Trump’s Calculus: Israel-Iran Conflict Escalates as Oil Markets Reel and Military Options Loom

The Middle East stands on the brink as Israel and Iran trade missile salvos, each vowing further escalation in a conflict that threatens to redraw the region’s geopolitical map. At the heart of this s

The Middle East stands on the brink as Israel and Iran trade missile salvos, each vowing further escalation in a conflict that threatens to redraw the region’s geopolitical map.

At the heart of this storm is Trump, whose administration is grappling with a high-stakes decision: whether to deepen U.S. involvement beyond defensive support for Israel and join its offensive against Iran’s nuclear ambitions. Trump’s recent moves—consulting his national security team, engaging Israeli leadership, and issuing fiery rhetoric—signal a pivotal moment. With oil prices surging and U.S. military assets like bunker-buster bombs on the table, the fallout could ripple through global markets and security architectures for years.

Trump’s Strategic Playbook

Trump’s response to the crisis blends diplomatic outreach with aggressive posturing.

On Tuesday, he huddled with his national security team in the White House Situation Room for over an hour, later speaking directly with Israeli Prime Minister Benjamin Netanyahu. While White House officials have stayed mum on specifics, Trump’s social media salvoes have been unequivocal. He demanded Iran’s “UNCONDITIONAL SURRENDER” and taunted Ayatollah Ali Khamenei, claiming, “We know exactly where the so-called ‘Supreme Leader’ is hiding. He is an easy target, but is safe there - We are not going to take him out (kill!), at least not for now.”

Yet, for all the bluster, Trump has held back from greenlighting direct strikes, resisting pressure from allies like Senator Lindsey Graham, who told reporters, “I’m all in for destroying their nuclear program. You can’t do it without destroying Fordow. If it takes bombs, bunker-buster bombs, so be it.” Vice President JD Vance underscored the administration’s bottom line: “Iran can’t have a nuclear weapon,” adding that Trump has “many different ways” to enforce that policy. For now, the president seems to be threading a needle—projecting strength while keeping military options in reserve.

A Conflict Spiraling Upward

The battlefield tells a story of unrelenting escalation. Israel has reported Iranian missiles raining down on its cities, with explosions rocking Tel Aviv and the IDF urging civilians to shelter.

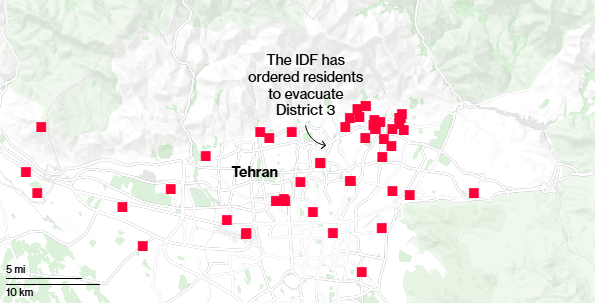

In retaliation, Israel has unleashed a barrage of air strikes on Iran’s nuclear sites, military leadership, and infrastructure. Defense Minister Israel Katz warned of hitting “very significant targets in Tehran,” while an IDF spokesperson noted that strikes on nuclear facilities were “deepening” daily. Iran, meanwhile, has promised a “punitive operation,” with its armed forces chief urging Israelis to flee Tel Aviv and Haifa.

The stakes are dizzying. Israel’s campaign, bolstered by U.S.-supplied defensive systems, has already damaged Iran’s Natanz enrichment site, per UN satellite imagery, though the fortified Fordow facility remains a tougher nut to crack. Iran’s proxy network, including Hezbollah, lies weakened after months of Israeli operations, but its ballistic missile arsenal still poses a credible threat—potentially even to U.S. interests if Trump escalates.

Oil Markets Brace for Impact

Global energy markets are feeling the heat. West Texas Intermediate crude soared 4.3% to near $75 a barrel, a five-month peak, as traders price in the risk of supply shocks from a region pumping a third of the world’s oil. The Strait of Hormuz, a narrow artery for 20% of global crude flows, looms as the ultimate wildcard—any Iranian move to choke it could send prices into the stratosphere. Qatar has already paused LNG vessels outside the strait, and navigation signals in the Persian Gulf are facing interference, per the UK Navy.

So far, Iran’s export terminals have dodged the crossfire, but the market isn’t taking chances. Morgan Stanley has jacked up its price forecasts, and options trading reflects bets on more volatility ahead. A tanker collision near the strait—unrelated to the conflict—only sharpened the sense of unease. As one analyst put it, “Investors are still positioning for potential price spikes this month as tensions persist.”

The U.S. Military Toolbox

If Trump opts for a harder line, the U.S. has a fearsome arsenal at the ready. The Massive Ordnance Penetrator (MOP), a 30,000-pound bunker-buster, stands out as the weapon of choice for cracking Iran’s Fordow site, buried deep under a mountain. Deployed via the B-2 stealth bomber from Missouri’s Whiteman Air Force Base, the MOP could deliver a decisive blow to Tehran’s nuclear dreams—a capability Israel lacks on its own. Former Ambassador Daniel Shapiro noted, “If it requires U.S. participation to target Fordow, that has to be on the table.”

The U.S. Navy is equally poised to act. The USS Carl Vinson strike group, anchored in the Arabian Sea for seven months, packs F-35 jets, radar-jamming aircraft, and guided-missile destroyers. The USS Nimitz group is steaming in to reinforce it, while three Aegis destroyers in the Eastern Mediterranean—soon to be five—have already downed Iranian missiles with SM-3 interceptors. These assets give Trump both offensive punch and defensive cover, amplifying his leverage as the crisis unfolds.

A High-Wire Act

The Israel-Iran clash has morphed into a global powder keg, with Trump’s choices poised to shape its trajectory. Oil markets teeter on the edge, U.S. military might stands ready, and the specter of a broader war hangs heavy. German Chancellor Friedrich Merz, speaking at the G7, put it starkly: “If Iran doesn’t return to the negotiating table, then the complete destruction of Iran’s nuclear program may be on the agenda.”

For now, Trump’s calculus remains fluid—balancing fiery rhetoric, strategic restraint, and the looming question of whether America’s bombs will fly. The world, and the markets, are watching.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.