Trump 2.0 Approval Drops 14% in Just 100 Days

Donald Trump’s second term is off to a rough start. Over 100 days into office, his public approval has dropped by 14 percentage points—nearly three times the decline seen during the same period in his

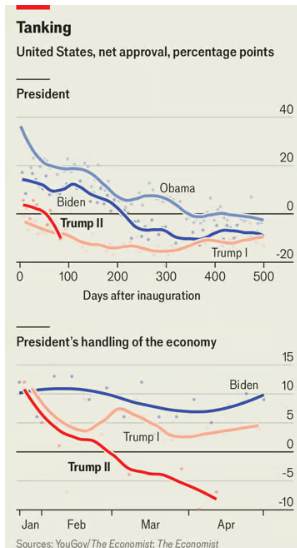

Donald Trump’s second term is off to a rough start. Over 100 days into office, his public approval has dropped by 14 percentage points—nearly three times the decline seen during the same period in his first term, when support fell just 5 points.

Polling from yougov and The Economist shows that Americans now rate Trump’s handling of the economy at a net negative 7 percentage points. During his first term at the same point, he still held a net positive rating.

Even among those who voted for him in 2024, dissatisfaction is rising: nearly 20% disapprove of how he’s tackling inflation and prices, and 12% are unhappy with his handling of employment and the broader economy.

Consumer sentiment among Republicans has also dimmed. According to a University of Michigan survey conducted in early April, GOP optimism about the economy is now lower than at any point during Trump’s first term—except immediately after his 2020 defeat.

A Fast-Moving Downturn, Fueled by Policy Missteps

The reasons behind this approval plunge are not hard to spot. Trump won re-election on promises to improve everyday economic conditions, taking over an economy that, though plagued by inflation, was fundamentally strong. But instead of offering stability, he appears to be triggering chaos.

His early backing of Elon Musk’s new “Department of Government Efficiency” led to deep federal workforce cuts and slashed agricultural subsidies—policies that hit some of Trump’s base directly.

This was followed by a volatile trade agenda. Within two weeks, Trump launched sweeping tariffs on nearly all major U.S. trading partners, then partially reversed course and granted exemptions for electronics. The uncertainty sent U.S. markets tumbling; the Nasdaq briefly entered a technical bear market. Although stocks have since rebounded, the policy whiplash has shaken some supporters’ confidence.

Will Public Opinion Make Trump Pivot?

Probably not. Trump, who once dubbed himself “Tariffs Man,” acknowledges that his tariff hikes might cause short-term pain for Americans, but he insists they are a necessary step to revive domestic manufacturing. His belief in the long-term payoff seems to outweigh concerns over short-term political costs.

However, while Trump himself is no longer constrained by re-election pressures, his Republican colleagues in Congress are not so lucky. Their slim House majority hinges on economically vulnerable swing voters. If tariffs drive inflation or recession, the political fallout could be severe—especially in battleground districts.

Base Still Loyal, But Swing Voters May Revolt

Trump’s core base remains enthusiastic: over 92% of Republican supporters still view him favorably. Yet his 2024 victory depended on attracting swing voters and infrequent voters—many of whom had been disappointed by Joe Biden’s economic stewardship. These voters are more diverse and less ideologically rigid than traditional Republicans.

According to the Cooperative Election Study, 84% of voters who backed Trump in both 2020 and 2024 are white, 74% identify as conservative, and 72% are over 45. By contrast, among Trump’s new 2024 supporters, only 65% are white, 42% identify as conservative, and just 41% are over 45.

This newer coalition may prove fragile if Trump fails to deliver on economic promises. Signs of erosion are already emerging. The Economist’s analysis of YouGov data shows his net approval among Hispanic respondents is a dismal -37 points; among voters under 30, it’s -25.

Key Swing States Are Turning Against Him

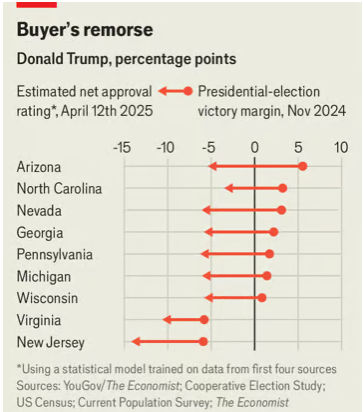

Most alarming for Trump: the swing states that clinched his 2024 win are showing strong signs of buyer’s remorse. In all six battlegrounds he flipped from Biden—Arizona, Nevada, Georgia, Pennsylvania, Michigan, and Wisconsin—Trump’s net approval has now turned negative.

Some Trump allies are brushing off the polling data as unreliable. But Republican candidates already saw concerning trends in recent congressional special elections and a closely contested Supreme Court race in Wisconsin.

Further trouble looms in this November’s statewide elections in Virginia and New Jersey. The Economist estimates Trump’s net approval in these states has fallen to -11 and -14, respectively.

Midterm Test Ahead

The ultimate test will come in the 2026 midterms, which will decide control of Congress—and the fate of Trump’s legislative agenda.

In 2018, during Trump’s first term, Republicans lost 42 House seats. At the time, his approval was around -8, slightly better than it is now. Plus, voters were generally more satisfied with the economy.

With 18 months to go, it’s too early to predict the scale of Republican losses. But history shows that the ruling party typically suffers in midterm elections, and Republicans now hold only a narrow majority in the House.

Ironically, the very drop in approval hurting Trump may also be a sign of democratic health. In an age of extreme polarization, some voters still cross party lines to punish arrogance or incompetence. If Trump fails to reverse economic discontent, that sentiment could again reshape the political map.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.