Li Auto, this marks the second month in a row of year-over-year decline.

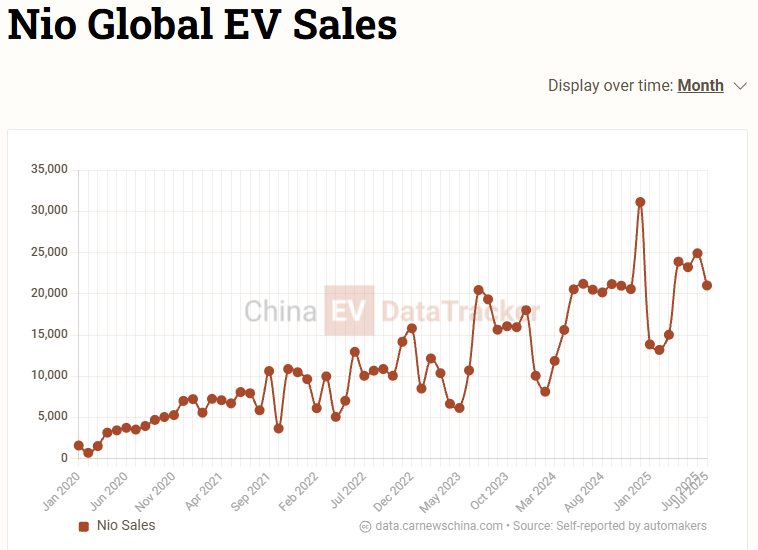

Nio sold 21,017 vehicles, down 15.7% from June and up 2.5% from the same month last year.

In 2025 so far (January – July), Nio sold 135,167 cars globally, up 25.2% from the same period last year.

Nio main brand decreased 38.2% year-over-year to 12,675 units, the entry-level lower margin Onvo sold 5,976, down 6.6% from June, and the budget Firefly brand fell 40% to 2,366 units. Both brands launched less than a year ago, so no YoY comparison is available.

Nio launched the large SUV L90 with all-or-nothing pricing this week, attracting lots of attention.

Polestones (Rox Motor) sold 1,316 vehicles, up 4.5% from June. No year-on-year comparison was provided.

China EV sales by brand

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.